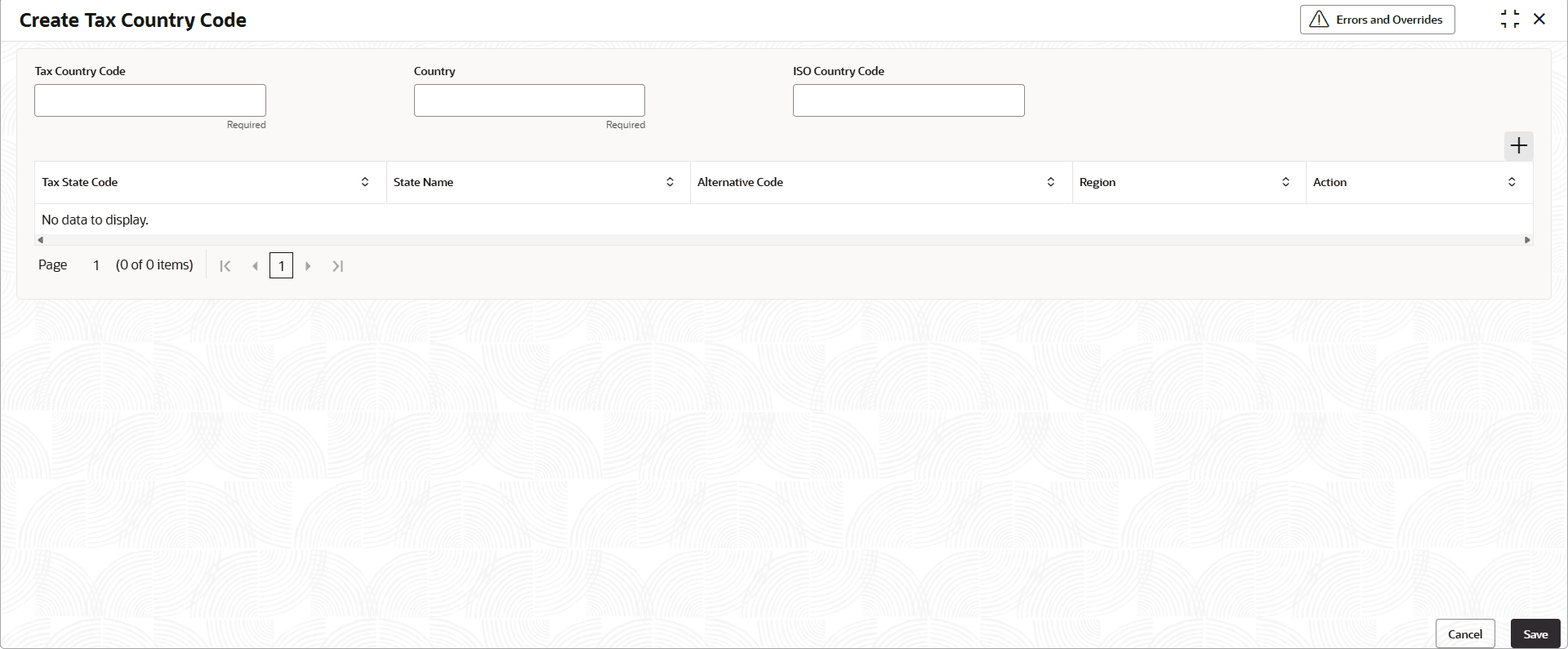

1.14 Tax Country Codes

This topic describes about systematic instructions to maintian tax country codes.

Taxation Country Codes are standardized codes used to identify countries for taxation purposes. These codes help ensure compliance with international tax regulations, reporting requirements, and financial transactions across different jurisdictions.

Key Uses of Taxation Country Codes:

- Tax Reporting & Compliance – Used in financial and tax reporting to determine the applicable tax rules for a specific country.

- Cross-Border Transactions – Helps identify the country of taxation for international business operations.

- Regulatory Filings – Required by government agencies to ensure businesses comply with local and global tax laws.

- Withholding Tax – Supports the correct application of withholding tax, and other country-specific tax structures.

Each country is assigned a unique Taxation Country Code, which aligns with international standards such as ISO 3166-1 alpha-2 (two-letter country codes) or ISO 3166-1 alpha-3 (three-letter country codes). These codes are widely used in tax forms, financial systems, and regulatory filings.

For example:

Table 1-20 Country Codes - Field Description

| Country | ISO Alpha-2 Code | ISO Alpha-3 Code |

|---|---|---|

| United States | US | USA |

| Canada | CA | CAN |

| United Kingdom | GB | GBR |

Initiate Tax Country Code Management

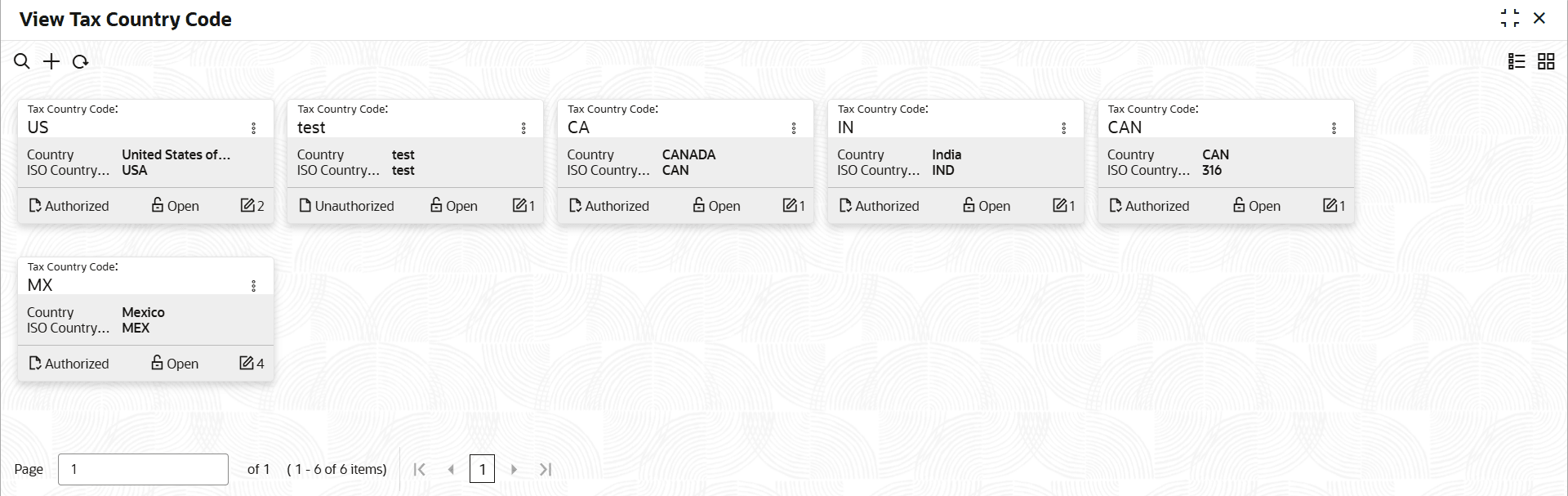

View and Edit Tax Country Codes

Once the record is authorized by the checker, the user can view the Entity Maintenance.

Parent topic: Configurations