About Transaction Codes

-

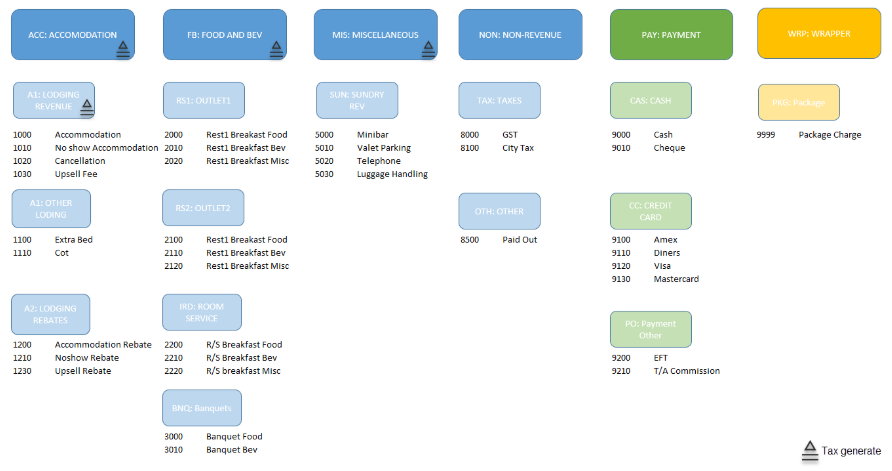

Sales charge transaction codes are required to post revenue , non-revenue and tax charges to guest, package, and city ledgers.

-

Payment transaction codes are required to post payment to deposit, guest, or city ledgers and would include cash, check, all credit card types, and other payment types such as bank EFT bank transfers and Travel Agent Commission (withheld).

-

You can include the charge in the calculation of reservation deposit and cancellation rules .

-

You can enable manual posting of the charge or limit to interfaces only.

-

You can set a default, minimum and maximum amounts to be posted.

-

You can nominate the charge requires a Check Number when posted

-

You can nominate the charge as eligible for member point calculation groups.

-

You can nominate the charge as a Paid Out, affecting the cashiers balance at shift drop.

-

You can nominate the ledgers where the charge can be posted - Guest (Cashier) and AR.

-

You can nominate the ledgers where the payment can be posted - Deposit, Guest (Cashier) and AR

-

You can nominate rounding of (cash) payment. Available when the Rounding Factor OPERA Control is active. For more information, see About Rounding Factors.

-

You can nominate the merchant commission for credit card payments

-

You can nominate the AR Account to use for tracking debtors collection from credit card merchants

-

A Package Wrapper transaction code is a single transaction code used to post the package (rate) charge to guest ledger; this amount is credited in the package ledger where the itemized package revenue charges are then posted. Applicable when the Advanced Packages OPERA Control is active.

-

Cash Shift Drop (Charge)

-

Check Shift Drop (Charge)

-

AR Old Balance (Charge)

-

Deposit Ledger Transfer (Payment)

-

Sales Charge (Revenue/Non-Revenue/Taxes)

-

Payment

-

Wrapper

For each Sales Charge transaction code, you can define other transactions to post automatically each time the charge is posted. These additional charges are called generates and are used to handle the calculation and posting of service charges and taxes. Generates are setup on a specific transaction code, on a sub-group or a main-group. For more information, see Generates Configuration. When configuring transaction codes for posting tax you must select the Transaction Type=Tax, this will enable the Tax Code field for the selection of a tax bucket; use these buckets to group various tax transactions into one total on the folio and in reports.

Figure 13-6 Transaction Codes

Transaction code numbers can be a 1-8 digit value. Consider numbering your transaction codes in a logical order to keep the auditing simple. For example, all room related charges could be in the 1000 group; food and beverage related charges in the 2000 group, and so on. You should always allow for future growth as your requirements change by leaving openings in the transaction code sequence.

Transaction codes are not fixed until they are posted to a ledger, so you are able to change them until you are satisfied. After posting transaction codes to a ledger, you are unable to change or delete the transaction code.

Various Cashier OPERA Controls reference a transactions code. Consequently, you cannot delete transaction codes if they are referenced in an OPERA Control, even if the transaction code has not been posted to a ledger. For example, a payment transaction code selected for the Deposit Ledger (Transfer) Transaction Code OPERA Control.

- Configuring Transaction Codes

- About Transaction Diversion

- Revenue Buckets Overview

- Configuring Routing Codes

- Configuring Transaction Code Groups

- Configuring Transaction Code Subgroups

- Tax Generates

- About Rounding Factors

- Configuring Payment Methods

- Configuring Transaction Code Protection (Ownership)

- Configuring Articles

- About Revenue Type Mapping

- Configuring Credit Card Types

Parent topic: Financial Administration