3.1.1.1 Process Main Tab

This topic explains the Main tab of the Cross Border Outbound FI to FI Customer Credit Transfer Input Detailed screen.

- From the main screen, select the Main Tab.The Main details are displayed.

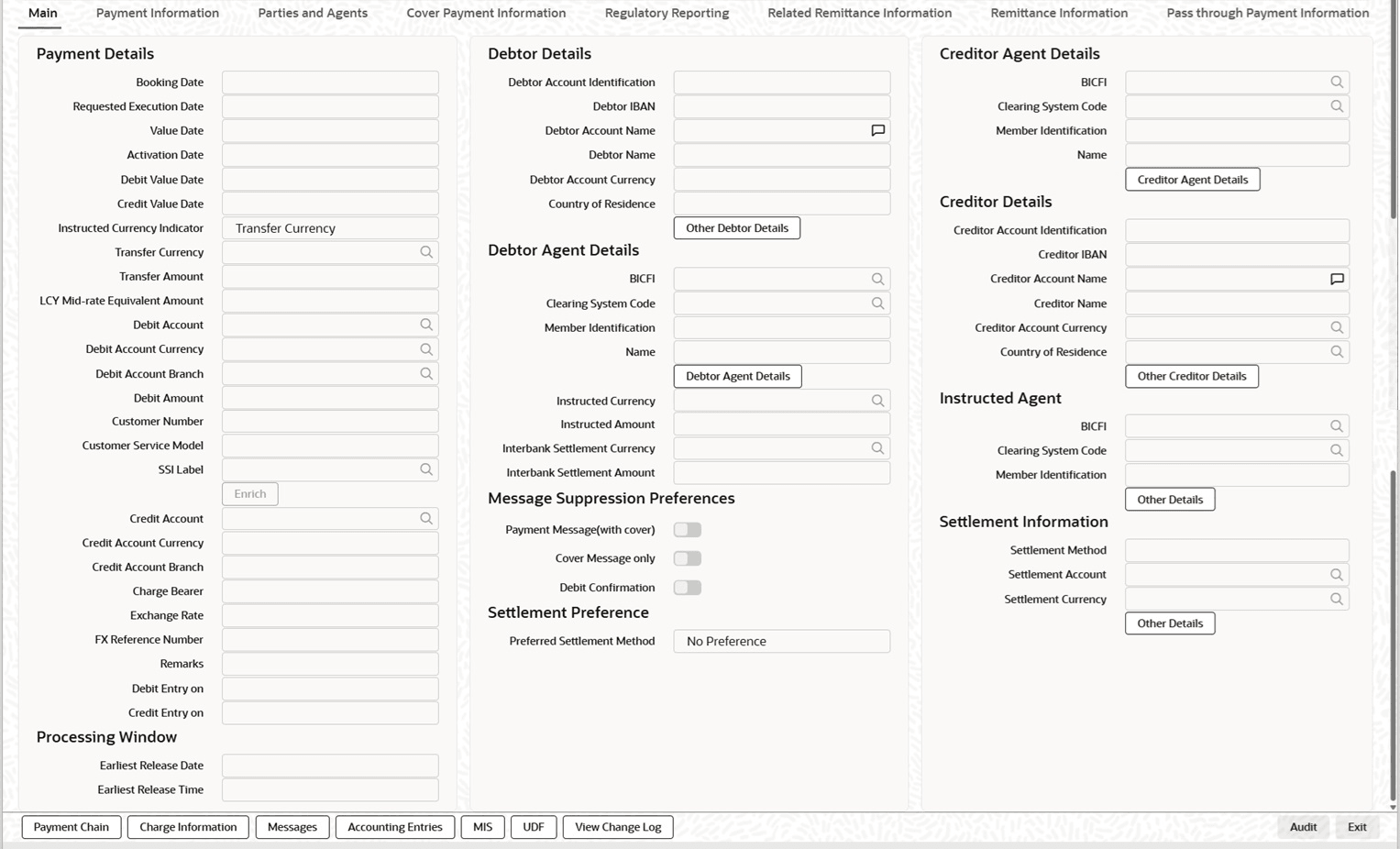

Figure 3-2 Cross Border Outbound FI to FI Customer Credit Transfer Input - Main Tab

Description of "Figure 3-2 Cross Border Outbound FI to FI Customer Credit Transfer Input - Main Tab" - On Main Tab, specify the fields.For more information about the fields, refer to field description table.

Table 3-2 Cross Border Outbound FI to FI Customer Credit Transfer Input Detailed_Main Tab - Field Description

Field Description Payment Details This section displays the following fields.

System defaults the following fields to current branch date:- Booking Date

- Requested Execution Date

- Value Date

- Activation Date

Debit Value Date System derives the debit value date as part of transaction processing when the user clicks the Enrich button. This field is disabled for user input. Credit Value Date System derives the credit value date as part of transaction processing when the user clicks the Enrich button. This field is disabled for user input. Instructed Currency Indicator Select the Instructed Currency Indicator from the drop-down list. The available options are: - Transfer Currency (Default)

- Debit Currency

Transfer Currency Select the Transfer Currency from the list of values. Transfer Amount Specify the transfer amount. Debit Account Specify debit account of the customer from the list of values. This list displays all open and authorized customer accounts maintained in External Customer Accounts Maintenance and GLs. Debit Account Currency System populates this field with the account currency based on the debit account selected. Debit Account Branch System populates this field with the account branch based on the debit account selected. Debit Amount Specify the debit amount. If you do not enter this value, the system populates this field based on specified transfer currency or amount. Customer Number System defaults the resolved customer number. Customer Service Model System defaults the Customer Service Model of the resolved customer number. SSI Label Select an SSI Label from the list of values. The list displays valid SSI Labels applicable to the customer and the network. Credit Account Specify the Credit Account of the currency correspondent.

Note: If you do not specify the credit account, the system populates it with the derived Nostro/Vostro (mirror) account when you click the Enrich button.

Credit Account Currency System populates this field with the account currency based on the credit account selected. Credit Account Branch System populates this field with the account branch based on the credit account selected. Charge Bearer Select a Charge Bearer from the drop-down list. The available options are: - CRED

- DEBT

- SHAR

Exchange Rate Specify the Exchange Rate if debit account currency is different from transfer currency or instructed currency is different from transfer currency. FX Reference Number Specify the FX Reference Number. Remarks Specify the Remarks, if applicable. Debit Entry on Select the Debit Entry on from the drop-down list. The available options are: - Activation Date

- Value Date

Credit Entry on Select the Credit Entry on from the drop-down list. The available options are: - Activation Date

- Value Date

Debtor Details This section displays the Debtor Details. Debtor Account Identification System defaults this field based on the selected debit account. The user can modify the account number. Debtor IBAN System defaults this field based on the selected debit account. The user can modify the account number. Debtor Account Name Specify the debited account name. Debtor Name Specify the debited customer name. Debtor Account Currency Specify the currency of the selected debit account. Country of Residence Specify the country of residence.

Note: Specify Country of Residence (where the party physically lives) only if it is different from Postal Address/Country.

Other Debtor Details Button Click the Other Debtor Details button on Main tab under Debtor Details header to open the sub-screen. This screen displays the Debtor Details.

Refer to the topic Main Tab - Other Details Button for details of fields and sub screen of the Other Debtor Details button.

Debtor Agent Details This section displays the following fields. BICFI Select the BICFI code from the list of values. Clearing System Code Select the Clearing System Code from the list of values. Member Identification Specify the member identification code. Name Specify the Name. Debtor Agent Details Button Click the Debtor Agent Details button on Main tab under Debtor Agent Details header to open the sub-screen. This screen displays the Debtor Agent Details.

Refer to the Section Main Tab - Agent Details Button for details of fields and sub screen of the Debtor Agent Details button.

Instructed Currency Select an Instructed Currency from the list of values. Instructed Amount Specify the debit amount. Interbank Settlement Currency System displays same as transfer currency. Interbank Settlement Amount System displays final amount resolved. Message Suppression Preferences This section displays the following fields. Payment Message (with cover) By default, the checkbox is unselected. If you select the checkbox, payment message with cover message is suppressed. Cover Message Only By default, the checkbox is unselected. If you select the checkbox, cover message is suppressed. Credit Confirmation By default, the checkbox is unselected. If you select the checkbox, debit confirmation (camt.054) is suppressed. Creditor Agent Details This section displays the following fields. BICFI Select the BICFI code from the list of values. Clearing System Code Select the Clearing System Code from the list of values.

Note: Specify either BICFI or Clearing System Code/Member Identification.

Member Identification Specify the clearing ID code. Name Specify the name. Creditor Agent Details Button Click Creditor Agent Details button on Main tab under Creditor Agent Details header to the sub screen. This screen shows the creditor agent details.

Refer to the Section Main Tab - Agent Details Button for details of fields and sub screen of the Creditor Agent Details button.

Creditor Details This section displays the following fields. Creditor Account Identification Specify the creditor account identification. Creditor IBAN Specify creditor IBAN.

Note: Specify either Creditor Account Number or Creditor IBAN.

Creditor Account Name Specify the creditor account name. Creditor Name Specify the creditor name. Creditor Account Currency Select a Credit Account Currency from the list of values. Country of Residence Select a Country of Residence from the list of values.

Note: Specify Country of Residence (where the party physically lives) only if it is different from Postal Address/Country.

Other Creditor Details Button Click the Other Creditor Details button on Main tab under Creditor Details header to open the sub-screen. This screen shows the Creditor Details.

Refer to the Section Main Tab - Other Details Button for details of fields and sub screen of the Creditor Details button.

Settlement Preference This section displays the following fields. Preferred Settlement Method Select the Preferred Settlement Method for transaction from the list of values. - No Preference

- Serial

- Cover

- On the Cross Border Outbound FI to FI Customer Credit Transfer

Input screen, specify the fields in the Instructed

Agent section of the Main tab.

Table 3-3 Main Tab - Instructed Agent

Field Description BICFI Select the BICFI code from the list of values. Clearing System Code Select the Clearing System Code from the list of values. Member Identification Specify the clearing ID code. Other Details Button Click the Other Details button on Main tab under Instructed Agent header to open the sub-screen. This screen shows the Instructed Agent Details. - Click the Other Details button on

Main tab under Instructing

Agent header to open the sub-screen. The Instructed Agent Details sub-screen is displayed.

Figure 3-3 Other Details - Instructed Agent Details

Description of "Figure 3-3 Other Details - Instructed Agent Details" - On the Instructed Agent Details screen, specify the

fields.For more information about the fields, refer to field description table.

Table 3-4 Instructed Agent Details - Field Description

Field Description Financial Institution Details This section displays the Financial Institution Details. LEI Specify LEI of the agent. - On the Cross Border Outbound FI to FI Customer Credit Transfer

Input screen, specify the fields in the Settlement

Information section of the Main

tab.

Table 3-5 Main Tab - Settlement Information

Field Description Settlement Method Select the Settlement Method for transaction from the list of values. - INDA

- INGA

- COVE

Settlement Account Specify Settlement Account from the list of values. Settlement Currency System defaults the Settlement Currency based on the selected settlement account. - Click the Other Details button on

Main tab under Settlement

Information header to open the sub-screen. The Settlement Information Details sub-screen is displayed.

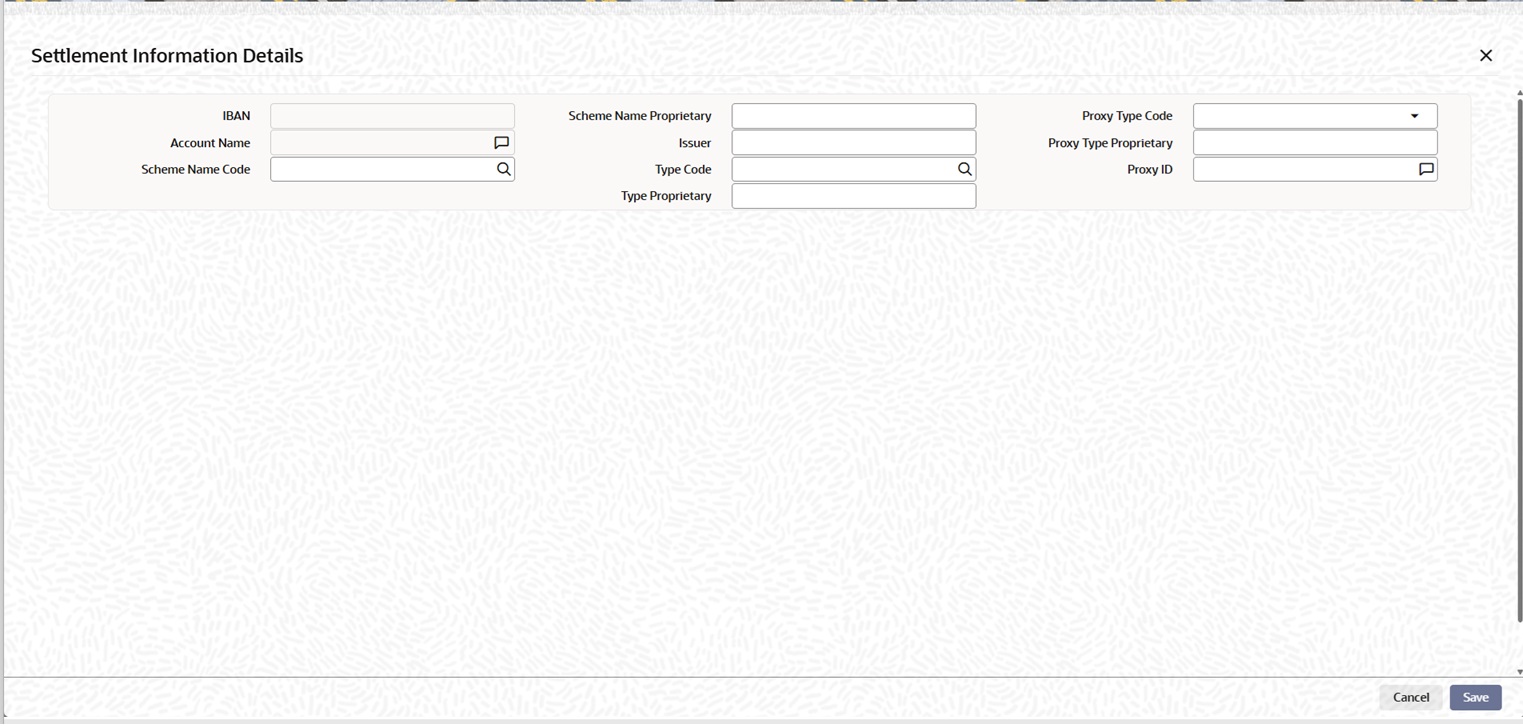

Figure 3-4 Other Details - Settlement Information Details

Description of "Figure 3-4 Other Details - Settlement Information Details" - On the Settlement Information Details screen, specify

the fields.For more information about the fields, refer to field description table.

Field Description Settlement Information Details This section displays the following fields. IBAN System defaults IBAN of the agent based on the provided settlement account. Scheme Name Proprietary Specify the Scheme Name Proprietary of the agent. Proxy Type Code Select the Proxy Type Code from the drop-down list. The list displays the following values:- TELE

- EMAL

- DNAM

Account Name System defaults account name of the agent based on the provided settlement account. Issuer Specify the issuer of the agent. Proxy Type Proprietary Specify the Proxy Type Proprietary of the agent. Scheme Name Code Select the Scheme Name Code of the agent from the list of values. Type Code Select the Type Code for the agent from the list of values. Proxy ID Specify the Proxy ID of the agent. Type Proprietary Specify the Type Proprietary of the agent.