Download Form W-2 and Form W-2 C for Employees

About Form W-2 and Form W-2 C

At the end of each financial year, every employer submits Form W-2 for all paid employees (current and terminated) during the calendar year. The Form W-2 is submitted to the Social Security Agency (SSA). This needs to be done for each employee who is paid a salary, wage, or other compensation as part of the employment relationship. The form shows a breakdown of an employee's gross taxable annual wages paid and withholding information. The withholding information includes any amount withheld toward:

-

Federal, Social Security, Medicare, State and other taxes (as applicable)

-

Medical insurance provided by the employer for the employee and their dependents

-

401k, Roth 401k, and Individual Retirement Account (IRA) contributions by an employee, including any matching 401k contribution by the employer

-

Bankruptcy claims (if any)

-

Child Support, Alimony, Federal and State tax levies, unpaid taxes or incorrect tax amount filed with IRS, bankruptcy, student loans, and other court-ordered garnishments

There can only be a single Form W-2 generated for each employee in a financial year. However, there can be multiple amendments made to it. Each time an amendment is made to Form W-2, a Form W-2 C will be generated. For example, correcting details like address, name, or Social Security Number (SSN) for an employee.

There can be more than one Form W-2 C issued for an employee in a financial year. If there are multiple amendments to Form W-2, only the latest amendment will be displayed.

If your employee notifies you of any inaccuracy in their W-2, you need to contact NetSuite Support. In such cases, the necessary corrections will be made and a Form W-2 C will be issued. The C added to a W-2 means it's an amendment to the original W-2 issued by the IRS.

For more information about Form W-2 and the fields in the form, see About Form W-2, Wage and Tax Statement. For more information about Form W-2 C and the fields in the form, see About Form W-2 C, Corrected Wage and Tax Statements.

View Form W-2 and Form W-2 C of an Employee

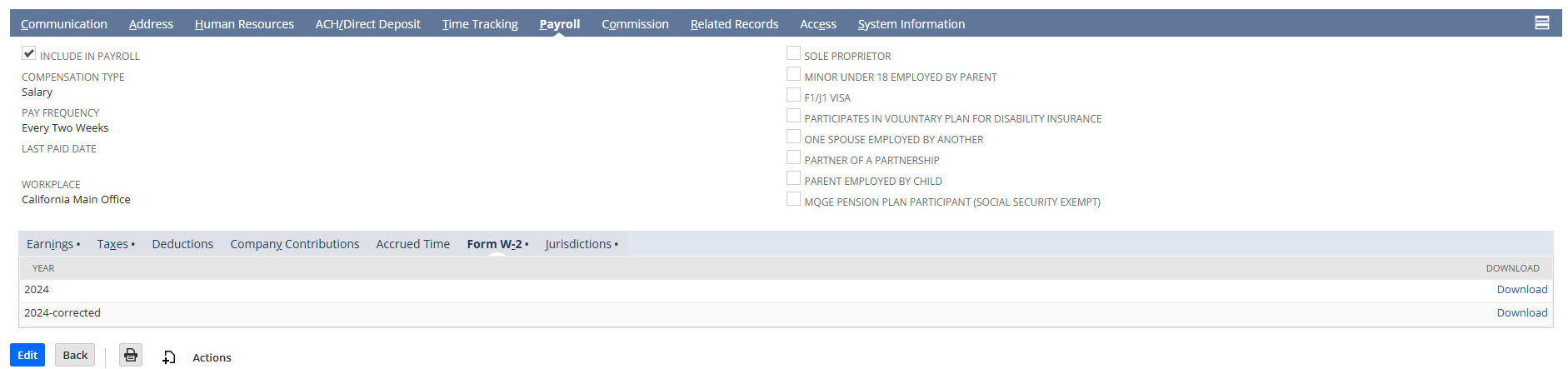

You can view an employee's Form W-2 and Form W-2 C from the Form W-2 subtab under the Payroll tab of the Employee record. If you have to download Form W-2 for multiple employees, you need to access the Employee record for each employee separately.

The Form W-2 and Form W-2 C will be available for download effective from the financial year of 2024 onward. To download the forms for previous years for employees, contact NetSuite Support. To download the forms for employees for 2024, follow the current process of downloading the forms from the secured folder when notified by NetSuite Support.

The Form W-2 and Form W-2 C will be available for download effective from the financial year of 2024 onward. The forms for 2024 will be available for download from the Employee Center at a later date. If you want to download the forms for 2024 before that date, contact your payroll team.

In NetSuite, Form W-2 will be shown in the YYYY format and Form W-2 C will be shown in the YYYY-corrected format. For example, Form W-2 and Form W-2 C for the year 2024 will be shown as 2024 and 2024-corrected.

Provide Access to View Form W-2 from Employee Record

Only an Administrator or users mapped to customized roles that can view, create, or edit the Employee record can view Form W-2 details of employees. You can add this permission to new or existing customized NetSuite roles, but not to standard NetSuite roles. After you add the permission to a customized role, you can assign it to users.

To provide access to view Form W-2 and Form W-2 C of employees from the Employee record for a customized role,

-

Log in to NetSuite using your credentials.

-

Change your role to Administrator if you are logged in to a different role. To know more about how to switch the roles, see Roles and Accounts.

-

To add the permission for existing roles, go to Setup > Users/Roles > Manage Roles. If you want to add this permission to a new customized role, create it following the steps mentioned in Customizing or Creating NetSuite Roles. After the role is created, you can add the permission to it.

-

Click Customize for the role to which you want to add the permission.

-

If you have NetSuite OneWorld, you can use Restricting Role Access to Subsidiaries (OneWorld Only) to restrict what users with this role can access. If you do not have NetSuite OneWorld, you can skip this step.

-

Go to Permissions > Lists.

-

Enter Form W-2 in the last row and click Add to add the permission to the selected customized role.

-

The permission will automatically be applied to all users assigned to this customized role. To know how to assign users to a new customized role, see Assigning Roles to an Employee.

Note:If a user is logged in to NetSuite, they need to log out of NetSuite and log in again to view the newly-added permission.

To add the permission to other customized roles, repeat the process described in the above steps.

Download Form W-2 and Form W-2 C for Employees as a PDF Document

To download Form W-2 and Form W-2 C for an employee,

-

Log in to NetSuite using your credentials.

-

Change your role to Administrator if you are logged in to a different role. To know more about how to switch the roles, see Roles and Accounts.

-

Go to List > Employees > Employees.

-

To download the form for an employee, click Edit or View on the respective Employee record.

-

Click Payroll > Form W-2 to view the W-2s available for the employee.

-

Click the Download link next to the year for which you want to download the W-2 form. For example, if you want to download the W-2 form for 2024, click the Download link next to it.

-

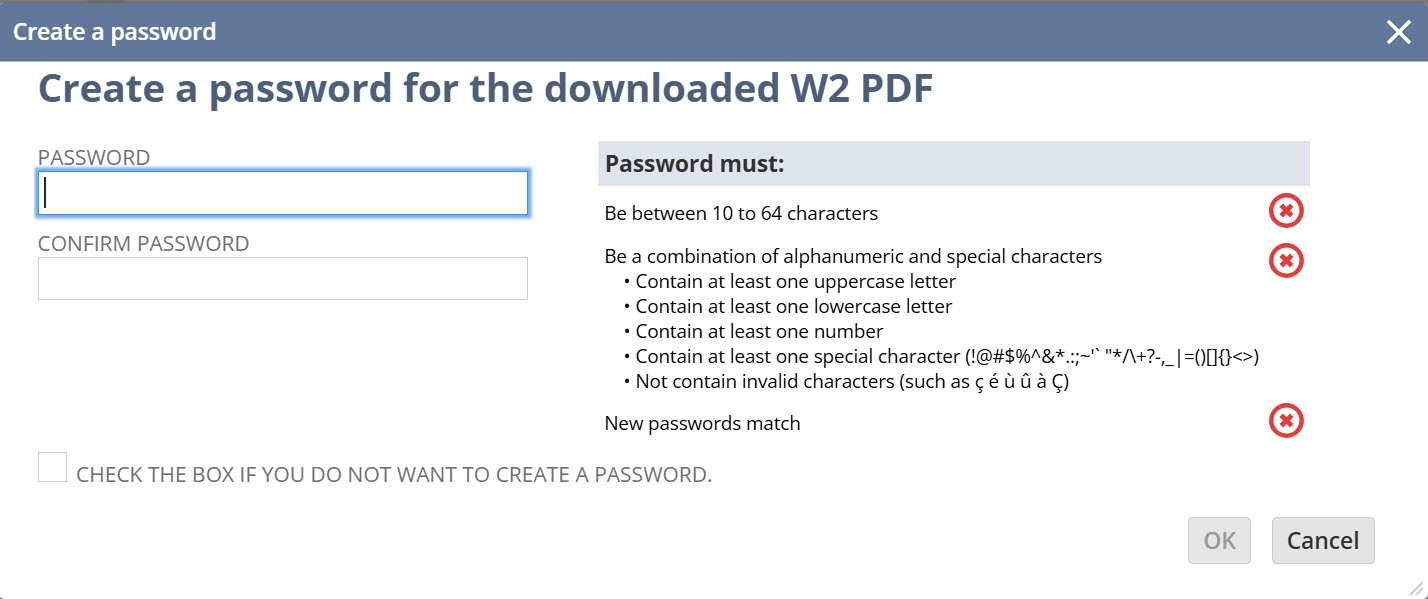

A pop-up appears asking you to create a password for the downloaded PDF.

Note:

Note:The pop-up will appear every time you try to download the form from NetSuite.

-

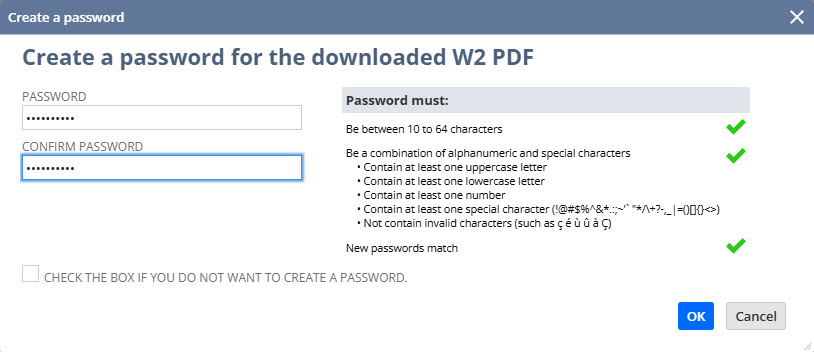

Enter a password that meets all the validation criteria mentioned in the pop-up in the Password field. As you type, the characters are validated against password policy criteria and the results are displayed.

-

Re-enter the same password in the Confirm Password field.

-

-

Click OK to save the form as a PDF document to the default downloads folder on your device. You can only save the form if you meet the password policy criteria mentioned in the pop-up.

Note:

Note:The password you created needs to be entered every time you try to access the PDF from your device.

-

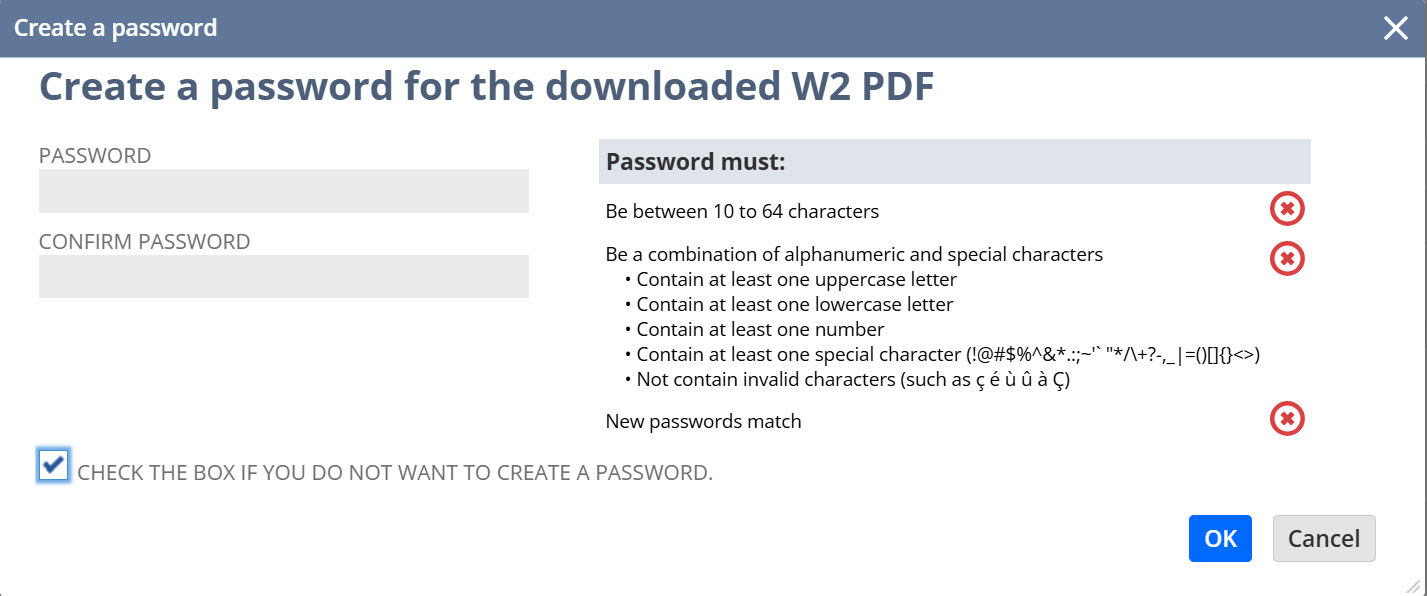

If you don't want to create a password, check the box as shown and click OK to save the form as a PDF document.

After you download the Form W-2 or Form W-2 C for an employee, you need to share it with the employee.

NetSuite Implementation - Payroll

If you have switched to NetSuite for processing payroll in the current year, you can view Form W-2 information from the current financial year onward. You'll need to take a back-up of Form W-2 and Form W-2 C of employees for previous financial years from the previous payroll provider. That data is not uploaded to NetSuite as part of the implementation process.

If you've recently started using NetSuite, a step-by-step implementation process is detailed in Set Up NetSuite. If you face any issues during the implementation, reach out to NetSuite Support and they can assist you with the implementation.

If you've recently started using NetSuite for payroll, the process to set up payroll in NetSuite is detailed in Payroll Setup for Employees. If you face any issues during the implementation, reach out to NetSuite Support and they can assist you with the implementation.

As part of the initial onboarding, you would have provided a list of authorized people who will process the payroll for your organization. NetSuite Support will notify this list of any important payroll-related activity, such as availability of Form W-2 and Form W-2 C. If you need to update this list, contact NetSuite Support.

Employee Rehire

There may be certain scenarios when an employee quits an organization and rejoins after a certain time. If you update the employee's details in the same Employee record when they rejoin, they will be able to view all the historical W-2s. If you create a new Employee record when the employee rejoins the company, they can't view historical W-2s. However, you'll still be able to view and download the W-2s from the financial year of the year they rejoin the organization. If the employee record is deleted, you can retrieve Form W-2s for up to the last three financial years by raising a support ticket. The request to download Form W-2 for a deleted record may incur additional charges.