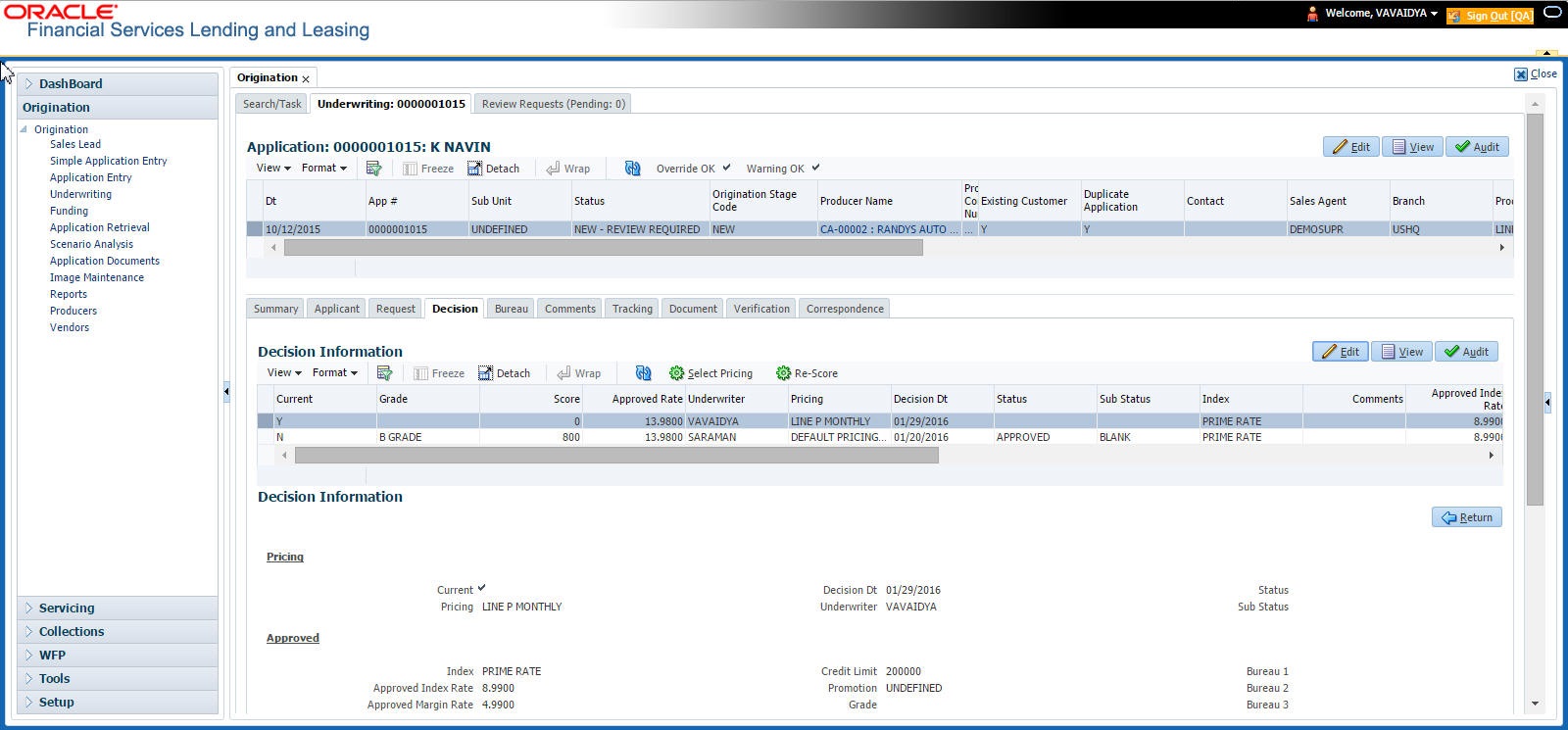

7.8 Decision Tab

If the application was initially approved automatically, the system displays its recommendations on the Decision tab’s Approved section.

If the application was initially rejected automatically, the system displays its reasons on the Decision link’s Stipulation sub tab.

- If the data meets your approval, change the status of the application to either APPROVED or REJECTED and enter any stipulations.

- If you reject the application, change the status to REJECTED and enter the reasons for the adverse action on the Stipulations sub screen.

- Open the Underwriting screen and load the underwriting application you want to work with.

- Click Decision tab.

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Table 7-26 Decision

Field Do this Pricing section Current Check this box to indicate that this is the current decision. Pricing View the pricing. Decision Dt View the decision date. Underwriter View the underwriter id. Status View the application status. Sub Status View the application sub-status. Approved section Index Specify the index type. Approved Index Rate Specify the approved index rate. Approved Margin Rate Specify the approved margin rate. Approved Rate Specify the approved rate. Maturity Index Select the approved maturity index. Maturity Margin Rt Specify the maturity margin rate. Credit Limit Specify the credit limit. Promotion Select the promotion. Grade Select the credit grade. Score Specify the credit score. Draw Term Specify the draw term. Repmt Term Specify the repayment term. Bureau 1 Specify the Bureau 1. Bureau 2 Specify the Bureau 2. Bureau 3 Specify the Bureau 3. Comments Specify comments, if any. - Perform any of the Basic Actions mentioned in Navigation chapter.

- Click Select Pricing.

The system determines the best pricing match of all enabled Line of credit pricing strings in the Setup menu and displays the results in the Pricing and Approved sections.

- Re-Score

A Re-Score button is available next to Calculate. Whenever any sensitive Financial or Collateral information is amended in the Application, OFSLL displays a warning message Scoring sensitive information is changed. Re-score the application. You need to click on Re-Score to re-validate the grade and pricing accordingly.

The display of the warning message to Re-score the application can be controlled using the respective System parameter. If the defined System Parameter is flagged Y, only then the message is displayed.

If you are underwriting a Line of credit, record the following information on the Decision tab:

- If you are approving the application, complete the Approved section with the values you want to approve as an underwriter. You can update the default values that appeared when you selected the pricing string in step 3. (The system calculator may be of use when completing this section. For more information, refer the Tools chapter).