2.1.2.16 Pricing

This topic provides systematic instructions about pricing.

Credit Pricing is the method by which a lender sets terms such as charge, commission or interest that is required as compensation for the assumed credit risk. Credit pricing may be set as an overall pricing for the credit facility involving all costs (funding cost and/or other operational costs) or it may be set up individually against the contracts associated with the facility.

Banks can maintain the various pricing components required for the facility through pricing maintenance functionality in OBELCM, so that when actual contracts are linked to the said facility, pricing decided as part of credit sanction can be referred for charging on the contracts.

- User can maintain multiple records of pricing components like Interest, Charges and Commission for a facility.

- Base don facility type, applicable pricing components can be

signified.

- For example, for Funded type of facility, Interest and Charges are supported whereas for non-funded type of facility, Commission and charge components are supported.

- Applicable attributes are provided for each pricing component as, INTEREST pricing details can be added only if Facility Type is selected as FUNDED.

- Click Next in previous data segment to proceed with the

next data segment, after successfully capturing the data.The Pricing screen is displayed.

- Click Charge tab.The Charge screen displays.For more information on fields, refer to the field description table below.

Table 2-45 Charge Details

Fields Description Charge Code Displays the charge code. Charge Currency Displays the charge currency. Amount Displays the amount. Action Displays the action based on the charge selected. - Click

, the Charge Details screen displays.For more information on fields refer to the field description table below.Table 2-46 Charge Details

Fields Description Charge Amount If the charge is based on a Fixed amount, you should specify the amount that will be applied. Charge Code Define unique identifier for the charge, called the charge code. Charge Currency Click  icon, to select the charge currency.

icon, to select the charge currency.

Charges levied on a contract will be settled in this currency that you specify for the charge code

Charge Description Provide the charge description that would help you easily identify the charge Charge Type Select the charge type from the drop-down list. The available options are: - Fixed

- Rate

The charge type indicates whether the charge to be applied is a flat amount or a percentage of the base amount.

If the charge that you are defining calculates charges on a flat amount (say a Documentation Charge on the contracts), choose the Fixed option. To levy a charge as a percentage basis, choose the Rate option.

Charge Base Amount This indicates the base amount on which the charge is to be applied on a percentage (Rate) basis. Is charge waived? Switch to

to enable this parameter.

to enable this parameter.

Switch to

to disable this parameter.

to disable this parameter.

Select this option if you want to waive the specific charge code that you do not wish to apply.

Maximum Charge Amount You can specify the minimum charge amount that will be applied on a contract involving the charge code. Manimum Charge Amount You can specify the maximum charge amount that will be applied on a contract involving the charge code. Net Charge Amount You can specify the net charge amount that will be applied on a contract involving the charge code. Waived Amount You can define the amount that is waived out of the total charge amount. Waived Remarks Provide the reason for fee waiver. Charge Rate If the charge is based on a rate, you should specify the rate that will be applied. - Click Comission tab.The Comission details screen displays.For more information on fields, refer to the field description table below.

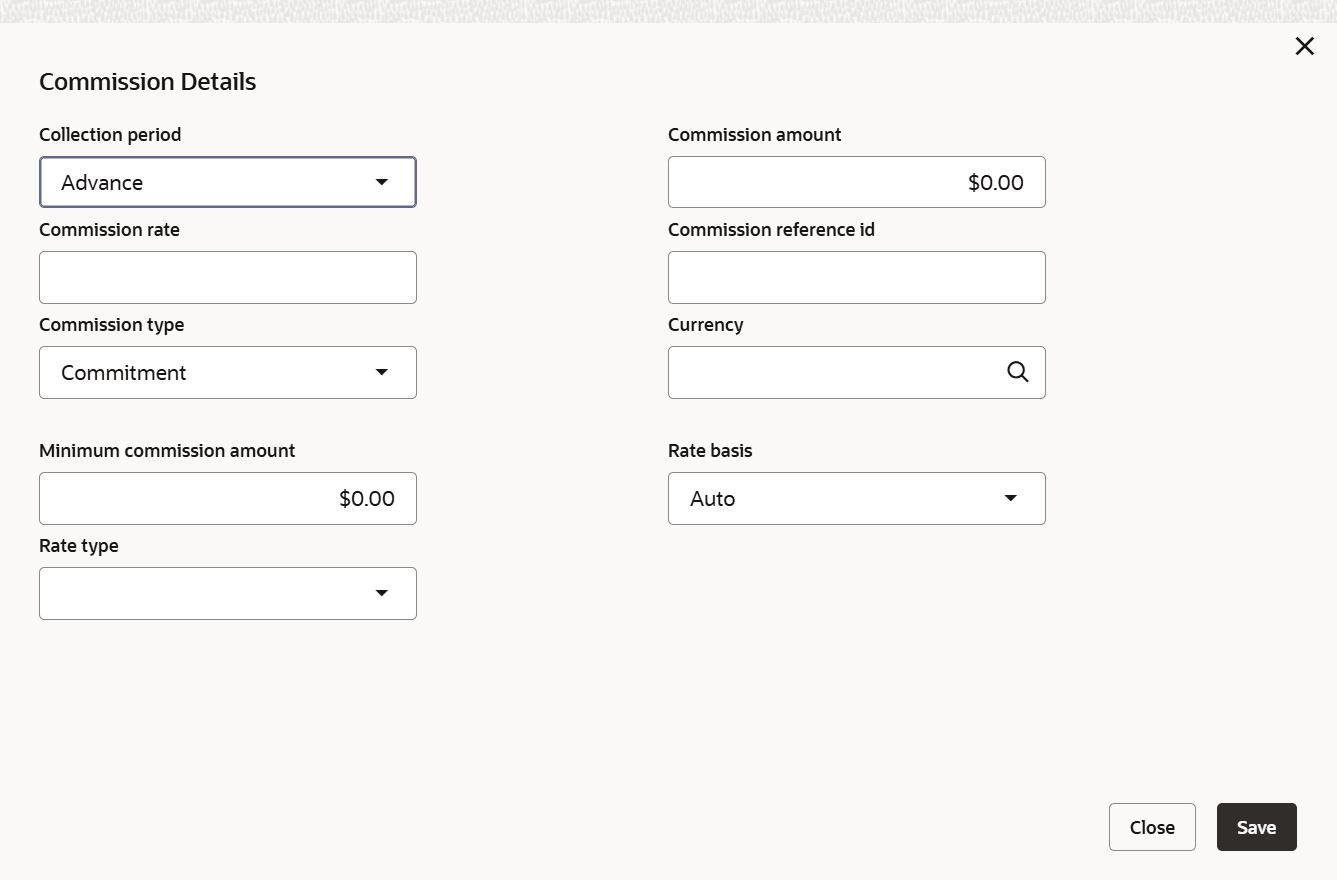

Table 2-47 Pricing - Commission Details

Fields Description Collection Period Displays the collection period. Commission Rate Displays the commission rate. Commission Amount Displays the commission amount. Action Displays the action based on the commission selected. - Click

, the Commission Details screen displays.For more information on fields, refer to the field description table below.Table 2-48 Commission Details

Fields Description Collection Period Select the collection Period from drop-down list. The available options are: - Advance

- Arrears

Commission can be collected at the beginning or end of each collection period or when the contracts are created or matured.

Select Advance if the commission is to be collected at the beginning of period or when contracts are created.

Select Arrears if the commission is be collected at the end of each collection period or when the contracts mature.

Commission Amount If the charge is based on a Fixed Amount, you should specify the amount that will be applied Commission Rate If the commission is based on a Fixed Rate, you should specify the rate that will be applied. Commission Reference ID Provide unique reference identifier for the commission, called the Commission reference id. Commission Type Select the commission type from the drop-down list. The available options are: - Commitment

- Usance

The commission type indicates whether the commission is to be applied on Usance type of contracts (typically in letters of credit) or it is to be applied on ‘Commitment’ type of contracts.

Currency Click the  icon and select the currency from the

list.

icon and select the currency from the

list.

Commission levied on a contract will be settled in this currency that you specify.

Minimum Commission Amount You can specify the minimum commission amount that will be applied on a contract involving the commission. Rate Basis Select the commission collection frequency from the drop-down list. The available options are: - Auto

- Daily

- Monthly

- Quarterly

- Half-yearly

- Yearly

Rate Type Select the rate type from the drop-down list. The available options are: - Fixed Rate

- Fixed Amount

Commission can be defined as a flat amount, or it can be expressed in terms of a rate. If the commission that you are defining calculates commission on a flat amount (say, Issuance commission)choose the Fixed Amount option. To levy a commission as a percentage basis, choose the ‘Fixed Rate’ option.

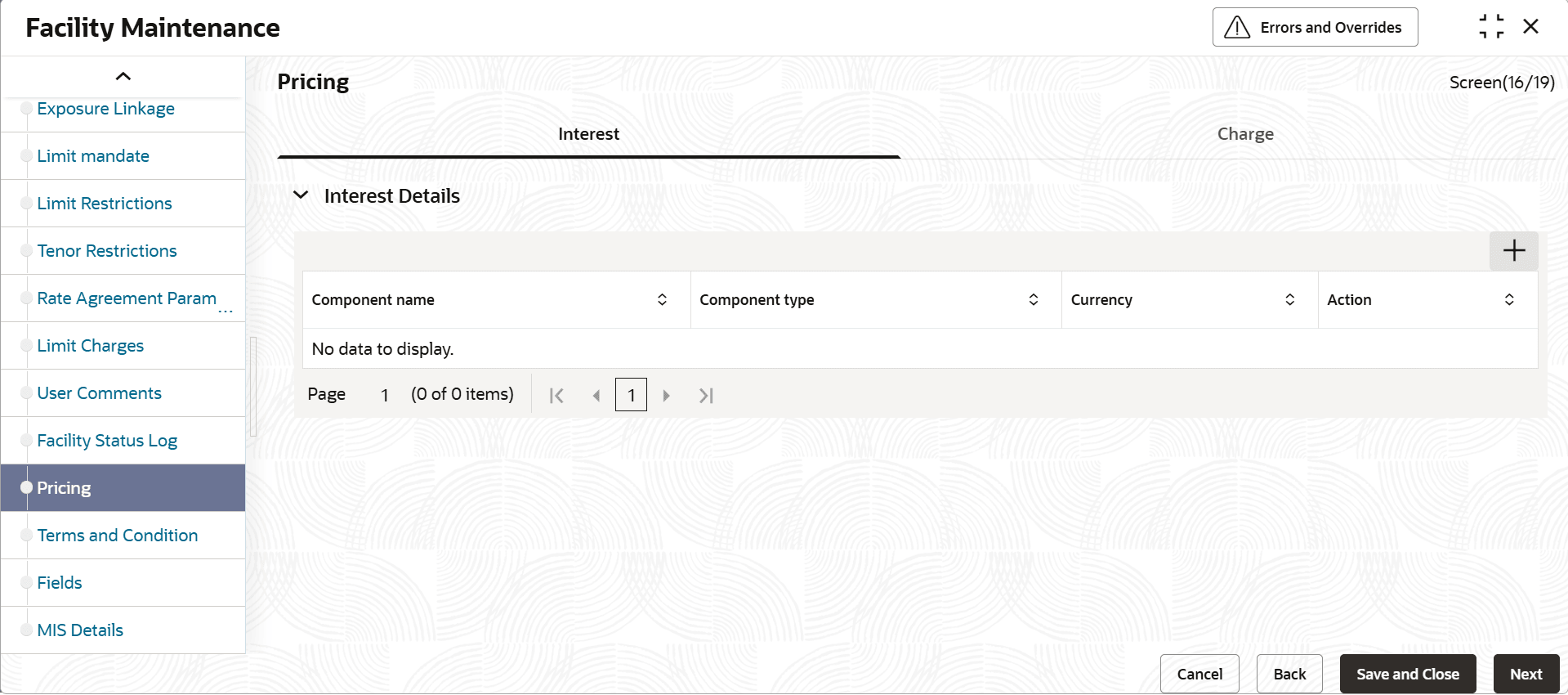

- Click Interest tab.The Interest details screen displays.For more information on fields, refer to the field description table below.

Table 2-49 Pricing - Interest Details

Fields Description Component Name Displays the component name. Component Type Displays the component type. Currency Displays the currency. Action Displays the action based on the commission selected. - Click

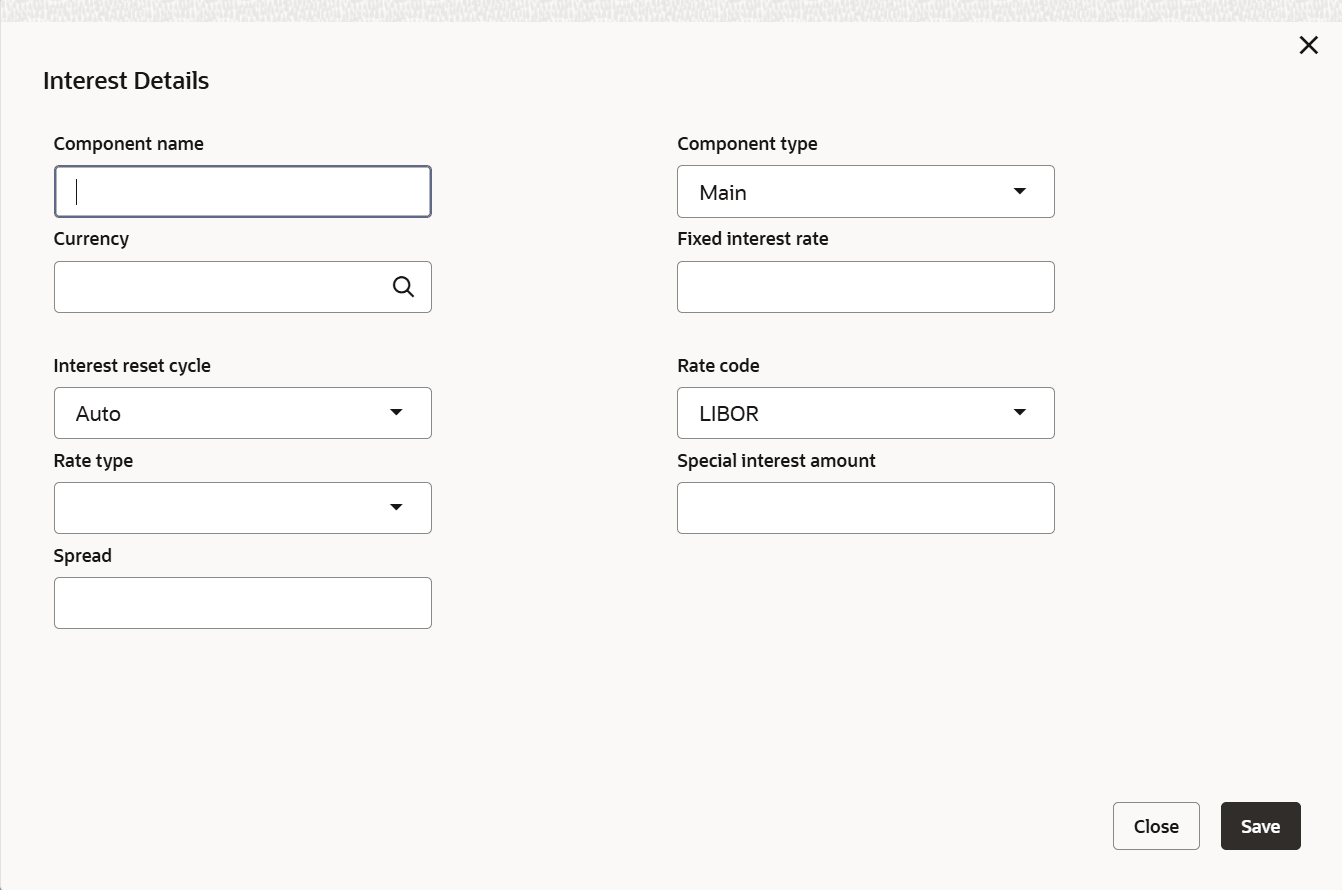

, the Interest Details screen displays.For more information on fields, refer to the field description table below.Table 2-50 Interest Details

Fields Description Component Name Define unique identifier for the interest. Component Type The component type indicates the type of interest to be applied if contract has more than one type of interest applicable. User can create the interest component of type- Main (For capitalization and amortization purposes)

- Penal (For penalty purposes)

- Prepay (For loan prepayment purposes).

Currency Interest levied on a contract will be settled in this currency that you specify. Fixed Interest Rate If you indicate that interest should be calculated based on a Fixed Rate, you must specify the ‘Fixed interest rate’. Interest reset cycle If the floating rates must be applied periodically, the frequency of application should be defined from the list of available options. - Auto

- Daily

- Monthly

- Quarterly

- Half-yearly

- Yearly

Rate Code If you indicate that interest should be calculated based on a Floating Rate. Specify the Rate Code from the available options: - LIBOR

- SIBOR

Rate Type Interest can be applied in different ways:

- Fixed: An interest rate is fixed at the time of initiating the contract. If you indicate that interest should be calculated based on a Fixed Rate, you must specify the Fixed interest rate.

- Floating: These are the market rates (with or without a spread) that are applied on the contract. If you indicate that interest should be calculated based on a Floating Rate, you must specify the Rate Code.

- Special: If the interest is a fixed amount and not a percentage of the principal amount, the rate type will be 'Special'. In this case you must specify the fixed amount in the Special Interest Amount field.

Special Interest Amount If you indicate that interest is of type Special, specify the Special Interest Amount. Spread A spread can be applied on top of the specified floating rate of interest. - Click Save and Close to save the added record. Click Next to navigate to the next screen.

Parent topic: Facilities Maintenance