1.5 Origination Preferences

This topic describes the preferences which are set at origination level.

User can maintain pre-defined origination parameters on this screen, allowing the bank to define generic parameters governing the application's behavior during account opening.

- Generic Parameters: The user defines parameters for dashboard widgets, age limits and nominees for minors, funding, incomplete application expiry, dedupe, and resident stability in this section.

- Credit and Compliance : The user defines the credit decision threshold limits at the insider and executive officer levels, as well as the annual percentage rate parameters, in this section.

- Offer: The user can define downsell offer expiry parameters in this section.

- Integration: The user defines the host integration parameter in this section.

To edit origination preferences:

- Navigate from Retail Origination to Configurations, then select Origination Preference from Configurations menu list.

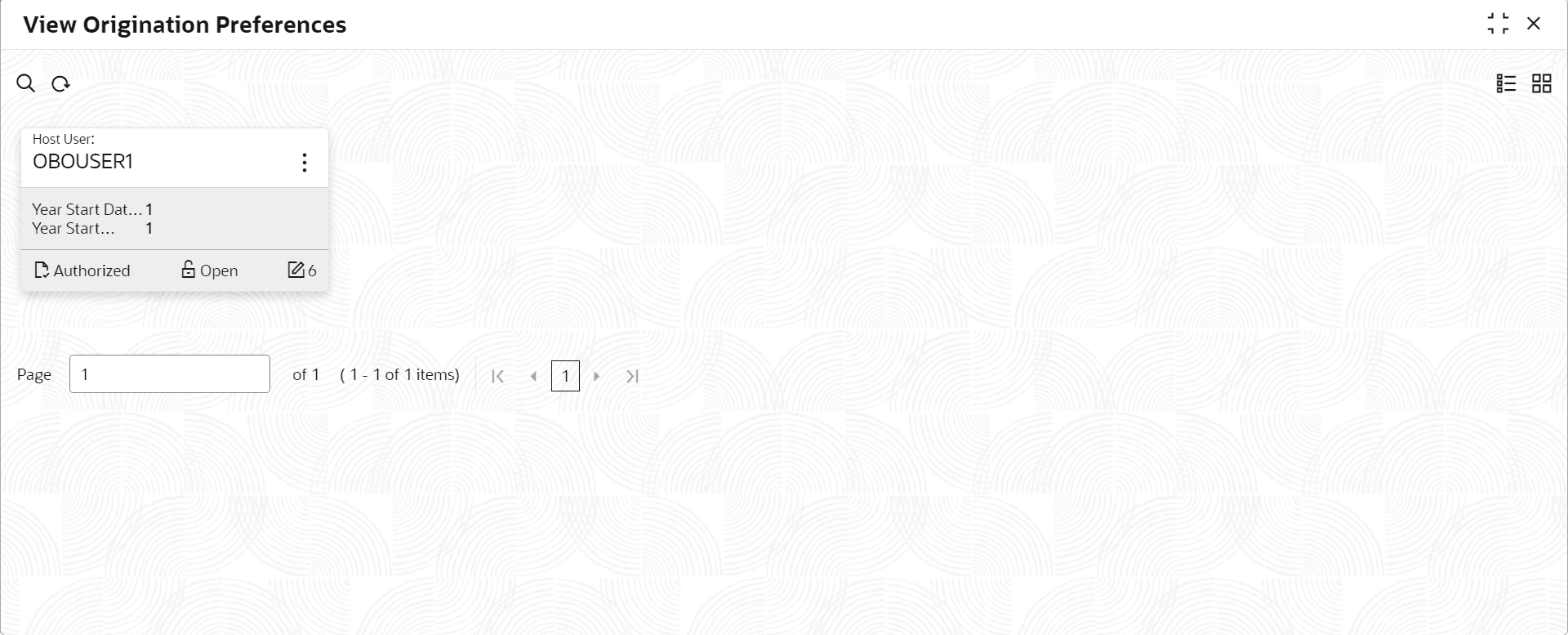

- Click View Origination Preference screen to view already defined

preferences.

The View Origination Preference screen is displayed.

For more information on fields, refer to the field description table below.

Table 1-102 View Origination Preference - Field Describes

Field Name Description Host User Displays the user ID of logged in user who set this preferences. Year Start Date Displays the year start date. Year Start Month Displays the year start month. <Footer of Title> This section displays the status of the record as,

- Whether the record is Authorized or Unauthorized

- Whether the record is Open or Closed

- Number of times the record is edited

- Click

on the top right of the questionnaire tile and click Unlock.

on the top right of the questionnaire tile and click Unlock.The Origination Preferences screen is displayed in edit mode.

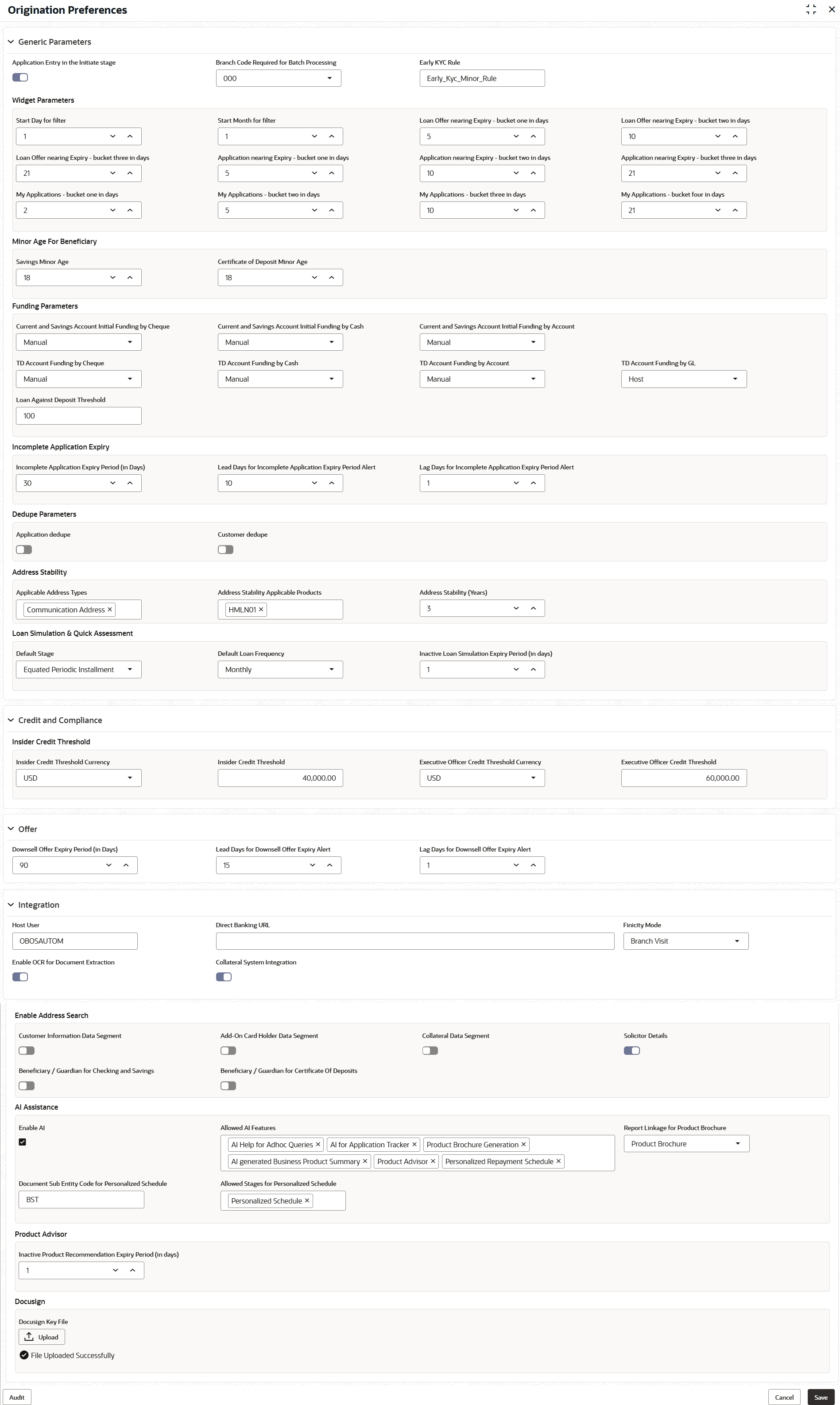

Figure 1-100 Origination Preference - Edit

- Specify the details in the relevant data fields. The fields which are marked with Required are mandatory. For more information on fields, refer to the field description table below.

Table 1-103 Origination Preference - Edit – Field Description

Field Description Generic Parameters In this section user can capture generic parameters. Application Entry in the Initiate stage Specify whether the application entry option is applicable while initiating the account opening application. Branch Code Required for Batch Processing Specify the branch code that processes the batch. Early KYC Rule Specify the early KYC rule. The Applicant data segment initiates the early KYC process based on the specified early KYC rules.

Widget Parameters In this section user can define dashboard widget preferences. Start Day for filter Specify the day of the month from which the application should be displayed in the dashboard widget. Start Month for filter Specify the start month count of the year to get the current financial year applications in the dashboard widget. Loan Offer nearing Expiry- bucket one in days Specify number of days to highlight the loan offers that are nearing to the expiry.

Based on this number of days the system calculates and displays the count of applications under the loan offer in the first bucket of the Loan Offers Near Expiry widget on dashboard.

Loan Offer nearing Expiry- bucket two in days Specify number of days to highlight the loan offers that are nearing to the expiry.

Based on this number of days the system calculates and displays the count of applications under the loan offer in the second bucket of the Loan Offers Near Expiry widget on dashboard.

Loan Offer nearing Expiry - bucket three in days Specify number of days to highlight the loan offers that are nearing to the expiry.

Based on this number of days the system calculates and displays the count of applications under the loan offer in the third bucket of the Loan Offers Near Expiry widget on dashboard.

Application nearing Expiry - bucket one in days Specify number of days to highlight the applications that are nearing to the expiry.

Based on this number of days the system calculates and displays the count of applications in the first bucket of the Product Application Near Expiry widget on dashboard.

Application nearing Expiry - bucket two in days Specify number of days to highlight the applications that are nearing to the expiry.

Based on this number of days the system calculates and displays the count of applications in the second bucket of the Product Application Near Expiry widget on dashboard.

Application nearing Expiry - bucket three in days Specify number of days to highlight the applications that are nearing to the expiry.

Based on this number of days the system calculates and displays the count of applications in the third bucket of the Product Application Near Expiry widget on dashboard.

My Applications - buckets one in days Specify number of days to highlight the applications that are initiated by the logged in user. This applications are highlighted as they are nearing to expiry within one day.

Based on this number of days the system calculates and displays the count of applications in the first bucket of the Product Application Near Expiry widget on dashboard.

My Applications - buckets two in days Specify number of days to highlight the applications that are initiated by the logged in user. This applications are highlighted as they are nearing to expiry within two day.

Based on this number of days the system calculates and displays the count of applications in the second bucket of the Product Application Near Expiry widget on dashboard.

My Applications - buckets three in days Specify number of days to highlight the applications that are initiated by the logged in user. This applications are highlighted as they are nearing to expiry within three day.

Based on this number of days the system calculates and displays the count of applications in the third bucket of the Product Application Near Expiry widget on dashboard.

My Applications - buckets four in days Specify number of days to highlight the applications that are initiated by the logged in user. This applications are highlighted as they are nearing to expiry within four day.

Based on this number of days the system calculates and displays the count of applications in the forth bucket of the Product Application Near Expiry widget on dashboard.

Minor Age For Nominees In this section, user can define the age limit of minor in years for opening and account. Savings Minor Age Specify the age of the minor to open saving account. Term Deposit Minor Age Specify the age of minor to open term deposit account. Funding Parameters In this section user can define the funding parameters. Current and Savings Account Initial Funding by Cheque Specify the preferences of initial funding for current and saving accounts. This preferences are specific to funding that are initiate by cheques.

The available option is Manual process.

Current and Savings Account Initial Funding by Cash Specify the preferences of initial funding for current and saving accounts. This preferences are specific to funding that are initiate by cash.

The available options are:

- Automatic

- Manual

Current and Savings Account Initial Funding by Account Specify the preferences of initial funding for current and saving accounts. This preferences are specific to funding that are initiate by account.

The available options are:

- Host

- Manual

TD Account Funding by Cheque Specify the preferences of initial funding for term deposit and saving accounts. This preferences are specific to funding that are initiate by cheque. TD Account Funding by Cash Specify the preferences of initial funding for current and saving accounts. This preferences are specific to funding that are initiate by cash.

The available options are:

- Automatic

- Manual

TD Account Funding by Account Specify the preferences of initial funding for term deposit accounts. This preferences are specific to funding that are initiate by account.

The available options are:

- Host

- Manual

TD Account Funding by GL Specify the preferences of initial funding for term deposit accounts. This preferences are specific to funding that are initiate by GL. User can select the Host option from the list for initial funding.

Loan Against Deposit Threshold This field defines the maximum loan amount as a percentage of the term deposit value (1% - 100%). Incomplete Application Expiry In this section user can define the expiry preferences for incomplete applications. Incomplete Application Expiry Period (in Days) Specify number of days to highlight the incomplete applications that are nearing to the expiry. Lead Days for Incomplete Application Expiry Period Alert Indicates the number of days prior to the application expiry, when an alert is triggered to the banker intimating about the application expiry. Lag Days for Incomplete Application Expiry Period Alert Indicates the number of days after the application is expired, an alert is triggered to the banker intimating about the application expiry. Dedupe Parameters In this section user can define preferences for dedupe parameters. Application dedupe Select to trigger the application dedupe process. Customer dedupe Select to trigger the customer dedupe process. Address Stability In this section user can set preferences for resident stability. Applicable Address Types Select the address types for which the address stability is applicable. Applicable Stability Applicable Products Select the products for which the resident stability is validated. Applicable Stability (Years) Specify the number of years for which the resident stability is valid. Loan Simulation & Quick Assessment In this section user can set preferences for loan simulation and quick assessment. Default Stage Select the repayment stage from the list for the loan simulation and quick assessment. The available options are: - Personalized Repayment schedule

- User Defined Schedule

- Interest and Principal Installment

- Interest Only Principal on Maturity

- Principal Only Interest on Maturity

- Fixed Principal Instalments

- BULLET

- Equated Periodic Installment

- Interest Only Installments

- Moratorium

Default Loan Frequency Select the loan repayment frequency for the loan simulation and quick assessment. The available options are: - Daily

- Weekly

- Biweekly

- Monthly

- Quarterly

- Half Yearly

- Yearly

- Not Applicable

Note: If the repayment stage is set to Bullet then this field will be defaulted to Not Applicable.

Inactive Loan Simulation Expiry Period (in days) Specify the number of days for an inactive loan simulation remain valid before it is expired. Credit and Compliance In this section user can set preferences for credit and compliance. Insider Credit Threshold In this section user can define the threshold limits for insider credit. Insider Credit Threshold Currency Specify the credit threshold currency for insider. Insider Credit Threshold Specify the credit threshold value for insider. Executive Officer Credit Threshold Currency Specify the credit threshold currency for executive officer. Executive Officer Credit Threshold Specify the credit threshold value for executive officer. Offer In this section user can define offer related preferences. Downsell Offer Expiry Period (in Days) Specify number of days to highlight the downsell offers that are nearing to the expiry. Lead Days for Downsell Offer Expiry Alert Indicates the number of days prior to the downsell offer expiry, when an alert is triggered to the banker intimating about the offer expiry. Lag Days for Downsell Offer Expiry Alert Indicates the number of days after the downsell offer expiry, when an alert is triggered to the banker intimating about the offer expiry. Integration In this section user can define integration preferences. Host User Specify the host user for integration. Direct Banking URL Specify the direct banking URL. Finicity Mode Select the finicity mode for fund transfer. The available options are:- Branch Visit: If this option is selected then it is mandatory for a customer to visit branch for fund transfer.

- Customer Email: If this option is selected then finicity URL is sent to the preferred Email ID of customer for completing the fund transfer.

Enable OCR for Document Extraction Specify whether the user wants to enable OCR for document extraction. Collateral System Integration Specify whether the user wants to enable the collateral system integration. Enable Address Search In this section user can define the preferences of enabling address search. Customer Information Data Segment Select to enable the address search in the Customer Information data segment of account opening application. Add-On Card Holder Data Segment Select to enable the address search in the Credit Card Add-On Card Holder data segment of the credit card account opening application. Collateral Data Segment Select to enable the address search in the Collateral data segment of account opening application. Solicitor Details Select to enable the address search while capturing solicitor details. Nominee / Guardian for Current and Saving Select to enable the address search while capturing nominee or guardian details in the current and saving application. Nominee / Guardian for Term Deposit Select to enable the address search while capturing nominee or guardian details in the term deposit application. Enable AI Select the checkbox to specify whether the AI assistance should be enable. Allowed AI Features Select the option to enable the AI assistance feature in the respective section. The available options are:- AI Help for Adhoc Queries: If this option is selected then the user can enter adhoc queries while processing the application.

- Account Opening Prediction: If this option is selected Machine Learning Model to predict the account opening date in the Application Details screen.

- AI Suggested Answers (Scorecard): If this option is selected then the Suggested Answer column appears with AI generated answers in the Qualitative Scorecard data segment. Refer to the images Figure 1-105 and Figure 1-106.

- AI for Application Tracker: If this option is selected then the Generative AI provides the key insights of the application in the Application Details screen. Refer to the images Figure 1-101 and Figure 1-102.

- AI Generated Business Product Summary: If this option is selected then the user can generate the business product summary.

- Product Brochure Generation: If this option is selected then the system will generate the PDF brochure using Gen AI. Refer to the images Figure 1-103 and Figure 1-104.

Question Configuration for AI Suggested Answers (Scorecard) In this section you configure the questionnaire for the AI assistance. This section is enabled if the AI Suggests Answers (Scorecard) option is selected. Click

to add relevant questions for which AI suggested answer are displayed.

Below fields appears in this section:

to add relevant questions for which AI suggested answer are displayed.

Below fields appears in this section:- UI Questionnaire Code: The user can select the questionnaire code.

- UI Question Code: The user can select the question code.

- Action: The user can perform the Delete action on the added record.

The set of questionnaire are configured using the Questionnaire screen.

Report Linkage for Product Brochure Select the report from the drop-down list linked to the product brochure. Credit Bureau Provider Select the provider from the list for credit bureau. - Experian

- Equifax

Docusign Integration This section is used in Docusign integration. - An RSA key pair is used to encrypt token in the JWT Grant authentication flow to provide assurances of authorship and data integrity.

- Create RSA key pair through DocuSign portal. The private key is copied and saved as private.key.

- Click on Upload button to upload file

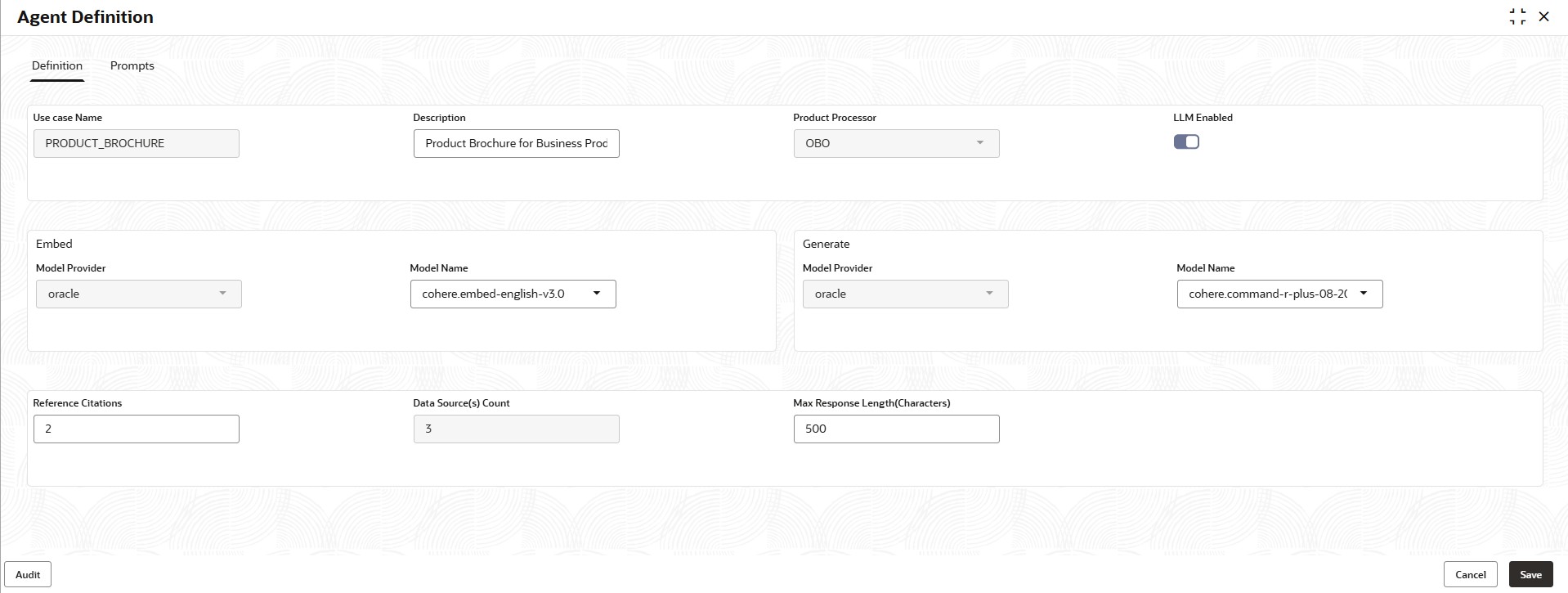

Figure 1-101 Agent Definition - Application Tracker Definition

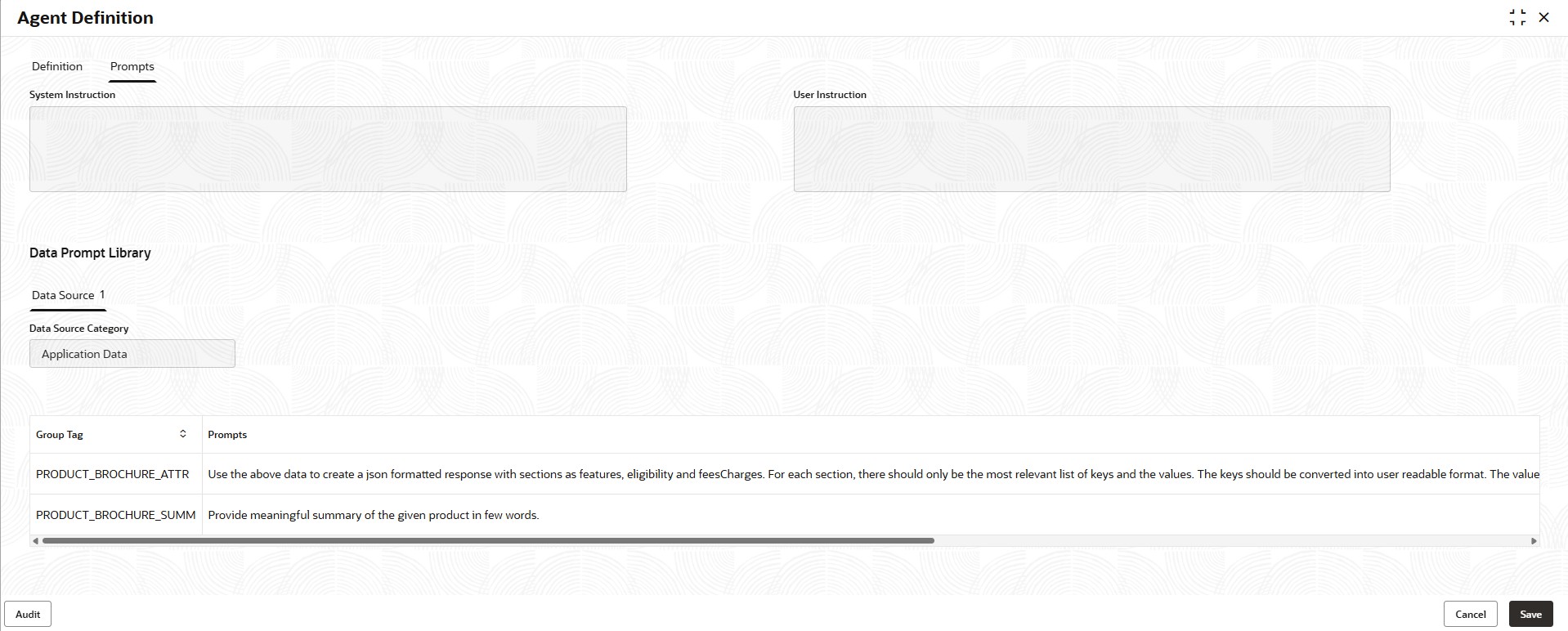

Figure 1-102 Agent Definition - Application Tracker Prompts

Figure 1-103 Agent Definition - Business Product Brochure Definition

Figure 1-104 Agent Definition - Business Product Brochure Prompts

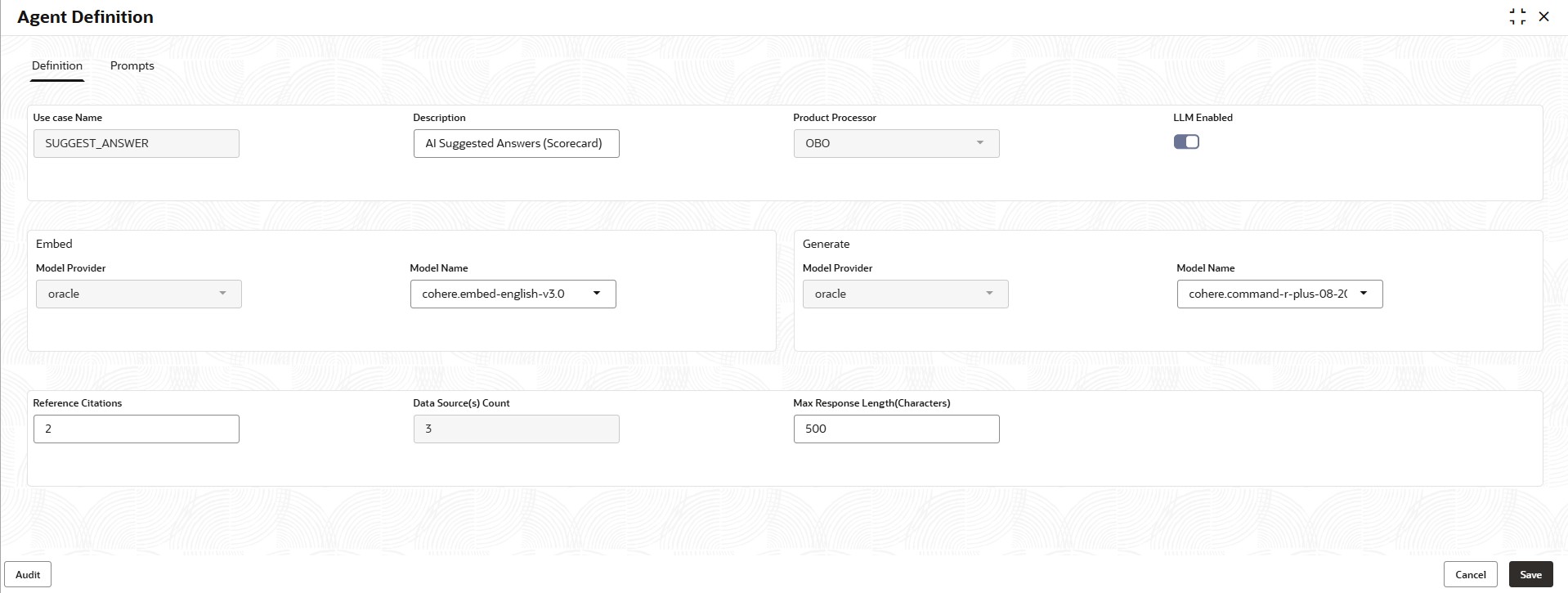

Figure 1-105 Agent Definition - Suggest Answer Definition

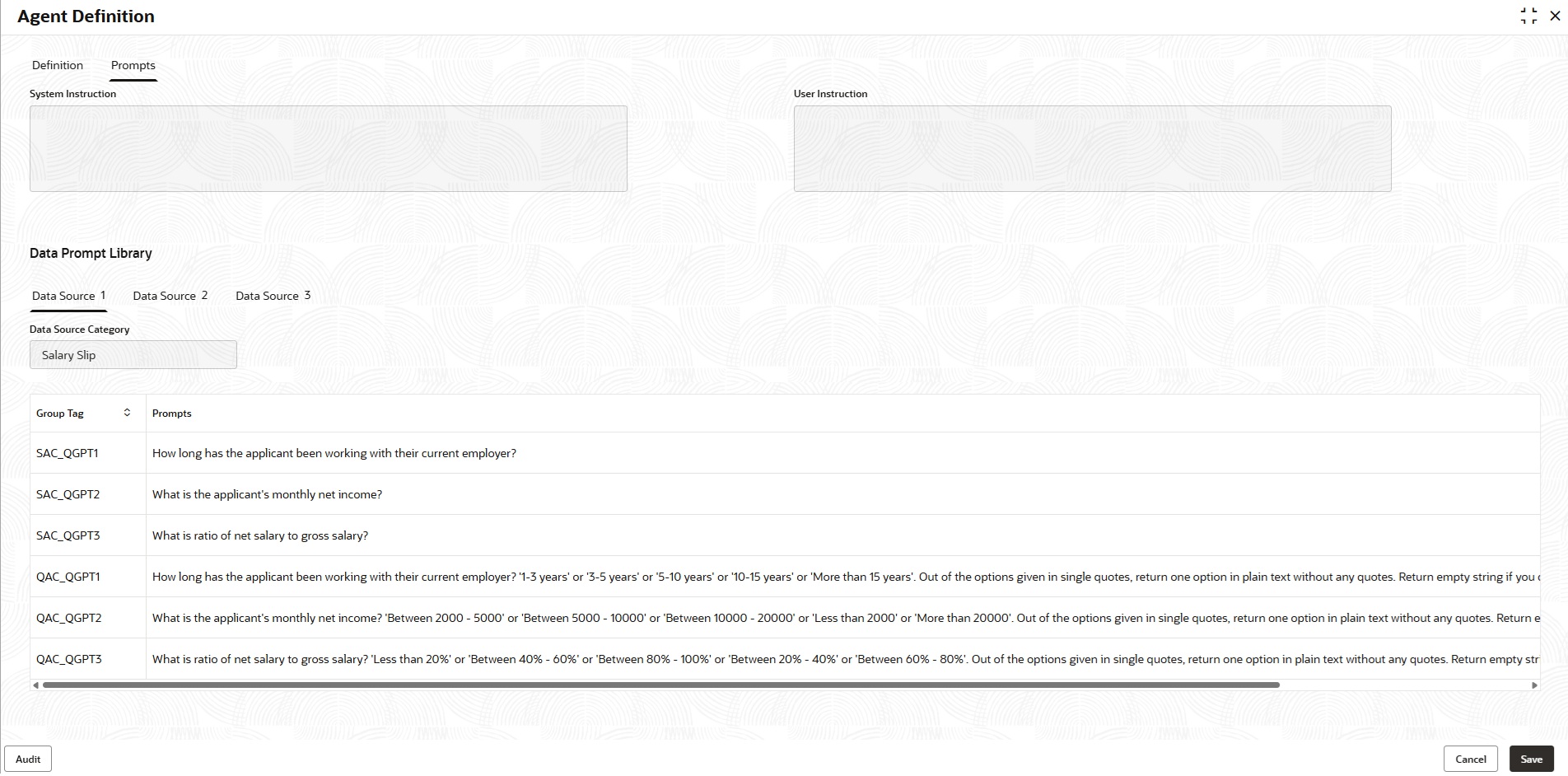

Figure 1-106 Agent Definition - Suggest Answer Prompts

Parent topic: Configurations