4.2.1 Collateral/ Collateral Pool Block

This topic provides systematic instructions about Collateral Pool Block.

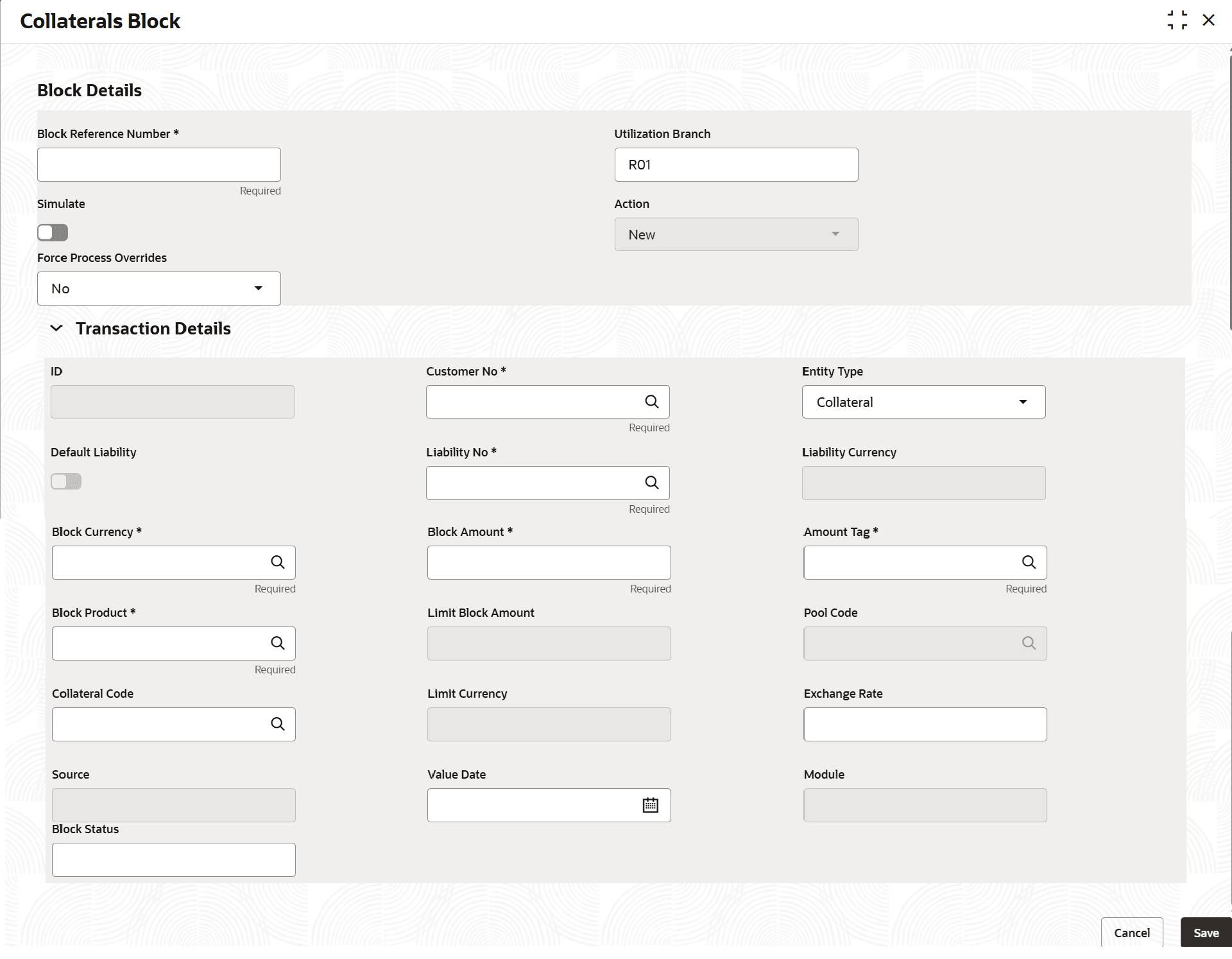

TheCollaterals Block screen is a screen for capturing utilization block request specific to collateral and collateral pool of a Liability in Enterprise Collaterals System.

- On Home menu, select Limits and Collaterals. Under Limits and Collaterals, select Collaterals.

- Under Collaterals, select Transactions. Under

Transactions select Collateral Block.The Collateral Block screen is displayed.

- On Collateral Block screen, specify the fields.For more information on fields, refer to the field description table.

Table 4-19 Block Details Fields and Descriptions

Field Descriptions Block Reference Number Specify the unique number which is to be assigned for every block to be created. Usually, Block reference Number is the actual contract number in external system which is placing the block. Utilization Branch Branch code is displayed here. It indicates the transaction branch code. Simulate Switch toggle to indicate that the details for the transaction being entered should be used only for simulation and not stored permanently within the system. After a successful simulation of a transaction, the system displays the block amount for collateral and collateral pool. Action During new block, you can perform below mentioned operations for the entities (liability, collateral, and collateral pool).

- NEW

- INCREASE

- DECREASE

- UNDO

- ALTER

- REVERSE

- RE-OPEN

- E-REVERSE

- Mature

For more information on block refer examples listed after this table.

Force Process Overrides This is for checking the error type of the error codes raised during transaction - online or batch. Possible values are N (Online) and B (Batch). ID Indicates the transaction ID. This is auto generated by the system. Customer No Specify the Customer Number of the contract blocking the collateral. Customer Number entered should be valid Customer Number in Oracle Banking ELCM system. Entity Type Select the limit type from the drop-down list. The options available are: This will be the entity against which block transaction will get processed.

- Collateral

- Collateral Pool

Default liability Switch toggle to enable this parameter. When a customer number is selected from drop-down list, default liability toggle is enabled by default and Liability Code column shows the liability to which this customer is linked as default. Switch toggle to disable this parameter. If a customer is linked to multiple liabilities and blocking transaction needs to consider the entity belonging to a liability which is not default, then default liability needs to be disabled, and liability number can be selected from drop- down list against this field. This gets disabled automatically when you select the non-default liability of the customer.

Liability Code Select the liability code from the list to which entity belongs to. All liabilities(default and non-default) to which a customer is linked are displayed. Liability Currency Displays the currency of the selected liability code. Block Currency Click Search icon and select the currency of block transaction. The adjoining option list contains all the currencies maintained in the system. Block Amount Specify the amount to be blocked. Amount Tag Click Search icon and select the amount tag from the list. The Amount Tag entered in Amount Tag Maintenance screen is displayed here. This typically indicates the type of the component of the transaction such as ‘PRINCIPAL AMOUNT’. Block Product Click Search icon and select the product for the transaction. This indicates external product code initiating the utilization transaction. Product is fetched from product maintenance.

Collateral Code Click Search icon and select the Collateral code associated with the selected liability that is to be used for the transaction. This option is required when you select Entity Type as ‘Collateral’. Limit Block Amount Specify the amount to be blocked from the entity in limit currency.

Note:

- As part of a cross-currency block transaction, this accepts the block amount in limit currency and uses that directly instead of deriving it based on the block amount in transaction currency and the exchange rate.

Pool Code Click Search icon and select the Pool code associated with the selected liability that is to be used for the transaction. This option is required when you select Entity Type as ‘Collateral Pool’ Limit Currency This field displays the limit currency of the entity (Collateral or Collateral Pool) Exchange Rate Specify the Exchange Rate for cross currency block transaction. The block amount for all Limit Entities (Collateral/Collateral pool linked to liability) will be calculated in the mentioned block currency directly using this exchange rate instead of the exchange rate mentioned in CONFIG SERVICE. Note: Refer to section , Direct Exchange Rate section in Common User Guide.

Source Indicates the product processor name from where the transaction has been originated. Value Date Specify the value date for the transaction. System supports both current dated and back dated block transactions. Module The module from which the transactions are triggered is displayed. This is typically the associated module of the product processor which initiates the transaction. Block Status Specify the block status. The available options are: - Active

- Reverse

- Liquidated

The following examples depict block applied on a collateral for different block operations (in the sequential order considering previous transaction).

Table 4-20 Collateral Amounts - Before Block

Available Amount Block Amount Block Amount 10000 0 A Table 4-21 After New Block of 1000

Available Amount Block Amount Block Status 9000 1000 A Table 4-22 After Alter Block of 3000

Available Amount Block Amount Block Status 7000 3000 A After Alter Block of 2000Table 4-23 After Alter Block of 2000

Available Amount Block Amount Block Status 8000 2000 A Table 4-24 After Increase of 1000

Available Amount Block Amount Block Status 7000 3000 A Table 4-25 After Decrease of 500

Available Amount Block Amount Block Status 7500 2500 A Table 4-26 After UNDO (reverses last transaction-Decrease)

Available Amount Block Amount Block Status 7000 3000 A Table 4-27 After Reverse of Block

Available Amount Block Amount Block Status 10000 0 R Reopen BlockTable 4-28 After Reopen of Block

Available Amount Block Amount Block Status 10000 0 A Table 4-29 After Increase of 3000

Available Amount Block Amount Block Status 7000 3000 A Table 4-30 After Decrease of 2000

Available Amount Block Amount Block Status 9000 1000 A Table 4-31 After Increase of 1000

Available Amount Block Amount Block Status 8000 2000 A After E-Reverse of Decrease (2000)Table 4-32 After E-Reverse of Decrease (2000)

Available Amount Block Amount Block Status 6000 4000 A - Click Save to save the record.

- View Collateral Block

This topic describes the systematic instructions to view the collateral block.

Parent topic: Collateral/ Collateral Pool Block