3.1.1.15 Remittance Information Tab -Tax Remittance - View Details Button

This topic explains the View Details button under Tax Remittance of Remittance Information tab in the Cross Border Outbound FI to FI Customer Credit Transfer Input Detailed screen.

- Click the View Details button under Tax

Remittance of Remittance Information

tab.The Tax Remittance Details sub-screen is displayed.

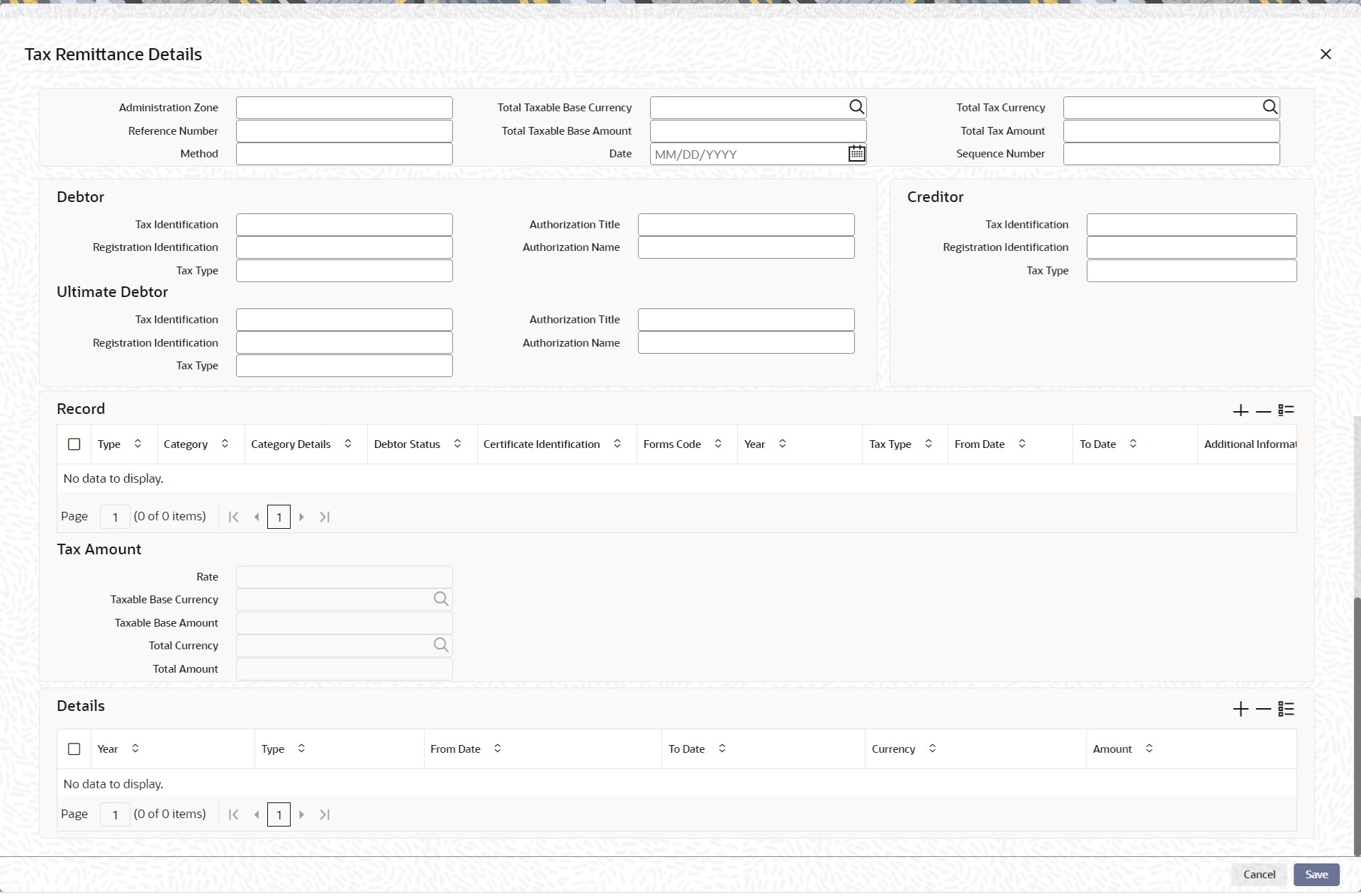

Figure 3-30 Remittance Information Tab_Tax Remittance Details - View Details

Description of "Figure 3-30 Remittance Information Tab_Tax Remittance Details - View Details" - On the Tax Remittance Details screen, specify the

fields.

Table 3-31 Remittance Information Tab_Tax Remittance Details_View Details - Field Description

Field Description Administration Zone Specify the Administration Zone of remittance. Reference Number Specify the reference number of remittance. Method Specify the method of remittance. Total Taxable Base Currency Specify the total taxable base currency of remittance. Total Taxable Base Amount Specify the total taxable base amount of remittance. Date Specify the date of remittance. Total Tax Currency Specify the total tax currency of remittance. Total Tax Amount Specify the total tax amount of remittance. Sequence Number Specify the sequence number of remittance. Debtor This section displays the following fields. Tax Identification Specify the tax identification of debtor for remittance. Registration Identification Specify the registration identification of debtor for remittance. Tax Type Specify the tax type of debtor for remittance. Authorization Title Specify the authorization title of debtor for remittance. Authorization Name Specify the authorization name of debtor for remittance. Creditor This section displays the following fields. Tax Identification Specify the tax identification of creditor for remittance. Registration Identification Specify the registration identification of creditor for remittance. Tax Type Specify the tax type of creditor for remittance. Ultimate Debtor This section displays the following fields. Tax Identification Specify the tax identification of ultimate debtor for remittance. Registration Identification Specify the registration identification of ultimate debtor for remittance. Tax Type Specify the tax type of ultimate debtor for remittance. Authorization Title Specify the authorization title of ultimate debtor for remittance. Authorization Name Specify the authorization name of ultimate debtor for remittance. Record This section displays the following fields. Type Specify the record type for remittance. Category Specify the category of record type for remittance. Category Details Specify the category details of record type for remittance. Debtor Status Specify the debtor status of record type for remittance. Certificate Identification Specify the certificate identification of record type for remittance. Forms Code Specify the Forms Code of record type for remittance. Year Specify the year of record type for remittance. Tax Type Specify the tax type of record type for remittance. From Date Specify the From Date of record type for remittance. To Date Specify the To Date of record type for remittance. Additional Information Specify the additional information of tax amount for remittance. Tax Amount This section displays the following fields. Rate Specify the rate of tax amount for remittance. Taxable Base Currency Specify the taxable base currency of remittance. Taxable Base Amount Specify the taxable base amount of tax Amount for remittance. Total Currency Specify the total currency of tax amount for remittance. Total Amount Specify the total amount of tax amount for remittance. Details This section displays the following fields. Year Specify the year of tax amount for remittance. Type Specify the type of tax amount for remittance. From Date Specify the From Date of record type for remittance. To Date Specify the To Date of record type for remittance. Currency Specify the currency of tax amount for remittance. Amount Specify the tax amount for remittance.