7.10.2 Input of Manual Payments

- The counterparty (customer) code

- The currency of the loan

- The status of the loan

- The total outstanding amount as of the value date (the date on which the payment is being made)

- The version of the loan (that is the number of times that the loan has been modified)

If there are no schedules due on that date, the schedule becomes a prepayment. But this is only if the Value Date is not a back valued date. You can have a back valued date but it cannot be earlier than the last schedule that was paid. You can also liquidate back valued schedules by entering a Limit amount.

If the Value Date is today or a date in the future, the prepayment is processed.

The Payment Limit Date or Amount of the payment should be given at the time of payment. If you have given a payment limit date, the system shows all the components, which are due till the limit date. If you have given the amount limit in the Amount field, it shows all the schedules for the limit amount.

The Amount Due for each component can be settled either partially or fully by specifying the Amount Paid, the Amount Waived, and the Amount Capitalized. The Total values displays the total amount settled for the component. When you collect the amount from the borrower, the waived portion is collected from the expense GL and the capitalized portion is collected from the Asset GL as per the accounting roles configured in the product.

Example

Say for a particular contract, there are two interest schedules pending on Ms Yvonne Cousteau loan — one on 1 October 1997 and the other on 15 October 1997. The third schedule is due on 30 October 1997.

If you give the Limit date as 25 October, (today’s date) the system shows the amount due for the interest component on the schedule dates of 1 October, and 15 October.

If you give the limit date as 1 November 1997, the system shows the schedules falling on 1 October, 15 October, and 30 October, and you can liquidate them accordingly.

Since today’s date is 25 October, if you liquidate the schedule due on 30 October, it amounts to a pre-payment. You can charge a prepayment penalty rate or an amount, which you enter in this screen.

Note:

While the Prepayment Limit Date is used to pick up the schedules pending as of that date, the Value Date is taken into account by the system for passing accounting entries.Alternatively, the system picks up a schedule according to the amount being paid. You can see the next schedule, which is due, within the limit of this amount. If the amount being settled is more than the total amount payable for the next schedule, the next schedule is considered. The total amount due for these schedules is displayed.

Example

System date: 1 June

Payment schedules for a contract are as follows:

| Schedule Date | 30 June | 31 July | 30 August |

|---|---|---|---|

| Principal | 1000 | 1000 | 1000 |

| Interest | 100 | 100 | 100 |

| Commission | 500 | 50 | 50 |

| Fee | 20 | 20 | 20 |

For the above schedule, if a prepayment is made as of an amount, the system validates it in the following manner:

Suppose the amount settled is USD 1000. The next available schedule is as of 30 June and the total amount due is USD 1170. This schedule is taken for processing and you can make the payments.

If the amount settled is USD 1170, which is equal to the schedule amount of 30 June, again only the schedule for 30 June is taken for processing.

If the amount settled is USD 1,270, which is more than the amount due for the schedule of 30 June, the schedule of 31 July will be picked up by the system for processing. After completely liquidating the schedule of 30 June, you can liquidate the interest schedule as of 31 July, which is the next schedule.

If the amount settled is USD 1300, the schedule for 31 July is taken for processing. The complete schedule of 30 June can be liquidated along with the interest component of 31 July. The remaining USD 30 can be used to partially liquidate the commission component for 31 July.

The Disc. Rate and the Liquidated Nominal fields are used for processing T-Bills. Liquidated Nominal is the amount that you would receive when you redeem a T-Bill on the maturity date. This is also known as the face value of the T-Bill. The discount rate is used to calculate the Net Present Value (NPV) of a T-Bill when it is liquidated before the liquidation date that is, the actual value obtained on the T-Bill when you redeem it prior to the maturity date.

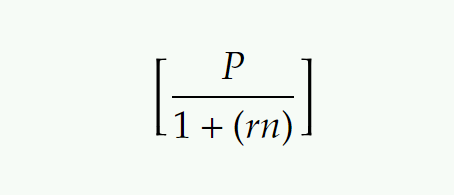

The following formula may be used to arrive at the NPV:

- P is the Face Value of the T-Bill

- R is the discount rate applicable.

- N is the period for which NPV is calculated.

Alternatively, you can also enter the amounts against the individual components. Click the Sum button to view the Net Amount Settled, Net Amount Paid, Net Amount Waived and Net Amount Capitalized. In case of prepayment, on click on ‘Sum’ button, you can view the Principal amount being prepaid in the field ‘Prepaid Principal Amount’.

Click Populate button to view the component wise amount to be paid on the closure date. The Principle, Main interest Component, and Tax as on the closure date are displayed. You cannot edit the displayed amounts.

The Computed amount to be paid is defaulted against the Principal and Main Interest component wise. It is disabled when the value date of the payment is after the maturity date of the contract. The system considers all the rollover preferences set in the contract level and display the amounts.

The system performs a Rollover on the maturity date of the contract. The system executes the future dated payment in the liquidation batch.Principal, Interest, and Tax amounts are liquidated.

Note:

You cannot perform any other financial activity on the contract once the future dated payment is captured.- Penalty interest (if one has been applied)

- Interest

- Principal

Note:

If a payment that covers both past and future schedules is made, the system forces you to pay out the past schedules before the future schedules are paid.If an ICCF component is based on the outstanding principal, you cannot make a payment where the amount is more than what is due for the component as of the system date.

Note:

In case of prepayment, the amount displayed in the field ‘Prepaid Principal Amount’ includes only the ‘Amount Paid’ also prepayment penalty is calculated only on this amount.Example

Suppose a loan Contract has the interest amount due of USD 29589.04 due as on 28-OCT- 2008 which is also the scheduled due date. The amount received from the customer is USD 29000. You can waive the difference of USD 589.04, and the schedule does not go into overdue.

You can specify the Amount Capitalized for each component, and the accounting entries for the corresponding capitalized amounts will be processed as defined at the product level, resulting in part or full capitalization of the due amount.

Example

Suppose a loan contract has an interest amount of USD 3,500 due on October 28, 2008, which is also the scheduled due date. The amount received from the customer is USD 3,000. You can capitalize the difference of USD 500, and the schedule will not go into overdue status. The capitalized amount will be added to the principal bullet schedule and the outstanding balance.

FX Variation on FCY Loans

- Payment By

You can either select Foreign Currency or Local Currency

- Spot Rate

The system calculates FX variation based on user input rate on Spot Rate and daily exchange rate as D-1, D,D+1,D+2. Each exchange rate variance on daily basis, accrual on FX variation is calculated and posted on daily event.

Parent topic: Making Manual Payments