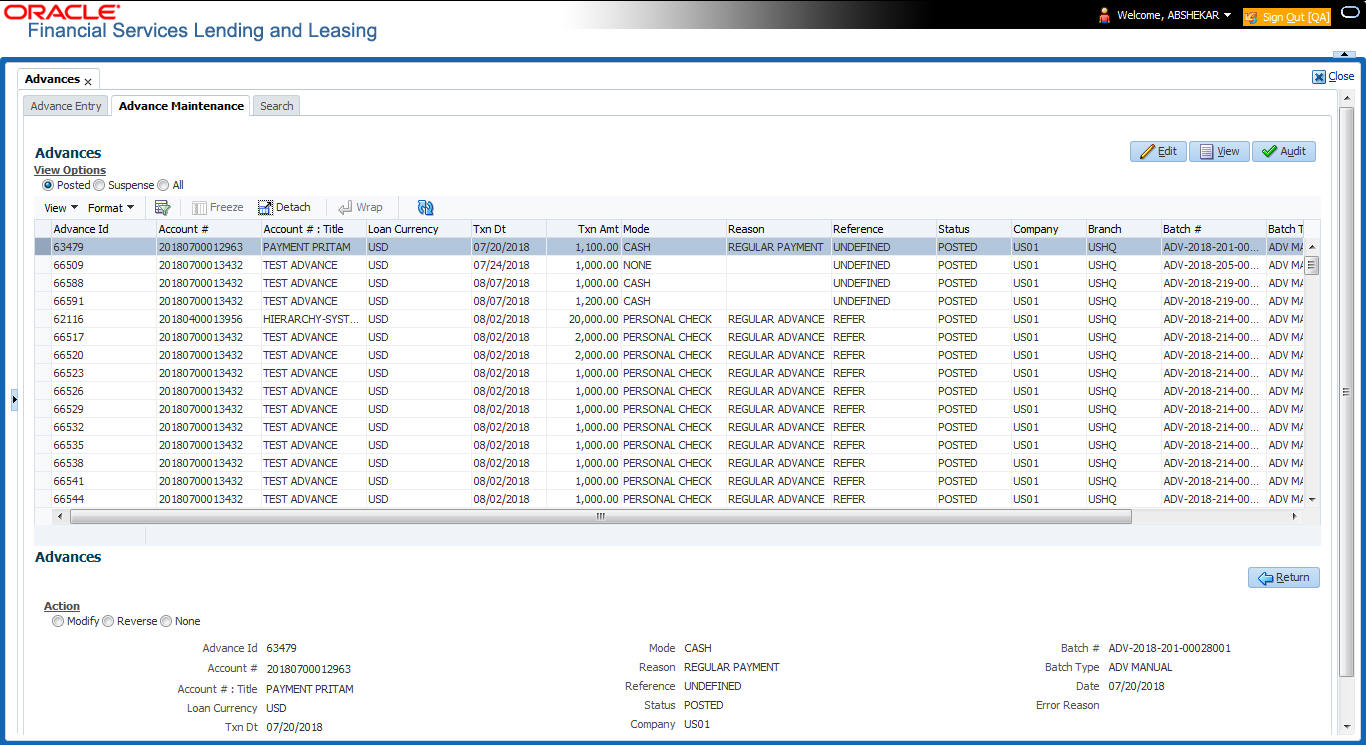

15.2.2 Advance Maintenance Tab

The Advance Maintenance tab on the Advances screen enables you to perform maintenance functions on individual advances that have been posted. The common functions are as follows:

Table 15-4 Common functions

| Function | Purpose |

|---|---|

| Modify | enables you to modify advance attributes such as amount, account number, and date. |

| Reverse | enables you to reverse the advance from the account completely. |

In all cases, the system performs true backdating to post the transaction based upon transaction date. Interest recalculations are automatic and all necessary transactions can be sent to the general ledger for automatic reconciliation.

Suspended advances

In case of advances that are not posted to accounts due to issues such as incorrect account condition, the advances are posted to suspense. You must process these advances using the work queue for suspense advances. This would typically involve identifying the correct amount or correcting problems with the account before attempting to re-post the advance. In this case, the advance is moved out of the suspense account and posted to the specified account.

- On the Oracle Financial Services Lending and Leasing Application home screen, click the Servicing > Servicing > Batch Transaction > Advances > Advance Maintenance tab.

- In the View Options section, select which advance you want to view:

Table 15-5 View Options

Choose View this Posted Posted advances. Suspense Suspended advances. In cases of advances that have been posted to suspense, the Suspense work queue can be used to process them (similar to suspense payments). All All advances. The system displays the selected payments in the Advances section.

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields are given below:

Table 15-6 Advances

Field View this Advance Id View the system-generated Advance Id generated while posting an advance transaction onto an account. The Advance Id is generated during any of the following AP transactions:- For advances to account generated in OFSLL

- For transactions posted from third party system to OFSLL through AdvanceDisbursement and Advance Entry RESTful web service to maintain advance balance on account and create Payable Requisition (AP Txn).

Account # Account number. Title Account title. Line of credit Currency Select the Line of credit currency Txn Date Advance effective date. Txn Amount Advance amount. Mode Advance mode. Reason Advance reason. Reference Reference information for advance. Status Advance status. Company Portfolio company. Branch Portfolio branch. Batch # Batch number. Batch Type Batch type. Date Displays batch date. - Perform any of the Basic Actions mentioned in Navigation chapter.

This section consists of the following topics: