- Bilateral Loans

- Disbursing a Loan

- Preferences for a Loan

- Setting Loan Schedule Preferences

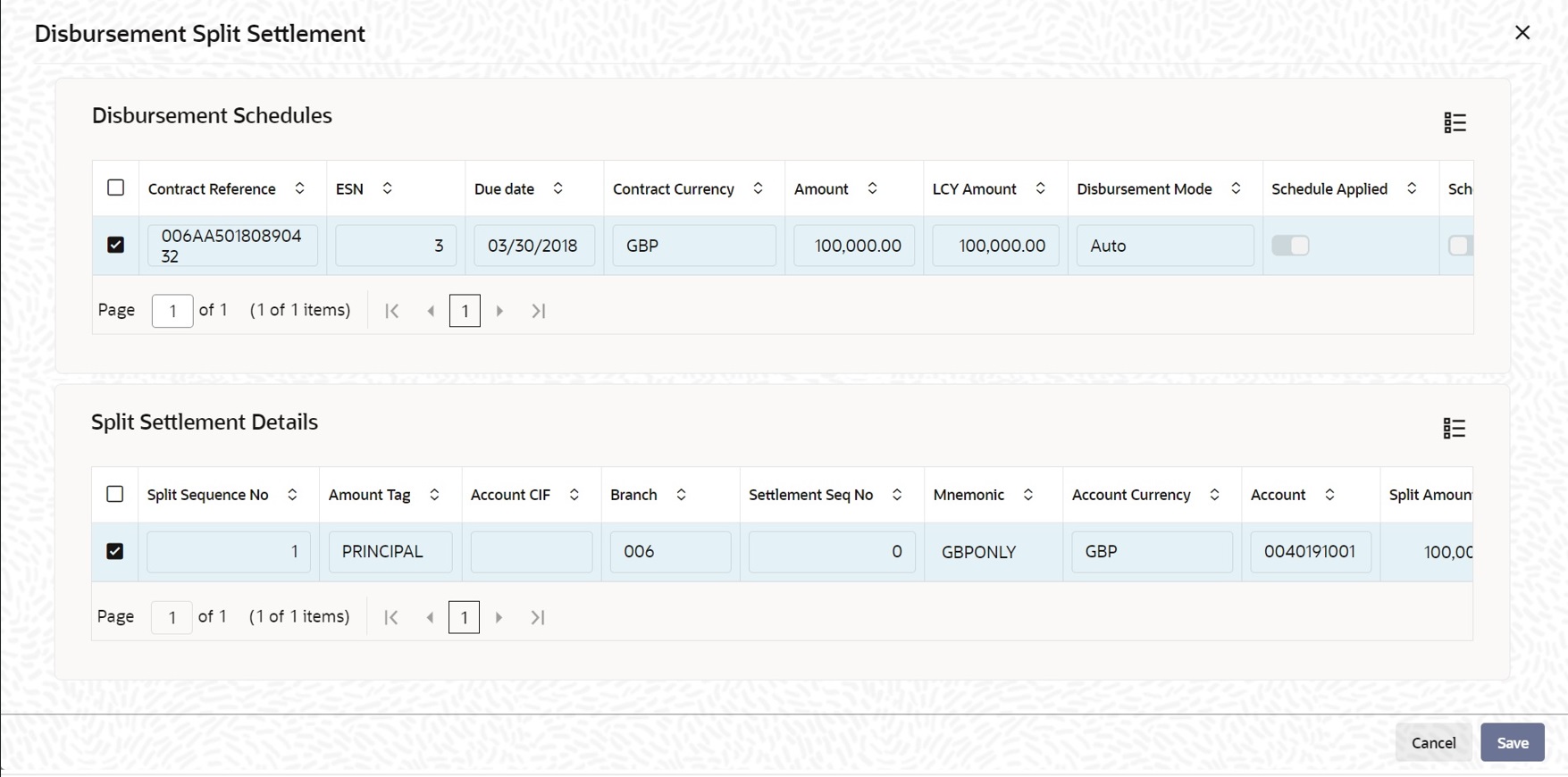

- Disbursement Split Settlement

4.3.1.1 Disbursement Split Settlement

Specify the User ID and Password, and login to Homepage.

From the Homepage, navigate to Loan and Commitment-Contract Input screen.

On the Loan and Commitment-Contract Input screen, click Schedules tab.

- On the Schedules screen, click Disbursement

Split Settlement.The Disbursement Split Settlement screen is displayed.

- For loans with auto disbursement, schedule wise split settlement is supported

during contract booking.

Table 4-11 Disbursement Split Settlement

Fields Description Disbursement Schedules You can view the disbursement schedules of the contract. Split Settlement Details The Split Settlement Details field values get populated from the main Settlement subsystem. You cannot add a new row in this section. Split Sequence No Indicates the split sequence number on new split. This appears after saving or querying existing contract. Account CIF Indicates the customer CIF. Branch The branch where the CASA account exists. Mnemonic Indicates SSI Mnemonic. Account Currency Account currency for the settlement account selected. Split Amount and Split Percentage During loan booking you have provide the eligible split accounts in the Settlement subsystem. You can enter the required split amount for the specific account and leave the other accounts with split amount as 0.You can either input split amount or split percentage for future auto disbursement schedules.

The split amount is calculated based on percentage entered and disbursement amount due. The split percentage is derived based on the split amount entered and disbursement amount due.The system validates the sum of split amount is equal to the disbursement amount due for each schedule.Types of repayment schedules When creating a product, you specify the type of repayment schedule - amortized, capitalized or normal (periodic). All loans involving the product acquires the repayment schedule type, defined for the product. When processing a loan you cannot change the repayment schedule type that the loan has acquired. For example, if you have specified an amortized, repayment schedule for a product, it applies to all loans involving the product. This cannot be changed.

By specifying that payment schedules have to be amortized over the period of repayment, you indicate that all the repayments should be in Equated Instalments. These repayment schedules are drawn up taking the Principal and the Main Interest. While defining the attributes of interest applicable on a product, you can designate one interest component as the main interest.If you specify amortized schedules, the system automatically do the amortization according to the frequency that you have defined.

You can also specify Capitalization and define schedules for the various components of the loan. If the repayments of principal or interest are not made on a particular schedule date, they are capitalized for the next schedule. If a partial payment has been made, the unpaid amount is capitalized (the unpaid interest is added to the unpaid principal and this becomes the principal for the next schedule).Note:

If a loan is to be amortized, it should have a fixed type of interest and a Bearing interest payment method. - If you have specified Normal type of schedules, you can define

your own schedules for loans involving the product.

- Specifying Moratorium

TypeYou can select the following moratorium type as the any one of the following:

- Liquidate Immediate

- Liquidate Across Schedule

- Liquidate With First Schedule

- Capitalize

- Consumer Credit

For information on moratorium related accounting entries, refer to Appendix B - Accounting Entries, Advices and Error Codes topic.Note:

- In case of any change in projected moratorium interest, for example. change in principal, change in moratorium interest rates or change in moratorium period, system re-distributes or re-amortize the new projected moratorium interest across the remaining schedules falling after moratorium end date.

- If there is user defined schedule amount/ EMI, the amount/EMI is not changed while considering moratorium interest for schedule calculation.

- Moratorium period should be defined as a single schedule.

- Moratorium period is applicable only for Bearing, Normal and Bearing Amortized type of schedules. It is not applicable for Discounted, True discounted, and Capitalized loans.

- If IOF capitalization is used, in moratorium formula, capitalized IOF amount should not be used as Principal. This is to ensure that moratorium interest is not calculated on Gross principal which includes the IOF amount.

- Specifying the amortization

typeYou need to specify the amortization applicable to the loan only if the schedule type is amortization. The following options are available:

- Reducing Balance

The reducing balance method is used for calculating interest on the reduced principal/outstanding balance for each repayment schedule. The principal repayment would be the difference between the equated monthly installment and the interest, for each schedule. The following example illustrates principal and interest calculation using this method.

Example

Assume that you have disbursed a loan with the following details:- Principal – 10,000 USD

- Interest Rate – 10%

- Interest Calculation Method – Actual/360

- Loan Start Date - 12/1/2000

- Loan End Date - 11/30/2001

- Days in the year – 364

The interest for the first schedule is computed on the loan principal (10,000) for the first month (31 days) using the following formula:Sl. No Interest Principal EMI Outstanding Bal 1 86.11 $793.05 $879.16 $9,206.95 2 79.28 $799.88 $879.16 $8,407.07 3 65.39 $813.77 $879.16 $7,593.30 4 65.39 $813.77 $879.16 $6,779.53 5 56.50 $822.66 $879.16 $5,956.88 6 51.30 $827.86 $879.16 $5,129.02 7 42.74 $836.42 $879.16 $4,292.60 8 36.96 $842.20 $879.16 $3,450.40 9 29.71 $849.45 $879.16 $2,600.95 10 21.67 $857.49 $879.16 $1,743.46 11 15.01 $864.15 $879.16 $879.31 12 6.11 $873.05 $879.16 $6.26 (10000 * 10 * 31) / (100*360)

Interest for the subsequent schedules are computed on the outstanding principal for each schedule. - Rule of 78

A method of amortization, the Rule of 78 is also a way of determining how much of each monthly payment is paid towards interest and how much is paid towards the principal component. First, you need compute the total interest on the original principal amount. Then, you need divide this interest amount equally into n parts, where n is the number of schedules and divide the loan principal amount also into n equal parts, so that each equal installment is basically a sum of the two. Subsequently, you need apply the rule of 78 to calculate how much of the EMI goes towards interest and principal. The following example illustrates this:

Example

Consider the loan details mentioned in the above example:- Total interest on the loan = (10000 * 10 * 364)/(100*360) = 1011.11

- Interest for each schedule = 1011.11/12 = 84.26

- Principal for each schedule = 10000/12 = 833.33

- EMI = 833.33 + 84.26 = 917.59

- First month’s interest = 12/78 times $1011.11

= 155.56

(78 is the sum of integers from 1 to 12)

Sl. No Interest Principal EMI 1 155.56 762.03 917.59 2 142.59 775.00 917.59 3 129.63 787.96 917.59 4 116.67 800.92 917.59 5 103.70 813.89 917.59 6 90.74 826.85 917.59 7 77.78 839.81 917.59 8 64.81 852.78 917.59 9 51.85 865.74 917.59 10 38.89 878.70 917.59 11 25.93 891.66 917.59 12 12.96 904.63 917.59 Total 1011.11 9999.97 11011.08

- Reducing Balance

- Handling a repayment schedule date that falls

due on a holiday

The holiday check parameter (Currency, Local or Both) and the holiday preferences specified at the product level is defaulted to the contracts associated with it.

You cannot change the holiday check parameter at the time of processing contracts. However, you can modify the holiday preferences for the contract. Oracle Lending performs holiday checks for the value date, maturity date, schedule date, and revision date.If any of these days falls on a holiday (either local holiday or currency holiday or both, whichever you have specified), the system handles the holiday treatment according to the holiday preferences specified for the contract.

You have specified that repayment schedules should be generated automatically, after indicating the frequency, number and the date of first repayment. When the system computes the repayment dates based on these values, there is a chance that one or more schedules fall due on a holiday. In such a case, you have the following choices:- Ignore the holiday and retain the due date

- Move it either backward or forward

- Move across months

- Move other schedule dates relative to the current rescheduled date

Table 4-12 Holiday Preferences

Field Description Ignoring Holidays If you specify that holidays are to be ignored, the schedule dates are fixed without taking the holidays into account. In such a case, if a schedule date falls on a holiday, the automatic processing of such a schedule is determined by your holiday handling specifications for automatic processes, in the Branch Parameters screen.

In this screen, you can specify the following:- Processing has to be done on the last working day before the holiday for automatic events falling due on the holiday. The schedule falling on the holiday is liquidated during End of Day processing on the last working day.

- Processing has to be done only up to the System Date. In this case, only the events scheduled for today is processed. The events of the holiday are processed on the next working day during Beginning of Day processing.

Example

A monthly repayment schedule date for Taggart Iron and Steel’s loan, of USD 100,000 (for one year at 16% interest) falls on October 31, a holiday. If you have specified that holidays should be ignored by clicking this field, the schedule date remains as October 31 when the schedules are fixed. The processing of this is determined by your holiday handling specifications in the Branch parameters screen.- You can specify that processing has to be done today (on System date) for automatic events up to the day before the next working day. Then, on October 30 itself, the schedule of October 31 is liquidated, during the EOD run of the Automatic Contract Update function.

- You can specify that processing has to be done today (on System date) for automatic events up to the day before the next working day. Then, on October 30 itself, the schedule of October 31 is liquidated, during the EOD run of the Automatic Contract Update function.

Note:

Oracle Lending applies to the above explained holiday checks on all contracts uploaded from an external system also.Moving schedule dates forward or backward For a schedule date falling on a holiday and you can specify that holidays are to be ignored at the time schedule definition. If you do so, then you have to indicate the movement of the schedule date, forward to the next working day or backward to the previous working day. In such a case, since the schedule date itself is moved to a working day, the payment is processed on the day it falls due, as of that day.

This concept can be easily explained with the help of an example:Example

For a loan, you have defined monthly schedules falling due on the following dates:- March 31

- April 30

- May 31

- You can ignore the holiday. In such a case, the schedule date is still be April 30, despite the holiday. The liquidation of the schedule is done as per your specifications in the Branch Parameters screen. You can move the schedule date forward to the next working day, which happens to be May 1. In this case, the schedule is liquidated during BOD processes on this date.

- You can move the schedule date backward. In such a case, the schedule date is April 29, the last working day before the holiday. The schedule is liquidated during BOD processes on this date.

Principal Holiday Treatment You can maintain separate holiday treatment for the principal and interest components interim payment schedules. In the Schedules tab, in Holiday Treatment, click in the to display the Holiday Treatment for Principal Schedules section. The holiday preferences available for the principal component are displayed here.

Note:

This button is enabled only if you have selected the Principal Holiday Treatment box at the product level.- Ignore Holidays – No holiday treatment for the Principal component.

- Cascade Schedules – The due date arrived at by the holiday treatment is considered as the start date for the due dates for the subsequent schedules.

- Move Across Months – Allows movement of schedule date of the contract across months.

- Move Backward – If a due date is a holiday, then the due date is moved backward to the previous working day.

- Move Forward – If a due date is a holiday, then the due date is advanced to the next working day

Moving a schedule date across the month Suppose you have chosen to move a schedule falling due on a holiday either forward or backward, so that it falls due on a working day. The next or the previous day crosses over into another month. In this case the schedule date is moved into the next month only if you so indicate. If not, the schedule date is kept in the same month. Example

Scenario 1

You have defined a repayment schedule that falls due on April 30. This happens to be a holiday. You have indicated that in case of a holiday, the schedule date is to be moved forward to the next working day.As you have indicated that the schedule can be moved across months, then the schedule is automatically moved to May 1, that is, the next working day in the next month. However, if you have not allowed movement across the month but have indicated forward movement for the schedule, the schedule date falls on the holiday itself.

Scenario 2

You have defined a repayment schedule that falls due on May 1. This happens to be a holiday. You have indicated that in case of a holiday, the schedule date is to be moved backward to the previous working day.As you have indicated that the schedule can be moved across months, the schedule is automatically moved to April 30, that is, the previous working day. However, if you have not allowed movement across months but have indicated backward movement for this schedule, the schedule date falls on the holiday.

Cascading schedules The question of cascading schedules arises only under the following conditions: - You have specified that a schedule falling due on a holiday has to be moved forward or backward.

- The schedule has been defined with a definite frequency.

Example

A monthly schedule has been defined with backward movement and a schedule date falling due on April 30 was moved to April 29, April 30 being a holiday.The schedule date for May depends on whether you have chosen to cascade schedules. If you have, chosen to cascade schedules, the schedule date for May is set as May 29, since the frequency has been specified as monthly. For the subsequent schedules also, May 29 is considered as the last schedule date.

If you have not specified that schedules have to be cascaded, the date originally specified is the date for drawing up the remaining schedules. Even if the April month end schedule has been moved to April 29, the next schedule remains on May 30.When you cascade schedules, the last schedule (at maturity), is liquidated on the original date. It will not be changed like the interim schedules. Thus, for this particular schedule, the interest days may vary from those of the previous schedules.

Specifying the Holiday Currency You can indicate here, the currency of a country for which the holiday table should be checked, before drawing the payment schedules related to the loan. By default, the currency to be checked is the loan currency. If a currency other than this is specified, the holiday table is checked for both the currencies.

Note:

Oracle Lending applies the above explained holiday checks on all contracts uploaded from an external system also.Holiday treatment for Maturity Date Just as you define holiday preferences for the schedule date, you can also maintain preferences for holiday treatment for the maturity date of a loan. The following options are available:- Ignore the holiday and retain the due date

- Move it either backward or forward

- Move across months

Apply Financial Centre Holiday Treatment This check box allows you to enable financial centre holiday treatment and add the financial centres for the holiday treatment. This option is available for Disbursement/Payment Schedules, Rate Revision Schedules, Maturity Schedules and Principal Schedules tabs of Holiday Preferences screen. The options of holiday treatment are defaulted from the product screen. If required, you can modify these options.

- Specifying Moratorium

Type

Parent topic: Setting Loan Schedule Preferences