1.2.4 Uploaded File Inquiry – File Details – Trade Finance (Islamic)

This topic provides the systematic instructions about to upload the inquiry in trade finance.

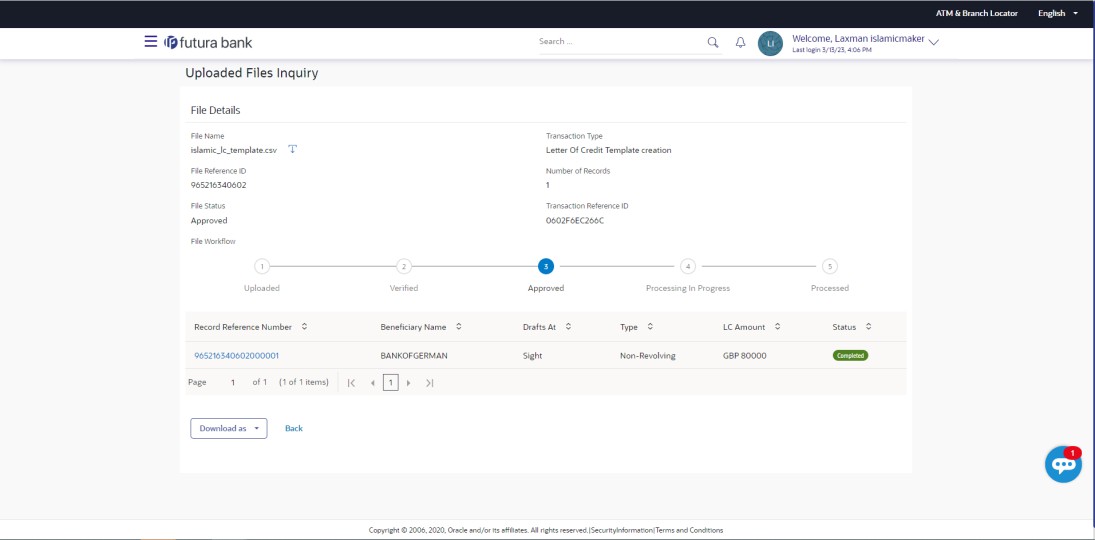

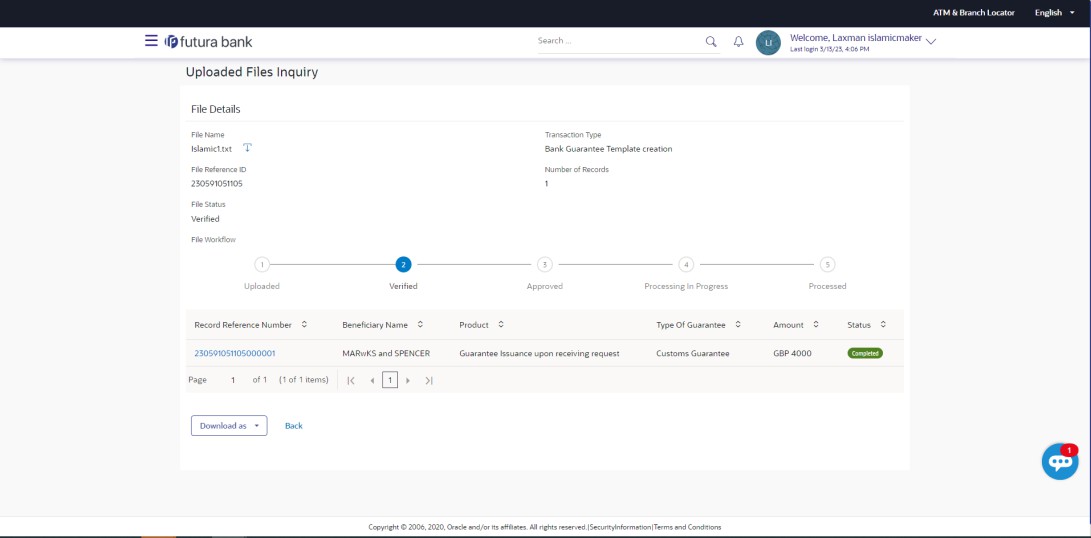

When the user clicks on the File Reference ID from the summary page of the Islamic trade finance file, a new screen appears. This screen allows the user to see the files uploaded by the corporate user for Islamic Trade Finance while creating Islamic LC templates and Islamic BG templates in bulk. The screen shows essential file details such as name, status, reference ID, and the file journey.

Users can download files, an error report if the file has an error status, and they can also download a response file to see the details at the record level.

The file details section displays a summary of the file's records along with the status of each record. Users can delete a specific record if it is dated in the future or has not been processed.

Users have the option to see the record details by clicking the link provided for each record.

The user will be taken to a screen displaying the specific record details, including the file information used for the upload.

The details of each record are tailored to the transaction type the user is asking about.

Figure 1-9 File Details – LC Template Creation (Islamic)

Figure 1-10 File Details – BG Template Creation (Islamic) Field Description Field Name

- On Uploaded Files Inquiry screen, specify the fieldsFor more information refer to the field description table below:

Table 1-5 Uploaded Files Inquiry

Field Name Description File Name File name of the uploaded file.

User can download the file by clicking in the icon available besides the file name.

Transaction Type Displays the transaction type associated with the file. File Reference ID Displays the file reference number, which was generated while uploading the file. Number of Records Displays the total number of records uploaded as a part of the file. File Status Displays the status of the file uploads. Error Report Shows an icon to download the error file in case the uploaded file faced some runtime issue and failed to execute. Response File Download Shows an icon to download the error response file. Transaction Reference ID The transaction reference number, which was generated at the time of transaction execution. File Workflow Flow displaying various stages and status of file upload. Record List – LC Template Creation (Islamic) If the user is inquiring for ‘Islamic LC Template Create’ type of transaction, the following fields are displayed. Record Reference Number The reference ID for identification of the records. Beneficiary Name The beneficiary against whom LC template is created. Draft At The LC draft type that is 'Sight' or 'Usance'. Type The corresponding LC product type. LC Amount The amount of LC. Status Status of the records of the uploaded file. Action Icon to download the e-receipt.

This column appears if the record status is Approved.

Record List – Beneficiary Creation (Islamic) If the user is inquiring for ‘Beneficiary Creation’ type of transaction, following fields are displayed. Record Reference Number The reference ID for identification of the records. Beneficiary Name The beneficiary’s name against whom BG template is created Product The BG product type. 'GLIR - Islamic Guarantee Issuance / Reissuance upon receiving request' or ' GLAM - Islamic Guarantee Issuance / Reissuance upon receiving request'. Type of Guarantee The corresponding BG Type of Undertaking. LC Amount The amount of BG. Status Status of the records of the uploaded file. Action Icon to download the e-receipt. This column appears if the record status is Approved. - Perform the following action to download the file.

- In the File Name field, click

to download the originally uploaded file.

to download the originally uploaded file.

- In the Response File Download field click

to download the response file.

to download the response file.

- In the File Name field, click

- Perform the following action to download the file or delete the file or

navigate to the previous screen. the file.

- Click Download as to download the file in .pdf or .csv format.

- Click Delete to delete the uploaded file.

- Click Back to navigate to the previous screen.

Note:

If there is an error during file verification (i.e. the file is in error status), an option will be available to download the generated error file.FAQ- What are some of the validations that a file goes through at various

stages, in its life cycle?

The following are the validations performed on an uploaded file by Oracle Banking Digital Experience and subsequently by the Host, before file is liquidated.

Table 1-6 Validation

Events Applicable to Checks On File Upload All Files File contents should not match an already uploaded file On File Upload All Files File should not exceed the Maximum Size limit On File Upload All Files The File Extension type should be the ones permitted On File Upload All Files The file should not be Malicious At Pre-Processing All Files The format for all fields, should be as templated viz., Date, Currency in accordance with ISO standards, CIF- numeric, account number-alphanumeric etc. At Pre-Processing All Files The CIF should be valid, should exist At Pre-Processing All Files CIF and Debit account should belong to each other At Pre-Processing All Files User should have access to Debit Account At Pre-Processing All Files Debit account should not be in closed status At Pre-Processing All Files Transaction Limits are not violated at user level At Pre-Processing All Files Payment date should not be in the past At Pre-Processing All Files Payment date should not be a holiday as per the host calendar maintenance At Pre-Processing All Files Debit account should be a CASA account, not loan or TD At Pre-Processing All Files Debit currency in the file, should match the currency of the CASA account At Pre-Processing Internal Files Transaction currency should match either the debit or credit CASA At Pre-Processing Internal Files The Credit Account should be a CASA account, not loan or TD At Pre-Processing All SDSC and SDMC files A file with multiple records, should have the same debit account At Pre-Processing Internal Ad hoc The Purpose of remittance should be valid At Pre-Processing Domestic Files The NEFT / RTGS code should be valid At Approval All Files Cumulative limits should not be violated either for the Approver and the Party Validations in Core All Files The Debit account should have sufficient balance Validations in Core All Files Debit account should not be in dormant status Validations in Core All Files Debit account should not be in debit block status Validations in Core Internal Files The Credit CASA account should not be closed Validations in Core Internal Files There should not be a Credit Block on the CASA account Validations in Core International Files The BIC / SWIFT code should be valid, as per the BIC / Clearing directory as maintained in the host system - If some records in a file are liquidated, others are deleted, what will

the status of the file be?

The table below displays the file status used to represent different stages of the file upload. If all records in the file are liquidated, the file status will be marked as processed. If some records are liquidated while the others are rejected, the file status will still be processed. However, if any records are liquidated and the rest have errors, the file status will be processed with exceptions.

Table 1-7 File Status

Verified Approved Processing in Progress Liquidated Rejected Deleted Error File Status All - - - - - - Verified - All - - - - - Approved - - All - - - - Processing in Progress - - - All - - - Processed - - - - All - - Rejected - - - - - All - Deleted - - - - - - All Error - - - 1 1 - - Processed - - - 1 - 1 - Processed - - - 1 - - 1 Processed with exception - - - 1 1 1 - Processed - - - 1 1 1 1 Processed with exception - - - - 1 1 - Deleted - - - - 1 - 1 Processed with exception - - - - - 1 1 Processed with exception - If a payment file is in the approved status, does it mean that all the

records are successfully liquidated?

No, the file still has to successfully pass validations in the host system, before records are processed.

- Can a user delete the entire file or deletion of only individual records

within a file is allowed?

Whether only records can be deleted, or the entire file will be deleted depends on the accounting type of the file, and the approval type (Record Level or File level).

The table below throws light on the combinations allowed.

Accounting Type Authorization Type File / Record Deletion allowed? SDMC File Level Not allowed SDSC File Level Not allowed SDSC Record Level Only records can be deleted, and not the entire file. MDMC Record Level Only records can be deleted, and not the entire file. - If a working window is set for the File Upload transaction – how will

processing be impacted outside of the working window?

Outside of the transaction working window set for file uploads, processing will depend on whether the file has a Record Level approval or a File Type approval.

Files with a File Type approval – will be rejected, outside of the transaction working window Files with Record Type approval – if some records are processed within the working window, will be completed – if processing of some records, falls outside of the working window – these will be rejected.

- What is the impact of limits on processing of File Upload

transactions?

File uploads transaction will utilize limits depending on if the transfer is an internal, domestic, or international funds transfer.

Further, for domestic funds transfer – limits are defined for each network – NEFT, RTGS and IMPS. Limits will be checked at the pre-processing’s stage for file uploads.

- After a file is successfully uploaded, is the user provided

notifications on its status?

Yes, Users mapped to the FI – initiators and approvers of the file, are provided with alerts / notification, as file progresses from the Uploaded stage to Approved to Processing in Progress to the Processed stage. Alternately, users can log in to view the status of the file.

Parent topic: Uploaded Files Inquiry