5.2 View Import Letter of Credit - LC Details

This topic provides the systematic instructions to view an Import Letter of Credit - LC Details in the application.

View Import Letter of Credit - LC Details tab captures the general details of the LC application process.

To view an Import Letter of Credit (LC):

- Navigate to View Import Letter of Credit screen.On navigation to View Import Letter of Credit screen, user lands to LC Details tab screen.

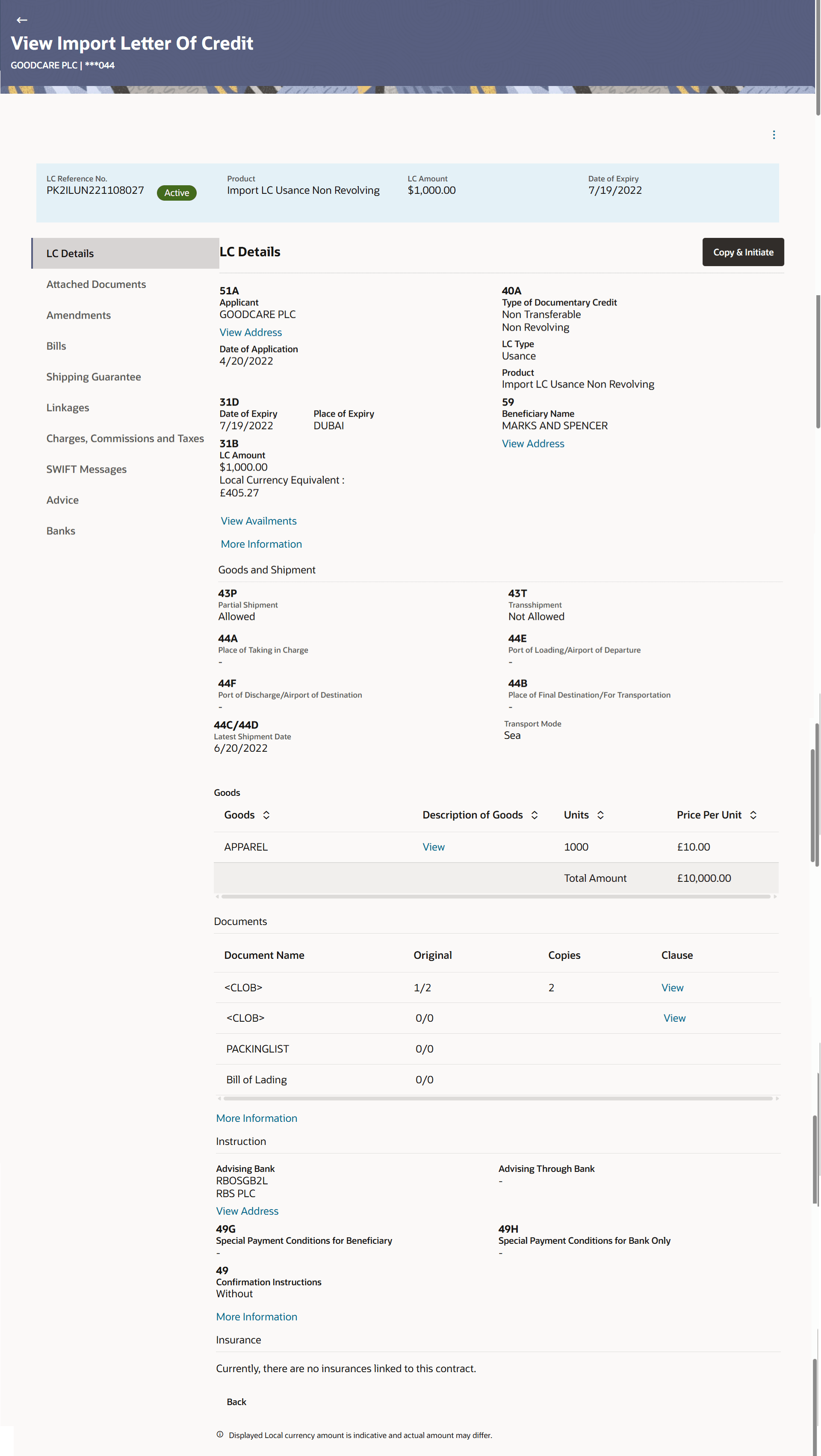

Figure 5-4 View Import Letter of Credit - LC Details

For more information refer to the field description table below:

Table 5-3 View Import Letter of Credit - Field Description

Field Name Description LC Reference No. Displays the reference number of the LC. Product Displays the Import LC product name under which the LC is created. LC Amount Displays the amount availed against the LC. Date of Expiry Displays the date on which the LC expires and holds no more valid. LC Details This section displays the View Import Letter of Credit - LC details. Applicant Displays the LC applicant name based on the selected party ID. View Address Click the link to view the address and country of the LC applicant in Structured/Hybrid and Unstructured format.

Clicking the link, displays Address overlay screen with complete address details of the applicant coming from Host.

Accountee Name Displays the name of the accountee. Date of Application Displays date of LC application. Date of Expiry Displays the date on which the LC expires. The expiry date must be later than the application date.

Place of Expiry Displays the place where LC would expire. LC Amount Displays the amount availed against the LC. Type of Documentary Credit Displays the type of documentary credit. The type of documentary credit are:

- Transferable

- Non Transferable

Revolving Type Displays the revolving type. The options are:

- Revolving

- Non Revolving

This field appears if the SWIFT Code option is selected in the Credit Available With field.

Auto Reinstatement Under a revolving LC, the amount is reinstated or renewed without any specific amendments to the LC. The credit becomes available for use again automatically. Cumulative Displays whether the frequency is cumulative for the LC. LC Type Displays the type of LC. The options are:

- Sight

- Usance

Product Displays the LC product. Beneficiary Name Displays the name of the LC beneficiary. View Address Click the link to view the address and country of the applicant of the LC beneficiary in Structured/Hybrid and Unstructured format. Clicking the link, displays Address overlay screen with complete address details of the beneficiary coming from Host.

Drafts section This section displays the number of drafts available. Tenor (In Days) Displays the number of days of its validity. Credit Days From Displays the date from which the Draft tenure shall be counted. Drawee Bank Displays the name of drawee bank, which would represent draft for claiming money against LC. Draft Amount Displays the amount which is seeked by beneficiary on representation of draft. More Information Following fields appear if you click the More Information link. Click the Hide Information link to hide the fields.

LC Amount Tolerance Displays the tolerance relative to the documentary credit amount as a percentage plus and/or minus that amount. Total Exposure Displays the total LC amount including the positive tolerance, with the currency. Additional Amounts Covered Displays any additional amounts available to the beneficiary under the terms of the credit, such as insurance, freight, interest, etc. Credit Available By Displays the manner in which credit is available when the bank is authorized to pay, accept, negotiate or incur a deferred payment undertaking for the credit. Credit Available With Displays the details of Bank where credit would become available. It is captured by Bank’s SWIFT code. Credit Days From Displays the date from which the Draft tenure shall be counted. Mixed Payment Details Displays the details of mixed payment. This field appears if Mixed Payment option is selected in the Credit Available By field.

Draft Displays the draft. Drafts At Displays the number of drafts available. Goods & Shipment This section displays the Goods & Shipment details. Partial Shipment Displays whether partial shipments is allowed or not or is conditional. Place of Taking in Charge Displays the place of receipt from where shipment will be done. Port of Discharge/Airport of Destination Displays the port of discharge or airport of destination to be indicated on the transport document. Shipment Date Displays the period of shipment during which the goods are to be loaded on board /dispatched /taken in charge. Transshipment Displays whether transshipment is allowed or not or is conditional. Port of Loading/Airport of Departure Displays the port of loading or airport of departure to be indicated on the transport document. Place of Final Destination/For Transportation Displays the place of delivery of goods or port of discharge. Latest Shipment Date The latest date for shipment loading goods on board/dispatch/taking in charge. Transport Mode Displays the transportation mode for the goods. More Information Following fields appear if you click the More Information link. Click the Hide Information link to hide the fields.

Goods Displays the type of good being shipped. Description of Goods Displays the description of goods. Units Displays the number of units of the goods. Price Per Unit Displays the price per unit of the goods. Total Amount Displays the total amount. Documents This section displays the Document details. Document Name Displays the lists of all the documents required to be represented. Original Displays the number “n” out of “m” original documents will be provided to bank. Copies Displays the number of copies that will be submitted as a set of documents for LC. Clause Click the View link to view the clause maintained in the bank application. More Information Following fields appear if you click the More Information link. Click the Hide Information link to hide the fields.

Additional Conditions Displays the description of further conditions of the documentary credit. Documents to be presented within/beyond days after the date of shipment but within validity of this credit Displays the number of days after the date of shipment when the documents will be presented to bank. Incoterms Displays the INCO terms for the LC application. Instruction This section displays the Instruction details. Advising Bank Displays the SWIFT ID and address of the Advising Bank. View Address Click the link to view the address and country of the Advising Bank of the LC beneficiary in Structured/Hybrid and Unstructured format. Clicking the link, displays Address overlay screen with complete address details of the Advising Bank coming from Host.

Special Payment Conditions for Beneficiary Displays the special payment conditions applicable to the beneficiary, for example, post financing request/ conditions. Confirmation Instructions Displays the confirmation instructions for the requested confirmation party. Advising Through Bank Displays the advising through bank SWIFT ID and address. Special Payment Conditions for Bank Only Displays the special payment conditions applicable to bank without disclosure to the beneficiary, for example, post-financing request /conditions. More Information Following fields appear if you click the More Information link. Click the Hide Information link to hide the fields.

Sender to Receiver Information Displays the additional information for the receiver. Special Instructions Displays the special instructions, if any. Charges Displays the details specify charges to be borne by the beneficiary. Insurance This section displays the Insurance details. Insurance Displays the insurance details of LC. - Click

icon and then click:

icon and then click:- Initiate Amendment to initiate the

amendment.

The Initiate Import LC Amendment screen appears.

- Copy & Initiate to copy the LC details and initiate the

import letter of credit.

The Initiate Letter of Credit screen appears.

- Initiate Tracers to initate the tracer.

The Tracers screen appears.

- Initiate Amendment to initiate the

amendment.

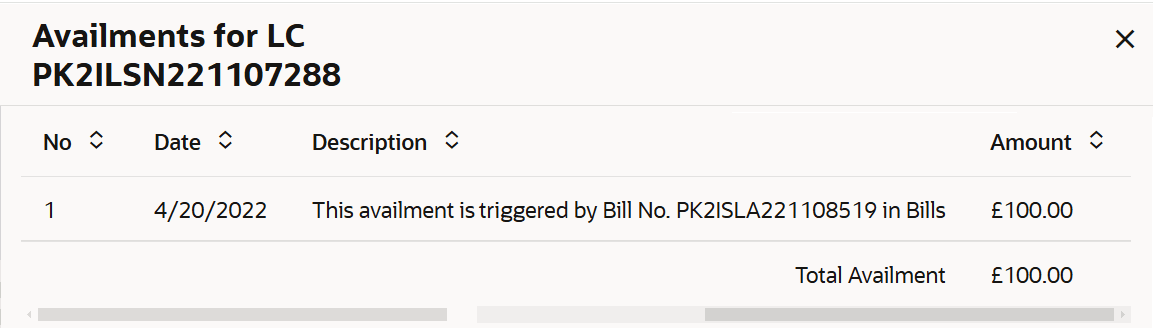

- Click the View Availments link to view the availments for LC.The Availments for LC overlay screen appears.

For more information refer to the field description table below:

Table 5-4 Availments for LC - Field Description

Field Name Description No Displays the serial no. of the availment record. Date Displays the date of availment. Description Displays the description of availment under an LC. Amount Displays the amount of availment against the LC. Total Availments Displays the total availment amount against the LC. - Perform any one of the following actions:

- Click the Copy and Initiate to copy details of LC, and initiate a new LC.

The Initiate Letter of Credit screen appears.

- Click Attached Documents tab to view the attached documents.

- Click Back to navigate back to previous screen.

Note:

- Repeat frequency and cumulative will come only in case of revolving LC.

- When the user clicks Initiate Amendment option, a warning message 'You are going to amend a Back to Back LC”, if the LC is a back to back LC.

- Click the Copy and Initiate to copy details of LC, and initiate a new LC.

Parent topic: View Import Letter of Credit