3.5.7 De-duping Credit Bureau data

Oracle Financial Services Lending and Leasing allows you to remove duplicate (de-dupe) liabilities data from the credit bureau information.

De-duping logic

Table 3-42 De-duping logic

| Field | Description |

|---|---|

| Account # | The account number of the consumer with the lender for the particular account. |

| Open Date | The date the account was opened. |

| Member Code |

The subscriber code of the lender with the respective credit bureau. Note: Since member codes for the same lender differ across bureaus, this field is used only for tradelines reported by the same bureau. Since reports obtained from CSC can have tradelines from different bureaus, this field is only for reports pulled from the credit bureaus. |

All available bureau reports pulled later than DEDUP_CRB_EXPIRATION_DAYS days old will be used.

- Last Reported Date: The row that has been reported most recently is used.

- Owner: In case of a tie on the last reported date, one of the tradelines is picked in the descending order of priority depending on who the tradeline belongs to: Primary, Spouse, then Secondary.

Debt Ratio combination

Oracle Financial Services Lending and Leasing uses the system parameter DBR_JOINT_INC_DEBT_WITH_SPOUSE to decide whether to combine debt ratios of the spouse with the primary applicant. The DBR_JOINT_INC_DEBT_WITH_COAPP parameter decides whether to do the same on a non-spousal joint application.

When this indicator is checked, all liabilities in the Liability section on the Summary sub screen of the Applicant (2) master tab with the Include box selected will be used in the debt ratio calculation.

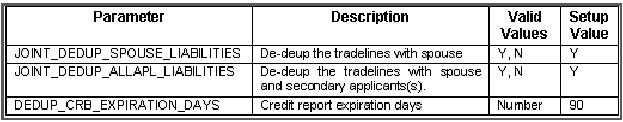

The following system parameter will be set up to provide switches to allow the functionality to be turned on and off:

De-duping process

The de-duping logic will be integrated into the system decision-making process in the following manner:

- If the JOINT_DEDUP_SPOUSE_LIABILITIES/ JOINT_DEDUP_ALLAPL_LIABILITIES system parameters are set to Y, uses the de-duping logic described above to uncheck the duplicate liabilities in the spouse's/co-applicant’s liabilities.

- If the DBR_JOINT_INC_DEBT_WITH_SPOUSE/ DBR_JOINT_INC_DEBT_WITH_ALLAPL parameters are set to Y, the system includes the liabilities of the spouse/ co-applicant while calculating the debt ratio of the primary applicant.

- The system will use all available credit reports at the time.

- To remove duplicate liabilities from the calculation, choose the Dedup Liabilities button on the Underwriting form (Applicants master tab > Summary sub screen > Liability section). (Potential record locking situations force the action to remain manual versus the system automatically doing it).

- If the Populate Debt and Include Debt boxes are selected in the Applicant/Customer Detail section on the Bureau master tab on the Underwriting form for the credit request and the JOINT_DEDUP_SPOUSE_LIABILITIES/ JOINT_DEDUP_ALLAPL_LIABILITIES system parameters are set to Y, the system will use the de-duping logic described above to uncheck the duplicate liabilities in the spouse's/co-applicant's liabilities.

- If the DBR_JOINT_INC_DEBT_WITH_SPOUSE/ DBR_JOINT_INC_DEBT_WITH_COAPL parameters are set to Y, the system will include the liabilities of the spouse/ co-applicant while calculating the debt ratio of the primary applicant.

- The system will use all available credit reports at the time of the request that have been requested within the number of days specified in the DEDUP_CRB_EXPIRATION_DAYS parameter.

Restrictions

The de-duping logic will be limited based upon the discussion above. If the system cannot identify two tradelines as duplicates based upon the logic mentioned above, the individual tradelines will be retained. In such circumstances, both tradelines will be used in the debt ratio calculation and it will be the user’s responsibility to disregard one of them by clearing the Include check box.

Parent topic: Credit Bureau