2.3.1.1 Main Tab

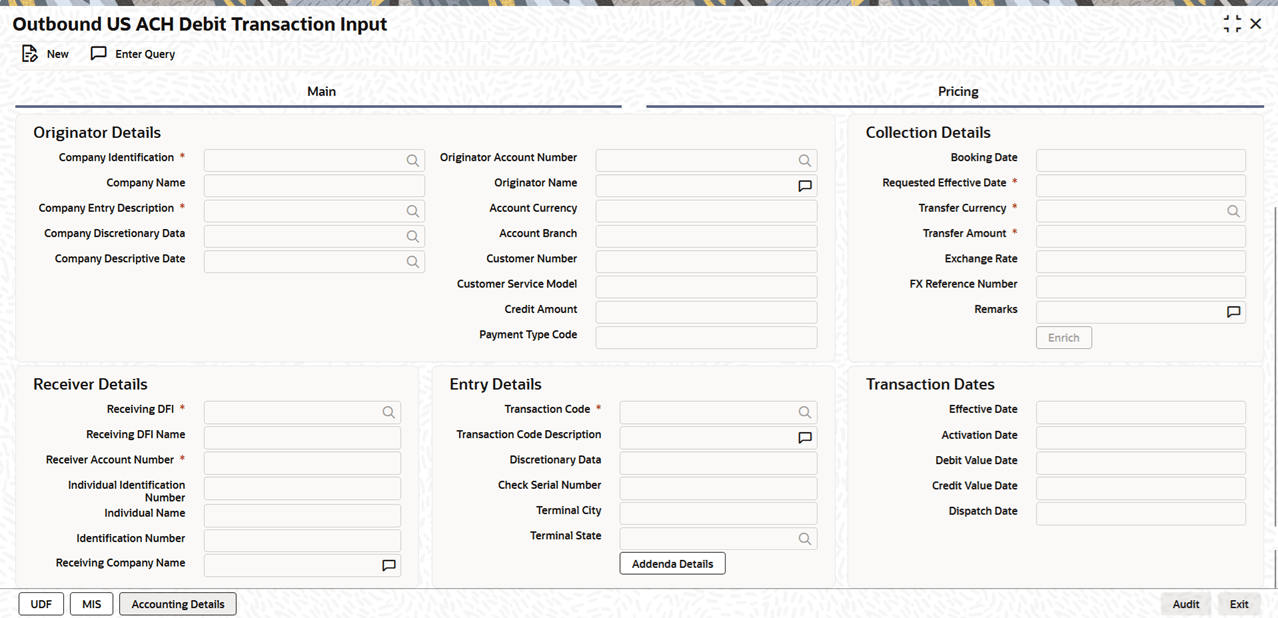

This topic explains the Main tab of the Outbound US ACH Debit Transaction Input screen.

- Select the Main tab in the main screen.The Main details are displayed.

Figure 2-70 Outbound US ACH Debit Transaction Input_Main Tab

- On Main Tab, specify the fields.For more information about the fields, refer to field description table.

Table 2-55 Outbound US ACH Debit Transaction Input_Main Tab - Field Description

Field Description Originator Details This section displays the Originator Details. Company Identification Specify the Company Identification from list of values. The list displays all the Company ID maintained in Company ID–Account Mapping Detailed (PMDCIACC) screen. Company Name This field is auto-populated based on the selected Company ID. Company Entry Description Specify the Company Entry Description from the list of values. Company Discretionary Data Specify the data as per the ACH entry in the outgoing file from list of values. Company Descriptive Date Specify the Company Descriptive Date from list of values. In outgoing ACH Debit transaction, even if this field contains one of the standard keywords for same-day settlement cycles, the same would not be considered by the system. This is because same-day processing of ACH Debit transactions is not in scope. Originator Account Number System populates Originator Account Number from list of values. Once you select Company ID and update the required fields and click Enrich button. Originator Name System defaults the originator name on selecting the account number. Account Currency System defaults the Account Currency based on the selected Account Number. Account Branch System defaults the Account Branch based on the selected Account Number. Customer Number System identifies the Customer Number maintained in the system for the originator based on the selected Originator Account Number and the same is defaulted in this field. Customer Service Model System defaults Customer Service Model linked to the identified customer. Creditor Amount This field is populated with the transfer amount converted in originator account currency using the exchange rate. Payment Type Code Select the Payment Type Code from the drop-down list. The available options are: - Recurring

- Single

Collection Details This section displays the Collection Details. Booking Date This is defaulted as application server date. Requested Effective Date This is the Requested Effective Date of the payment, as instructed by the customer. Transfer Currency Specify the Transfer Currency which should always be USD. Transfer Amount Specify the amount of the outgoing debit transaction in the transfer currency. This amount is populated in the amount field of the entry details record. Exchange Rate If transfer currency and originator account currency are different then exchange rate can be provided by user. System retains the input value and will validate the same against override and stop variances maintained at Network Preferences. FX Reference Number Specify a specific reference number of Fx deal/contract to be used for deriving the exchange rate to be used for the transaction. Remarks Specify any user remarks for the outgoing payment transaction. Enrich Button On click of this button, system computes the Exchange Rate and charges if applicable.

Exchange Rate is computed if the creditor account currency is different from transfer currency.

Receiver Details This section displays the Receiver Details. Receiving DFI Specify a 9 digit ABA number of the Receiving DFI (RDFI) from the list of values that would fetch values from the US ACH Directory (PMDNCHDR) maintenance. Receiving DFI Name System defaults the name of the Receiving DFI selected. Receiver Account Number Specify the account number of the receiver (beneficiary) such as corporate or individual as applicable based on the selected SEC code. Individual Identification Number This field is mandatory only when the selected SEC code is CIE, and optional for other applicable SEC codes such as PPD, WEB and so on. Identification Name Specify the Identification Name. Identification Number This field is optional for applicable SEC codes such as CCD and CTX. It typically contains the customer or accounting identification number, usually issued by the originator, by which the receiver is identified. Receiving Company Name Specify the company name of receiver where the receiver is corporate. Entry Details This section displays the Entry Details. Transaction Code Select the appropriate options for the ACH Debit transaction based on the chosen SEC code. - Zero dollar transaction codes such as 24, 34, 44, and 54 are applicable for CCD and CTX SEC codes.

- Pre-notification transaction codes such as 23, 33, 43, and 53 are applicable to all debit transaction SEC codes.

- Normal transaction codes such as 22, 32, 42, and 52 are applicable to all debit transaction SEC codes.

Transaction Code Description This field is auto-populated with the description of the selected transaction code. Discretionary Data Specify the Discretionary Data. Check Serial Number Specify the Check Serial Number. Terminal City Specify the Terminal City. Terminal State Specify the Terminal State from the list of values. Transaction Dates This section displays the Transaction Dates. Effective Date Specify the Effective Date.

As part of processing dates resolution, Requested Effective Date would be validated to be a working day for ACH. This date would be adjusted (moved ahead), if required, which would then be populated in this field.

Settlement Date This field is same as the Effective Date, which is the date of settlement with the originator. On this date, the originator’s account is credited with the Credit Value Date. Debit Value Date The value date with which the debit to clearing GL would be done as part of the DRLQ event of transaction accounting on the settlement date. This date would be same as settlement date. This is a view only field. Credit Value Date The value date with which the credit to originator account would be done as part of the CRLQ event of transaction accounting on the settlement date. This date would be calculated as Effective Date plus 2 ACH business days. This is a view only field. Dispatch Date Dispatch Date is the date on which the transaction is dispatched to ACH as part of an outgoing ACH file.

Parent topic: Outbound US ACH Debit Transaction Input