6.2 Entering a Credit Application

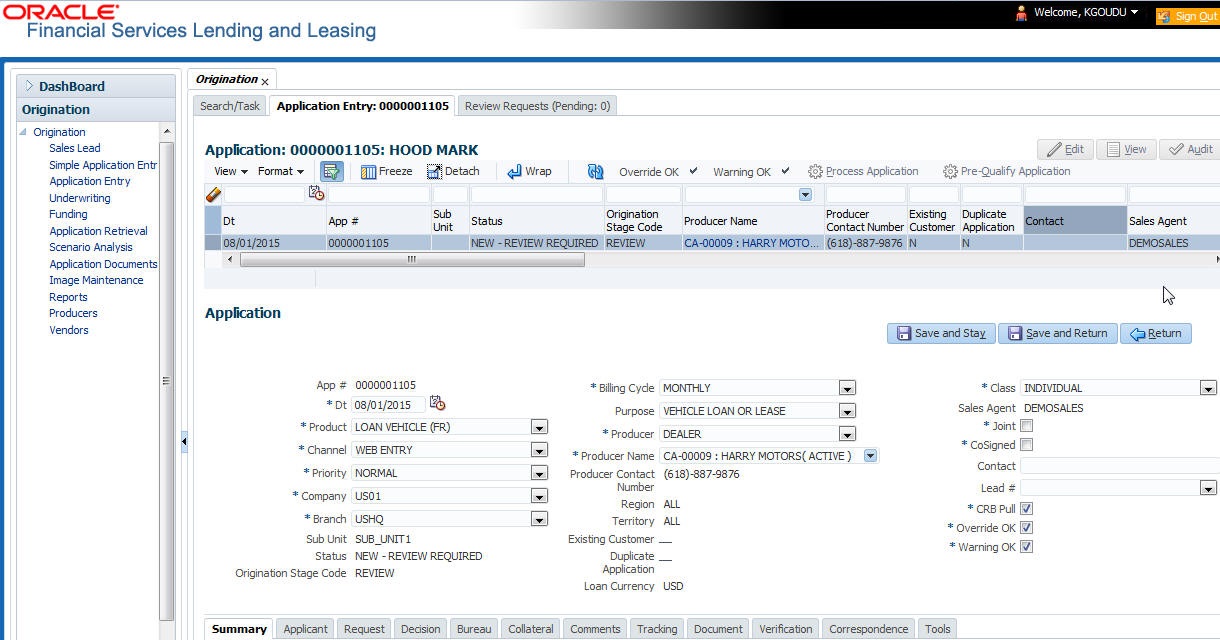

- Select product type and producer at the top of the Application screen in Applications section. The product defines the type of credit application: Loan as well as any collateral, such as vehicles or homes, associated with the Loan. When you save the application, system activates the links on Applications screen that are associated with the product, streamlining the application process. The producer is the dealer supplying the application. When selected, the status of the Producer is displayed along with Producer Name.

- Enter information regarding the primary applicant, such as name, social security number, address, place of employment and financial assets and liabilities. Enter this same information for any other applicants, such as co-signers or joint applicants, if they exist. System displays the error message as The Application does not exist if the provided details does not match with any application details.

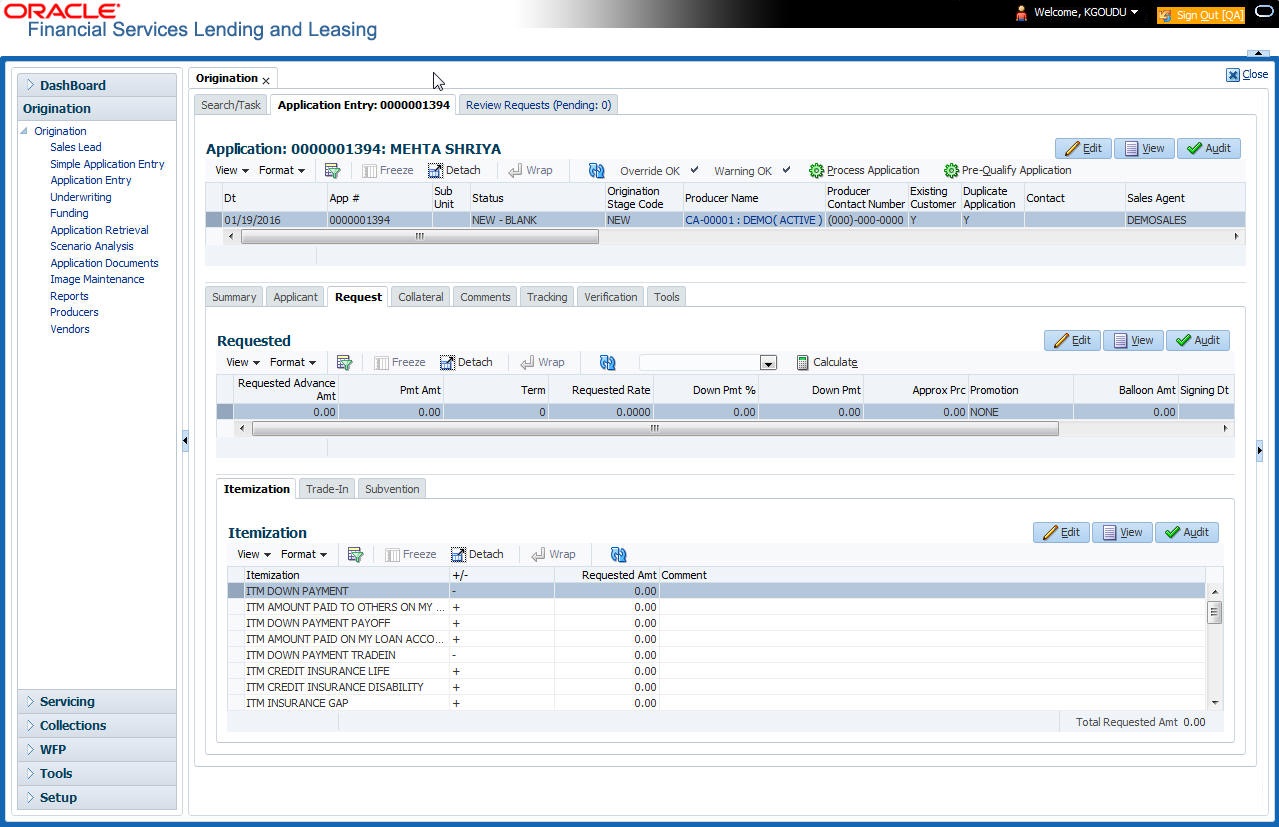

- Enter information about the requested credit for the Loan such as Loan amount and number of terms.

- Enter information about the collateral.

You can also enter credit application data into Oracle Financial Services Lending and Leasing Application using the Fax-In container. For more details, refer to Application Entry using Fax- In section.

Once the basic details are entered, the user has to check whether the application prequalifies or not. Once the pre-qualified edits are satisfied, click Submit in the Application screen. Prequalification edits can be viewed from the Verification sub tab.

When finished, Oracle Financial Services Lending and Leasing checks the application for completeness using a predefined set of edits. These edits search for errors and warnings based on your system setup. Status change of the application can be determined by credit bureau and scoring model of the application. The prescreening checks ensure that automatic credit bureau reports are pulled only for applications which meet set criteria, thus saving cost.

After an application clears the edits check, click Process Application in the Applications section. The system begins the processes of prescreening the application and pulling a credit bureau while you can begin entering the next application in your queue.

Credit Application via External Interface

You can also load credit applications created in external system into Oracle Financial Services Lending and Leasing for further processing.

OFSLL integrating with external system facilitates to transfer the pre-populated credit application data into the system through an xml file. Such credit applications are categorized in OFSLL as either 'eCONTRACT/DEALER CONTRACT in the actions section. However, OFSLL generated credit applications are marked as MANUAL CONTRACT.

Once a credit application is successfully validated and loaded in Application Entry screen, a response is sent back from OFSLL to the external system. Similarly, all subsequent status changes initiated in OFSLL are updated to the external system. All communications between OFSLL and external systems are recorded into a log and is accessible through Dashboard > System Monitor > Database Server Log Files screen. Also the Comments screen facilitates to exchange information regarding credit application processing between OFSLL and external system as comments, provided the comment Sub Type is selected as OUTBOUND TO INTERFACE for such communications.

Hence effectively you can by-pass the need to re-create the application in OFSLL and helps in faster processing of credit applications and decision making.

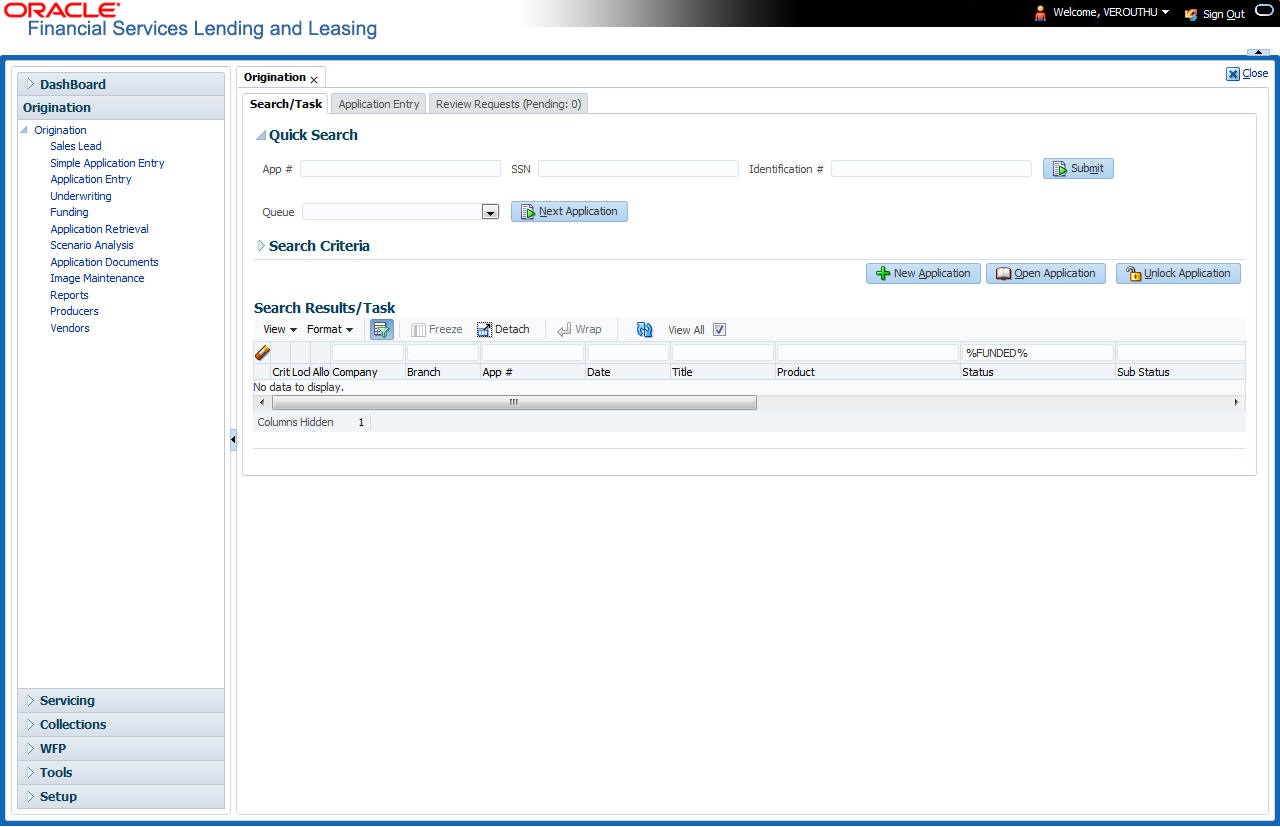

- Click Origination > Origination > Application Entry.

- The Application Entry screen appears, opened at the Search link’s Results screen.

The Recreate Instance button appears only when the BPEL parameter is YES.

- In the Results tab’s Quick Search section, click New Application. The Search link’s Applications Entry screen opens at the Application Entry tab.

For details on this screen refer Applications section in Underwriting chapter.

Parent topic: Application Entry