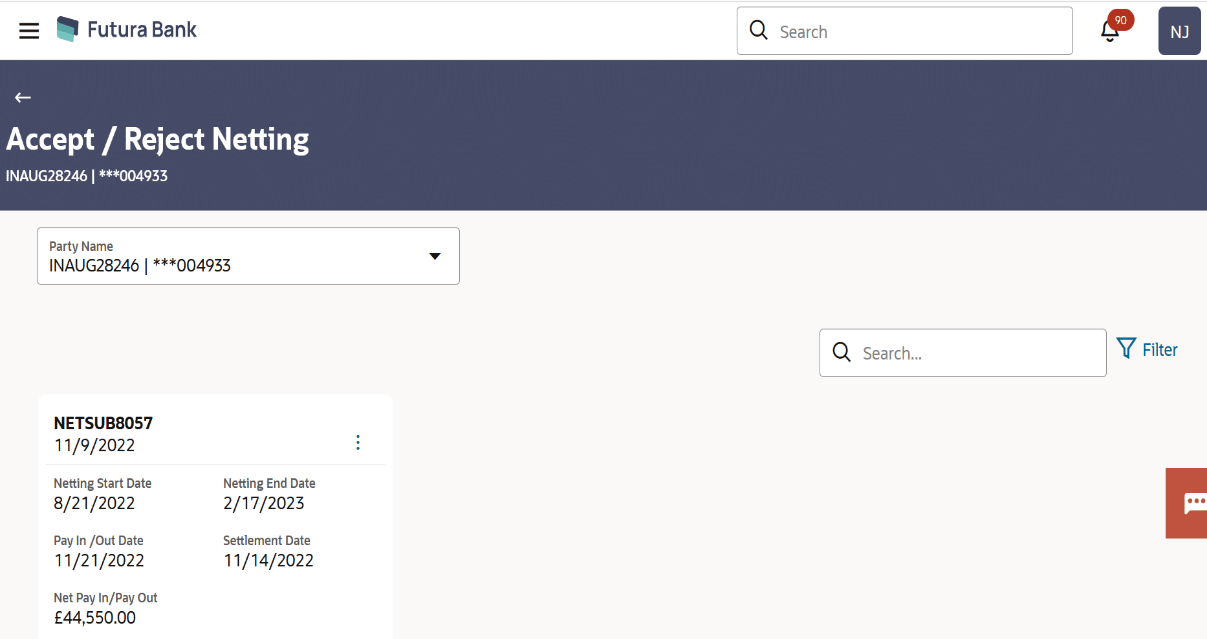

5.5.1 Accept / Reject Netting

The ‘Netting’ screen helps user to accept or reject a netting transaction on a particular associated party against its receivables and payables so that number of payment transactions between those two parties is reduced leading to significant cost savings. User can search for the netting transaction by Netting Reference Number.

Pre-requisites

User must have valid corporate login credentials.

- Perform the following navigation to access the Accept / Reject Netting

screen:From the Dashboard, click Toggle Menu. Under Toggle Menu, click Cash Management . Under Cash Management, click Netting. Under Netting, click Accept/Reject Netting.The Accept / Reject Netting screen displays.For more information on fields, refer to the field description table:

Table 5-21 Accept/Reject Netting - Field and description

Field Description Party Name Select the party name from the dropdown list to view the netting transaction for that selected/logged in party. By default, the primary party/gcif of the logged-in user is selected.

Note:

Only accessible parties are displayed to the user. Based on the party/gcif selection, the list of netting transaction is displayed.

Netting ID Displays the ID of the netting transaction. Netting Creation Date Displays the date of netting transaction created. Netting Start Date Displays the date from when the invoices are considered for netting purpose based on the payment due date. Netting End Date Displays the date till when the invoices are considered for netting purpose based on the payment due date. Pay In / Out Date Displays the date of Pay In/Out of netting transaction. This is only for MIS purpose. Settlement Date Displays the settlement date of netting transaction. Net Pay In/Pay Out Displays the net of Pay In/Out of netting transaction. - On the Accept/Reject Netting screen,

- To search for specific netting transaction, in the Search field, enter the partial or complete transaction ID.

- To filter the search results:

- Click

. The Search overlay window appears. For more

information on the fields in this overlay window.

. The Search overlay window appears. For more

information on the fields in this overlay window.

- Enter the search criteria in the overlay window.

- Click Apply to filter the cash deposit records.

- Click Reset to clear the entered search criteria.

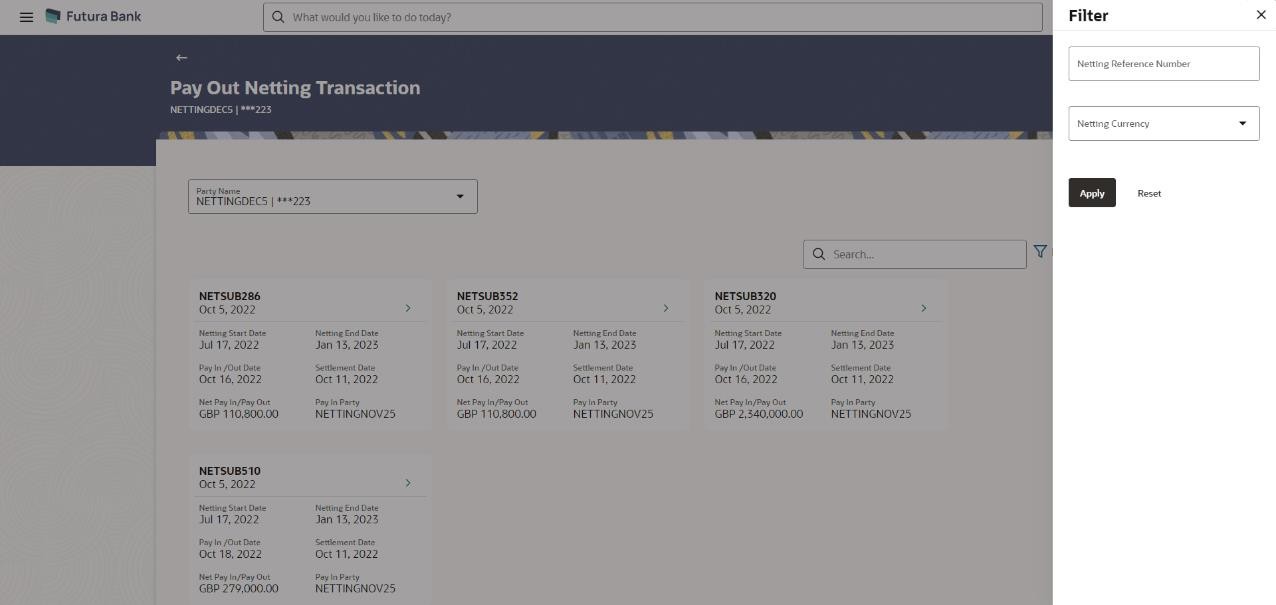

Search (overlay window)

This window appears when you click in the Accept / Reject Netting screen.

Figure 5-44 Accept/Reject Netting - Filter

For more information on fields, refer to the field description table.

Table 5-22 Accept/Reject Netting - Filter - Field Description

Field Description Netting Reference Number Indicates an option to search for a netting record based on the netting reference number. Currency Indicates an option to search for a netting record based on the currency listed in the dropdown. - Click

- Click

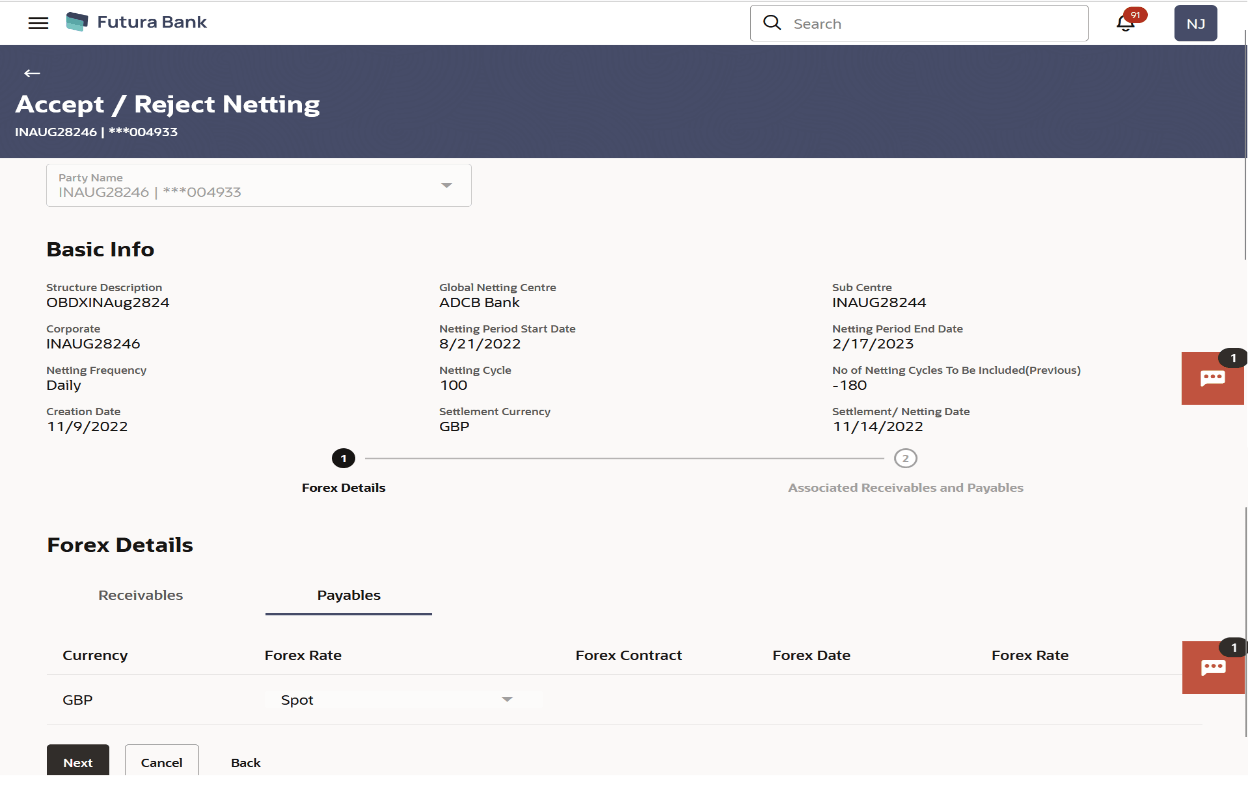

icon to select the accept/reject for the selected netting

transactions.The Accept/Reject Netting – Forex Details screen displays.

icon to select the accept/reject for the selected netting

transactions.The Accept/Reject Netting – Forex Details screen displays.Figure 5-45 Accept/Reject Netting – Forex Details

For more information on fields, refer to the field description table:

Table 5-23 Accept/Reject Netting – Forex Details - Field and Description

Field Desription Structure Description Displays the description of the structure associated to that netting transaction. Global Netting Center Displays the ID of the global netting center associated to that netting transaction. Sub Center Displays the Sub center associated to that netting transaction. Corporate Displaysthe corporate associated to that netting transaction. Netting Period Start Date Displaysthe start date of netting period of that netting transaction. Netting Period End Date Displays the end date of netting period of that netting transaction. Netting Frequency Displays the frequency of that netting transaction. Netting Cycle Displays the netting cycle of that netting transaction. No of Netting Cycle To Be Included (Previous) Displays the previously included netting cycles for that netting transaction. Creation Date Displays the creation date of netting transaction. Settlement Currency Displays the currency for the settlement. Settlement / Netting Date Displays the settlement / netting date. Currency Displays the currency of the receivables associated with that netting transaction Forex Rate Selectthe appropriate forex rate(spot/forward) for conversion of receivables from invoice currency to settlement currency. This will get disabled and defaulted to spot if invoice ccy is same is settlement ccy. Forex Contract Specify the contract number of the forex rate. Note:

This Field will get enabled only when forex contract is selected as forward.

Forex Date Specify the date of the forex contract. Note:

his Field will get enabled only when forex contract is selected as forward.

Forex Rate Displaysthe rate of the forex for receivables if in case forex rate is selected as spot else user can input the forex rate in case forex rate is selected as forward. Currency Displays the currency of the payables associated with that netting transaction. Forex Rate Selectthe appropriate forex rate(spot/forward) for conversion of payables from invoice currency to settlement currency. This will get disabled and defaulted to spot if invoice ccy is same is settlement ccy. Forex Contract Specify the contract number of the forex rate. Note:

This Field will get enabled only when forex contract is selected as forward.

Forex Date Specify the date of the forex contract.

Forex Rate Displaysthe rate of the forex for payables if in case forex rate is selected as spot else user can input the forex rate in case forex rate is selected as forward. - Click Next to Associated Receivables and Payables

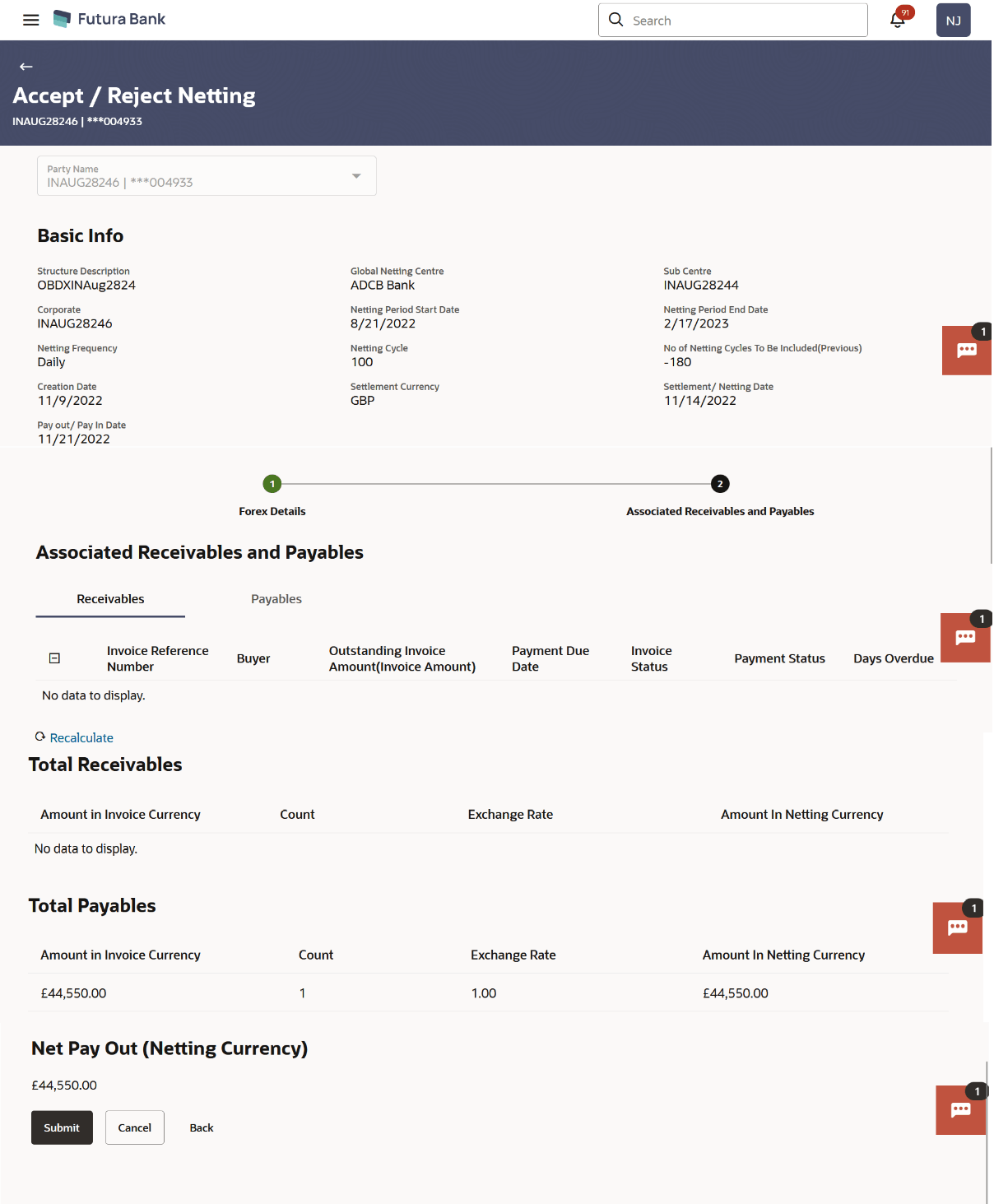

section.The Accept/Reject Netting – Associated Receivables screen displays.

Figure 5-46 Accept/Reject Netting – Associated Receivables

For more information on fields, refer to the field description table:

Table 5-24 Accept/Reject Netting – Associated Receivables - Field and description

Field Description Invoice Reference Number Displays the reference number of receivables invoice. Buyer Displaysthe buyer details of receivables. Outstanding InvoiceAmount Displaysthe Invoice amount of receivables. Payment Due Date Displays the payment due date of receivables. Invoice Status Displaysthe instrument status of the invoice/receivable. Payment status Displays the payment status of the invoice/receivable. Days Overdue Displays the ageing days (if any) for associated receivables. Amount in Invoice Currency Displays the aggregated invoice amount for specific currency of receivables associated to netting transaction. Count Displays the total count of receivables invoices associated with the netting transaction for specific invoice currency. Exchange Rate Displayst he appropriate exchange rate applicable for that specific invoice currency required to convert the amount in invoice currency to amount in netting currency. Amount in Netting Currency Displays the aggregated receivable amount(in netting currency) for that specific invoice currency of receivables associated to netting transaction. Amount in Invoice Currency Displays the aggregated invoice amount for specific currency of payables associated to netting transaction. Count Displays the total count of payables invoices associated with the netting transaction for specific invoice currency. Exchange Rate Displays the appropriate exchange rate applicable for that specific invoice currency required to convert the amount in invoice currency to amount in netting currency. Amount in Netting Currency Displays the aggregated payable amount(in netting currency) for that specific invoice currency of payables associated to netting transaction. Netting Payout (Netting Currency) Displays the total pay in/payout in netting currency. Net Pay in will get displayed if total receivables amount is greater than total payables amount and Net Payout will get displayed if total payable amount is greater than total receivables amount. The Accept/Reject Netting – Associated Payables screen displays.

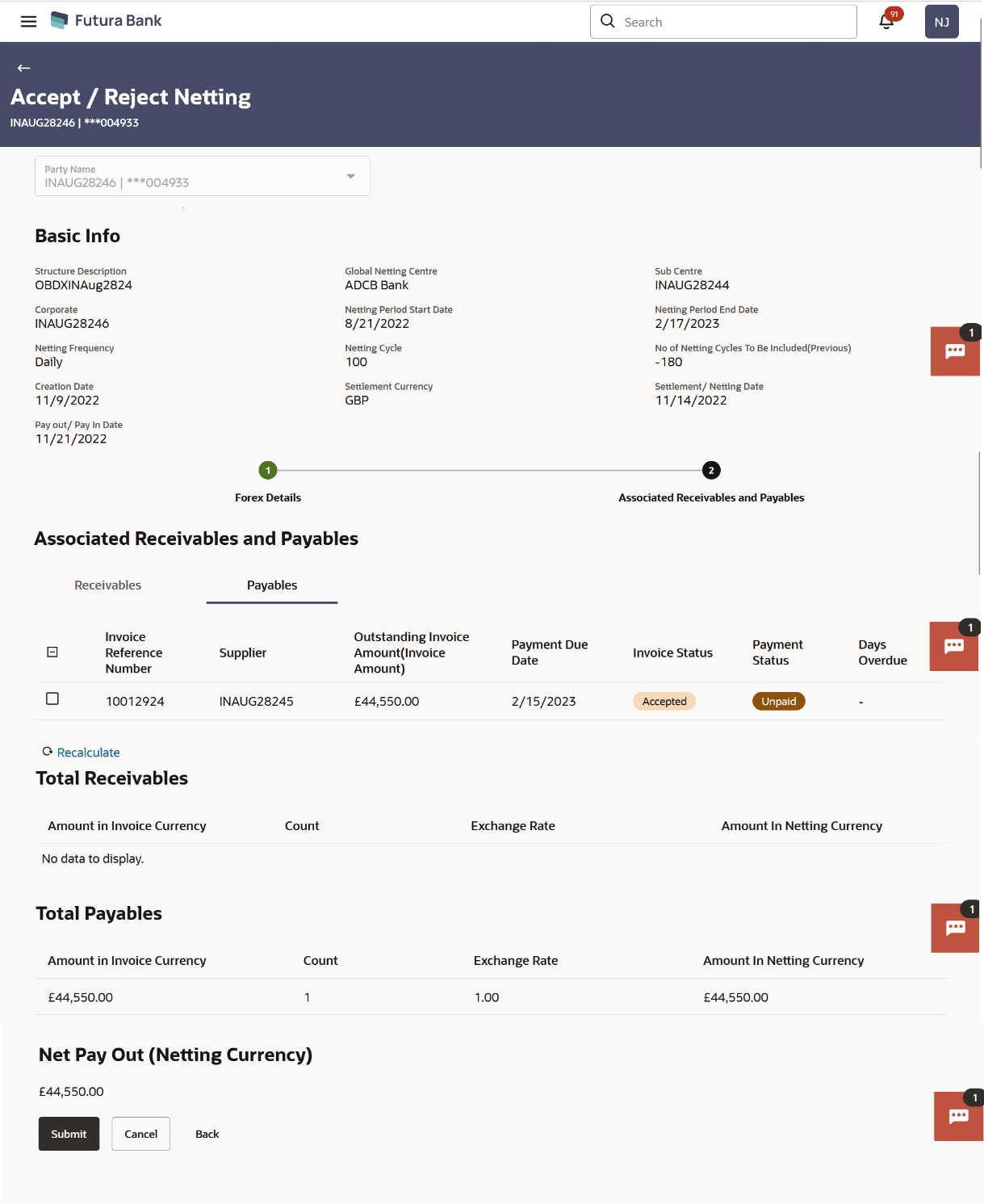

Figure 5-47 Accept/Reject Netting – Associated Payables

For more information on fields, refer to the field description table:

Table 5-25 Accept/Reject Netting – Associated Payables - Field and Description

Field Description Invoice Reference Number Displays the reference number of payables invoice. Supplier Displays the Supplier details of payables. Outstanding Invoice Amount Displaysthe outstanding invoice amount of payables. Payment Due Date Displays the payment due date of payables. Invoice Status Displays the instrument status of the invoice/receivable. Payment status Displays the payment status of the invoice/receivable. Days Overdue Displays the ageing days (if any) for associated payables. Amount in Invoice Currency Displays the aggregated invoice amount for specific currency of receivables associated to netting transaction. Count Displays the total count of receivables invoices associated with the netting transaction for specific invoice currency. Exchange Rate Displays the appropriate exchange rate applicable for that specific invoice currency required to convert the amount in invoice currency to amount in netting currency. Amount in Netting Currency Displays the aggregated receivable amount (in netting currency) for that specific invoice currency of receivables associated to netting transaction. Amount in Invoice Currency Displays the aggregated invoice amount for specific currency of payables. Count Displays the total count of receivables invoices associated with the netting transaction for specific invoice currency. Exchange Rate Displaysthe appropriate exchange rate applicable for that specific invoice currency required to convert the amount in invoice currency to amount in netting currency. Amount in Netting Currency Displaysthe aggregated payable amount (in netting currency) for that specific invoice currency of payables associated to netting transaction. Net Pay Out (NettingCurrency) Displaysthe total payin/payout in netting currency. Net Payin will get displayed if total receivables amount is greater than total payables amount and Net Payout will get displayed if total payable amount is greater than total receivables amount. - Select the Invoices to be delinked from the netting transaction and click Recalculate to calculate the Net Pay in/Net Payout amount Total receivables or total payables fields will also get recalculated basis whether the invoice to be delinked has been delinked from associated receivables or associated payables section.

- Click Submit.

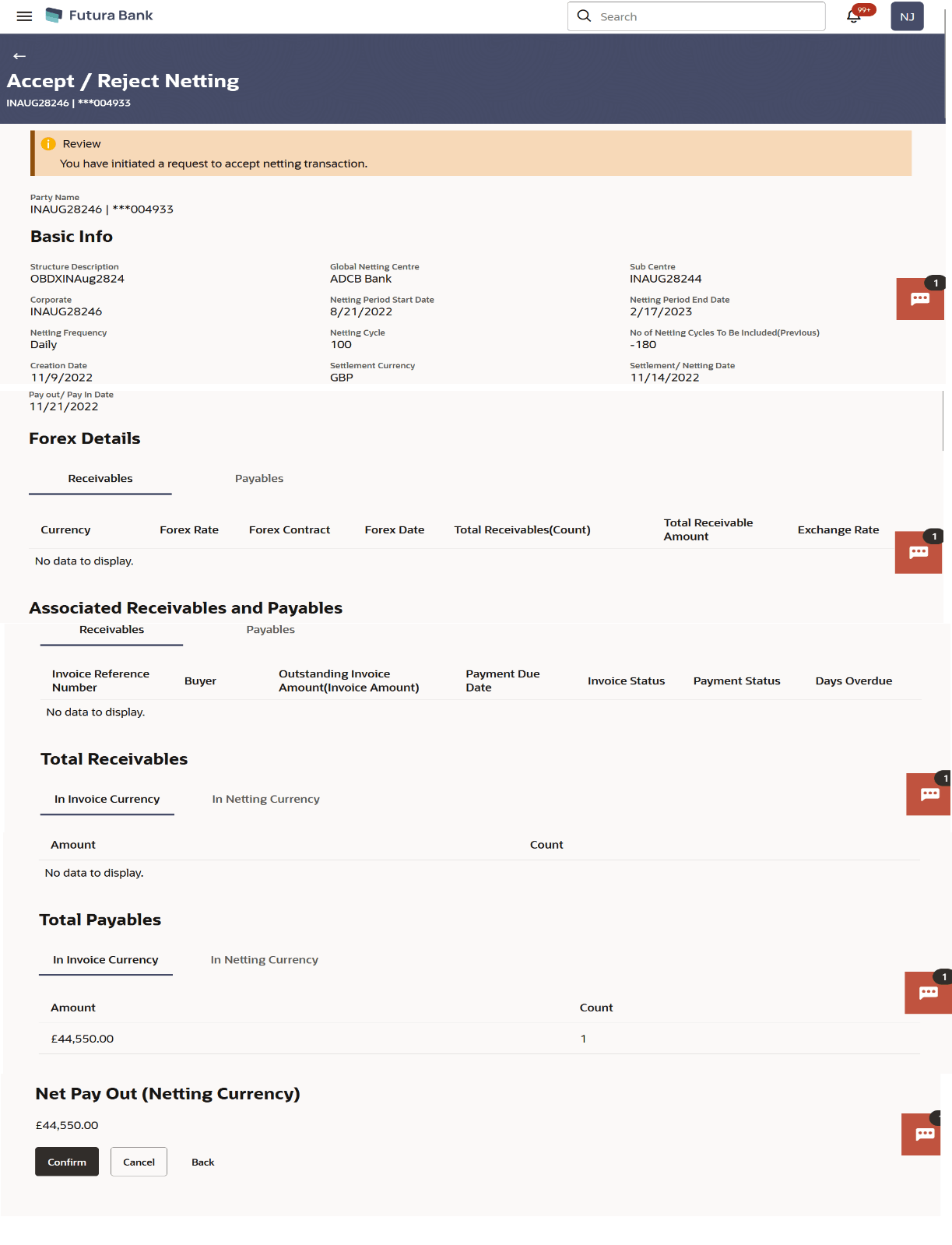

The Accept/Reject Netting – Review screen displays.

Figure 5-48 Accept/Reject Netting – Review

- In the Accept / Reject Netting - Review screen, verify the details and

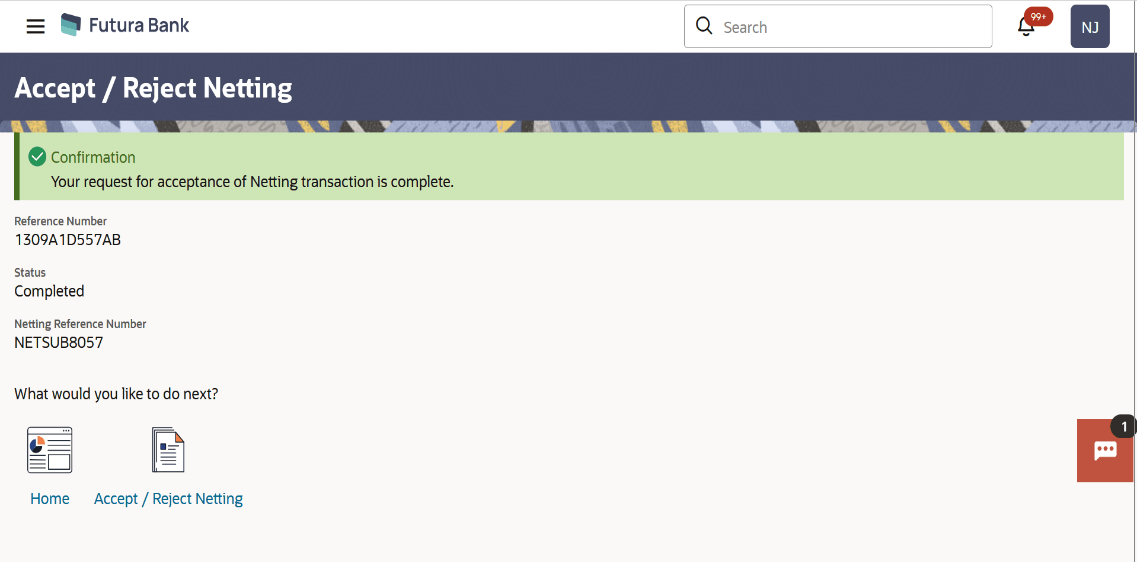

click Confirm. A confirmation message of request initiation of acceptance/ rejection of transaction appears along with the reference number and status.

Figure 5-49 Accept/Reject Netting – Confirmation

- Click Cancel to cancel the netting transaction.

- Click Back to navigate to previous screen.

Parent topic: Netting