4.13 Insurance

Most financial institutes offer financing for insurance to the borrowers; examples include credit life, credit disability, and GAP. The insurance product offer permits the customer to cancel the insurance in mid term or automatically end when the product matures or is paid-off. The system supports financing of insurance products during origination and automatically end the insurance when the product is paid-off. The system also can compute the rebate premium based on Rule of 78 or Actuarial method. As the customer might cancel the insurance in mid term of the loan, the system computes the premium rebate on a prorate basis. This also applies to additional insurance purchase during the life of the loan. Normally, mid term insurance cancellations have associated fees and grace period. In such cases, the customer may cancel the insurance during the grace period without accruing any fees. However, when a customer cancels after the grace period, the result is a predefined fees which the system deducts from the computed rebate.

The system supports mid term insurance cancellation with and without grace period and cancellation fees. With this enhancement of insurance processing, you can define the premium rebate computation with a prorate basis.

You can define financed insurance related itemizations in the Origination Fees screen, as you have in previous releases with the Insurance screen. You can also set the refund method to Pro Rate Basis in the Refund Method field in the Contract Itemization section on the Itemization sub screen during setup with the on the Contracts screen.

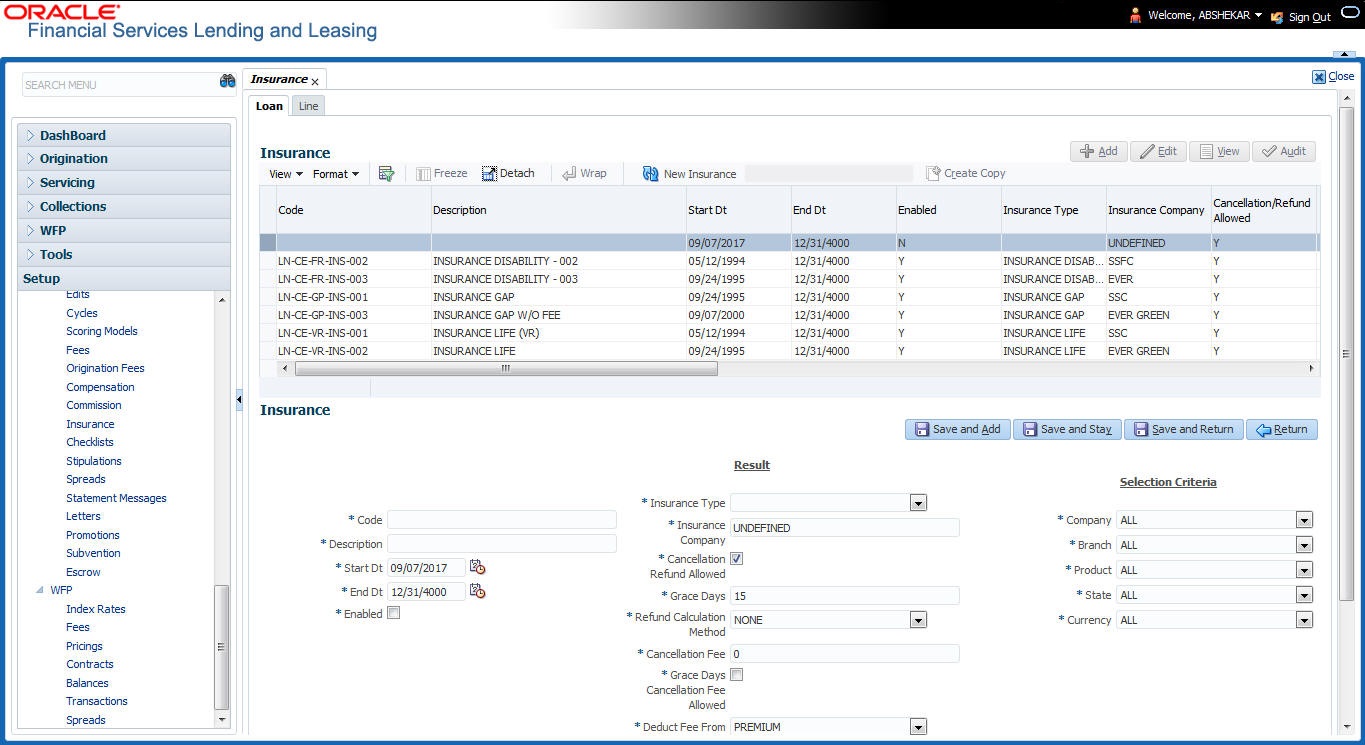

To set up the Insurances

- On the Oracle Financial Services Lending and Leasing home screen, click Setup > Setup > Products > Insurance > Loan.

- In the Insurance Definition section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Table 4-35 Insurance Definition

Field Do this Code Specify the code associated with the insurance product. Description Specify a brief description of the insurance product. Start Dt Specify the date from which you can start offering the product to customers. You can even select the date from the adjoining Calendar icon. End Dt Specify the date from which to stop offering the product to customers. You can even select the date from the adjoining Calendar icon. Enabled Check this box to allow the offering of this insurance product. Result section Insurance Type Select the insurance types available for financing, from the drop-down list. Insurance Company Specify the name of the company through which the insurance product is offered. Cancellation /Refund Allowed Check this box to allow the insurance rebate or refund for cancellation or paid-off. Grace Days Specify the number of grace days allowed for cancellation without charging a cancellation fee. Refund Calculation Method Select the insurance premium refund/rebate calculation method to be used when insurance is cancelled, from the drop-down list. Cancellation Fee Specify the amount of the cancellation fee to be charged when the insurance is cancelled. Grace Day's Cancellation Fee Allowed Check this box to allow cancellation fees during grace period. Deduct Fee From Select one of the followings option from the drop-down list to deduct the cancellation fee:

Premium amount - which is deducted upfront before computation

Rebate amount - which is deducted after computation

Selection Criteria Section Company Select the portfolio company that can offer the insurance product, from the drop-down list. Select ALL if offered by all companies. Branch Select the branch of the specified portfolio company that can offer the insurance product, from the drop-down list. Select ALL if offered by all the branches of the specified portfolio company. Product Select the product for which you can offer the insurance product, from the drop-down list. Select ALL if offered for all the products. State Select the state for which you can offer the insurance product, from the drop-down list. Select ALL if this is offered for all the states. Currency Select the currency for which you can offer the insurance product, from the drop-down list. Select ALL if this is offered for all the states. - Perform any of the Basic Actions mentioned in Navigation chapter.

- Click Create Copy button in the Insurance Definition section to create copy of selected record with details.

- In the Insurance Details section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Table 4-36 Insurance Details

Field Do this Insurance Sub Type Select the insurance sub type you want to define for the entry in the Insurance section, from the drop-down list. For example SINGLE. Term From Specify the minimum term for the insurance sub type. Rate Specify the rate for premium calculation per $1,000.00 for the insurance sub type. Max Coverage Amt Specify the maximum coverage amount covered by the insurance sub type. Enabled Check this box to enable the insurance. - Perform any of the Basic Actions mentioned in Navigation chapter.

Parent topic: Product