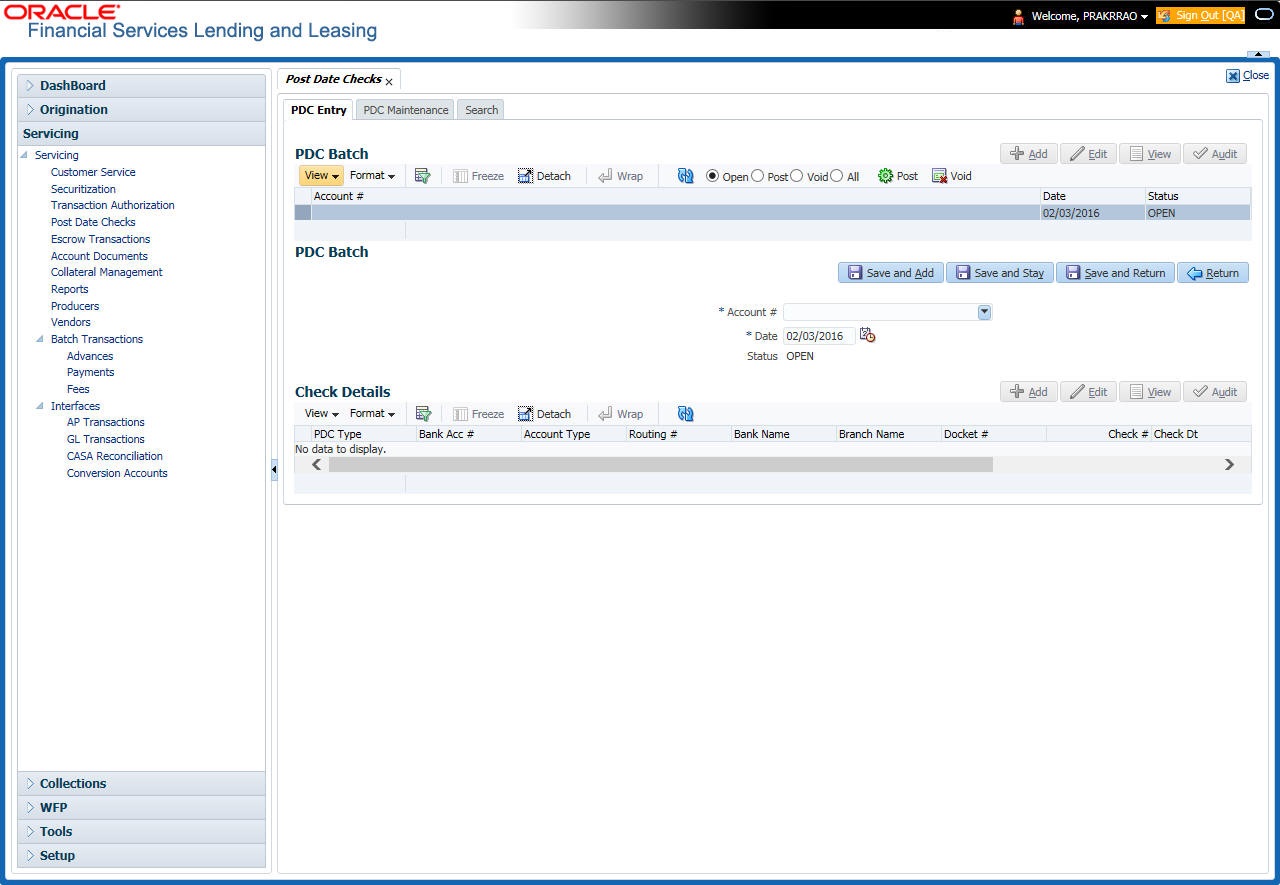

7.1 PDC Entry Tab

When post dated check is processed by the PDC batch, the status changes to PROCESSED. All the processed checks will then be picked by the Payment Batch and processed. After this, the system posts s payment transaction on the Payment screen’s Payment Entry tab.

The View Options section enables you to view PDC batches by status (Open, Post, Void, and All). You can choose whether the PDCs from the customer are for a single Line of credit account or for multiple Line of credit accounts in the same bank. Once you enter the Line of credit account number of the customer in the PDC Batch section, The system displays all Line of credit accounts pertaining to the customer.

The information has to be captured to facilitate the inward sorting i.e. sorting the cheques by Line of credit product group and location and then vaulting them in boxes placed in the vaults at the PDC center and subsequently send them for clearance on the day the payment is due. Usually the PDCs are sent for clearance a few days before the actual due date.

Information maintained here can be viewed at Customer Service > Account Details > Contract Information > PDC sub tab.

After the batch has been created, click POST in Action section to post the batch of PDCs to Line of credit account. You can also click VOID in the Action section to cancel the PDC entry on a Line of credit account.

To view the PDC Entry section

Parent topic: Post Dated Cheques (PDC) Management