3.6 Initiate Back to Back Letter of Credit

This topic provides the systematic instructions to initiate a Back to Back Letter of Credit in the application.

Using this option, the user can initiate a Back to Back Letter of Credit (LC) in the application. This LC reduces the fund constraints problems of the exporter by providing the opportunity to open the LC against Export LC and to pay after getting the export proceeds.

The application will do the Amount and Expiry Date Validation with the underlying Export LC while listing the export LCs where Back to Back LC can be initiated.

System validates that Back to Back LC should not have maturity date/ tenor date/ expiry date greater than that in parent LC and the application amount of Back to back should not be more than parent export LC.

Once submitted by user, the application would be available in OBTFPM for bank user to process. The created LC will be available along with other initiated Import LCs and also available in application tracker for tracking purpose.

To initiate a Back to Back Letter of Credit:

- Navigate to Initiate Letter of Credit screen.

- On Initiate Letter of Credit screen, then click Back

to Back LC tab. The Initiate Letter of Credit - Back to Back LC Search Results screen appears.

- In the Initiate Letter of Credit - Back to Back Search Results screen, click the

Reference Number link. The Initiate Letter of Credit - Back to Back LC screen appears.

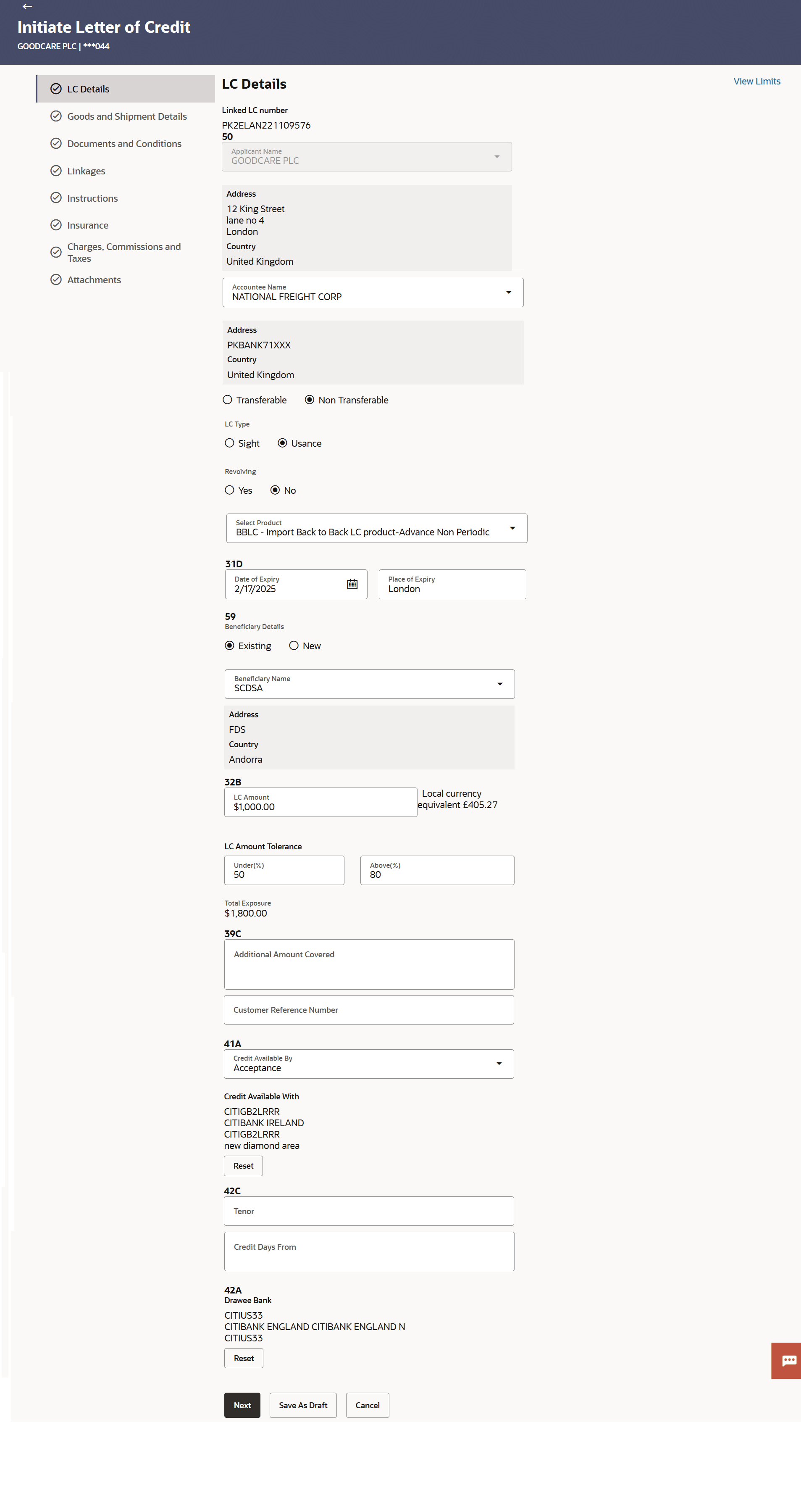

Figure 3-22 Initiate Letter of Credit Back to Back - LC Details

Note:

The fields which are marked as Required are manadatory.For more information refer to the field description table below:

Table 3-20 Field Description

Field Name Description Linked LC Number Displays the linked Export LC reference number. Applicant Name Displays the LC applicant name based on the selected party ID. Address Displays the LC applicant address. Limits Indicates the available limits for applicant under the selected Line. The limit details are also represented in a graphical manner with available, sanctioned and utilized limit details for the users.

View Limit Details Click the link to open the Facility Summary screen. Country Displays the country of the LC applicant. Accountee Name Select from the list of all accountees mapped to a party. Address Displays the accountee's address. Country Displays the country of the accountee. Type of Documentary Credit Move the slider to select the type of documentary credit. The type of documentary credit are:

- Transferable

- Non Transferable

LC Type Indicates the type of LC. The options are:

- Sight

- Usance

Revolving Indicates whether the product is revolving or not. The options are:

- Yes

- No

Select Product Select the LC product. Auto Reinstatement This option indicates that reinstatement will happen automatically, if not chosen it has to be done manually if required. The options are:

- Yes

- No

Revolving Type The option to select the revolving type. The options are:

- Value: LC revolves in value.

- Time : LC revolves in time

This field is enabled if Yes option is selected in the Revolving field.

Cumulative Displays whether the frequency is cumulative for the LC. If it is cumulative then unused amount of previous LC would be added and available for the new LCs. The options are:

- Yes

- No

This field is enabled if Time option is selected in the RevolvingType field.

Repeat Frequency Select the time duration of revolving frequency. Specify the values for:

- Days

- Month

This field is enabled if Time option is selected in the RevolvingType field.

Date of Expiry Specify or select the expiry date of the LC. The expiry date must be later than the application date.

Place of Expiry Specify the place where LC would expire. Beneficiary Details The option to select the beneficiary type. The options are:

- Existing

- New

Beneficiary Name The name of the LC beneficiary. This field allows the user to select the beneficiary name from drop-down, if Existing option is selected in the Beneficiary Details field.

This field allows the user to specify the beneficiary name, if New option is selected in the Beneficiary Details field.

Address Specify the address of the LC beneficiary. This field is enabled to enter the address details, if New option is selected in the Beneficiary Details field.

Country Specify the country of the LC beneficiary. This field is enabled to enter the country name, if New option is selected in the Beneficiary Details field.

Currency Specify the currency under which the LC can be issued. LC Amount Specify the amount for the Letter of Credit. The user can see the equivalent amount in the local currency, if the application is in foreign currency.

LC Amount Tolerance Specify the tolerance relative to the documentary credit amount as a percentage plus and/or minus that amount. Specify the values for:

- Under (-) %

- Above (+) %

Total Exposure Displays the total LC amount including the positive tolerance, with the currency. Additional Amounts Covered Specify any additional amounts available to the beneficiary under the terms of the credit, such as insurance, freight, interest, etc. Customer Reference Number Specify the customer reference number. Credit Available By Select the value credit available by. Indicates the manner in which credit is available when the bank is authorized to pay, accept, negotiate or incur a deferred payment undertaking for the credit.

The options are:

- Acceptance

- Deferred Payment

- Mixed Payment

- Negotiation

- Sight Payment

Negotiation/ Deferred Payment Details Specify the details of Negotiation/ Deferred Payment. This field is enabled if the Negotiation/ Deferred Payment option is selected in the Credit Available By field.

Mixed Payment Details Specify the details of mixed payment. This field is enabled if the Mixed Payment option is selected in the Credit Available By field.

Credit Available With The option to select the details of Bank where credit would become available. It is captured by Bank’s SWIFT code. The options are:

- SWIFT Code

- Bank Address

Lookup SWIFT Code Select the SWIFT code of the issuing bank. This field is enabled if the SWIFT Code option is selected in the Credit Available With field.

SWIFT code Look up The following fields appear on a pop up window if the Lookup SWIFT Code link is clicked. Swift Code The facility to lookup bank details based on SWIFT code. Bank Name The facility to search for the SWIFT code based on the bank name. Country The facility to search for the SWIFT code based on the country. City The facility to search for the SWIFT code based on city. SWIFT Code Lookup Search Results This section displays the SWIFT Code lookup search results. Bank Name Displays the names of banks as fetched on the basis of the search criteria specified. Address Displays the complete address of each bank as fetched on the basis of the search criteria specified. Swift Code Displays the list of SWIFT codes as fetched on the basis of the search criteria specified. Bank Details Specify the name and address of the bank where credit would be available. This field is enabled if the Bank Address option is selected in the Credit Available With field.

Tenor (In Days) Specify the tenor of drafts to be drawn under the documentary credit. Credit Days From Specify the days from which the draft tenor is to be counted. Indicates the days from which the draft tenor is to be counted. Drawee Bank Select the drawee bank of the LC. The options are:- SWIFT Code

- Name and Address

SWIFT Code Specify the SWIFT code or click the Lookup SWIFT Code to search and select the SWIFT code. System fetches the SWIFT code details on the basis of the search criteria specified.

Draft Amount The various drafts amount for the LC application. Action Click  to delete the record

to delete the record

- To initiate back to back LC, refer the steps of Initiate a Letter of Credit section.

Parent topic: Initiate a Letter of Credit