4.11.1 Credit Score Models

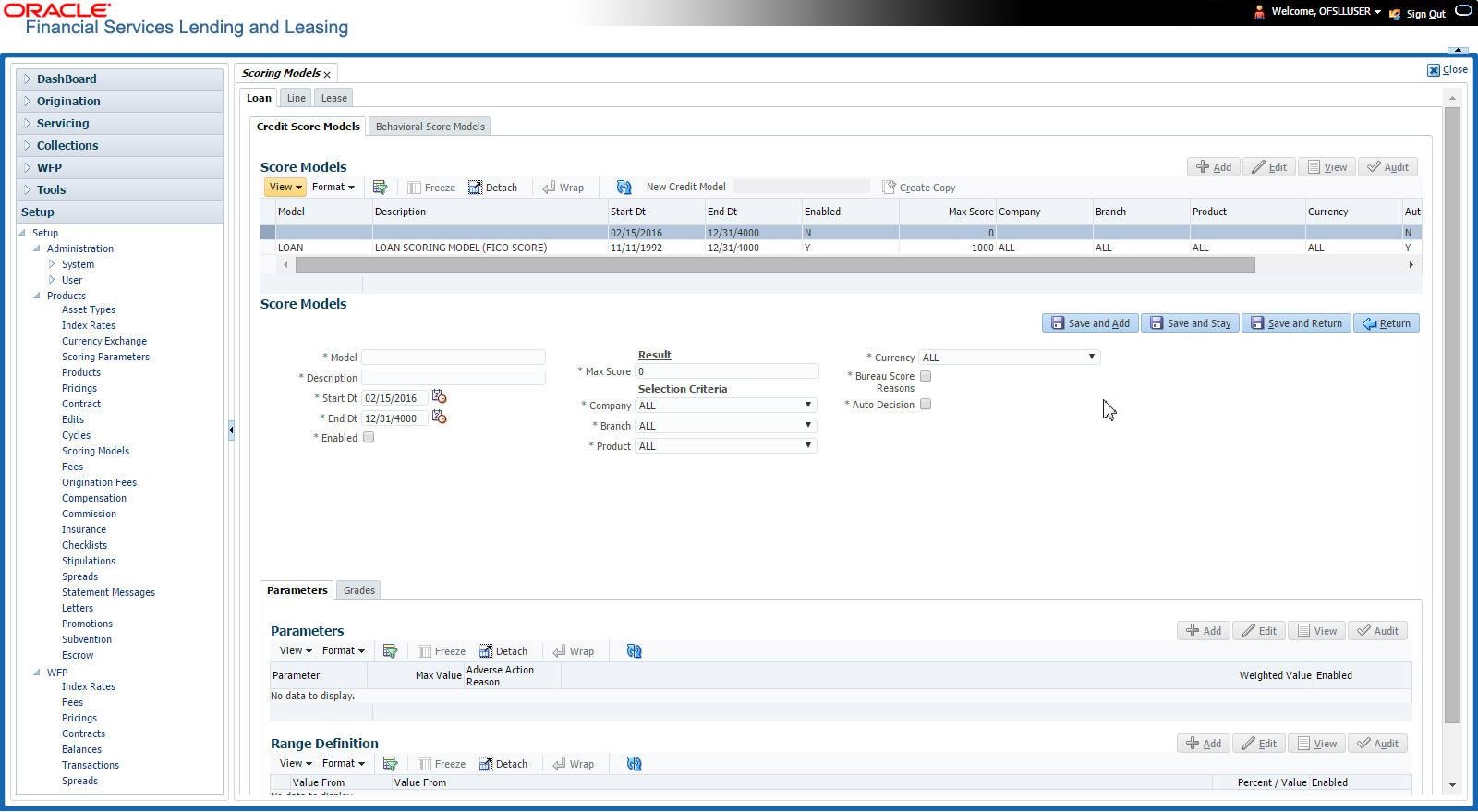

- Click Setup > Setup > Administration > User > Products > Scoring Models > Loan > Credit Score Models.

- In the Score Models section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Table 4-34 Score Models

Field Do this Model Specify the code for the scoring model. Description Specify a description of the scoring model. Start Dt Specify the start date for the scoring model. You can even select the date from the adjoining Calendar icon. End Dt Specify the end date for the scoring model. You can even select the date from the adjoining Calendar icon. Enabled Check this box to enable the scoring model. Results section Max Score Specify the maximum score allowed. (This is normally the sum of the Max Value fields within the scoring parameters.). Selection Criteria section Company Select the company for the scoring model, from the drop-down list. This may be ALL or a specific company. Branch Select branch within the company for the scoring model, from the drop-down list. (This may be ALL or a specific branch. However, if you have selected ALL in Company field, then you must select ALL for this field). Product Select the product for the scoring model, from the drop-down list. This may be ALL or a specific product. Currency Select the currency for the scoring model, from the drop-down list. This may be ALL or a specific currency. Bureau Score Reasons Check this box to use the score reasons supplied by the credit bureau. If unchecked, then automatically rejected applications scored using this scoring model display the Adverse Action Reasons from the Parameters sub screen. Auto Decision Check this box to assign an application, a status/sub status based on the grade associated with the score returned for this scoring model. If not selected, the system assigns applications scored using this scoring model a status/sub status of NEW-REVIEW REQUIRED.

- In the Score Models section, perform any of the Basic Operations mentioned in Navigation chapter.

- Perform any of the Basic Actions mentioned in Navigation chapter.

Parameters

The Parameters records the parameters used to determine the score calculated by the scoring model. You can define multiple parameters and adverse action reason associated with each parameter in a scoring model. Each scoring parameter can have maximum values set. The score range is based upon the information in the Range Definition section on the Parameters sub tab.

Note:

- A character parameter range definition should contain the exact value of the parameter.

- Each scoring parameter should have range definitions defined that encompass all of the values that might result.

- Click Setup > Setup > Administration > User > Products > Scoring Models > Loan > Credit Score Models > Parameters.

- In the Parameters section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Table 4-35 Parameters

Field Do this Parameter Select the parameter from the field, from the drop-down list. Max Value Specify the maximum value allowed for the selected parameter. Adverse Action Reason Select the adverse action reason, from the drop-down list. (If, on the Scoring Models screen, the Bureau Screen check box is checked for the scoring model, you cannot update this field). Weighted Value Specify the adverse action weighted value. This indicates the priority of this parameter when determining which adverse action reasons to use on the application. The top ten adverse action reasons based on the weighted value of the parameter will be populated. Enabled Check this box to enable the parameter. - Perform any of the Basic Actions mentioned in Navigation chapter.

- The Range Definition section allows you to translate the calculated value for a scoring parameter into the value to be used, depending on the returned value of the parameter.

- In the Range Definition section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Table 4-36 Range Definition

Field Do this Value From Specify the lowest calculated value to apply the specific translation. The ceiling of the range definition is based on the range definition with the next highest Value From or the Max Value of the scoring parameter (whichever is less). Value From Select the following options to determine how values for a scoring parameters are translated:

% Max Value – If selected, then the calculated values within the range definition receives a value based on a percentage of the Max Value of the scoring parameter.

% Param – If selected, then the calculated values within the range definition receives a value based on a percentage of the calculated value of the scoring parameter.

Value – If selected, then the calculated values with in the range definition receives a specific value.

Percent / Value Specify the percent or value to be used in the translation of the calculated value of the scoring parameter. Enabled Check this box to consider this range definition while translating values for this scoring parameter. - Perform any of the Basic Actions mentioned in Navigation chapter.

Grades

Note:

Each scoring model should have grade definitions defined that encompass all of the values that might result.- Click Setup > Setup > Administration > User > Products > Scoring Models > Loan > Credit Score Models > Grades.

- In the Grade Definition section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Table 4-37 Grade Definition

Field Do this Score Specify the score the application receives. Credit Grade Select the grade to assign to an application, from the dropdown list. Application Status Select the status to assign to applications with a score starting with the value of this grade definition, from the drop-down list. Sub Status Select the sub status to assign to applications with a score starting with the value of this grade definition, from the dropdown list.

Credit scoring allows you to select the following status/sub status pairs:

APPROVED - AUTO APPROVED

REJECTED - AUTO REJECTED

NEW - REVIEW REQUIRED

NEW - RECOMMEND APPROVAL

NEW - RECOMMEND REJECTION.

Enabled Check this box to indicate that this grade definition will be considered when grading an application using this scoring model. - Perform any of the Basic Actions mentioned in Navigation chapter.

Parent topic: Scoring Models