2.7 Transaction Codes

The system uses transaction codes to define the actions and tasks it can perform; for example, activating an account, changing a due date, applying a late fee, and charging off an account.

The Transaction Codes Setup screen catalogs and defines these core system actions.

The system organizes transaction codes in Super Groups. All transaction codes within a particular super group are processed in a similar manner. The transaction super groups in the system are as follows:

Table 2-20 Transaction Super Group

| Super Group Type | Description |

|---|---|

| ACCOUNT CONDITION TXN | These transaction codes control a user’s ability to open and close account conditions. |

| ACCOUNT MONETARY TXN | These transaction codes affect the monetary value of accounts in the system; for example, activating accrual of interest, the assessment of fees, and closing the account. |

| ACCOUNT NON MONETARY TXN | These transaction codes do not have a direct effect on the monetary value of the account, but are used in maintaining account information. This includes changing a customer’s driving license, or adding information for automated clearing house (ACH). |

| AMORTIZATION TXN | These transaction codes affect the amortized balances of the accounts in the system. |

| CORRESPONDENCES | These transaction codes relate to the system correspondences. |

| ESCROW ANALYSIS AND DISBURSEMENTS | These transaction codes allow for reviewing and approving escrow analysis, stopping an escrow override, and posting escrow disbursement. |

| ESCROW MONETARY TRANSACTIONS | These transaction codes affect the monetary value of escrow accounts in the system; for example, disbursing escrow to a customer and insurance, and receiving payment. |

| ESCROW NON MONETARY TRANSACTIONS | These transaction codes do not have a direct effect on the monetary value of an escrow account, but are used in maintaining account information, such as changing insurance maturity date and adding new escrow tax details. |

| FEE ASSESSMENTS | These transaction codes determine if fees such as nonsufficient funds fees or membership fees are to be applied. |

| FUNDING TXN | These transaction codes affect the funding of applications and accounts within the system. |

| ITEMIZATION TXN | These transaction codes affect the itemization of applications and accounts within the system. |

| MENU TXN | These transaction codes affect the menus within the system. |

| PRODUCER MONETARY TXN | These transaction codes relate to the monetary transactions that apply to the system producers (or dealers). |

| REPORTS | These transaction codes are related to generating the system reports. |

| SETUP LOCK/UNLOCK | These transaction codes limit a user’s ability to change the existing setup data, even if they are allowed access to the form, by restricting access to the Lock/ Unlock Record icon on the system tool bar. |

| ACCOUNT CONDITION TXN | These transaction codes control a user’s ability to open and close account conditions. |

| CORRESPONDENCES | These transaction codes relate to the system correspondences. |

| MENU TXN | These transaction codes affect the menus within the system. |

| REPORTS | These transaction codes are related to generating the system reports. |

| SETUP LOCK/UNLOCK | These transaction codes limit a user’s ability to change the existing setup data, even if they are allowed access to the form, by restricting access to the Lock/ Unlock Record icon on the system tool bar. |

Note:

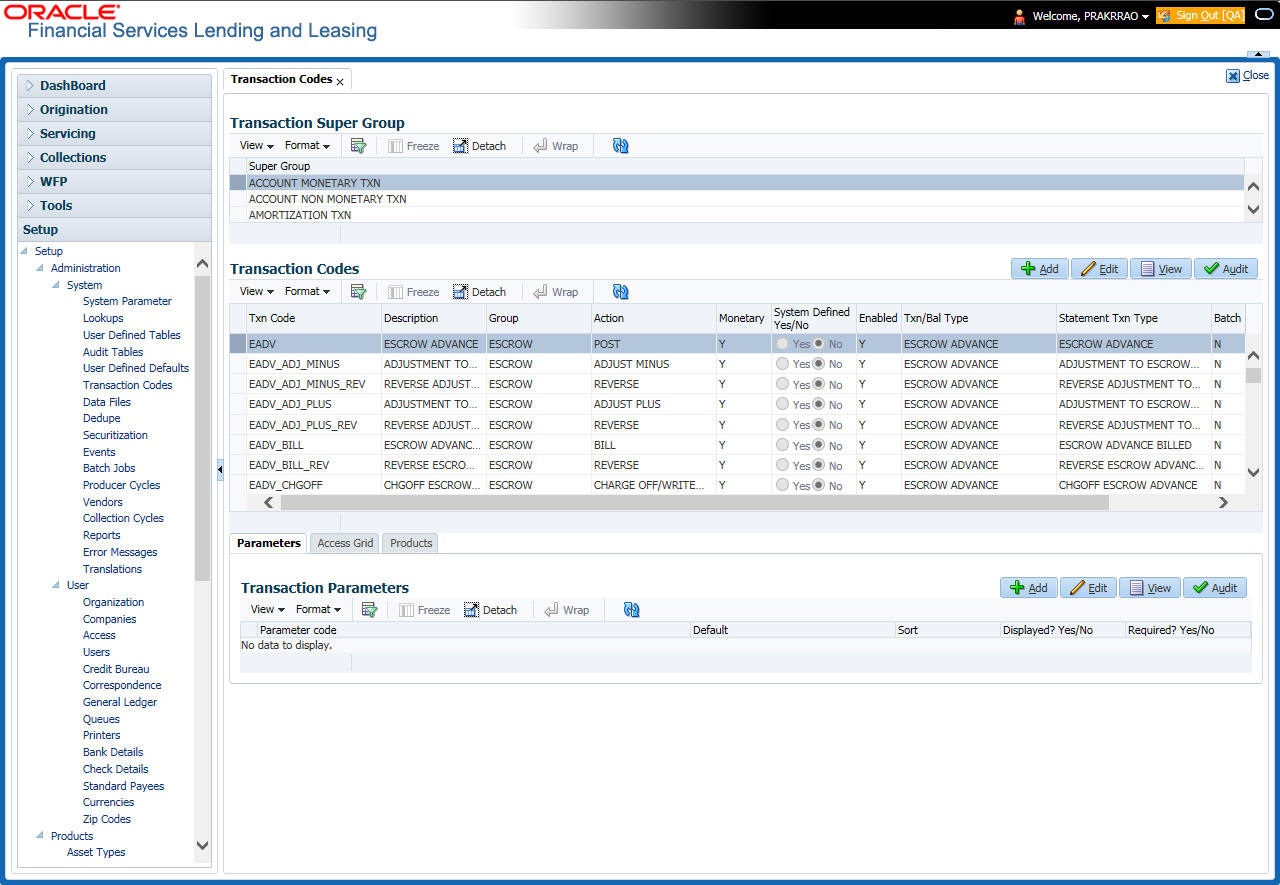

The Software recommends that you restrict the access to the seed data once you are in production.- Click Setup > Setup > Administration > System > Transaction Codes. The system displays the Transaction Codes screen.

- In Transaction Super Group section, you can view the following information.

A brief description of the fields is given below:

Table 2-21 Transaction Super Group Fields

Field Do this Super Group Select the Super Group you want to work with in the Transaction Codes screen. - Perform any of the Basic Actions mentioned in Navigation chapter.

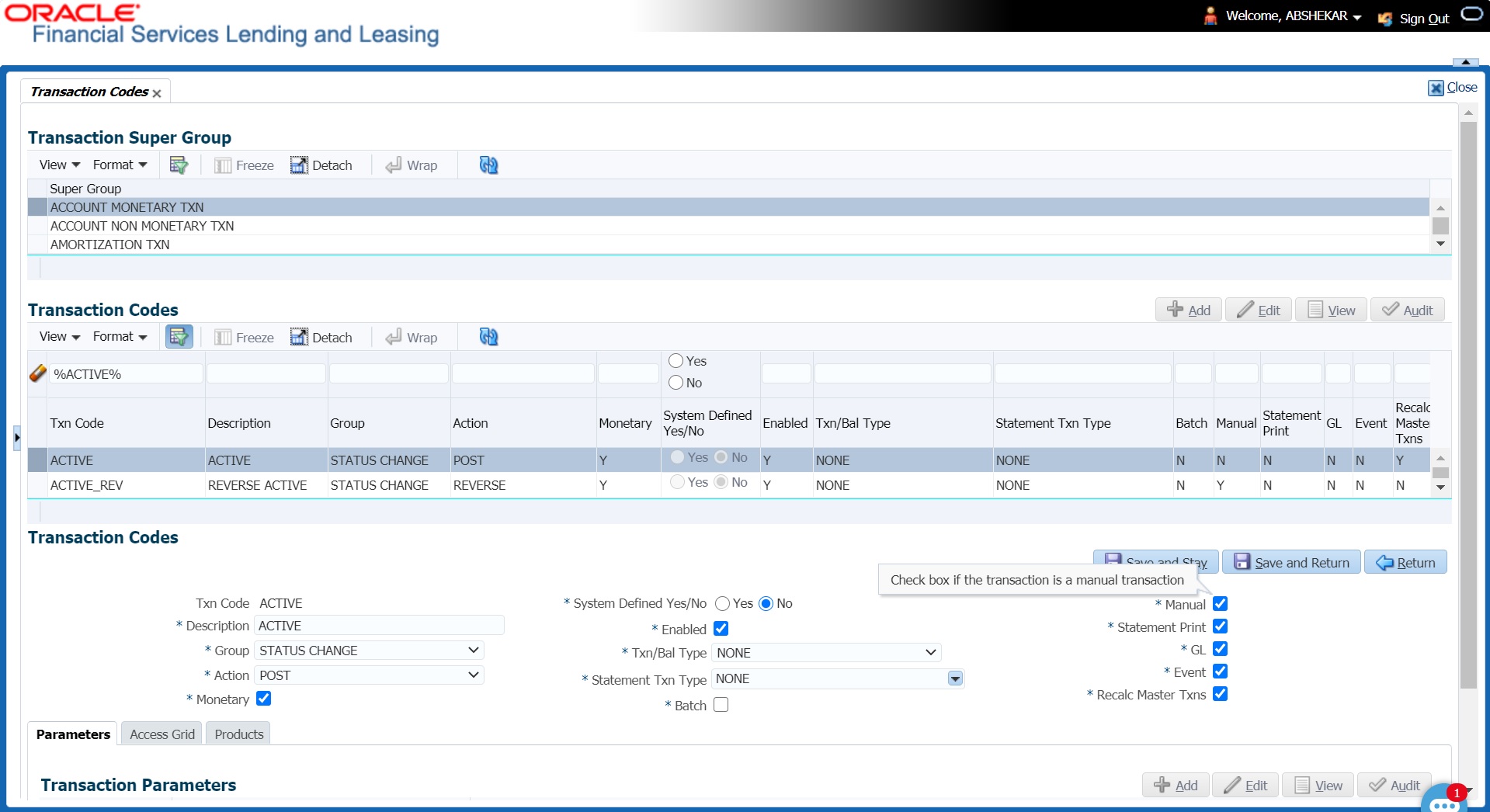

- In the Transaction Codes section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Table 2-22 Transaction Codes Fields

Field Do this Txn Code Specify the transaction code (required). Description Specify the description for the transaction. Group Select the transaction group (the group within the Transaction Super Group that the transaction code belongs to) from the drop-down list. Action Select the action type code for the transaction (what action will take place when the transaction occurs) from the drop-down list. Monetary Check this box to maintain the transaction as a monetary transaction. If unchecked, then the transaction is nonmonetary. System Defined Yes/ No Select Yes, if you wish to maintain the transaction code as system defined and No, if you do not want to maintain it as system defined. System defined entries cannot be modified. If entry is not system defined, then it can be modified. Enabled Check this box to enable the transaction. Txn/Bal Type Select the transaction / balance type affected by the Transaction from the drop-down list. Statement Txn Type Select the statement transaction type (how the transaction should appear on the customer statement) from the drop-down list. Batch Check this box to perform the transaction in a batch process. Manual Check this box, if the transaction is a manual transaction. If you define a transaction as manual, the system recommends that the transaction that reverses it also be defined as manual. Stmt Print Check this box to print the transaction on customer statements. GL Check this box, if the transaction is a general ledger transaction. Event On selecting this check box, the particular Monetary/Non-Monetary transaction is considered for triggering of respective Monetary and Nonmonetary transaction posting Event type. The particular Monetary/Non- Monetary transaction is available while defining Event Actions.

For more information, refer to Events (New Framework) section.

Recalc Master Txns Check this box for system to recalculate and repost consolidated fee at Master Account level. This is done automatically by identifying those monetary transactions which should trigger recalculation of Late Charge, Cycle Based Late Fee and Cycle Based Collection Late Fee at Master Account level when backdated transaction is posted on any Associated Account that is marked for fee consolidation.

For more information, refer to Cycle Based Fees and Fee Consolidation sections in Contract setup screen.

- Perform any of the Basic Actions mentioned in Navigation chapter.

This section consists of the following topic:

Parent topic: Administration System