5 Top Up

This topic provides the systematic instructions for users to invest additional funds in an existing term deposit.

Customers can top-up an existing term deposit with the desired and permissible top-up amount. The application not only displays the current investment position of the term deposit, but also has the provision to calculate the revised maturity amount, interest rate and total investment. The customer can fund the top-up using any of his current or savings accounts held with the bank.

Note:

Send to Modify functionality is now supported for this transaction.To top-up the term deposit:

- Perform anyone of the following navigation to access the Top Up

screen.

- From the Dashboard, click Toggle menu, click Menu, then click Accounts, and then click Term Deposits . Under Term Deposits , click Top Up.

- From the Search bar, type Term Deposits – Top Up and press Enter

- From the Dashboard, click Toggle menu, click Menu, then click Accounts, and then click Term Deposits . Under Term Deposits , click Overview, then click Top Upof Quick Links widget.

- Access through the kebab menu of transactions available under the Term Deposits module

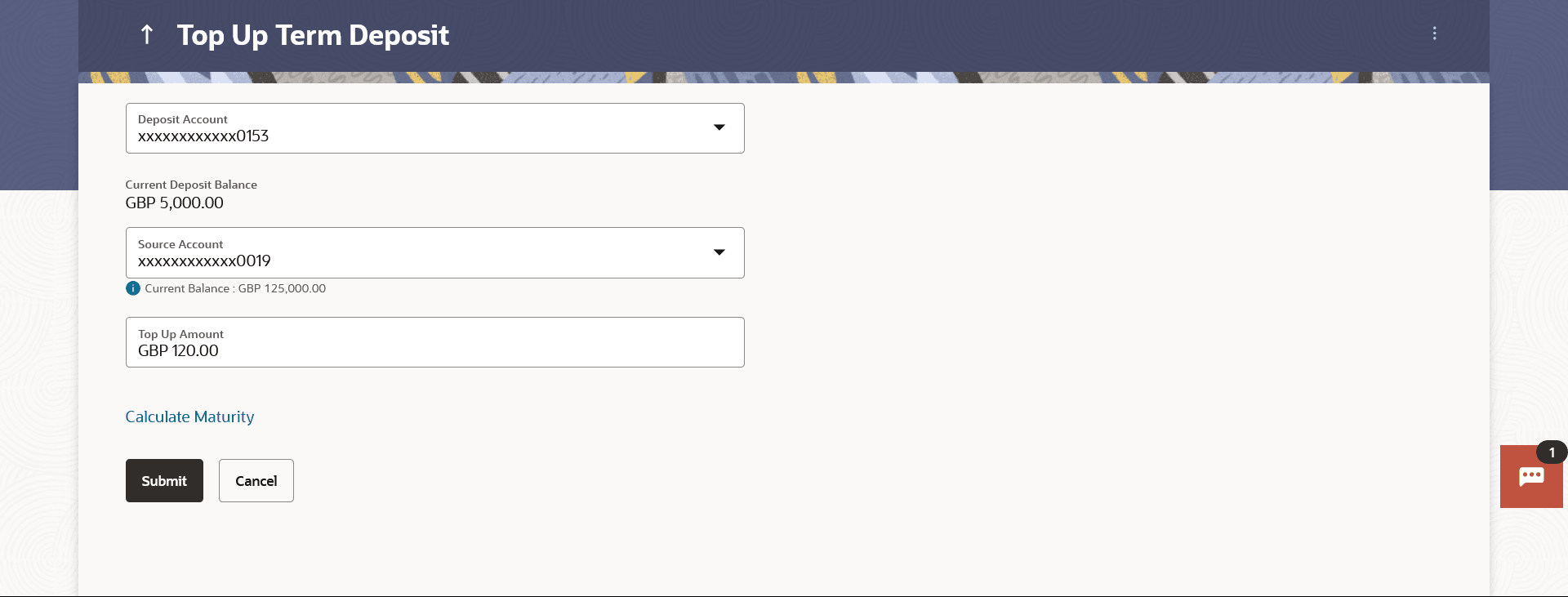

The Top Upscreen appears.

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 5-1 Field Description

Field Name Description Deposit Account Account number along with the account nickname of the term deposit for which top-up is to be done. The account number could be either the users own Party account or any linked party accounts that he has access to. Current Balance The current balance of the deposit account is displayed. Top-up Amount The customer is required to specify the amount by which the term deposit is to be topped up. Maximum Deposit amount applicable for Top-up Application displays the maximum top-up allowed for this product. Top up amount in Multiple of (X amount with currency) Application displays the denomination supported for top-up. Source Account CASA account along with the account nickname mapped to the user. The user can select the account to be debited in order to top-up term deposit. The account could be either the users own Party account or any linked party accounts, which he has access to. Balance Application displays the Account balance of the selected source account. The following revised values are displayed on clicking Calculate Maturity. Revised Principal Amount Calculated principal amount as on current date after top-up.

This field appears, if the user clicks on the Calculate Maturity link

Revised Maturity Amount Calculated maturity amount after top-up.

This field appears, if the user clicks on the Calculate Maturity link

Revised Interest Rate Interest rate applicable after top-up.

This field appears, if the user clicks on the Calculate Maturity link

- In the Top-up Amount field, enter the amount by which the deposit account is to be topped up.

- From the Source Account list, select the current or savings account from which the amount is to be debited in order to top up the deposit.

- To calculate the revised principal amount and maturity amount, click Calculate Maturity.

- Perform one of the following actions:

- Click Top Up to add the top-up amount.

The Review screen appears.

- Click Cancel to cancel the transaction.

- Click Top Up to add the top-up amount.

- Perform one of the following actions:

- Verify the details and click

Confirm.

The success mssage of topup appears along with the reference number.

- Click Back to navigate back to the previous screen.

- Click Cancel to cancel the transaction.

- Verify the details and click

Confirm.

- Perform one of the following actions:

- Click Home to go to the Dashboard screen.

- Click Go To Account Details to view the deposit details page.