3.1 Deposit Account Opening

User can open a Certificate of Deposit account and simulate its creation by providing funds from Account, and Ledger modes or a combination of Account and Ledger modes.

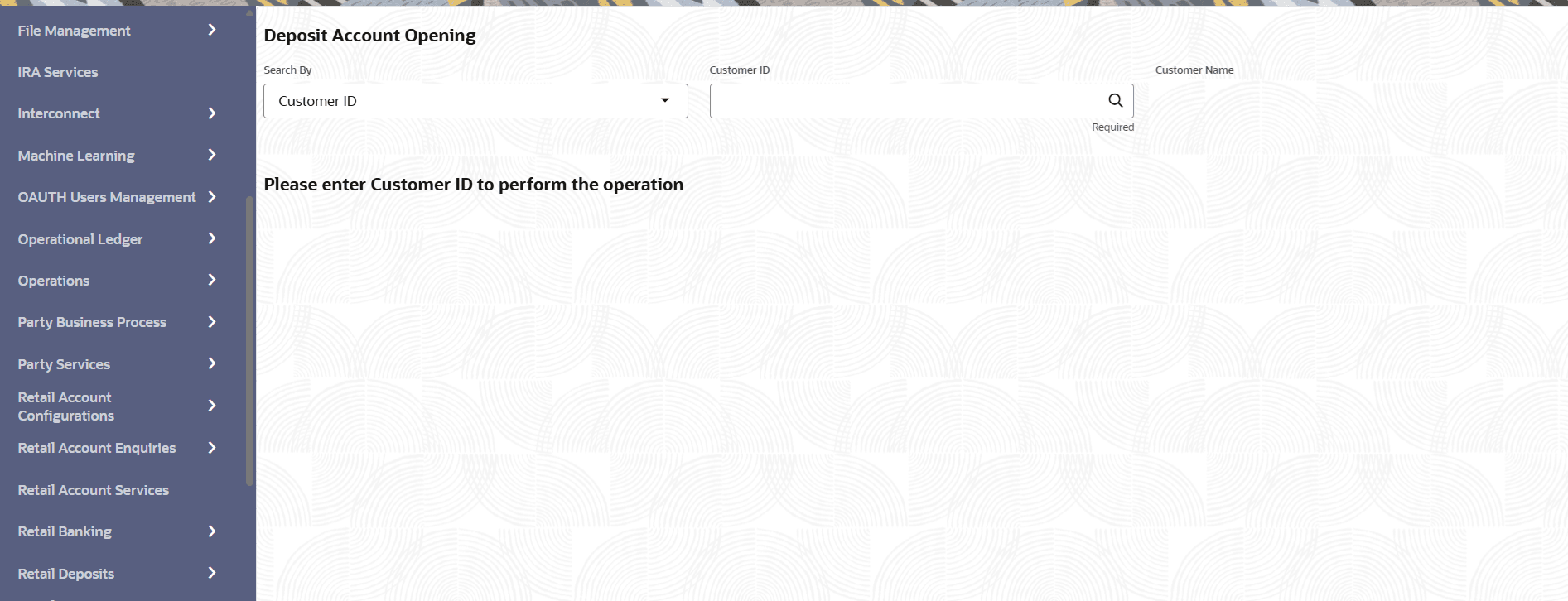

- On the Homepage, from the IRA Services click Deposit Account Opening, or specify Deposit Account Opening in the search icon bar and select the screen.The Deposit Account Opening screen is displayed.

- On the Deposit Account Opening screen, specify the customer number in the Customer ID field, and press Enter or Tab.All available CD account deposit accounts are displayed by the system.

Figure 3-2 Deposit Account Opening - Product Details

For more information on fields, refer to field description table below:Table 3-1 Active Deposit Product – Field Description

Field Description Product Description Displays the description of the product. Product Code Displays the product code. APY Displays the APY percentage. Currency Displays the currency code. Interest Cycle Displays the interest cycle in months. - On the Deposit Account Opening screen, click Search bar to search for products based on the product code, product description, and currency to search or filter the deposit products.

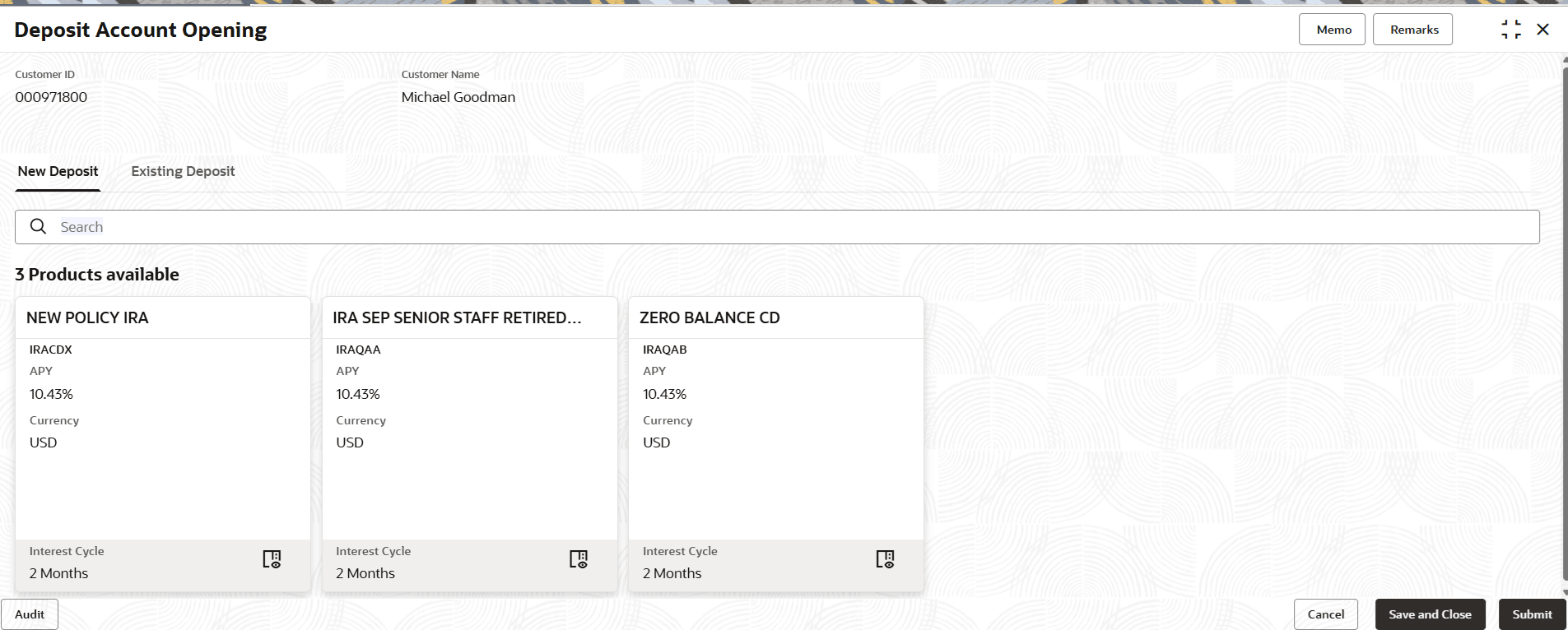

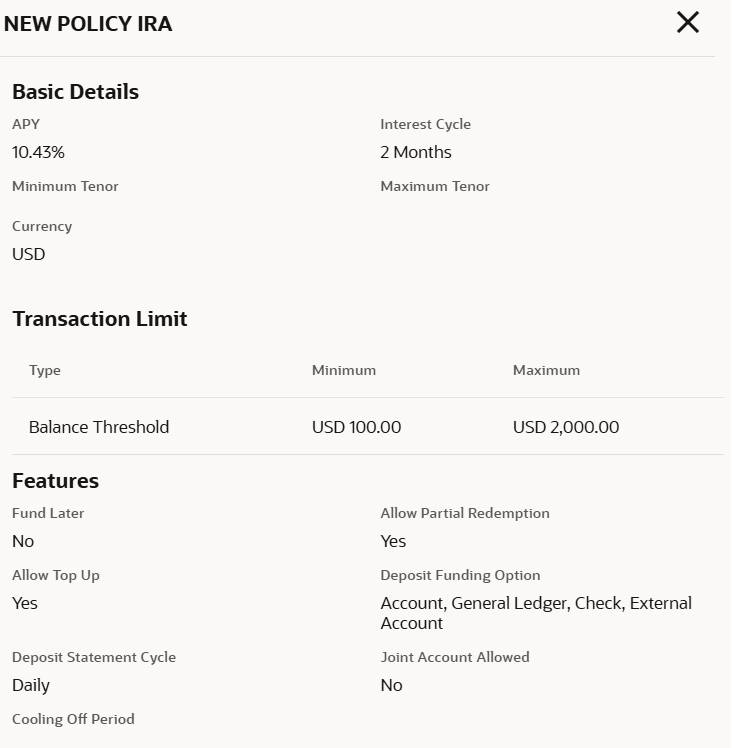

- Click View icon in the product widget, to view

additional details of the product.The account detail screen is displayed with basic product details and allowed features.For more information on fields, refer to field description table below:

Figure 3-3 Deposit Account Opening - View Product Details

Table 3-2 New Deposit - View Details – Field Description

Field Description Basic Details This section displays the basic details of the account. APY Displays the APY percentage of the deposit. Interest Cycle Displays the deposit's interest cycle. Minimum Tenor Displays the minimum tenor for deposit. Maximum Tenor Displays the maximum tenor for deposit. Currency Displays the deposit amount currency. Transaction Limit This section displays the transaction limit details. Type Displays the transaction type. Minimum Amount Displays the minimum transaction limit amount. Maximum Amount Displays the maximum transaction limit amount. Features This section displays the features of the deposit account. Fund Later Displays whether funding has to be done later. Allow Partial Redemption Displays whether partial redemption is allowed on the account or not. Allow Top Up Displays whether top up is allowed on the account or not. Deposit Funding Option Displays the allowed funding options. The possible options are: - Ledger

- Account

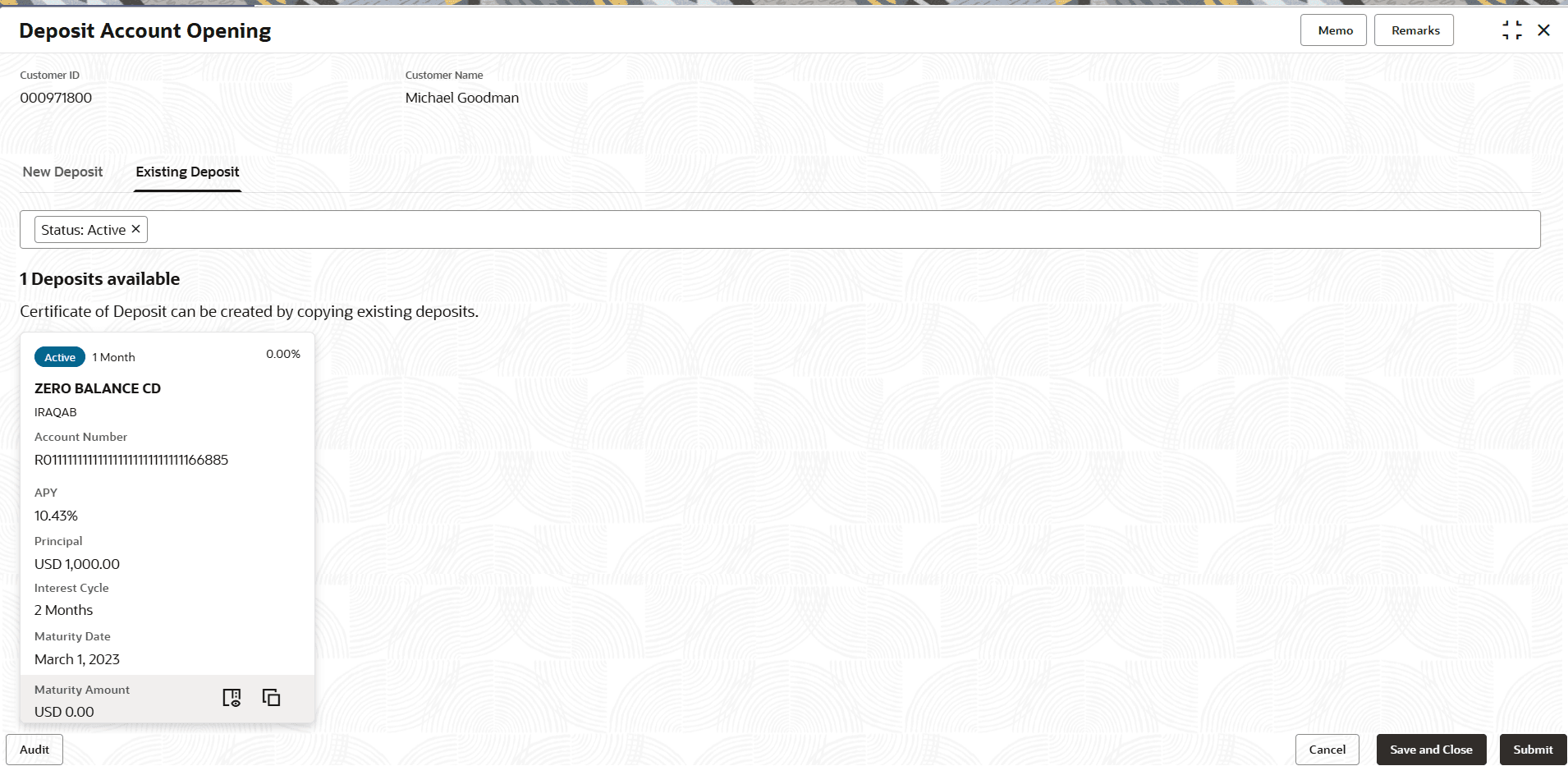

Deposit Statement Cycle Displays the statement cycle maintained for the deposit. Joint Account Allowed Displays whether joint account is allowed for the account. Cooling Off Period Displays the cooling off period for the account, if any. - Click Existing Deposit tab.The customer sees all available deposit accounts displayed by the system, with the default setting showing active account details.For more information on fields, refer to field description table below:

Figure 3-4 Deposit Account Opening - Existing Deposit

Table 3-3 Existing Deposit Account – Field Description

Field Description Status Displays the status of the account. The options are: - Active

- Matured

- Closed

Interest Rate Displays the rate of interest for an account. Product Description Displays the product description. Product Code Displays the product code. Account Number Displays the existing deposit account number of the customer. APY Displays the APY percentage. Principal Displays the amount available in an account. Interest Cycle Displays the interest payout cycle. Maturity Date Displays the maturity date. Maturity Amount Displays the maturity amount. - In Search bar, the user can search the accounts with

different status (Active, Closed,

Matured and All).If the user chooses All, the system displays the accounts of a customer with the statuses Active, Closed, and Matured.

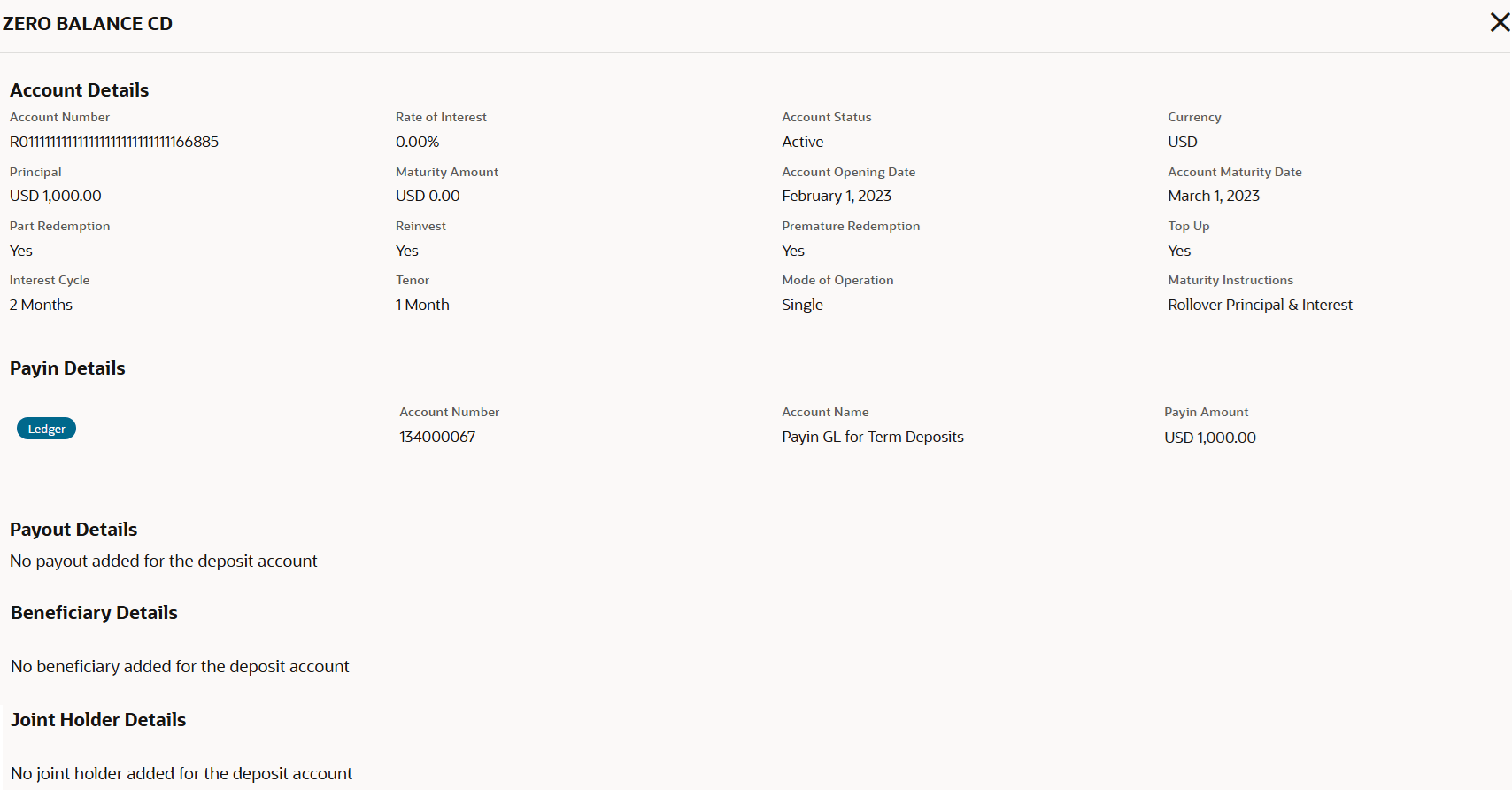

- Click View icon in the existing product widget, to view additional details of the account.The view screen is displayed with account details, payin details, payout details, beneficiary details and joint holder details if available. For more information on fields, refer to field description table below:

Table 3-4 View Existing Account Details - Field Description

Field Description Account Details This section the existing account details. Account Number Displays the deposit account number. Rate of Interest Displays the current rate of interest. Account Status Displays the current deposit account status. Currency Displays the deposit amount currency. Principal Displays the principal amount. Maturity Amount Displays the matured deposit amount. Account Opening Date Displays the date on which the deposit account is opened. Account Maturity Date Displays the maturity date of the deposit. Part Redemption Displays whether part Reinvest Displays whether the reinvest is applicable for the deposit account. Premature Redemption Displays whether premature redemption is allowed on the account. Top Up Displays whether top up is allowed on the account. Interest Cycle Displays the interest cycle set for the deposit account. Tenor Displays the tenor for deposit account. Mode of Operation Displays the mode of operation for the account. Maturity Instructions Displays the maturity instructions for the deposit which is defaulted from the product. Payin Details This section displays payin details of the deposit account. <Account Type> Displays the type of account. Account Number Displays the payin account number. Account Name Displays the payin account name. Payin Amount Displays the payin amount. Payout Details This section displays the payout details of the account, if they are already added. Beneficiary Details This section displays the beneficiary details of the account, if they are already added. Joint Holder Details This section displays the joint holder details of the account, if they are already added. - On Deposit Account Opening screen, the user will be able to create new CD in two methods.They are as follows:

- Copying the existing account to create new deposit

- Selecting the product to create new deposit.

- Click Copy icon in the existing account tile, to copy the existing details of an account.On copying the account, the system defaults the Account details (that is, Deposit Amount, Tenor, Reinvest Interest, Maturity Instruction), Payin Details, Payout Details, Beneficiary Details, and Joint Holder Details if any. All these details are displayed by default and the user is allowed to modify the value.

Note:

- The payin details will not be defaulted, if the Payin account is closed or payin GL is not valid for the branch.

- The payout details will not be defaulted, if account payout mode is other than the account, multi-mode payout, and payout account is closed.

- Beneficiary details are nullified, if beneficiary customer ID is closed.

- Existing guardian details are nullified, if beneficiary become major for the new account.

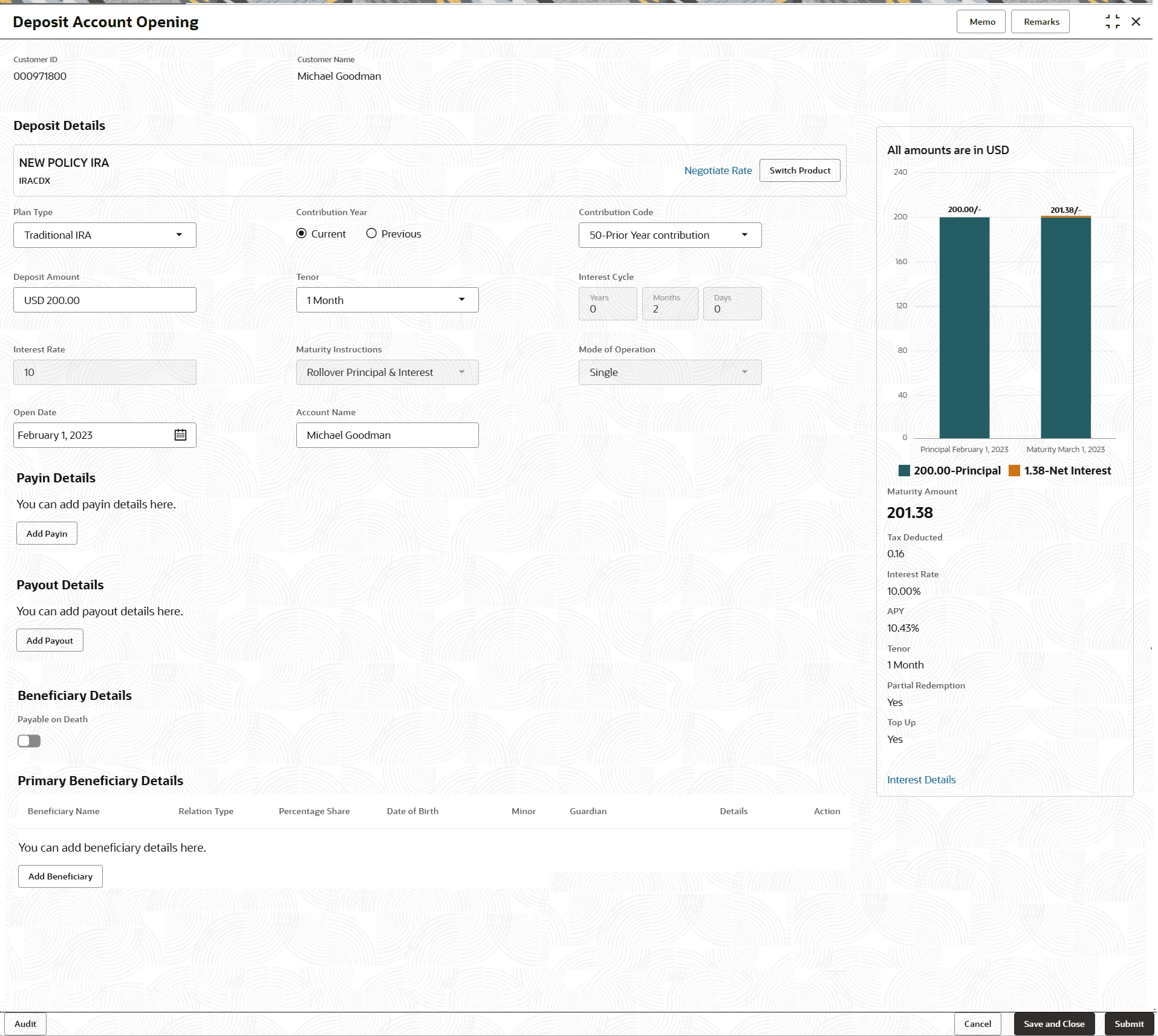

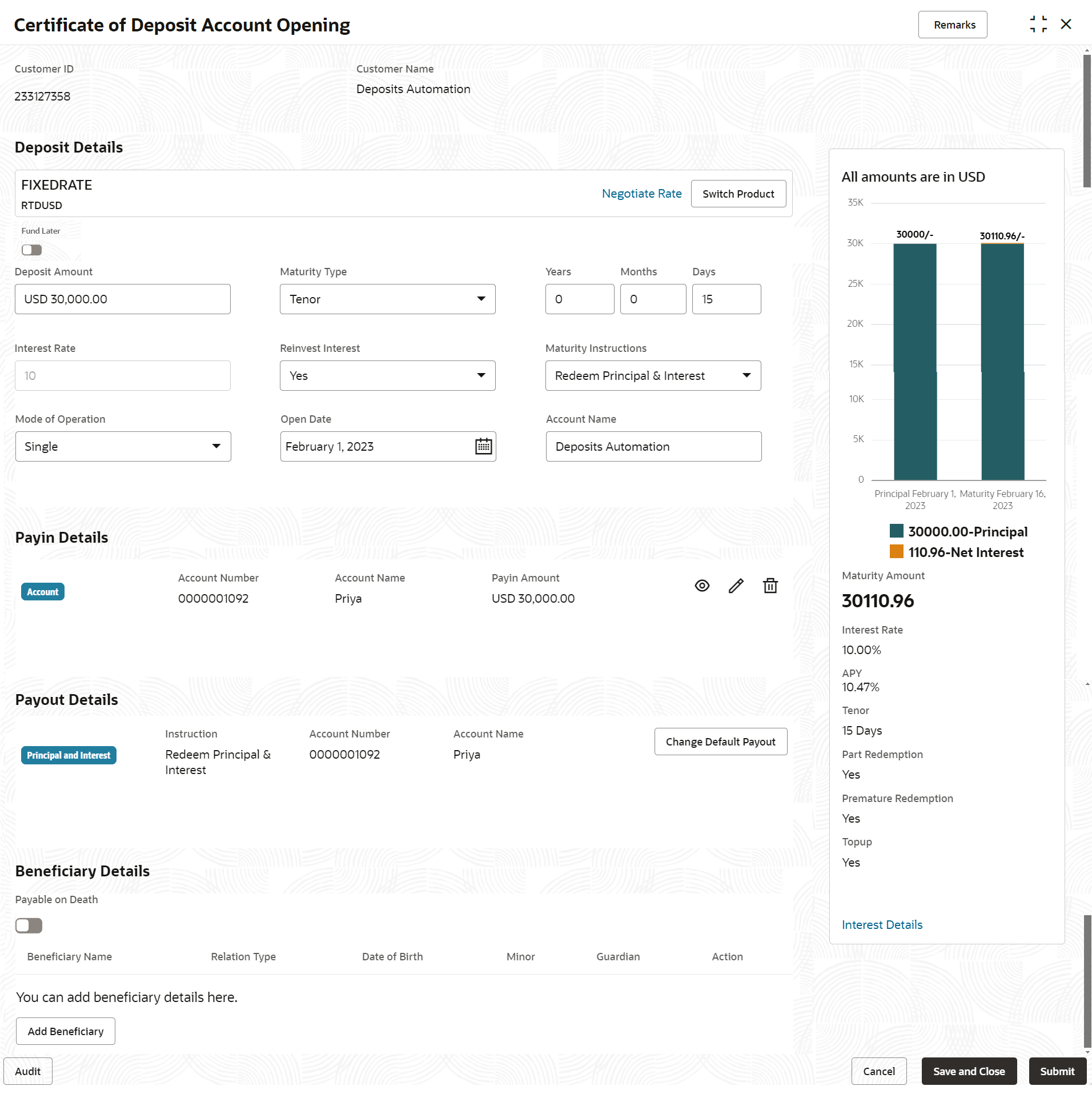

- On the Deposit Account Opening screen, select the product to create a new deposit account.The Deposit Account Opening is displayed with the Deposit Details fields to specify the details.

Figure 3-6 Deposit Account Opening - Deposit Details

- Perform the required actions on the Deposit Details section. For more information on fields, refer to field description table below:

Table 3-5 Deposit Account Opening - Deposit Details – Field Description

Field Description <Product Name>

Displays the name of the deposit product selected. <Product Description>

Displays the description of the deposit product selected. Plan Type Select the plan type for the deposit account. The options are: - Traditional IRA

- Roth IRA

- Simplified Employee Pension IRA

Contribution Year Select the year of contribution. The options are: - Current

- Previous

Contribution Code Select the code of contribution for the account, Deposit Amount When user Specify the deposit amount, the system simulate the maturity amount and interest details based on given deposit amount, defaulted tenor, and account opening date. The tenor opening date and reinvest interest is defaulted. Tenor Select the tenor for the deposit. Interest Cycle Displays the cycle for charging the interest. The interest cycle is displayed in Years, Months, and Days. By default, the interest cycle is set based on the product. If required, users can modify it. The interest cycle can be set to Years, Months, Days or combination of year, month and days.Note:

This field can only be modified if the Account Level Liquidation Preferences option is enabled at the Interest and Charge product level.Interest Rate Displays the interest rate of the deposit and it is defaulted from the product, when you specified the deposit amount. Maturity Instructions The product displays its default maturity instructions, which the user can modify. The following maturity instructions are supported. - Reinvest Interest is selected as Yes:

- Redeem Principal and Interest

- Rollover Principal and Redeem Interest

- Special Rollover

- Reinvest Interest is selected as No:

- Redeem Principal

- Rollover Principal

- Special Rollover

Note:

If auto-rollover is disabled for the product, it displays only Redeem Principal and Interest or Redeem Principal.Mode of Operation Displays the mode of operation from the drop-down. The possible options are: - Single

- Jointly

- Either Anyone or Survivor

- Former or Survivor

- Mandate Holder

Open Date Select or specify the account opening date. Account Name Displays the customer name as the account name and the user is allowed to modify the name. If the user wishes to change the selected product before the save/submit operation, click Switch Product in the deposit details screen, and the system displays a confirmation message related to clearing the input details. On confirmation, all input details are cleared and the user will navigate to the product selection screen.

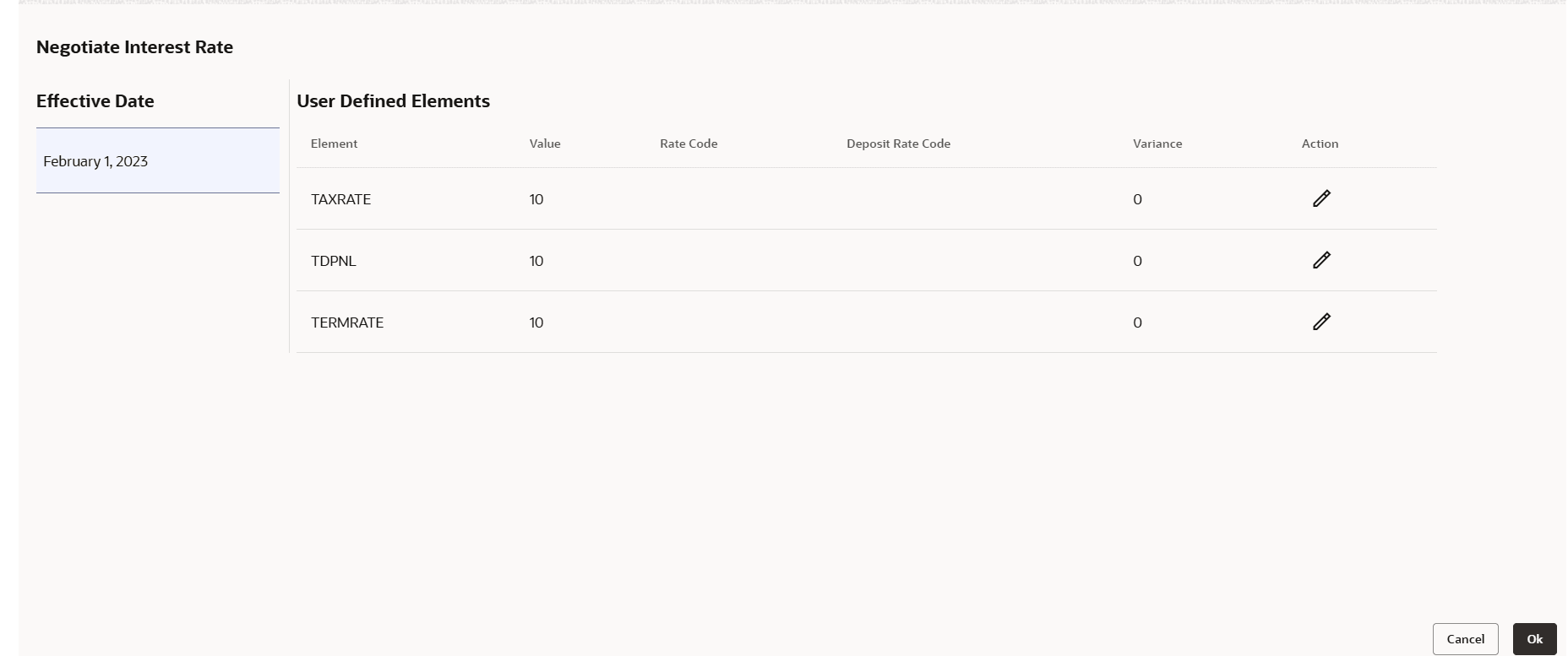

- Click Negotiate Rate link, to negotiate the interest

rate by modifying the variance.The Negotiate Interest Rate is displayed.

- On Negotiate Interest Rate screen, perform the required action. For more information on fields, refer to field description table below:

Table 3-6 Negotiate Interest Rate – Field Description

Field Description Effective Date Displays the date from which the interest rate is effective. User Defined Elements This section displays the user defined element details. Element Displays the user defined elements that are already linked to the Interest product. Value Displays the user defined value. Rate Code Displays the rate code for the interest. Deposit Rate Code Displays the rate code for the deposit. Variance Displays the variance for the user defined value and the user is allowed to modify the value. Action Click the Edit icon, to edit only the variance in user defined elements. - Click Interest Details link in the simulation widget to view the interest details.

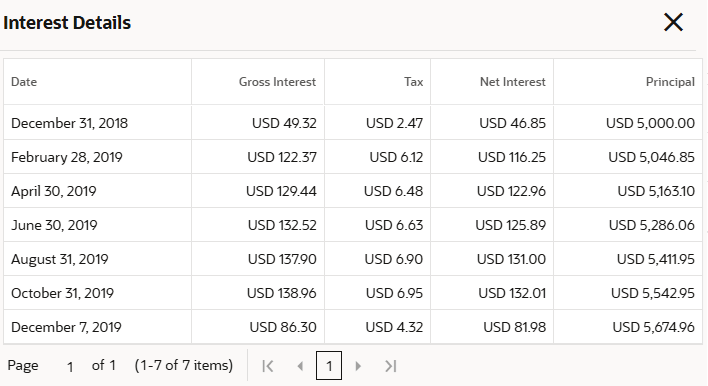

- Click Interest Details link in the simulation widget to view the interest details.The Interest Details screen is displayed.For more information on fields, refer to field description table below:

Table 3-7 Interest Details - Field Description

Field Description Date Displays the date of the interest cycle. Gross Interest Displays the gross interest amount. Note:

The amount will display both the Reinvest Yes and Reinvest Nos cases.Tax Displays the tax interest amount. Net Interest Displays the total net interest. Note:

Net Interest will be calculated as, Gross Interest - Tax.Principal Displays the interest principal amount.

- Click Interest Details link in the simulation widget to view the interest details.

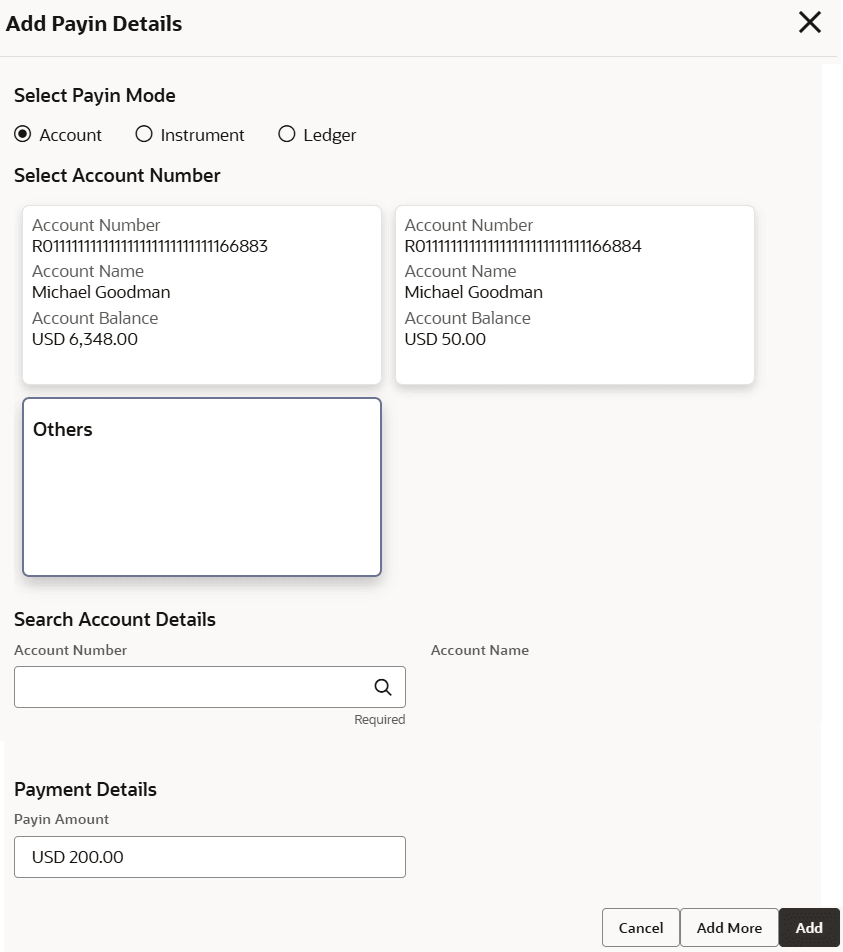

- Click on Add Payin, in the Payin Details section on the Deposit Account Opening screen.The Add Payin Details screen is displayed.

Note:

The system will defaults the payin account to pay the deposit amount if the customer has an active Current and Saving Account with sufficient balance, the accounts where deposit currency and account currency are same, and the single-match account is found.If the user wants to modify the defaulted payin details, click Change Default Payin. Then the system will delete the defaulted payin details and open the Add Payin Details screen.

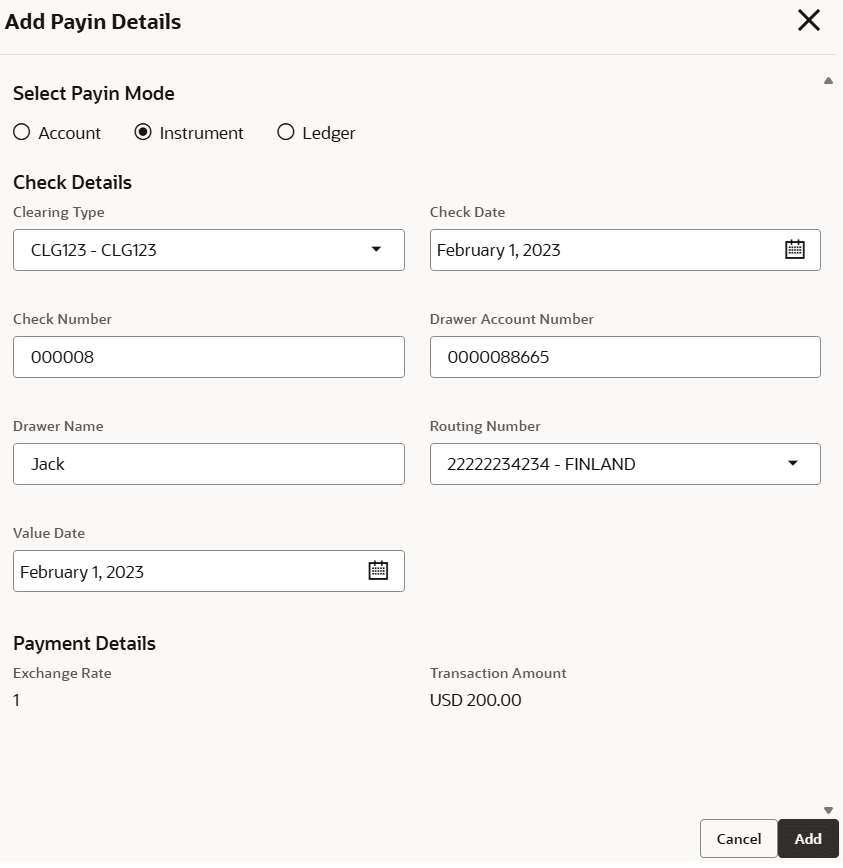

Figure 3-10 Add Payin Details - Instrument

- Perform the required action for payin details as an account. For more information on fields, refer to field description table below:

Table 3-8 Add Payin Details as Account

Field Description Select Payin Mode The Account mode is selected by default. Select Account Number The own accounts are displayed as widgets with the Account Number, Account Name, and Account Balance. You can select the account for CD payin. You can select Others from the widget to select any other accounts in the same bank for CD payin.

Search Account Details This will display, if you select Others from the widgets. click the Search icon to select from the list or specify the account number in the Account Number field and the Account Name is displayed adjacent to the account number.

- Perform the required action for payin details as instrument. For more information on fields, refer to field description table below:

Table 3-9 Add Payin Details as Instrument - Field Description

Field Description Select Payin Mode Select the Instrument option for the payin mode. Check Details This section displays the check details for payin. Clearing Type Select the clearing type of the instrument. Check Date Select or specify the date on the check. Check Number Specify the check number. Drawer Account Number Specify the account number of the drawer. Drawer Name Specify the name of the drawer. Routing Number Select the routing number for the instrument. Value Date Select or specify the value date. Payment Details This section displays the details related to payments. Exchange Rate Displays the current exchange rate. Transaction Amount Displays the transaction amount for payin.

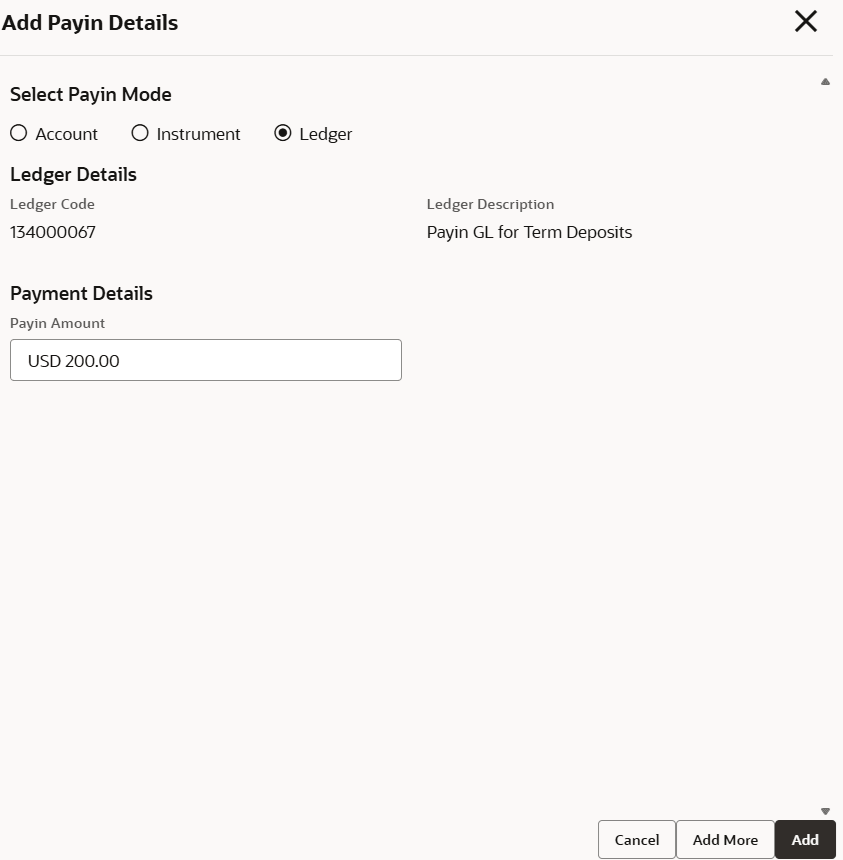

- Perform the required action for payin details as ledger. For more information on fields, refer to field description table below:

Table 3-10 Add Payin Details as Ledger

Field Description Select Payin Mode Select the Ledger option to perform the settlement. Ledger Code Displays the ledger code used for the transaction. Ledger Description Displays the ledger description used for the transaction. Payin Amount Displays the amount and also you can modify the amount.

- Click Cancel, to close the Add Payin Details screen without adding the payin details.

- Click Add More, the system add the payin details in the main screen and refreshes the Add Payin Details screen with default values, and the payin amount is updated for the remaining payin amount.

- Click Add to add the payin details in the main screen.

- Perform the required action for payin details as an account. For more information on fields, refer to field description table below:

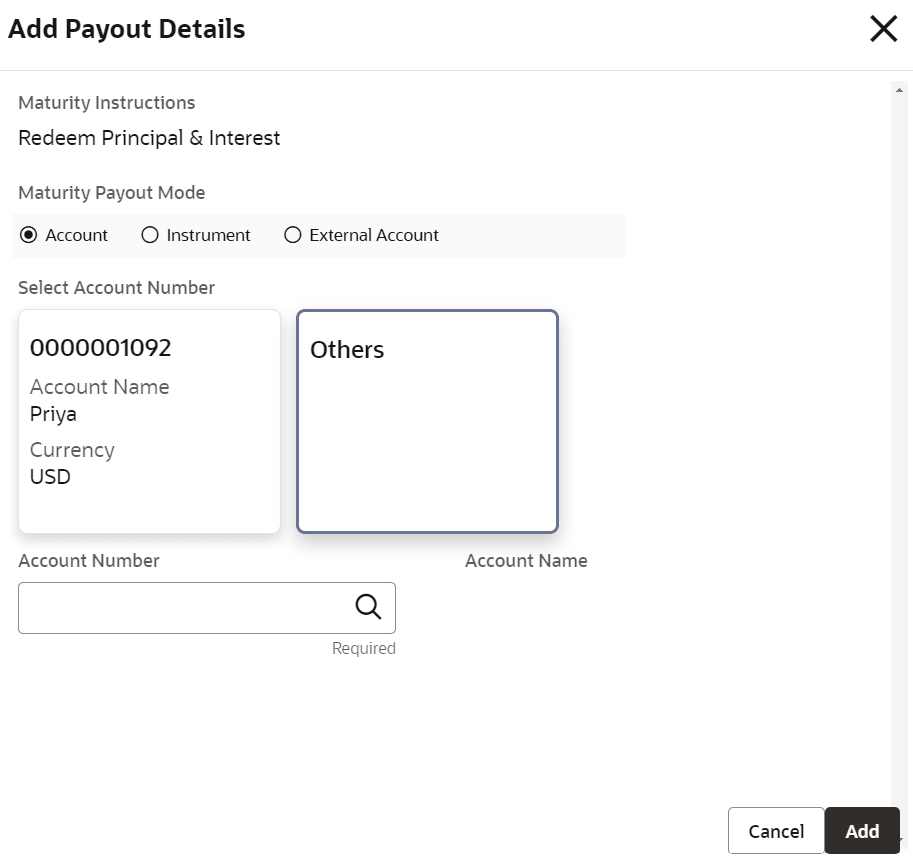

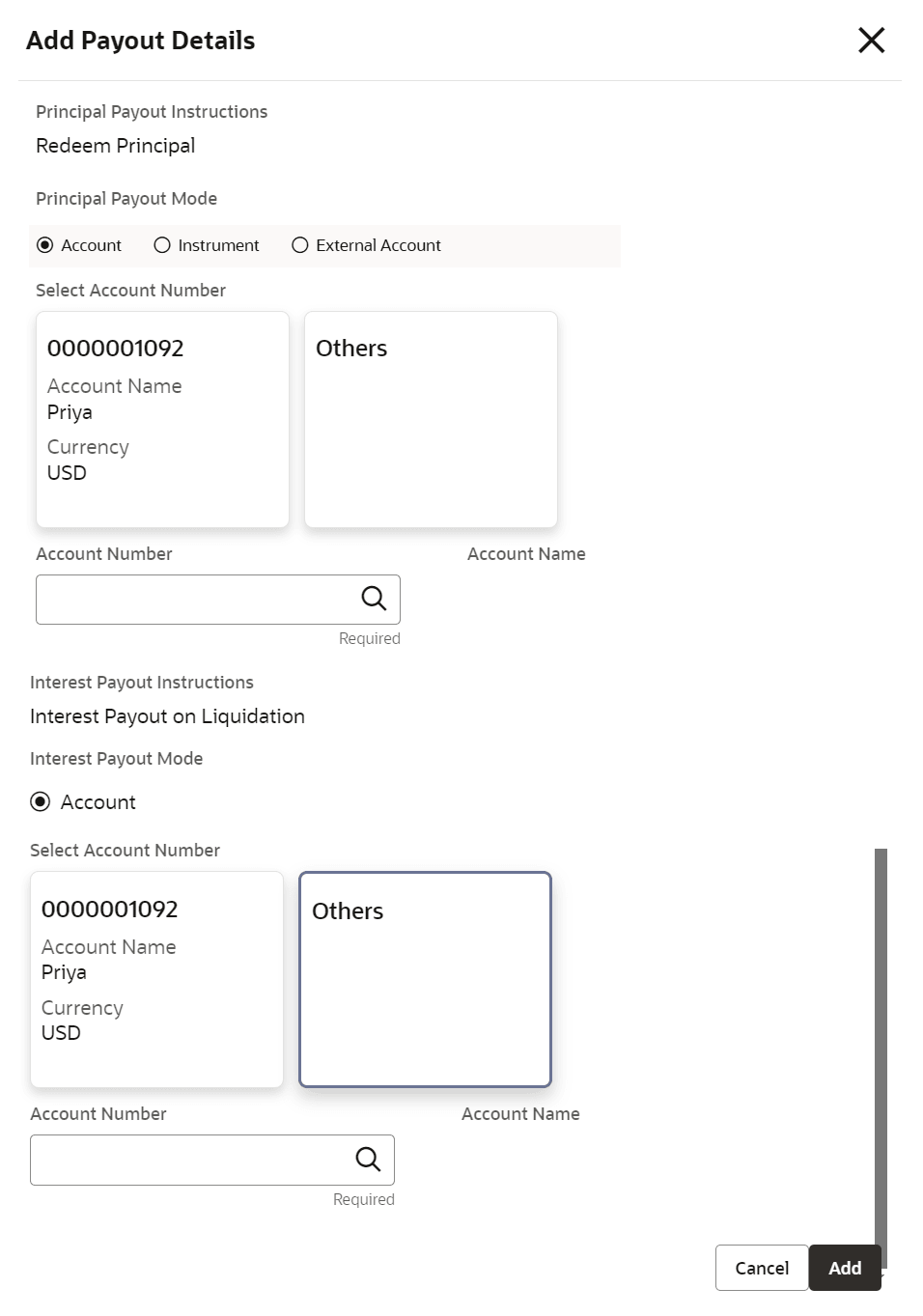

- Click on Add Payout, in the Payout Details section on the Deposit Account Opening screen.The Add Payout Details screen is displayed.

Note:

The system will defaults the payout account if the customer has an active Current and Saving Account, the accounts where deposit currency and account currency are same, and the single-match account is found.If the user wants to modify the defaulted payin details, click Change Default Payout. Then the system will delete the defaulted payin details and open the Add Payout Details screen.

Figure 3-12 Add payout Details with Reinvest Interest is Yes

Figure 3-13 Add payout Details with Reinvest Interest is No

- Perform the required action for payout details with Reinvest Interest is selected as Yes in Deposit Details section. For more information on fields, refer to field description table below:

Table 3-11 Add Payout Details with Reinvest Interest is Yes - Field Description

Field Description Maturity Instructions

Displays the maturity instructions for the deposit which is defaulted from the product. The options are:- Redeem Principal & Interest

- Rollover Principal & Interest

- Rollover Principal & Redeem Interest

- Special Amount Renewal

Maturity Payout Mode

Select the maturity payout mode.Note:

This field is displayed if Redeem Principal & Interest, Renew Principal & Redeem Interest, or Special Amount Renewal option is selected from the Maturity Instructions field.Select Account Number

Select the type of account.Note:

This field is displayed if Account option is selected from the Maturity Payout Mode field.Account Number

Select the Current and Savings Account account number.Note:

This field is displayed if Others option is selected from the Account field.Account Name

Displays the account name upon account number selected. Rollover Amount Specify the rollover amount. Note:

This field is displayed if you select Special Amount Rollover option from the Maturity Instructions field.

- Perform the required action for payout details with Reinvest Interest is selected as No in Deposit Details section. For more information on fields, refer to field description table below:

Table 3-12 Add Payout Details with Reinvest Interest is No - Field Description

Field Description Principal Payout Instruction Select the principal payout instructions for the deposit. The options are:- Redeem Principal

- Renew Principal

- Special Amount Renewal

Principal Payout Mode Select the principal payout instructions for the deposit.Note:

This field is displayed if Redeem Principal or Special Amount Renewal option is selected from the Principal Payout Instruction field.Select Account Number

Select the type of account.Note:

This field is displayed if Account option is selected from the Maturity Payout Mode field.Account Number

Select the Current and Savings Account account number.Note:

This field is displayed if Others option is selected from the Account field.Account Name

Displays the account name upon account number selected. Interest Payout Mode Select the maturity payout mode.

Select Account Number

Select the type of account.Note:

This field is displayed if Account option is selected from the Interest Payout Mode field.Account Number

Select the Current and Savings Account account number.Note:

This field is displayed if Others option is selected from the Account field.Account Name

Displays the account name upon account number selected. Rollover Amount Specify the rollover amount. Note:

This field is displayed if you select Special Amount Rollover option from the Maturity Instructions field.

- Click Cancel, to close the Add Payout Details screen without adding the payin details.

- Click Add More, the system add the payout details in the main screen and refreshes the Add Payout Details screen with default values, and the payout amount is updated for the remaining payout amount.

- Click Add to add the payout details in the main screen.

- Perform the required action for payout details with Reinvest Interest is selected as Yes in Deposit Details section. For more information on fields, refer to field description table below:

- Click on Add Beneficiary, in the Beneficiary Details section on the Deposit Account Opening screen.The Add Beneficiary Details screen is displayed.

For more information about Add Beneficiary Details, refer to the Beneficiary Details Update.

- Click on Add Joint Holder, in the Joint Holder Details section on the Deposit Account Opening screen.The Add Joint Holder Details screen is displayed.

For more information about Add Joint Holder Details, refer to the Joint Holder Maintenance.

- After adding the Add Payin, Add Payout, and Add Beneficiary details, the Deposit Account Opening screen displays the added information.

Figure 3-14 Deposit Account Opening - Added Details

- Click Submit.The screen is successfully submitted for authorization.

Note:

The CD account number is displayed when the CD account creation is successful.

Parent topic: Transaction