2.10.1.8 Draft Proposal Approval Details

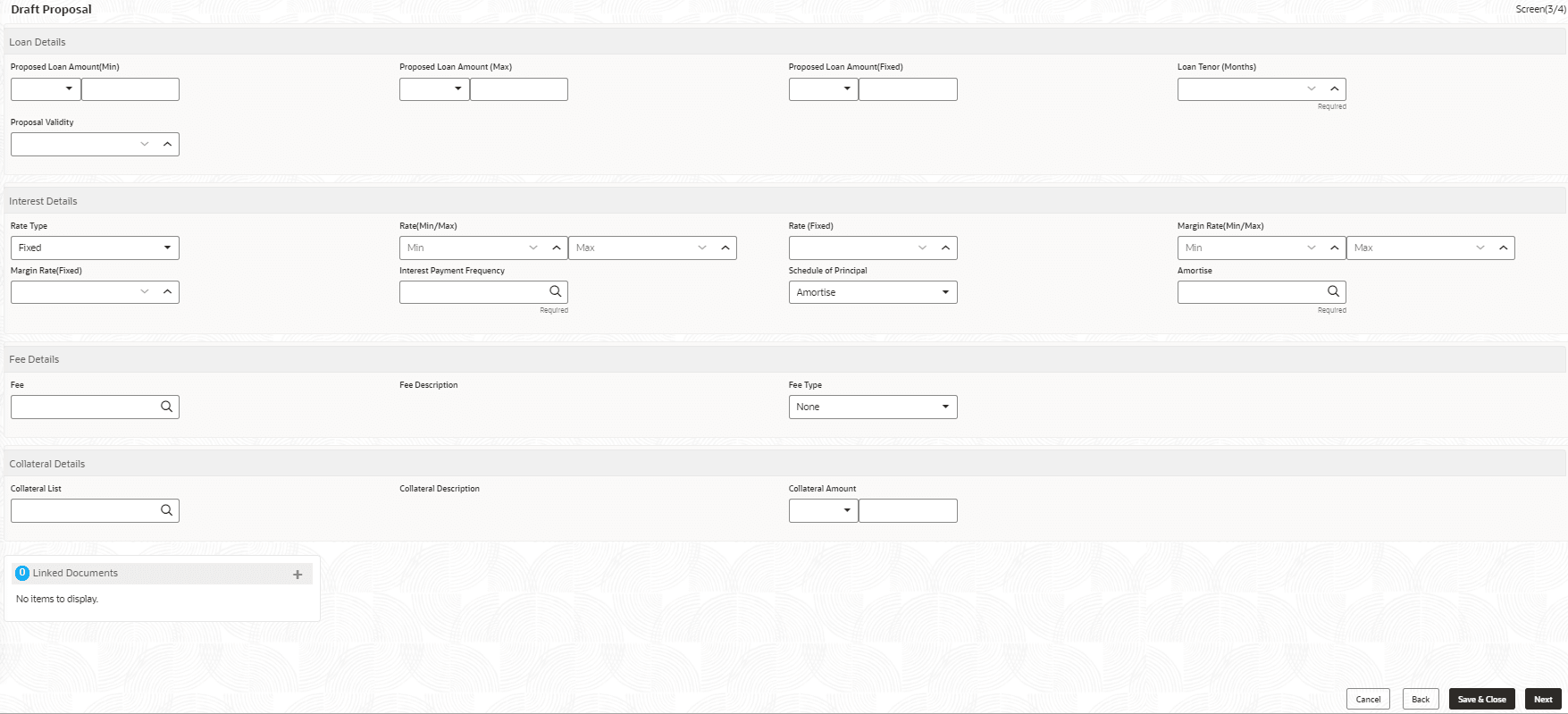

This topic describes the systematic instructions to Draft Proposal screen. This screen is used to verify and input all the details captured for draft proposal captured in various data segment such as client name, loan amount, currency, tenor, company profile, collateral requirements, fee and charges details,and interest details.

The details captured in various data segments are displayed as summary tile view, the details of each tile can be viewed by a click on the tile. The user will have option to either verify and approve or reject the application. He can also input his new details as per the approval.

Following options are supported as exit criteria in this data segment:

Table 2-21 Data Segment - Options

| Option | Description |

|---|---|

| Approve | Approve the application task and proceed to next stage. |

| Reject | Rejects the application and takes the application to enrichment stage. |

| Cancel Application | Cancel the application and send notification to customer. |

| Cancel | Close the screen and retain the task in the same stage. |

Parent topic: Cash Flow