3.1.9 Payments

This topic provides information on payments.

- In the Global Configuration screen, click

Payments.The Payments screen is displayed.

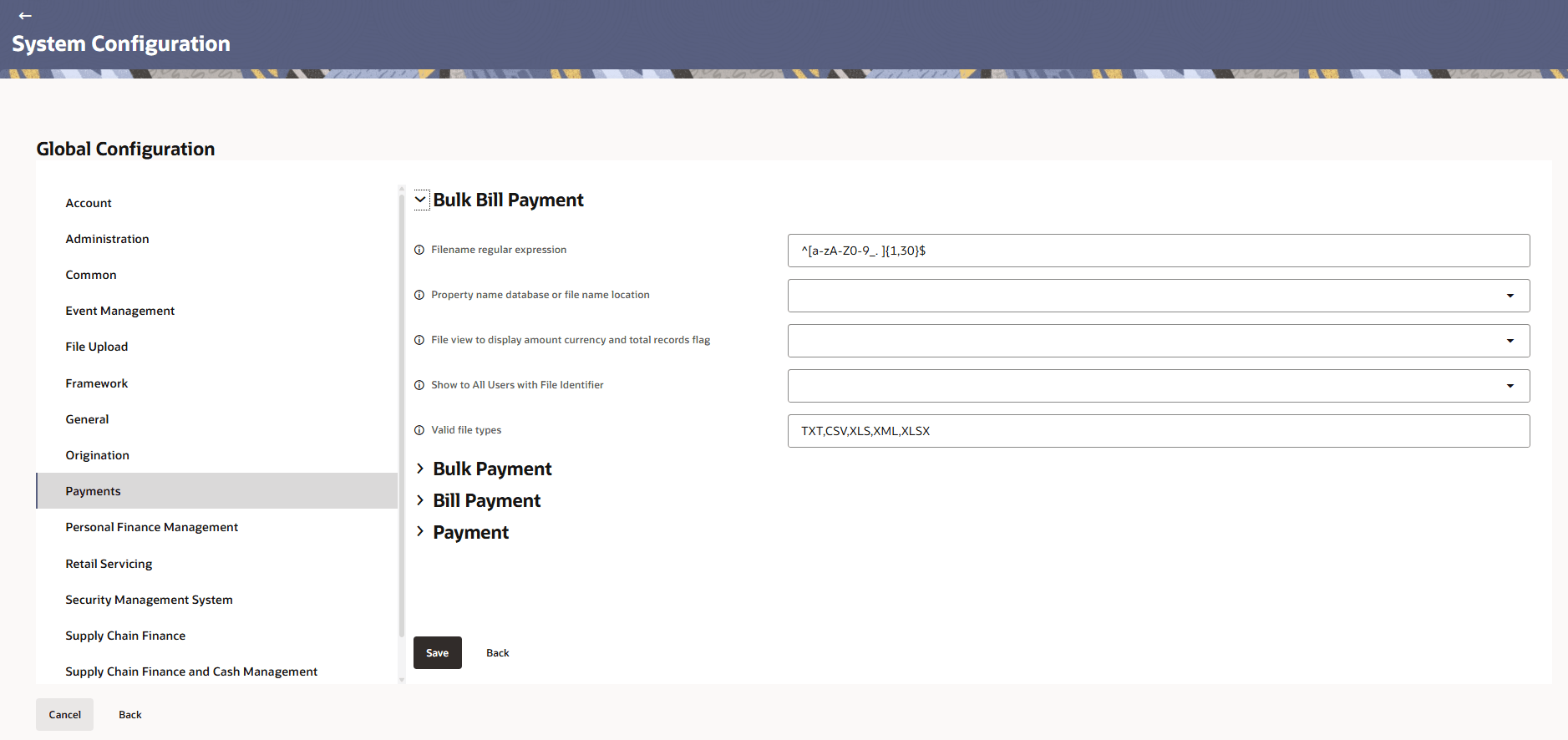

Figure 3-46 Payments

- Click Edit to specify the details under account.The Payments - Edit screen is displayed.

Figure 3-47 Payments - Edit

- Click expand and specify the details.

Note:

The fields marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 3-27 Bulk Bill Payment - Field Description

Field Name Description Filename regular expression Defines the regex pattern used to validate file names during upload or processing. Property name database or file name location Specifies the property name, database, or file location used for configuration or mapping purposes. File view to display amount currency and total records flag Indicates whether the file view should display amounts, currency, and total record counts. Show to All Users with File Identifier Specifies if the file should be visible to all users who have the corresponding file identifier. Valid file types Specifies the allowed file types for upload or processing. Note:

The fields marked as Required are mandatory.For more information on fields, refer to the field description table.

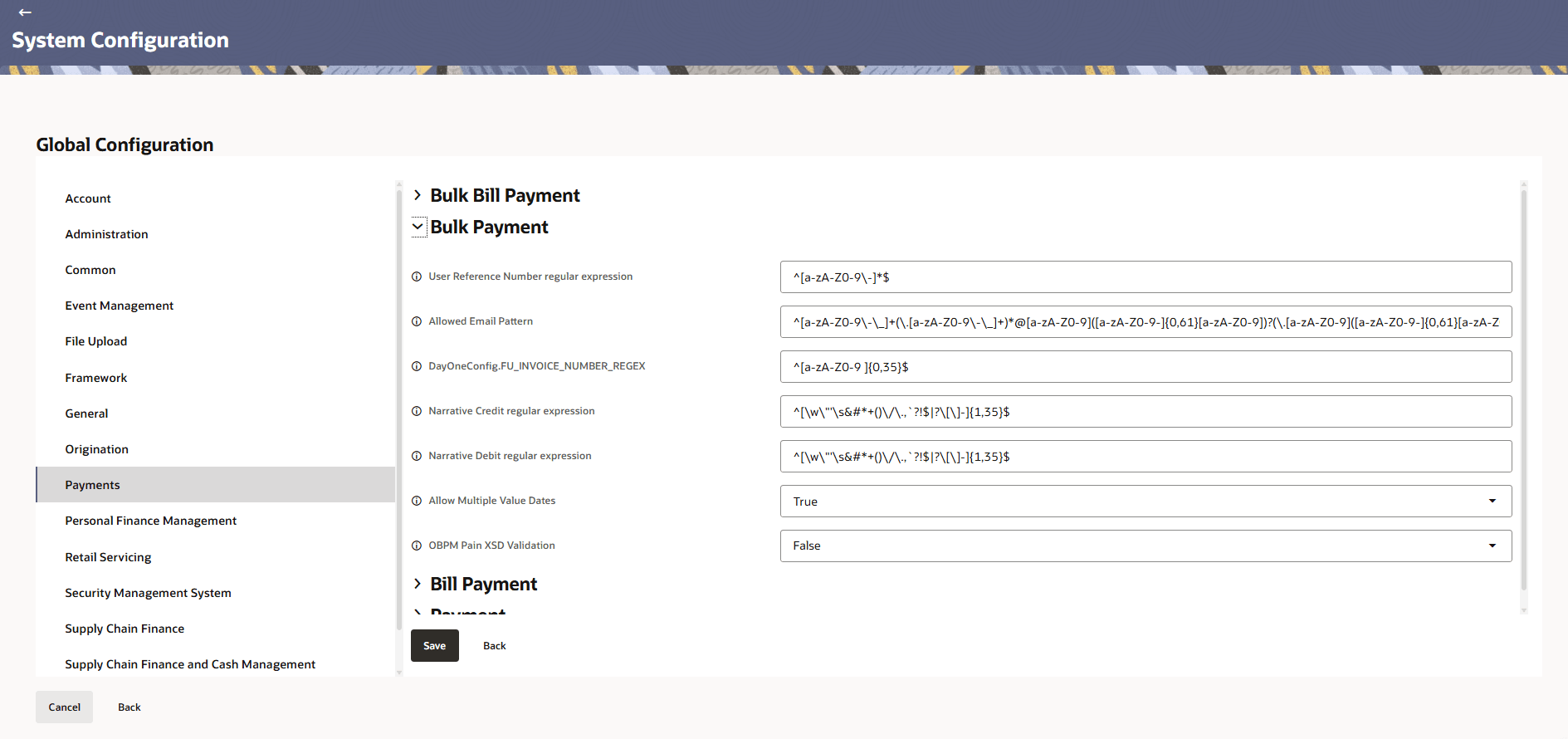

Table 3-28 Bulk Payment - Field Description

Field Name Description User Reference Number regular expression Specifies the regex pattern used to validate user reference numbers for format and allowed characters. Allowed Email Pattern Defines the regex pattern that validates email addresses, ensuring correct syntax and format. DayOneConfig.FU_INVOICE_NUMBER_REGEX Specifies the regex pattern used to validate invoice numbers in the DayOne configuration. Narrative Credit regular expression Regex pattern used to validate narrative text for credit transactions. Narrative Debit regular expression Regex pattern used to validate narrative text for debit transactions. Allow Multiple Value Dates Indicates whether multiple value dates are permitted for a transaction or operation. OBPM Pain XSD Validation Specifies whether OBPM PAIN XML messages should be validated against the defined XSD schema. Note:

The fields marked as Required are mandatory.For more information on fields, refer to the field description table.

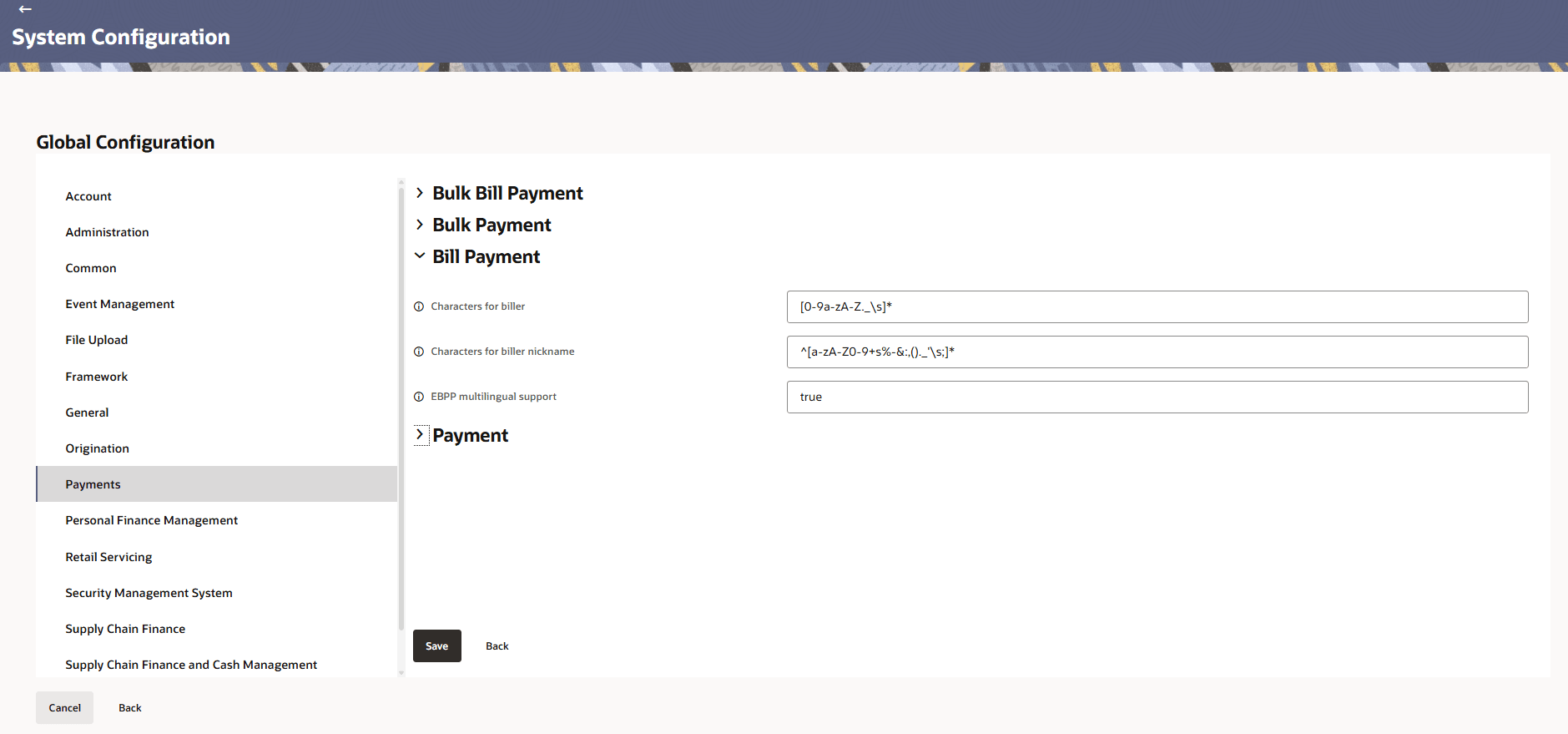

Table 3-29 Bill Payment - Field Description

Field Name Description Characters for biller Specifies the allowed characters for the biller name during setup or registration. Characters for biller nickname Defines the allowed characters for the biller nickname used in user interfaces or reports. EBPP multilingual support Indicates whether the Electronic Bill Presentment and Payment (EBPP) system supports multiple languages. Note:

The fields marked as Required are mandatory.For more information on fields, refer to the field description table.

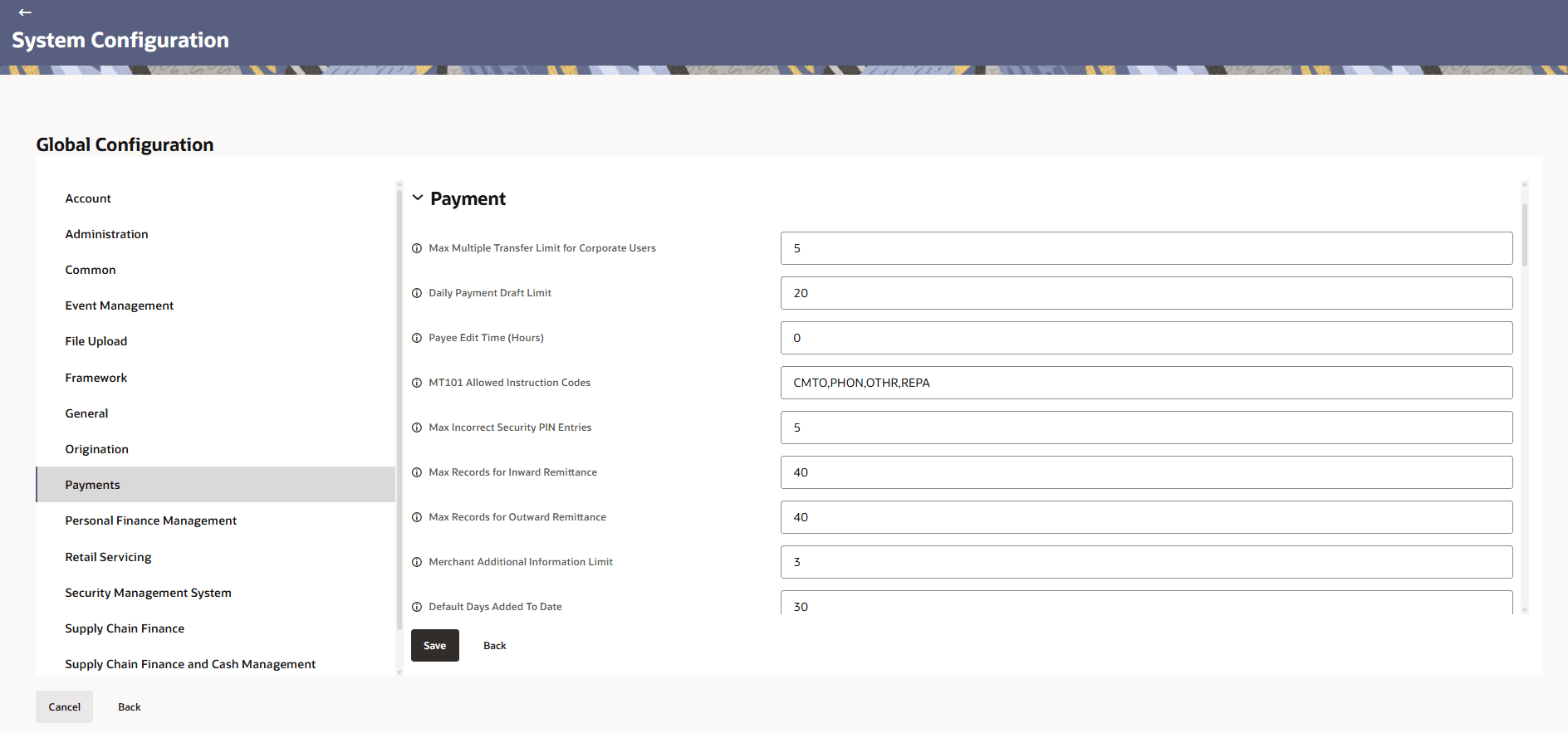

Table 3-30 Payment - Field Description

Field Name Description Max Multiple Transfer Limit for Corporate Users Defines the maximum limit for multiple fund transfers initiated by corporate users. Daily Payment Draft Limit Specifies the daily limit for creating or issuing payment drafts. Payee Edit Time (Hours) Indicates the duration in hours during which payee details can be edited post-creation. MT101 Allowed Instruction Codes Lists the instruction codes permitted in MT101 payment messages. Max Incorrect Security PIN Entries Specifies the maximum number of incorrect PIN attempts allowed before lockout. Max Records for Inward Remittance Defines the maximum number of inward remittance records processed per batch. Max Records for Outward Remittance Defines the maximum number of outward remittance records processed per batch. Merchant Additional Information Limit Specifies the maximum number of additional information fields allowed for merchants. Default Days Added To Date Indicates the number of days automatically added to a date field for default processing. Peer To Peer Reversal Retry Count Defines the number of retries allowed for peer-to-peer payment reversals. Payee Creation Delay (Minutes) Specifies the delay time in minutes before a newly created payee becomes active. Enable Frequent Payee List Determines whether the system maintains a list of frequently used payees for quick selection. Demand Draft Payee Name Pattern Defines the validation pattern for demand draft payee names. Favorite Name Pattern Specifies the allowed format or pattern for naming favorite payees or templates. Payee Account Number Pattern Regular expression used to validate payee account numbers. Internal Payee Name Pattern Validation pattern for payees within the same bank or institution. Cross-border Payee Name Pattern Validation pattern for international or cross-border payee names. NEFT Payee Name Pattern Specifies the allowed naming format for NEFT payees. RTGS Payee Name Pattern Defines the validation pattern for RTGS payee names. Payee Access Policy for Payee-User Mapping Specifies the access control policy governing mapping of payees to users. SEPA Credit Payee Name Pattern Defines the allowed naming pattern for SEPA credit transfer payees. Payee Nickname Pattern Specifies the regular expression used for validating payee nicknames. Draft Name Pattern Validation pattern for naming demand drafts or payment drafts. Positive Pay Invoice Description Pattern Regular expression to validate invoice descriptions in Positive Pay. Positive Pay Invoice Number Pattern Defines the pattern used for validating invoice numbers under Positive Pay. Positive Pay Remarks Pattern Validation pattern for remarks provided during Positive Pay submissions. Max Multiple Transfer Limit for Retail Users Defines the maximum limit allowed for multiple fund transfers by retail users. Upcoming Payments Lookahead (Days) Specifies how many days in advance upcoming payments are displayed. Payment Questionnaire Answer Pattern Defines the allowed format for answers in payment-related questionnaires. External Account Company Code Pattern Regular expression for validating company codes in external accounts. External Account IBAN Pattern Specifies the format for validating IBANs of external accounts. External Account Name Pattern Validation pattern for names associated with external accounts. External Account Number Pattern Regular expression for validating external account numbers. Peer-to-Peer Mobile Number Pattern Defines the validation pattern for mobile numbers used in peer-to-peer payments. Other Payment Details Pattern Specifies the format for validating additional payment details. Claim Money Link Expiry (Days) Indicates the number of days after which a claim money link expires. Max Days Allowed for Pay Later Defines the maximum number of days allowed to defer a payment under Pay Later option. Max Email IDs Per Payment Specifies how many email addresses can be associated with a single payment. Allowed Email Pattern Defines the regular expression for validating allowed email formats. Payment Remarks Pattern Specifies the validation pattern for remarks entered during payments. Payment Duplicate Check Window (Seconds) Defines the time window (in seconds) used to check for duplicate payments. Customized Payee Property ID Identifier for custom attributes associated with payees. Change Date at EOD Indicates whether date changes should be applied automatically at the end of the day. Thread Pool Type Defines the thread pool type used for handling concurrent payment processing tasks. Demand Draft Duplicate Check Window (Seconds) Specifies the duplicate validation time window (in seconds) for demand drafts. Account and branch separator Character used to separate account number and branch code in combined identifiers. Encryption Scheme Defines the encryption algorithm used for securing payment-related data. Thread Pool Size for Record Approvals Specifies the number of threads allocated for processing record approvals. Token Generation Secret Secret key used for generating secure tokens for payment sessions. Enable Taxonomy for SWIFT Indicates whether SWIFT messages use taxonomy-based categorization. Enable Taxonomy for Peer To Peer Payee Create Determines if taxonomy applies during peer-to-peer payee creation. Enable Taxonomy for Peer To Peer Payee Update Determines if taxonomy applies during peer-to-peer payee updates. Content Upload MIME Types White list Lists the MIME types allowed for file uploads in the payment module. Allowed File Types for Upload Defines the permitted file types that can be uploaded by users. Max Upload Size (KB/MB) Specifies the maximum allowed upload file size in kilobytes or megabytes. Security Code Expiry Time Defines how long a security code remains valid after generation. Payment Summary Date Range Specifies the default date range displayed in payment summary reports. Peer To Peer Payee Critical Fields Lists the key fields required for peer-to-peer payee creation or validation. Domestic Payee Region List configuration Specifies configuration for listing and managing domestic payee regions. Payment Error Code Mapper Defines mappings between payment error codes and their descriptions. QR Transfer Public Key Public key used for encrypting data during QR-based transfers. - Click Save to save the details.

- Click Back to navigate to previous page.

- Click Cancel to cancel the details.

Parent topic: Global Settings