4.8 Contract

The Contract screen allows you to define the instruments used within your system. A instrument is a contract used by a financial organization with specific rules tied to it. When processing an application, an instrument associated with the application informs the system of the type of contract being used for the approved product. This ensures that all parameters tied to the instrument are setup for the account as it is booked - without requiring you to do it.

- Company

- Branch

- Product

- Application state

- Currency

- Selection Criteria

- Accrual

- Rebate

- Imputed Interest

- Capitalization

- Scheduled Dues

- Billing

- Delinquency

- Payment Caps

- Extension

- Advance Details

- Rate Cap And Adjustments

Items defined in the contract are locked in when you choose Select Instrument on the Funding form’s Contract link.

The Contract screen’s Instrument and Description fields allow you to enter the financial instrument’s name and description, for example; INS-LOAN: VEHICLE.

- BILL_CYCLE_CD

- LOAN_BILL_CYCLE_CD - For Loan accounts, the Biennial and Triennial billing cycles are applicable only for Standard Product Category and for both Advance and Arrears type of Rent Collection Methods - Advance (if First Payment Date is equal to Contract Date) and Arrears (if First Payment Date is greater than Contract Date). However, these billing cycles are allowed for Balloon Methods N and N+1 and not allowed for Flexible repayment > Skip Months.

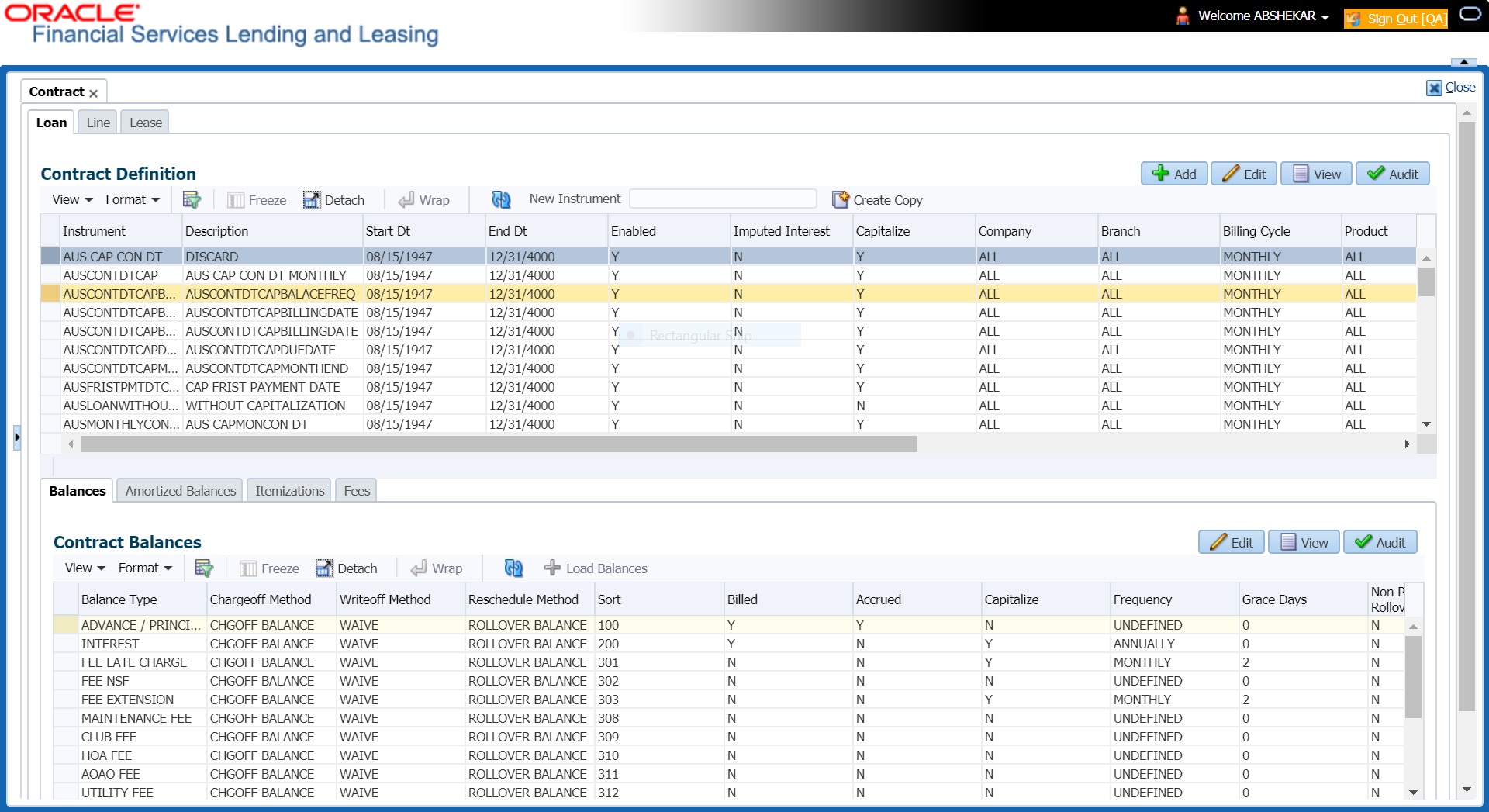

To set up the Contract

- On the Oracle Financial Services Lending and Leasing home screen, click Setup > Setup > Administration > Products > Contract > Loan.

- On the Contract Definition section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Table 4-19 Contract Definition

Field Do this Instruments section Instrument Specify the code identifying the instrument. Description Specify the description of the instrument being defined. Start Dt Specify the start date for the instrument. You can even select the date from the adjoining Calendar icon. End Dt Specify the end date for the instrument. You can even select the date from the adjoining Calendar icon. Enabled If you check this box, the system will consider this contract definition when selecting a instrument for an application.

Note: Once the field is enabled load balances button in balances sub tab will be disabled.

Selection Criteria section Company Select the company for the instrument from the drop-down list. This may be ALL or a specific company. Branch Select the branch within the company for the instrument from the drop-down list. This may be ALL or a specific branch. This must be ALL, if you have selected ALL in the Company field. Billing Cycle Select the billing cycle selected from the drop-down list. Product Select the product for the instrument from the drop-down list. This may be ALL or a specific product. State Select the state in which the instrument is used from the drop-down list. This may be ALL or a specific state. Currency Select the currency for the instrument from the drop-down list.

IMPORTANT: By selecting which type to use, the system searches for a best match using the following attributes:- Billing Cycle

- Start Date

- Company

- Branch

- Product

- State

Hence, Oracle Financial Services Software recommends creating one version of each type, where ALL is the value in these fields.

Pricing Select the pricing in which the instrument is used from the drop-down list. This may be ALL or a specific pricing. Accrual section Accrual Method Select the accrual method used to calculate interest accrual for this instrument from the drop-down list. Base Method Select the base method used to calculate interest accrual for this instrument from the drop-down list. Start Dt Basis Select to define the start date from when the interest accrual is to be calculated for this instrument from the drop-down list.

Note:

If you select the Effective Date, then the interest is calculated from the Contract date + Start Days (indicated below).

If you select the Payment Date, then the interest is calculated based on (first payment date + Start Days (indicated below) minus one billing cycle).

Start Days Specify the number of grace days after which the interest accrual is to be calculated. Ensure that the number of grace days is less than first payment date. Time Counting Method Select the time counting method used to calculate interest accrual for this instrument from the drop-down list. Installment Method Select the payment installment method from the drop-down list.

Note: the system supports an amortized repayment schedule with the final payment potentially differing from the regular payment amount in the other billing cycles. You may choose:

Whether the equal installments for each billing cycle includes any minute final payment differences (EQUAL PAYMENTS)

-or-

If the final payment amount may be slightly different (FINAL PAYMENT DIFFERS).

Int Amortization Freq Select one of the following interest amortization frequency from the drop-down list:- DAILY - if selected, the interest amortization (TAM) GL entries hand-over happens every day.

- EVERY BILLING CYCLE MONTH END - if selected, the interest amortization (TAM) GL entries hand-over happens on month end of the account billing cycle. For example, if account billing cycle is quarterly, the GL handover happens on month end of the quarter.

Imputed Interest

This section allows you to enable/disable the imputed interest calculation options in Origination > Contract screen. These options are required while funding a loan application with imputed interest for system to calculate Imputed Interest Amortization Schedule. For more information, refer to Imputed Interest section in Loan Origination User guide.

Imputed Interest Check this box to enable imputed interest related fields in Origination >Contract screen. By default, this option is un-checked. Capitalization section

This section allows you to define capitalization parameters which helps to capitalize the corresponding account balances to the principal balance of the account based on specific frequency. For example, you can capitalize the accumulated Interest or Late Fees to principal balance of the account.

You can either capitalize all the balances based on same frequency or define different frequency for each type of balance. Balance capitalization is processed during the execution of batch job TXNCPT_BJ_100_01 (CAPITALIZATION PROCESSING) which is executed after running the billing batch job.

Note: Capitalization parameters can also be updated by posting CAPITALIZATION MAINTENANCE monetary transaction.

Capitalize Check this box to enable capitalization parameters for the contract. By default, this option is un-checked.

The option is available only for Interest Bearing Loans and Mortgage Loans.

Frequency Select the required capitalization frequency from the drop-down list. The list contains the following types of frequency to either capitalize all the balances based on same frequency or define different frequency for each type of balance.- Based on specific intervals such as Monthly, Quarterly, Annual and so on.

- Based on contract Billing Frequency, Billing Date, or Due date.

- Specifically on every Month End.

-Or-

- Based on Balance Frequency to define different capitalization frequency for each balance. This can further be defined in Balances sub tab.

Capitalization Start Basis Select the capitalization start date from the drop-down list as either Contract Date or First Payment Date to calculate the capitalization frequency accordingly.

However, this field is not enabled for Billing date or Due Date type of capitalization frequency.

Grace Days Specify the grace days allowed in the frequency (minimum 0, maximum 31) before capitalizing the balances to account. This is also the deciding factor for executing the capitalization batch job which is based on Capitalization Frequency + Grace Days.

However, note that Grace Days are not accounted for Month End type of capitalization frequency and is ignored even if specified.

Cap Tolerance Amt Specify the capitalization tolerance amount which is the minimum amount to qualify for capitalization. Any amount less than this is not considered for capitalization of balances.

This helps to avoid capitalization of nominal or decimal amounts.

Note: There is no specific accounting maintained for non-capitalized decimals with reference to setup.

Rebate section Pre Compute Check this box to indicate that this is a precomputed loan. Rebate Method Select the rebate calculation method from the drop-down list. Rebate Term Method Select the rebate term method from the drop-down list. Rebate Min Fin Chg Mthd Select the rebate minimum finance charge calculation method from the drop-down list. Min Finance Charge Specify the minimum finance charge value. Acquisition Charge Amt Specify the acquisition charge amount. Scheduled Dues section Due Day Min Specify the minimum value allowed for the due day for this instrument. Due Day Max Specify the maximum value allowed for the due day for this instrument.

Note: If billing cycle is selected as weekly, then Due Day Max field value cannot be greater than 7.

Max Due Day Change / Year Specify the maximum number of due day changes allowed within a given year for this instrument. Max Due Day Change / Life Specify the maximum number of due day changes allowed over the life of a product funded with this instrument. Max Due Day Change Days Specify the maximum number of days a due date can be moved. Pmt Tolerance Amt* Specify the payment tolerance amount. This is the threshold amount that must be achieved before a due amount is considered PAID or DELINQUENT. If (Payment Received + Pmt Tolerance: $Value) >= Standard Monthly Payment, the Due Date will be considered as satisfied in terms of delinquency. The amount unpaid is still owed. Pmt Tolerance%* Specify the payment tolerance percentage. This is the threshold percentage that must be achieved before a due amount is considered PAID or DELINQUENT. If Payment Received >= (Standard Monthly Payment * Pmt Tolerance% / 100), the due date will be considered satisfied in terms of delinquency. The amount unpaid is still owed.

The system uses the greater of these two values.

Promise Tolerance Amt* Specify the promise tolerance amount. This is the threshold amount that must be achieved before a due amount is considered KEPT or BROKEN. If (Payment Received + Promise Tolerance: $Value) >= Promise Amount, the Due Date will be considered KEPT (satisfied). Promise Tolerance %* Specify the promise tolerance percentage. This is the threshold percentage that must be achieved before a due amount is considered KEPT or BROKEN. If Payment Received >= (Promised Amt * Promise Tolerance%), the due date will be considered KEPT (satisfied).

The system uses the greater of these two values.

Billing section Prebill Days Specify the prebill days. This is the number of days, before the first payment due, that accounts funded with this instrument will be billed for the first payment. Thereafter, the accounts will be billed on the same day every month. If an account has a first payment date of 10/ 25/2003 and Pre Bill Days is 21, then the account will bill on 10/04/ 2003, and then bill on the 4th of every month. Billing Type Select the billing type for accounts funded using this instrument from the drop-down list. Billing Method Select the billing method for accounts funded using this instrument from the drop-down list. Balloon Method Select the balloon payment method for accounts funded using this instrument from the drop-down list. Multiple Billing Asset Rate Check this box to indicate if multiple asset rates are applicable for one billing period.

System considers billing period from current due date to the next due date. Multiple rates are fetched only when rate end date (rate start date + rate frequency) ends one or more cycle(s) before the next due date i.e. current rate record does not cover the entire billing period.

Delinquency section Late Charge Grace Days Specify the number of grace days allowed for the payment of a due date before a late charge is assessed on the account. Stop Accrual Days Specify the number of days a contract can be in delinquent state, after which the interest accrual must stop for an account.

A Batch Job is run daily to select accounts in delinquent status for a pre-defined number of days and post No Accrual transaction for such accounts on current date. When the account recovers from Delinquency, the system will then post a Start Accrual Transaction on the date the account is recovered from delinquency.

Delq Grace Days Specify the number of grace days allowed for the payment of a due date before an account is considered delinquent. This affects DELQ Queues, the system reporting, and the generation of collection letters. Time Bar Years Specify the total number of years allowed to contact the customer starting from the first payment date and beyond which the account is considered delinquent. You can specify any value between 0-999. Cure Letter Gen Days Specify the number of delinquency days to initiate cure letter generation. Cure Letter Valid Days Specify the number of days during which the issued cure letter is valid. Usually financial institutions will start the collection activities after the lapse of cure letter validity date. Delq Category Method Select the delinquency category method to determine how the system populates delinquency counters on the Customer Service form.

Note: This value does not affect credit bureau reporting.

Accrual Post Maturity Check this box to indicate that this is the post maturity default rate.

Extensions allow you to extend the maturity of the contract by one or more terms by allowing the customer to skip one or more payments. The skipped terms are added to the end of the contract.

Cycle Based Fees - This section allows to define the parameters for calculating cycle based fees at individual account level. Using the below parameters, system derives the Cycle Base Fees and updates the account balances on processing the following batch jobs - TXNCBC_BJ_100_01 (CYCLE BASED COLLECTION LATE FEE PROCESSING) and TXNCBL_BJ_100_01 (CYCLE BASED LATE FEE PROCESSING). For more information, refer to ‘Fee Consolidation Maintenance’ section in Appendix chapter.

System calculates the below type of fee in combination of associated and master account and is assessed only when total due crosses Threshold amount (that is defined in Setup > Products > Contract > Fees tab and Setup > Products > Fees screen):

Fee Late Charge (FLC)- Percentage of sum of payment due

- Percentage of sum of standard payment

- Percentage of sum of billed amount

Cycle Based Collection Late Fee- Flat amount

- Percentage of sum of payment due

- Percentage of sum of standard payment

- Percentage of sum of billed amount

- Percentage of payment due

- Percentage of standard payment

- Percentage of billed amount

- Percentage of total due amount

- Percentage of sum of total due amount

Cycle Based Late Fee- Flat amount

- Percentage of sum of total due amount

- Percentage of sum of payment due

- Percentage of sum of standard payment

- Percentage of sum of billed amount

- Percentage of total due amount

- Percentage of payment due

- Percentage of standard payment

- Percentage of billed amount

Cycle Based Collection Late Fee Check this box to enable cycle based collection late fee assessment on the account.

If selected, the balance type CYCLE BASED COLLECTION LATE FEE is made available in the Balances tab which further allows to define how system should derive the balances when an account is booked and funded.

If unchecked (default), system does not display the Cycle based Collection Late Fee balance in Contract >Balances tab on clicking Load Balances button.

Cycle Based Late Fee Check this box to enable cycle based late fee assessment on the account.

If selected, the balance type CYCLE BASED LATE FEE is made available in the Balances tab which further allows to define how system should derive the balances when an account is booked and funded.

If unchecked (default), system does not display the Cycle Based Late Fee balance in Contract >Balances tab on clicking Load Balances button.

Cycle Based Collection Late Fee Grace Days Specify the number of grace days allowed before cycle based collection late fee is assessed on the account. This field is enabled only if the Cycle Based Collection Late Fee option is checked above. Cycle Based Late Fee Grace Days Specify the number of grace days allowed before cycle based late fee is assessed on the account. This field is enabled only if the Cycle Based Late Fee option is checked above. Fee Consolidation - If Cycle Based Late Fee is assessed based on above parameters, this section allows to enable/disable the option to consolidate the late fee at Master Account level. Late Charge at Master Account Check this box to allow system to consolidate the late charge assessment at master account level. Cycle Based Collection Late Fee at Master Account Check this box to allow system to consolidate the cycle based collection late fee assessment at master account level.

Ensure that, the option Cycle Based Collection Late Fee is also checked for fee consolidation at Master Account level.

Cycle Based Late Fee at Master Account Check this box to allow system to consolidate cycle based late fee assessment at master account level.

Ensure that, the option Cycle Based Late Fee is also checked for fee consolidation at Master Account level.

Extension section Max Extn Period / Year Specify the maximum number of terms that the contract may be extended, within a given rolling calendar year. Max Extn Period / Life Specify the maximum number of terms that the contract may be extended, within the life of the loan. Max # Extn / Year Specify the maximum number of extensions that may be granted within a given rolling calendar year. Max # of Extn / Life Specify the maximum number of extensions that may be granted within the life of the loan. Minimum # Payments Specify the minimum number of payments that must be made before extension. Extension Gap in Months Specify the gap between previous extension provided in the account and current one as specific number of months. Advance Details section Multi Disbursements Allowed Check this box, if this contract allows disbursement of funds to customers through multiple advances or draws up to the approved amount within a specified draw period. If you select the Multiple Disbursements Permitted box, complete the Advance Details section on the Contract section. (For more information, see the Stages Funding section in this chapter.) Min Initial Advance Specify the minimum initial advance amount allowed. This is the smallest possible initial advance that can be disbursed to the borrower after funding. Max Initial Advance Specify the maximum initial advance amount allowed. This is the largest possible initial advance that can be disbursed to the borrower after funding. Late Charge Allowed Check this box to allow disbursement period late charge. Min Advance Specify the minimum advance amount. This is the smallest advance amount that a borrower may subsequently request after the initial advance. Max Advance Specify the maximum advance amount. This is the largest advance amount that a borrower may subsequently request after the initial advance. Billing Allowed Check this box to allow stage funding with draw period billing. Draw Period Billing Method Select the method for billing during the draw period from the drop-down list. Reschedule Ind Select this check box to indicate that the rescheduling is allowed at the draw period. Rate Cap & Adjustments section Max Rate Inc / Year Specify the maximum rate increase allowed in a year. Max Rate Inc / Life Specify the maximum rate increase allowed in the life of the loan. Max Rate Dec / Year Specify the maximum rate decrease allowed in a year. Max Rate Dec / Life Specify the maximum rate decrease allowed during the life of the loan. Max # Adjust / Year Specify the maximum number of rate changes allowed in a year. Max # Adjust / Life Specify the maximum number of rate changes allowed during the life of the loan. Min Int Rate (Floor) Specify the minimum rate. Max Int Rate (Ceiling) Specify the maximum rate. Payment Caps section Max Pmt Inc / Year Specify the maximum payment increase allowed in a year. Max Pmt Inc / Life Specify the maximum payment increase allowed in the life of the loan. Statement section

This section allows to define the preferences for Mock Statement generation at Master Account level. Generating a Mock Statement helps to mock the asset billing process with a future date and to get an upfront statement indicating future dues of Master and Associated Accounts. In Vacation Ownership industry, such statements are required to forecast future dues based on current Timeshare holdings.

The selected preference here are propagated to Application > Contract screen when the instrument is loaded.

Mock Statement Req Select this check box to indicate if the account is to be include in Mock statement Generation.

Note: Based on this selection, others fields related to Mock Statement below are enabled and becomes mandatory for providing details.

Mock Start Month Select the start month of Mock Statements period from the dropdown list.

Note: During the Mock Statement Next Run Date validation if next run date is less than Contract Date or GL Date, system moves the Mock Start Month to same month of next year. For more information, refer to Mock Statement Maintenance in Appendix - Non Monetary transactions sections.

Mock Statement Cycles Select the total number of billings (between 1-12) that are to be generated post Mock Statement Start Date. Mock Pre Statement Days Specify the number of Pre bill days for Mock Statements generation. Stmt Preference Mode Select the account statement preference mode as either Email or PHYSICAL from the drop-down list.

The selected preference will be propagated to Application > Contract screen when the instrument is loaded.

Other section 1st Pmt Deduction Allowed Check this box to indicate that the first payment for fixed rate loans using this instrument may be deducted from the producer's proceeds. 1st Pmt Refund Allowed Check this box to indicate that refunding first payment deductions to the producer is allowed. 1st Pmt Deduction Days Specify the first payment deduction days. If the first payment for fixed rate loans using this instrument is less than this number of days from funding, the first payment will be deducted from the producer’s proceeds if 1st Pmt Deduction. 1st Pmt Refund Days Specify the first payment refund days. If the first payment for fixed rate loans using this instrument is received within this number of days from the first payment date, the first payment deduction will be refunded to the producer if 1st Pmt Refund. Refund Allowed Check this box to indicate that refunding of customer over payments are allowed. Refund Tolerance Amt Specify the refund tolerance amount. If the amount owed to the customer is greater than the refund tolerance, the over payment amount will be refunded if Refund Allowed box is selected. Anniversary Period Specify the anniversary term that define the anniversary period. This is based on billing cycle, so normally for MONTHLY the value is 12 and for WEEKLY the value is 52. WriteOff Tolerance Amt Specify the write off tolerance amount. If the remaining outstanding receivables for accounts funded using this instrument is less or equal to the write off tolerance amount, the remaining balance on the account will be waived. Pre Pmt Penalty Check this box, if there is a prepayment penalty charged for accounts funded using this instrument. % of Term for Penalty Specify percentage of term for prepayment penalty. If the (remaining terms / total terms) expressed as a percentage exceeds this amount, a prepayment penalty will be assessed if the Pre-Pmt Penalty box was selected. Recourse Check this box if recourse is allowed. This indicates whether the unpaid balance may be collected from the producer if the consumer fails to perform on the loan. Max Recourse% Specify the maximum percentage of the outstanding receivables that may be collected from the producer if the Recourse Allowed box was selected. Pay Off Fee Allowed Check this box to allow for a payoff quote fee to be assessed to the account attached to this contract.

Note: This will require you to set up a payoff fee at the contract (Fees sub screen) or state (Fee screen) level. For more information, see the following Contract screen (Loan)’s Fees sub screen or Fee screen (Loan) sections in this chapter.

Escrow Allowed Check this box, if this contract can do escrow of tax and insurances. (For more information, see the Escrow Setup Form chapter.) Repmt Currency Select the designated repayment currency for this contract from the drop-down list. PDC Security Check Check this box to indicate that post dated checks are the method of repayment for this contract. Default Pmt Spread Select the default payment spread to be used when receiving payments for this account if one is not explicitly chosen, from the drop-down list. Calendar Method Select the required calendar method for this contract from the dropdown list. The calendar method Hijri should be selected, if the product category is selected as Standard in the Products screen. For Islamic product category, the calendar method can be either Gregorian or Hijri. ACH Fee Ind Check this box to indicate that direct debit fee is included.

Note: The ACH Fee/Direct Debit Fee balance will be displayed in Balances sub tab only when this checkbox is selected.

Track Down Payment Balance Select this check box for system to validate if Down Payment Balance is loaded. This helps to record the Down Payment balance Agreed and Paid by the customer.

If selected, system validates if Down Payment Balance is loaded in the contract setup. However, system does not validate Down Payment Balance if unchecked. This check box is available only for Loan contracts.

- Perform any of the Basic Actions mentioned in Navigation chapter.

Extension of Terms

- Specified number or more payments made in the account

- Gap between the previous and current extension provided in the account must be a specific number of months that could be specified

If the above conditions are not satisfied, then the system displays an appropriate error message.

A new transaction Force Extension will be available. This transaction will be posted when you want the system to bypass the extension validations defined at the contract level.

When a backdated transaction with TXN Date exists before the transaction date of extension, all the transactions are reversed and posted again. If extension transaction is posted again, then the validation rules are not validated again.

This section consists of the following topics:

Parent topic: Product