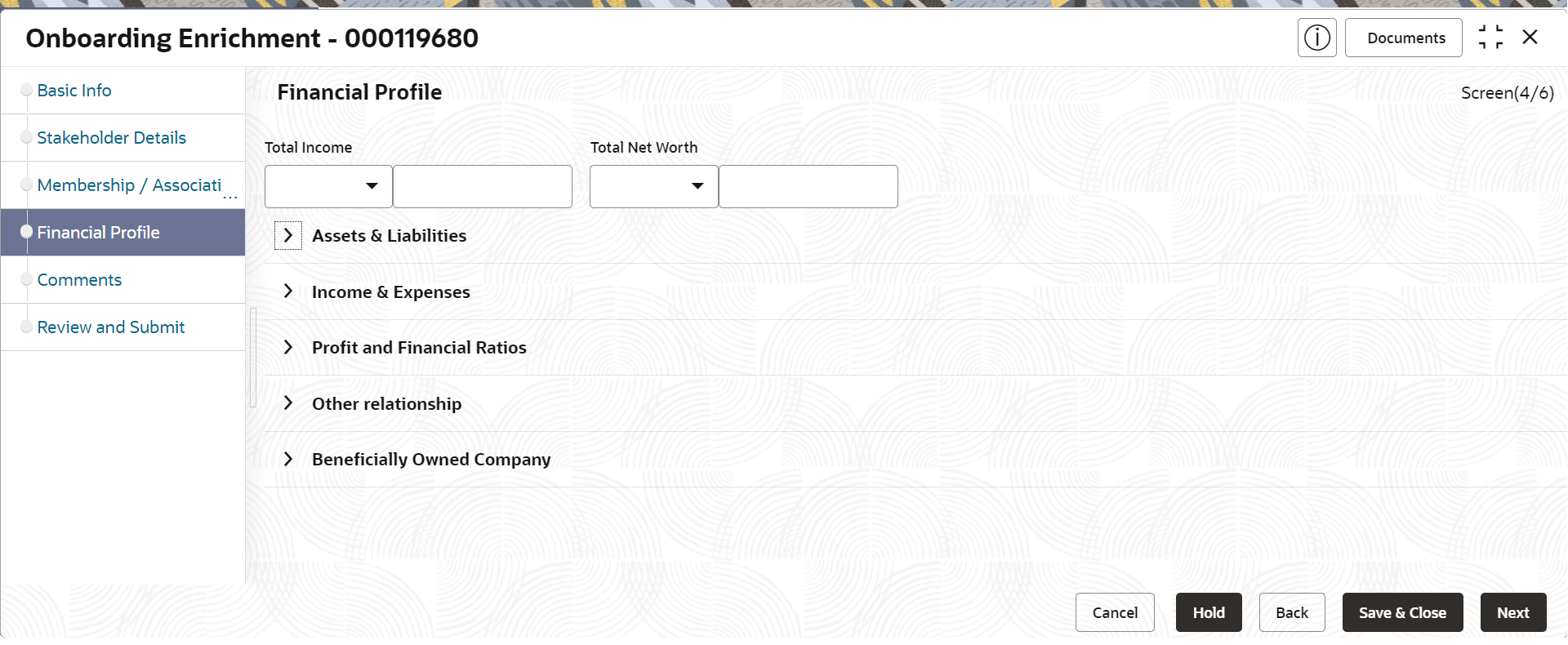

1.1.2.5 Onboarding Enrichment - Financial Profile

The RMs can further enrich the customer’s financial information in the Financial Profile screen, by adding income details, expense details, and details about the relationship with other banks.

Note:

The fields marked as Required are mandatory.- Click Next in the Onboarding Enrichment -

Membership / Association screen.The Onboarding Enrichment - Financial Profile screen displays.

Figure 1-28 Enrichment – Financial Profile

- On the Financial Profile screen, click View detail in the corresponding tiles to change the chart view of asset and liabilities details to the list view.The Assets and Liabilities Detail screen displays.

- Click the configure icon in the corresponding tile.

The following options are displayed in the assets and liabilities details:

- Add

- Modify

- Delete

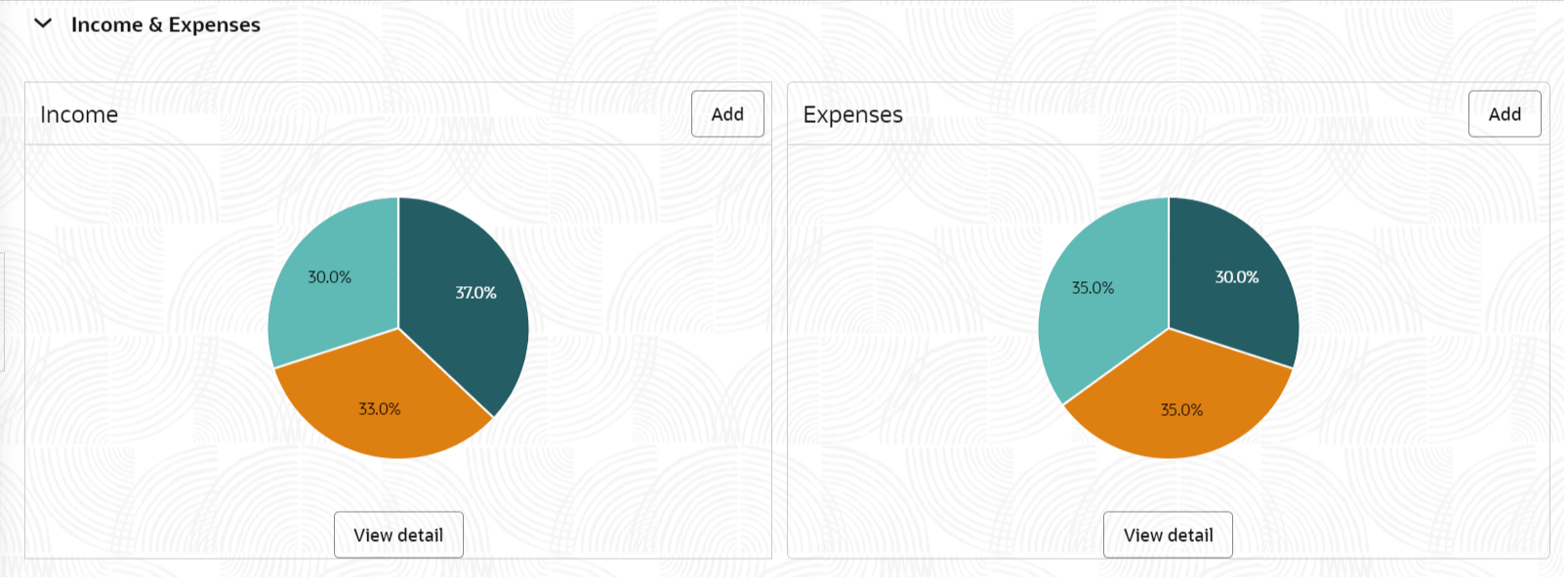

- Click and expand the Income & Expenses

section.

Figure 1-30 Financial Profile – Income and Expense

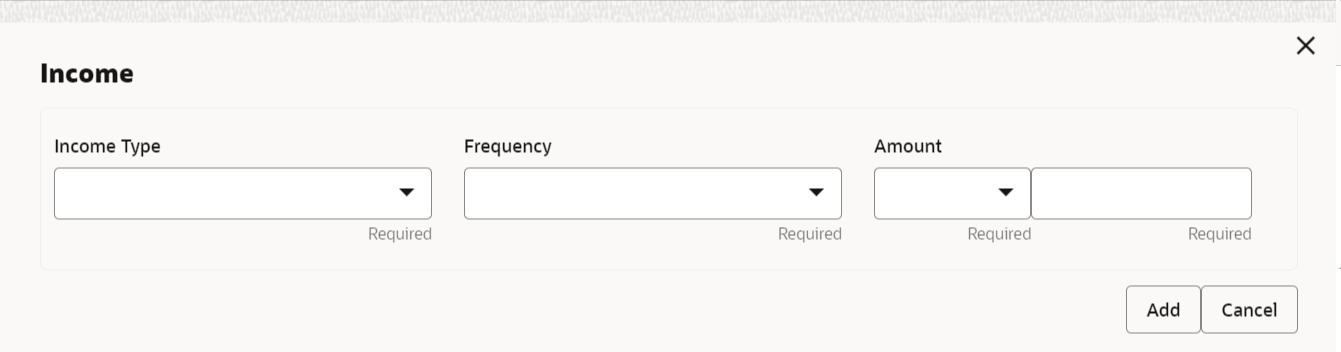

- Click Add in the Income & Expenses segment.The Add Income screen displays.

- On the Add Income screen, specify the fields.For more information on fields, refer to the field description table.

Table 1-29 Add Income – Field Description

Field Description Income Type The category or source of income for the party (e.g., Salary, Investment). Entity Code: INY

Frequency The frequency at which the party receives their income (e.g., Monthly, Annually). Entity Code: FTY

Currency The currency in which the party’s income is received (e.g., USD, EUR). Common Core Maintenance: cmc currency maintenance

Amount The total amount of income received by the party, in the specified currency. - Click Add to save the details.

Note:

You can also select the required item from the list, and click Edit/Delete icon to modify/delete the added membership details. - Click

icon to exit the Income window.

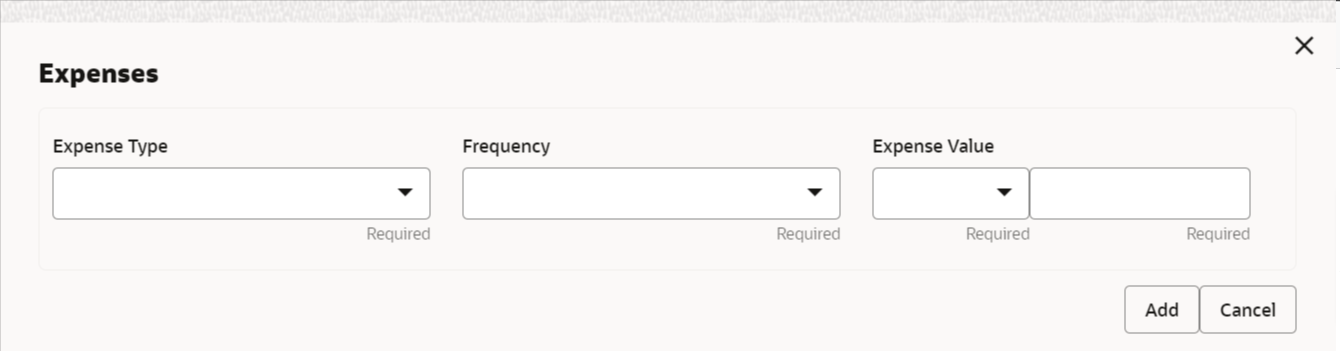

icon to exit the Income window. - Click Add in the Income & Expenses segment.The Add Expenses screen is displayed.

- On the Add Expense screen, specify the fields. For more information on fields, refer to the field description table.

Table 1-30 Add Expenses - Field Description

Field Description Expense Type The category or type of expense incurred by the party (e.g., Rent, Utilities, Loan Payment). Entity Code: EXY

Frequency The frequency at which the party incurs the expense (e.g., Monthly, Annually). Entity Code: FTY

Expense Currency The currency in which the party’s expense is paid (e.g., USD, EUR). Common Core Maintenance: cmc currency maintenance.

Expense Value The total amount of the party’s expense, in the specified currency. - Click Add to save the details.

Note:

You can also select the required item from the list, and click Edit/Delete to modify/delete the added membership details. - Click

icon to exit the Income window.

icon to exit the Income window. - Click and expand the Profit and Financial Ratios

section.

- Click Add to add the profit and financial ratios.The Profit and Financial Ratios screen displays.

Figure 1-34 Profit and Financial Ratios - Add

- On the Profit and Financial Ratios window, specify the

fields. For more information on fields, refer to the field description

table.For more information on fields, refer to the field description table.

Table 1-31 Profit and Financial Ratios – Field Description

Field Description Financial Year Year of Financial Profit and Ratio. Entity Code: FIY

Financial Period Financial Period of profit and ratio. Entity Code: FIP

Currency Currency of Financial Profit and Ratio. Balance Sheet Size Balance sheet size of Small and Medium Business. Operating Profit Operating profit of Small and Medium Business. Net Profit Net Profit of Small and Medium Business. Year Over Year Growth (%) Year on Year Growth of Small and Medium Business. Return On Investment (%) Return on Investment of Small and Medium Business'. Return On Equity (%) Return on Equity of Small and Medium Business. Return On Asset (%) Return on Asset of Small and Medium Business. - Click and expand the Other Relationship section.The Other Relationship screen displays.

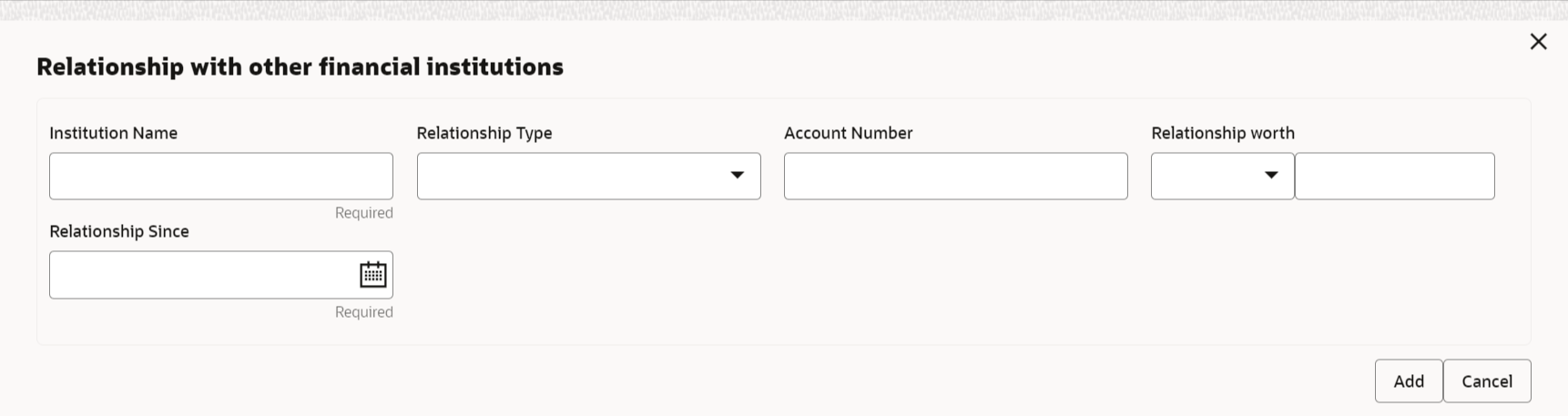

- Click Add to add details about the customer’s

relationship with other banks.The Relationship with other financial institutions screen displays.

Figure 1-36 Relationship with other financial institutions

- On the Relationship with other financial institutions

screen, specify the fields.For more information on fields, refer to the field description table.

Table 1-32 Relationship with other financial institutions - Field Description

Field Description Institution Name The name of the financial institution where the party holds an account or financial relationship. Relationship Type The type of relationship the party has with the other financial institution. Entity Code: RTY

Relationship Worth The total monetary value of the party’s relationship with the other financial institution. Relationship worth Currency The currency in which the relationship worth is denominated (e.g., USD, EUR). Common Core Maintenance: cmc currency maintenance.

Relationship Since The date or year when the party started their financial relationship with the other institution. - Click Add to save the details.The system adds and lists the relationship details in the Other relationship section.

Note:

You can also select the required item from list and click the edit/delete icon to modify/delete the other relationship details.

- Click Next to move to the Onboarding Enrichment - Comments segments.

Parent topic: Onboarding Enrichment