2.2.4.1 Process Main Tab

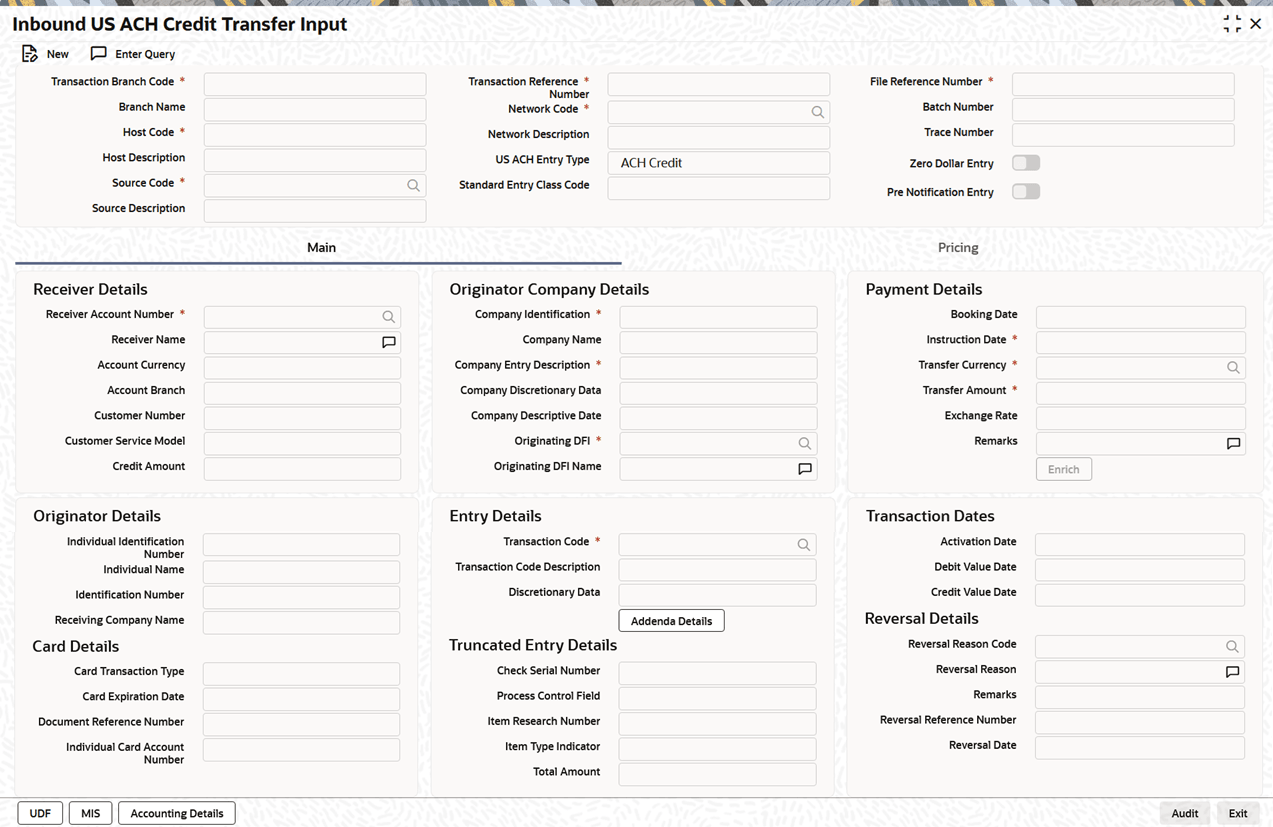

This topic explains the Main tab of the Inbound US ACH Credit Transfer Input screen.

- Select the Main tab in the main screen.The Main details are displayed.

Figure 2-43 Inbound US ACH Credit Transfer Input_Main Tab

- On Main Tab, specify the fields.For more information about the fields, refer to field description table.

Table 2-35 Inbound US ACH Credit Transfer Input_Main Tab - Field Description

Field Description Receiver Details This section displays the Receiver Details. Receiver Account Number Select the customer account to be credited from the list of values. The list displays all valid Account Numbers available in the system. Receiver Name System defaults the Receiver Name based on the selected Receiver Account Number. Account Currency System defaults the Account Currency based on the selected Receiver Account Number. Account Branch System defaults the Account Branch based on the selected Receiver Account Number. Customer Number System identifies the customer number maintained in the system for the creditor based on the selected Receiver Account Number and the same is defaulted in this field. Customer Service Model System defaults the Customer Service Model linked to the identified customer. Credit Amount This field will be populated with the transfer amount converted in Receiver account currency using the exchange rate. Originator Company Details This section displays the Originator Company Details. Company Identification Specify the identification of originator of the ACH Credit transaction. Company Name Specify the originator name. Company Entry Description Specify the Company Entry Description as per the ACH entry in the inbound file.. Company Discretionary Data Specify the Company Discretionary Data as per the ACH entry in the inbound file. Company Descriptive Date Specify the Company Discretionary Date. Originating DFI Specify the Debtor Bank ABA Number from the list of values which displays all ABA numbers of all DFIs. Originating DFI Name System indicates the Originating DFI name once you select the Originating DFI from the list of values. Payment Details This section displays the Payment Details. Booking Date This is defaulted as current date. Instruction Date This is the effective entry date or settlement date on which the payment is settled as part of the inbound file by ACH. Transfer Currency Specify the Transfer Currency as USD. Transfer Amount Specify the amount to be credited to the customer. Exchange Rate If transfer currency and receiver (credit) account currency are different, then exchange rate can be provided by user. System retains the input value and validates the same against override and stop variances maintained at Network Preferences. Remarks This field indicates any user remarks for the outgoing payment transaction. Enrich button On click of this button, system computes the exchange rate and charges if applicable.

Exchange rate is computed if the creditor account currency is different from transfer currency. You can view the computed rate in the Exchange Rate field in the Main tab.

You can view the computed charges in Pricing tab.

Originator Details This section displays the Originator Details. Individual Identification Number This field is applicable but optional for SEC code of PPD and CIE. Individual Name System defaults the individual name on selecting the Individual Identification Number. Identification Number This field is optional for the applicable SEC codes of CCD and CTX. Receiving Company Name Defaulted on selecting Receiver Account Number. Entry Details This section displays the Entry Details. Transaction Code Select the Transaction Code from the List of Values. Transaction Code Description Specify the Transaction Code Description. Discretionary Data Specify the Discretionary Data. Transaction Dates This section displays the Transaction Dates. Activation Date This is the date on which transaction would be processed, and would be generally same as Settlement Date. Debit Value Date The value date with which the debit to Clearing GL would be done as part of the DRLQ event of transaction accounting on the Activation date. This date would always be same as Settlement Date. Credit Value Date The value date with which the credit to receiver account would be done as part of the CRLQ event of transaction accounting on the Activation date. This will be a View only field. Card Details This section displays the Card Details. Card Transaction Type Specify the Card Transaction Type. Card Expiration Date Specify the Card Expiration Date. Document Reference Number Specify the Document Reference Number. Individual Card Account Number Specify the Individual Card Account Number. Truncated Entry Details This section displays the Truncated Entry Details. Check Serial Number Specify the Check Serial Number. Process Control Field Specify the Process Control Field. Item Research Number Specify the Item Research Number. Item Type Indicator Specify the Item Type Indicator. Total Amount Specify the Total Amount. Reversal Details This section displays the Reversal Details. Reversal Reason Code Select the Reversal Reason Code from the list of values. The list of ACH reversal reason codes is maintained in Reject Code Detailed (PMDRJMNT) screen. Reversal Reason System displays the description of the selected reason code. Remarks Specify the operational reason for reversal of the transaction. This is mandatory field. Reversal Reference Number System defaults this field when the user clicks the Reversal button. Reversal Date System displays the current system date of reversal. - Click the Save button to save the inbound payment and

make it available for authorization.On authorization by a different user, system starts processing the US ACH inbound payment.

Parent topic: Inbound US ACH Credit Transfer Input