3.2 Collateral Category

This topic offers structured guidance on maintaining Collateral Category Maintenance.

- From Menu, select Limits and Collaterals. Under Limits and Collaterals, select Collaterals.

- Under Collaterals, select Maintenances. Under Maintenance, select Collateral Category.

- Under Collateral Category, select Collateral Category

Maintenances. The Collateral Category Maintenances screen is displayed.

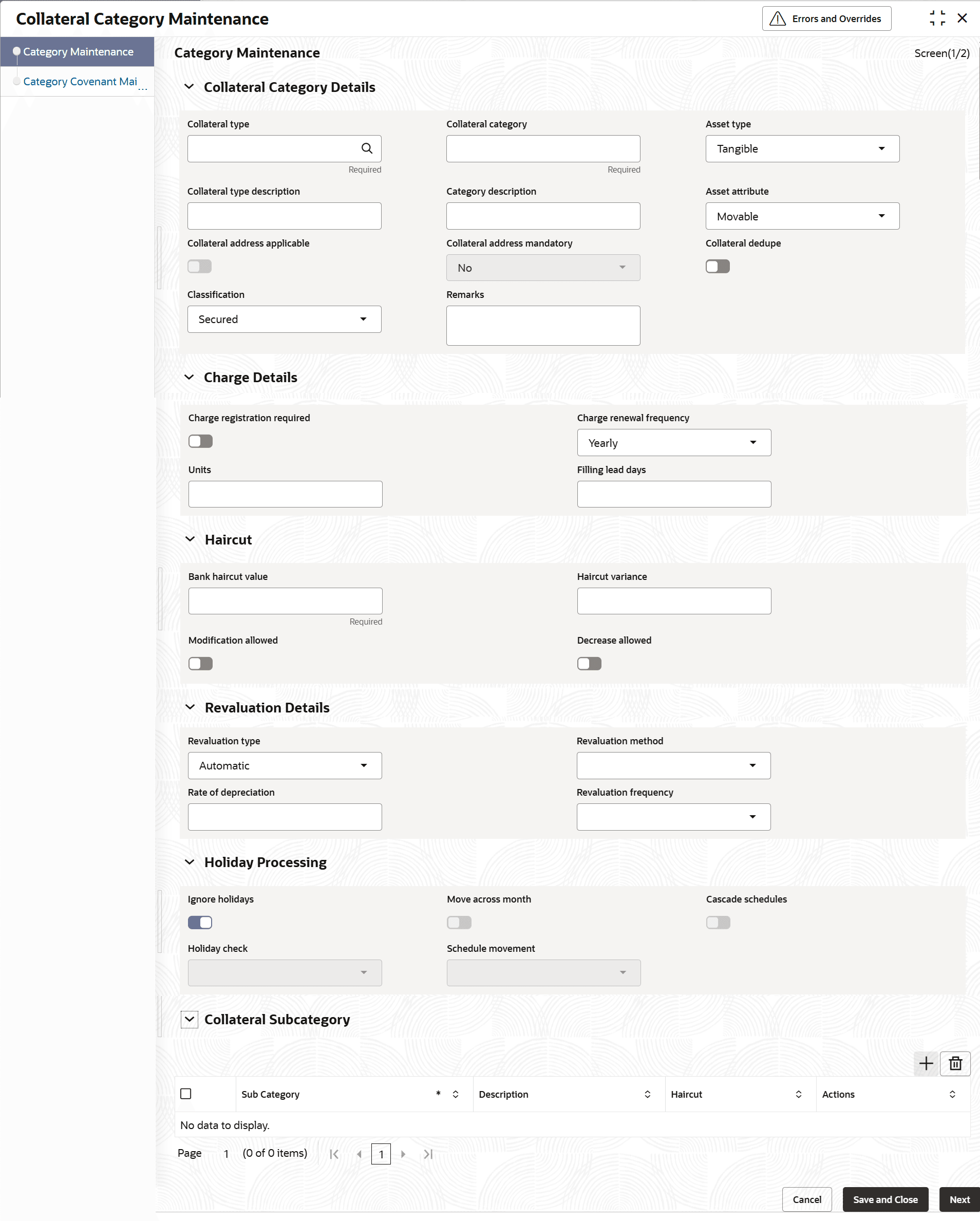

Figure 3-1 Collateral Category Maintenances

- On Collateral Category Maintenances screen, specify the

fields.For more information on fields, refer to the field description table.

Note:

The categories for the below mentioned Collateral Types are factory shipped:

- Agriculture

- Aircraft

- Vessels

- Vehicles

- Property

The user will not be able to add any new Collateral Category for the above-mentioned Collateral Types. Only the existing categories values can be modified.

Table 3-1 Collateral Categories - Field Description.

Field Description Collateral Type Click the  icon and select the collateral type from the

list..

icon and select the collateral type from the

list..

Collateral Category The Collateral Category created for the selected Collateral Type can be specified in this field. For Factory shipped Collateral Category, the user can modify the categories for the selected Collateral type by clicking the icon in a modification mode. The system displays the possible values for selected Collateral Type.

Note:- User defined category is applicable only for Vehicle and Property types of collateral.

- Collateral category for factory shipped collateral types can be selected for the collateral type selected.

Asset Type Select the asset type from the list. The available options are: - Tangible

- Intangible

Collateral Type Description Displays the description of the selected Collateral Type. Collateral Category Description Specify the description for the Collateral Category. Asset Attribute Select the attribute from the list. The available options are: - Movable

- Immovable

Collateral Address Applicable Switch to Select the Collateral Address Applicable field in the "Collateral Category" Screen for property type of collaterals. - Selection is optional at category level. It is a check box

-

By default, it is un-checked. If you select Collateral Address Applicable check box, then Collateral Address Mandatory additional field will be available for selection.

Collateral Address Mandatory It is a is a drop-down list with option Yes/No. By default, value is selected as No. This value can be modified by the user. Note:- The above fields will indicate, if the Collateral Address needs to be captured or not while creating/ updating the property collateral record.

- If this check-box is selected, then while creating the property collateral record the system will validate whether address is captured in address panel of property collateral type.

- Collateral Address Applicable and Collateral Address Mandatory fields can be updated in the collateral category.

Refer to Property Details - Common for more information.

Collateral Dedupe Select this check box if you want to perform collateral dedupe validation for the selected collateral type and category combination during collateral creation. Note: Collateral Dedupe validation can be performed only for the following collateral types:- Property

- Vehicle

- Agriculture

- Aircraft

- Vessel

Classification Select the classification type from the list. The available options are: - Secured

- Unsecured

- Liquid

Note: By default, secured option is selected.

Remarks Specify the Remarks for the collateral type and category combination, if any. Charge Registration Required Select this toggle to record the charge details of collateral. Post charge registration, a notice containing the required details can be sent to the appropriate registration authority. A filing statement can also be submitted to the registrar for charge creation. Charge Renewal Frequency Select the charge renewal frequency from the drop-down list. The available options are: - Daily

- Weekly

- Monthly

- Quarterly

- Half Yearly

- Yearly

Units Specify the units. For example, if Frequency is selected as Monthly and Unit is selected as 2, then the system updates the charge end date considering perfection date + 2 months.

Filing Lead Days Specify the lead days. The number of days before the charge expiry date during which charge can be renewed. Haircut Specify the Haircut details under this section. Bank Haircut Value Specify the haircut value set by the bank for the selected collateral type and category combination. Bank Haircut Value can be any value between 0 to 100. Note: The Haircut mentioned here will be defaulted on Collateral Maintenance screen which can be increased or decreased based on the Modification Allowed and Decrease Allowed parameters

Haircut Variance Specify the haircut variance allowed for the Bank Haircut Value, in case the Modification Allowed toggle is enabled. This is mandatory when Modification Allowed is enabled. Haircut variance can be any value between 0 to 100.You can increase or decrease the Bank Haircut Value to the extent of Haircut Variance during collateral maintenance. Modification Allowed Enable this Switch to indicate that modification to the Bank Haircut Value is allowed. Decrease Allowed Enable this check box to indicate that decrease in the ‘Bank Haircut Value’ is allowed, in case ‘Modification Allowed’ check box is enabled. By default this option is selected as “No”. Revaluation Details Specify the details under this section. Revaluation details can be configured at collateral category level based on revaluation type and revaluation method as applicable to the collateral type.

Revaluation Type Select the type from the drop-down list. The available options are: - Automatic

- Manual

For more information on collateral types with supported revaluation type/method refer,Manual type: Table 3-3, Manual & Auto-external: Table 3-4.

Revaluation Method Select the method from the drop-down list. The available options are: - External

- Custom

- Staright Line

- Written Down Value

- Sum of Years Digit

Note: These methods are used for revaluation when the Revaluation Type is set to Automatic.

For illustrations on Straight line method, Written down value method and Sum of years digit method please refer Processing Section

Rate of Depreciation Specify the percentage. The depreciation rate is applicable only if the revaluation method selected is either Straight line or written down value. Revaluation Frequency Select the frequency from the drop-down list. The available options are: - Daily

- Weekly

- Monthly

- Quarterly

- Half Yearly

- Yearly

This field is applicable only when the Revaluation Type is set to Automatic. For the Sum of Years' Digits method, the revaluation frequency must be yearly and cannot be modified during Collateral Creation once the default Category-level Revaluation settings are applied.

Holiday Processing Specify the Holiday Processing details under this section. Note: The holiday processing settings are applicable only when Revaluation Type is Automatic.

Refer to Processing section on details about Holiday Treatment.

Ignore Holidays Switch to

to enable this parameter.

to enable this parameter.

Switch to

to disable this parameter.

to disable this parameter.

Note: If this parameter enabled, than during revaluation process system will ignore the Holiday maintenance.

Move Across Month Switch to

to enable this parameter.

to enable this parameter.

Switch to

to disable this parameter.

to disable this parameter.

This field becomes available when the Ignore Holidays is disabled.

Note:

Move across month works in consonance with schedule movement setting and is applicable when next revaluation date of a collateral falls on a holiday.

For more information, refer example: If Move Across Month is selected, then the system moves next revaluation date to first working date of next month. If Move Across Month is not selected, then the system changes next revaluation date to immediately preceding working date of the current month.

Cascade Schedules Switch to

to enable this parameter.

to enable this parameter.

Switch to

to disable this parameter.

to disable this parameter.

This field becomes available when the Ignore Holidays is disabled. Refer Processing section for illustration on Holiday Treatment Processing.

Holiday Check Select the holiday check from the drop-down list. The available options are: - Currency

- Local

- Both

This field becomes available when the Ignore Holidays is disabled.

Refer Processing Section for illustration on Holiday Processing.

Schedule Movement Select the schedule movement from the drop-down list. The available options are: - Move Forward:

In case calculated next revaluation date is holiday, then date must be moved forward. In the scenario, suppose August 31st is the holiday, then next revaluation date moves to 1st September next working date if move across month is enabled.

- Move Backward: In case calculated next revaluation date is holiday, then date must be moved backward. In the scenario, suppose August 31st is the holiday, then next revaluation date moves to 30th August which is previous working date.

Collateral Sub Category Multiple Sub Categories can be maintained for the Collateral Type and Category combinations. Sub Category Speicfy the sub-category for the selected collaterals type and category. This is an optional maintenance for the collateral categories.

For example, if Residential Property is selected as category for Property collateral type, Villa/Flat/Duplex can be specified as sub-category.

Note:- Sub Category value must be unique across all collateral type and category combination records.

- Sub Category cannot be de-linked once it is linked to a collateral.

Please refer to the illustration of Collateral Hierarchy supported in Collateral Module.

Description Specify the brief description of the subcategory. Haircut Specify the haircut for the collaterals of mentioned sub-category. Haircut can be any value between 0 to 100. The Haircut maintained for Sub Category will have precedence. I.e. During Collateral creation for the selected Collateral Type and Category combination, if Sub Category is also selected, then system will default the hair cut specified for such selected Sub Category.

If haircut is not provided at sub-category level, the system will apply the Bank Haircut Value maintained for collateral type and category combination to the sub-categories.

The following configurations set for the collateral type and category combination will also be applicable For collaterals created with sub-category.- Modification Allowed

- Decrease Allowed

- Haircut Variance

Illustration of Collateral Hierarchy:

The Collateral Module supports three hierarchical levels for Collateral:- Level 1: Collateral Type

- This represent the primary classification of the Collateral, which is factory shipped.

- Level 2: Collateral Category

- This categorizes the Collateral into various categories for a given Collateral Type. For Collateral types such as Property, Agriculture, Aircraft, Vehicles and Vessels, the Collateral categories are factory shipped. For other Collateral types, the Collateral Categories can be configured as per the requirement of the banks

- Level 3: Collateral Sub-Category

- This level is optional. Multiple sub-categories can be defined for each combination of Collateral Type and Category.

Illustration:Table 3-2 Illustration

Collateral Type Collateral Category Collateral Sub-Category Vehicle Passenger Vehicle Bus Car Auto Electric Vehicle Goods Vehicle Trailer Tempo Traveller Semi-Trailer Trucks Table 3-3 Manual Revaluation

SL.No Collateral types - Only manual 1 Corporate Deposits 2 Inventory 3 Account receivable 4 Guarantee 5 Other bank deposits 6 Accounts & Contracts 8 Obligation 9 Insurance Auto and Manual Revaluation

Revaluation is based on configured depreciation method and percentage or external price change. The following collateral types are applicable for both ‘Auto’ and ‘Manual ‘revaluation type.Table 3-4 Auto and Manual Revaluation

SL.No Collateral types with revaluation type Manual & Auto External/Depreciation 1 Vehicles 2 Machinery 3 Vessel 4 Aircraft Auto Revaluation

The following collateral types are applicable only for ‘Auto’ revaluation type.Table 3-5 Auto Revaluation

SL.No Collateral types with only Auto-external 1 Funds 2 Bonds 3 Stocks Following collateral types are considered for manual type of revaluation as well as automatic revaluation with external revaluation method.

Table 3-6 Manual and Auto External Revaluation

SL.No Collateral types with Manual and Auto-External revaluation 1 Commercial papers 2 Agriculture 3 Perishables 4 Commodities 5 Metals 6 Property For more information on collateral revaluation, refer Collateral Revaluation section in this User Manual.

- Click Save and Close to save the added record. Click Next to navigate to the next data segment, after successfully capturing the data.

- Category Covenant Maintenance

This topic provides information on linking Covenant details for Collateral Category which are maintained in the Covenant Master Maintenance in covenant domain. - View Collateral Category

This topic describes the systematic information to view the collateral category.

Parent topic: Maintenances