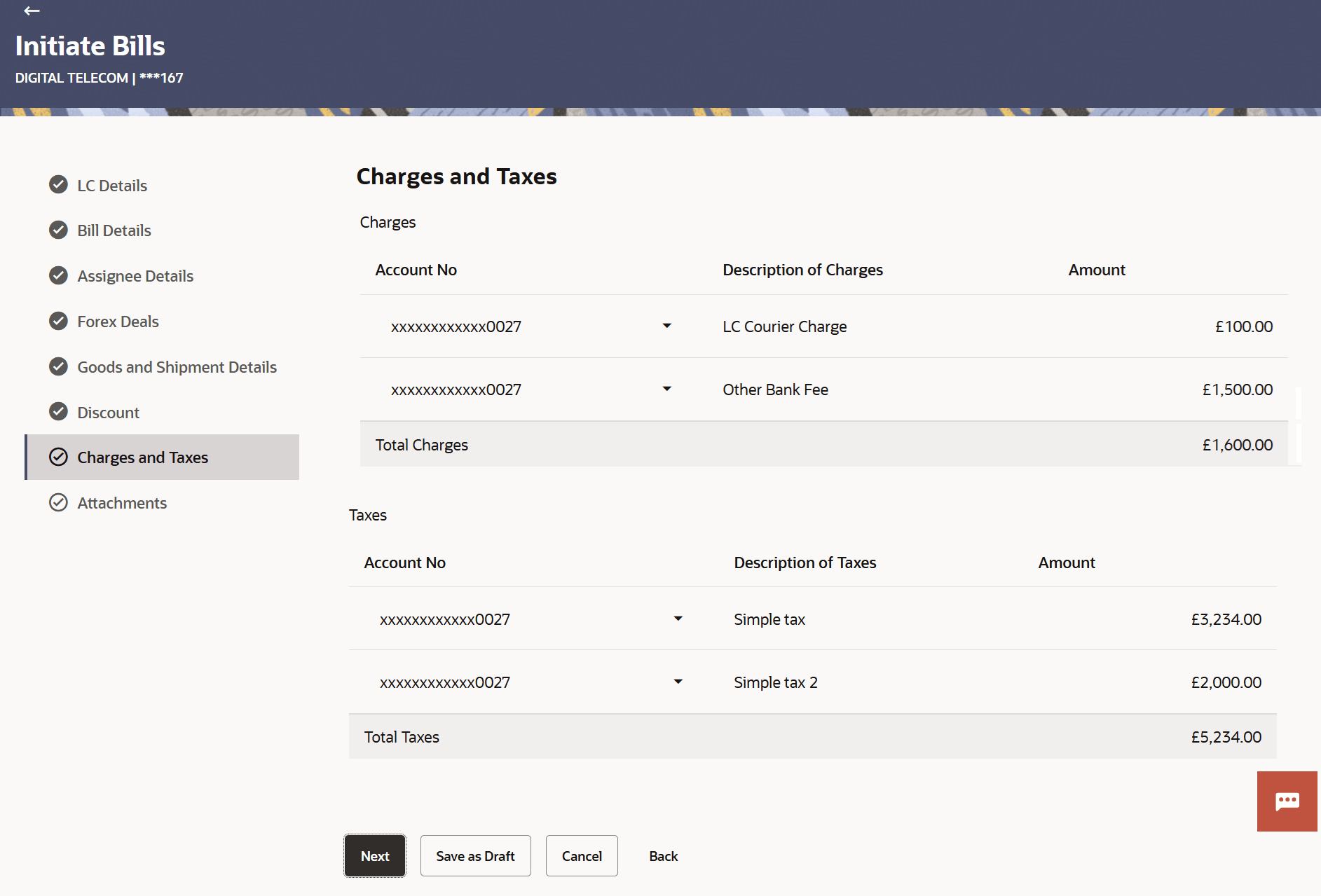

12.8 Initiate Bills - Charges and Taxes

This topic provides the systematic instructions to capture the Charges and Taxes details in the application.

This tab includes the miscellaneous information such as Charges Borne By and Remarks.

- Specify the Charges Commissions and Taxes details.

Figure 12-12 Initiate Bills - Charges and Taxes

Note:

The fields which are marked as Required are manadatory.For more information refer to the field description table below:

Table 12-12 Initiate Bills - Charges and Taxes - Field Description

Field Name Description Charges This section displays the Charges details. Account No Select the account which will be charged for the specific charge. Description of Charges Displays the description of the charges. Amount Displays the amount that is maintained under the charge. Total Charges Displays the total charge that will be levied in the transaction. Taxes This section displays the Taxes details. Account No Select the account from which the taxes will be taken. Description of Taxes Displays the description taxes applicable. Amount Displays the amount that is maintained under the taxes. Total Taxes Displays the total Taxes amount. - From the Account No. list, select the applicant account.

- Perform any one of the following actions:

- Click Next to save the entered details and proceed to the next

level.

The Attachments tab appears in the Initiate Bills screen.

- Click Save As Draft, system allows transaction details to be saved as a template or draft. (For more details, refer Save As Template or Save As Draft sections.)

- Click Cancel to cancel the

transaction.

The Dashboard appears.

- Click Back to go back to previous screen.

- Click Next to save the entered details and proceed to the next

level.

Parent topic: Initiate Bills