A.1.30 Account Acceleration

OFSLL supports accelerating a fraudulent loan account for immediate settlement for both pre-compute and non-pre-compute loans. During account acceleration, the loan maturity date is moved to the specified date (either current date or back date) and appropriate transactions are posted for Principal and Interest Adjustment calculations.

Before posting an account acceleration transaction, refer to Appendix - Account Acceleration chapter for detailed information on the process and operational changes on accelerated account.

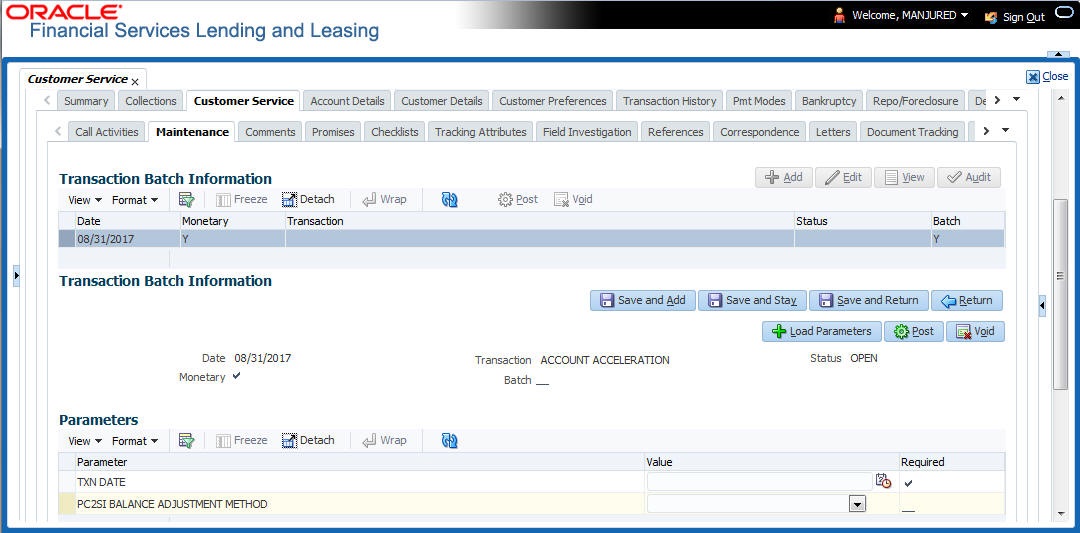

You can accelerate only those accounts which are in ACTIVE status and post the transaction either manually in the Customer Service > Maintenance screen or through Web Service (generic post transaction service).

Table A-56 To post an account acceleration transaction

| Transaction | Parameters | Description |

|---|---|---|

| ACCOUNT ACCELERATION | TXN DATE |

Select the date from which the acceleration is effective on the account. The same can either be the current date or a back date (up to contract date or account back date whichever is higher) but not a future date. The selected date will be the acceleration start date and the new maturity date of the account. In case of pre-compute loan accounts, the same date is used for the following actions:

|

| PC2SI BALANCE ADJUSTMENT METHOD |

For 'Pre-Compute' accounts, select one of the following parameter from the drop-down list. The values in this list are populated based on the lookup code ‘PC2SI_BAL_METHOD_CD (PC2SI BALANCE ADJUSTMENT METHOD CODES)’

For details on how the PC to SI conversion calculation is done based on above selection, refer to Appendix - Account Acceleration chapter. For Non-Pre-Compute accounts, select the parameter value as Undefined. Else, system displays an error on selecting any other value as Balance Adjustment Method mandatory for Pre-Compute a/c. |

On posting the transaction, there are certain pre-defined validations preformed before proceeding with the transaction. Also, on successfully posting the transaction there are certain operational changes on the accelerated account and common actions / implications on posting of transaction (PC or Non PC Account Types).

Reversing Account Acceleration

Acceleration applied on an account can be reversed if required so that the account is reinstated to its previous status. However, the reversal is to be triggered immediately after posting the transaction such that the post maturity interest accruals, fee/expenses posting, and customer payments posting are not initiated.

However during reversal of an account acceleration, there are some changes are performed on the account and the same is detailed in Appendix - Account Acceleration chapter.

Table A-57 To reverse an account acceleration transaction

| Transaction | Parameters |

|---|---|

| ACCOUNT_ACCELERATION_REV | Txn Date |

Parent topic: Monetary Transactions