3.17.1.1 Relationship pricing benefit with charges

This topic describes the information about the relationship pricing benefit with charges.

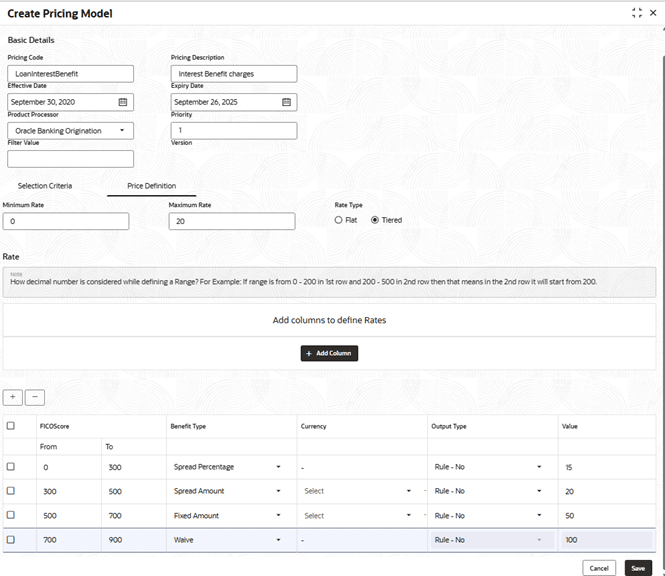

During evaluation user can send the rpApplicable flag as true in the context of getCharges and system will internally call the pricing model for extra benefits to be applied on the computed charges.

Bank does not offer generic pricing be it interest/charge/commission to its entire customer base. It varies from customer to customer like a different interest rate for new customer Vis-a Vis an existing customer on saving account or loan account.

Various facilities on the account like waiver/discount on account maintenance fee, number of free ATM transaction, number of free cheque book etc., varies customer to customer based on various financial or non-financial factor such as age of relationship, customer exposure with the bank, customer category, products availed by the customer and many more such parameters. The benefit can be in any form like additional interest on saving account, waiver of fees, discounted interest rate on loan account, lesser margin charges on foreign exchange etc. Financial Institution needs a model, which can consider all these dynamic parameters and suggest best pricing, that it can offer to the customer.

Following benefit types are added: Benefit Type The following options are available:

Waive – full waiver is offered as benefit i.e. 100%. Waive-off benefit is applicable for price components of type charges, fees and commission

Fixed Percentage - fixed rate will be applied over the rate used for computation.

Spread % - Spread rate will be either added to or subtracted from the rate computed.

Fixed Amount - fixed amount will be applied over the computed price amount.

Spread Amount - spread amount will be added to or subtracted from the base amount computed.

Parent topic: Create Charge Code