5.1 Introduction

Customer Credit limit in general refers to the maximum amount of credit that a financial institution can extend to a prospective customer which can then be leveraged by an underwriter while funding an application.

In Oracle Financial Services Lending and Leasing, you can define the Customer Credit Limit during underwriting stage based on the customer credit worthiness or historical customer data. Using this limit, applications can be funded up to the credit limit amount allowed. However, application funding with or without customer credit limit is controlled based on the setup and applications can still be funded with the normal process when a particular customer is not allocated with any credit limit.

A customer credit limit facilitates for quick decisioning by an underwriter and also facilitates for auto approval of accounts on-boarded from external system with basic validations. While approving, underwriter has to ensure that the sum of utilizations should always be equal to the financed amount which can be distributed within applicants primary / secondary or business categories.

A minimum of one application has to be funded to define customer credit limit for funding subsequent applications and the defined information is updated into credit limit details. A credit limit once defined can further be increased from servicing module by posting the required transaction which is referenced in origination module during application funding.

On receiving a payment, the amount is reinstated to the credit limit balance which can be reused while funding next application. Similarly, the credit limit balance is also updated when account is moved to VOID status. On reversing a payment, the Total Utilization of credit limit is increased by the principal portion of the payment and decreased with the Available Amt field. Also, the Suspended and Hold amount fields are increased and decrease based on the respective transactions posted.

When two applications are being funded simultaneously (i.e. moving application to Approved Funded status), the utilization amount will be considered for first application while the second one will be on HOLD since there could be a difference in the available credit limit after funding. In such a case, you need to re-hash the application, fetch the details in Origination > Decision tab, (if required) increase credit limit from servicing module, and then proceed for funding.

While processing applications using Customer Credit Limit, the Update Customer Info (check box in applicant tab) and Link to Existing Customer (check box in contract tab) are selected by default for all the existing customers. This is to ensure the application details are propagated to customer accounts.

On funding a new application for an existing customer using customer credit limit, the details are updated into the existing customer details in the Servicing module. Also, while posting any monetary transaction that results in increase of account maturity date, system auto validates if the same is within the Customer Credit Limit Expiry date of any one or all of the customer(s) who contributed for funding the Account. In case it is greater, system displays an error indicating that the resulting Maturity date is greater than Customer Credit Limit Expiry date and does not allow to post the transaction.

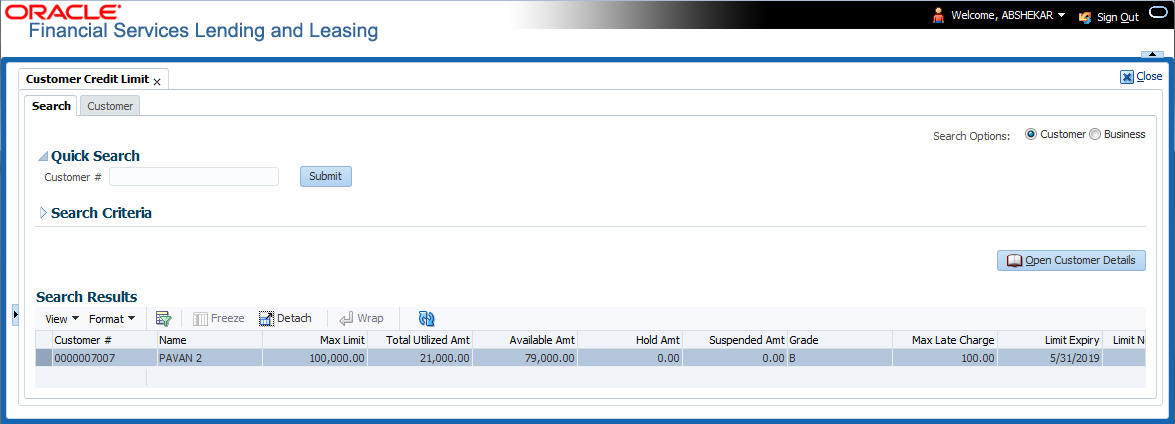

Navigating to Customer Credit Limit screen

From the LHS menu, select Servicing > Customer Credit Limit. The screen by default opens with Search tab.

- Search

- Customer

Parent topic: Customer Credit Limit