2.2.1.1 Main Tab

This topic explains the Main tab of the Outbound US ACH Credit Transfer Input screen.

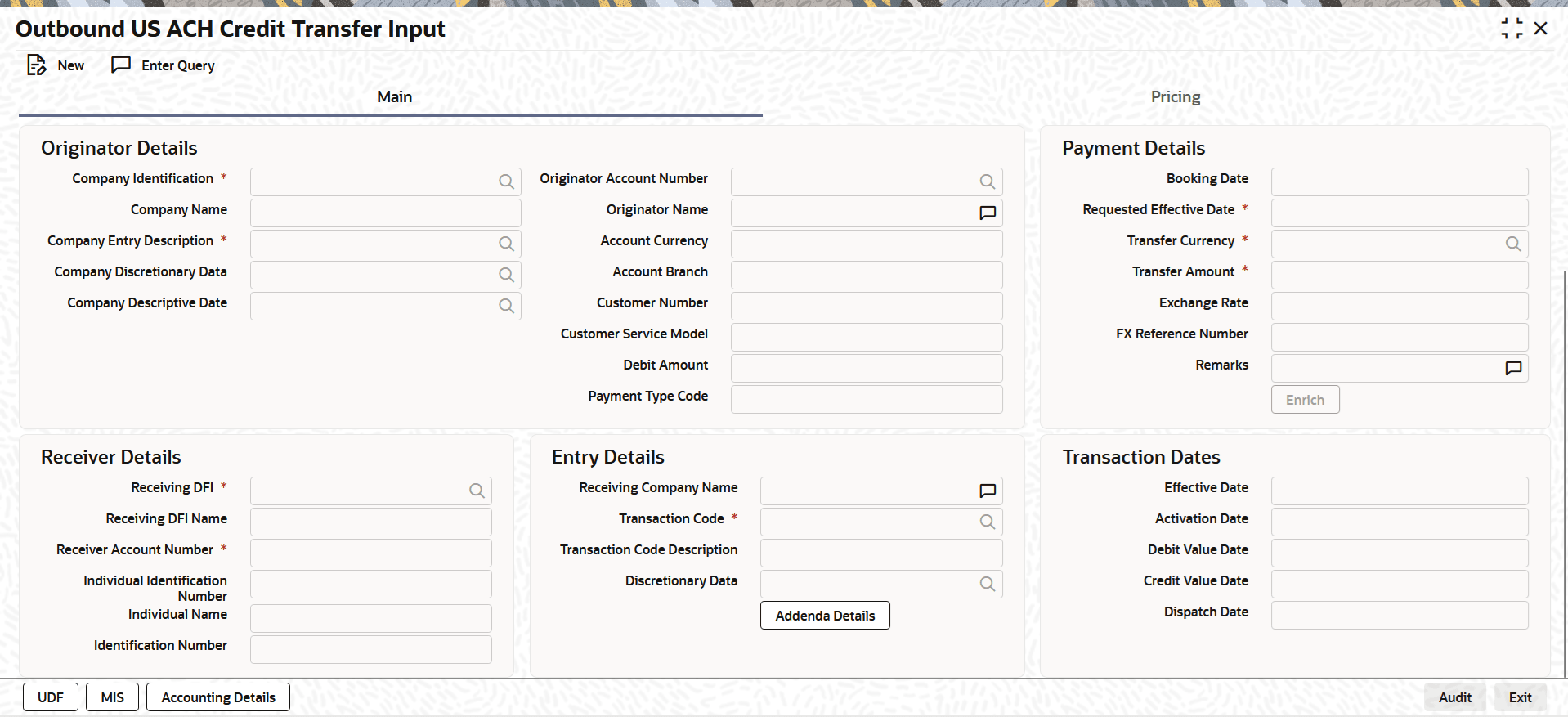

- Select the Main tab in the main screen.The Main details are displayed.

Figure 2-24 Outbound US ACH Credit Transfer Input_Main Tab

- On Main tab, specify the fields.For more information about the fields, refer to field description table.

Table 2-21 Outbound US ACH Credit Transfer Input_Main Tab - Field Description

Field Description Originator Details This section displays the Originator Details. Company ID Specify the Company ID of the originator from list of values that fetches company Id records from the existing Originator Maintenance Detailed (PMDORGDT). Company Name This field is auto-populated from the Company Identification Maintenance based on the company Id. Company Entry Description Specify the Company Entry Description. This is a mandatory field. Company Discretionary Data This field in the Batch Header allows Originators/ODFIs to capture any data that is of significance to the processing of the transaction. Company Descriptive Date Specify the transaction date that the originator wants the Receiving Depository Financial Institution (RDFI) to include in communications to the receiver. Note that this date will not appear as the transaction or value date in the receiver’s account statement. Originator Account Number System populates the Originator Account Number after you select the Company ID, update the required fields, and click the Enrich button. This field is populated from the Company ID and SEC Code maintained in the Company ID–Account Mapping Detailed (PMDCIACC) screen.

Originator Name System defaults the originator name upon selecting the account number. Account Currency System defaults the account currency upon selecting the account number. Account Branch System defaults the account branch upon selecting the account number. Customer Number System identifies the customer number maintained in the system for the originator based on the selected Debtor Account Number and the same is defaulted in this field. Customer Service Model System defaults Customer Service Model linked to the identified customer (originator). Debit Amount This field is populated with the transfer amount converted in originator account currency using the exchange rate. Payment Type Code Payment Details This section displays the Payment Details. Booking Date This is defaulted as application server date. Requested Effective Date This is the Requested Effective Date of the payment, as instructed by the customer. Transfer Currency Specify the Transfer Currency which should always be USD. Transfer Amount Specify the amount to be transferred. Exchange Rate If transfer currency and originator account currency are different then exchange rate can be provided by user. System retains the input value and will validate the same against override and stop variances maintained at Network Preferences. FX Reference Number Specify a specific reference number of Fx deal/contract to be used for deriving the exchange rate to be used for the transaction. Remarks This field indicates any user remarks for the outgoing payment transaction. Receiver Details This section displays the Receiver Details. Receiving DFI Specify a 9 digit ABA number of the Receiving Depository Financial Institution (RDFI) from the list of values that would fetch values from the US ACH Directory (PMDNCHDR) maintenance. Receiving DFI Name System defaults the name of the selected Receiving DFI. Receiver Account Number Specify the account number of the Receiver (beneficiary) corporate or owned by the Receiver individual as applicable for selected SEC code. Individual Identification Number This field is mandatory only when the selected SEC Code is CIE and optional for other applicable SEC codes such as PPD, WEB, and others.

Identification Name Specify the Identification Name. Identification Number This field is optional for applicable SEC Codes such as CCD and CTX. It typically contains the customer or accounting identification number (normally issued by the Originator) by which the Receiver is identified.

Entry Details This section displays the Entry Details. Receiving Company Name Specify the company name of receiver where the receiver is corporate. Transaction Code Select the appropriate options for the ACH credit transaction based on the chosen SEC code. - Zero dollar transaction codes such as 24, 34, 44, and 54 are applicable for CCD and CTX SEC codes.

- Pre-notification transaction codes such as 23, 33, 43, and 53 are applicable for all credit transaction SEC codes.

- Normal transaction codes such as 22, 32, 42, and 52 are applicable for all credit transaction SEC codes.

Transaction Code Description This field is auto-populated with the description of the selected Transaction code. Discretionary Data This field in the entry detail record of the batch file allows Originators/ODFIs to capture any two-character code or data relevant to transaction processing or for making a request to the RDFI. It is optional and can be populated by the user. For example, the code AK is used with CCD and CTX SEC codes to indicate that an acknowledgement is requested from the RDFI.

Transaction Dates This section displays the Transaction Dates. Effective Date Specify the Effective Date. Activation Date This is the date on which the transaction would be processed. Debit Value Date The value date with which the debit to originator account would be done as part of the Debit Liquidation accounting event. This date is derived by the system as part of processing the transaction. This is a view-only field. Credit Value Date Specify the value date with which the credit to Network Nostro account would be done as part of dispatch accounting for the file containing this transaction. Dispatch Date The date on which the transaction would be dispatched to ACH as part of an outgoing ACH file. It is calculated as the Effective Date less the Network Lead Days.

Parent topic: Outbound US ACH Credit Transfer Input