4.18 Promotions

The Introductory tab of Promotions screen allows you to set up the promotions that a financial institution can offer its customers. Promotion details defined here can be selected during Application Entry and Application processing.

You can define multiple promotions for a product, then select the appropriate promotion at the time the application is processed. Promotions also serve as a selection criteria on the Pricing screen.

CAUTION: The system supports promotions selected only when a product is funded.

Same as Cash promotions

- If the outstanding amount at the end of the promotional period is within the tolerance amount, then the customer receives the full benefit of the promotion and the system will not charge any interest on the borrowers’ account.

- If the outstanding amount is higher than the authorized tolerance amount, then the customer loses the benefit of the promotion and the system computes and charges the borrower interest from the date the product was funded.

Interest & Payments

Interest still continues to accrue for a account that is funded using the SAME AS CASH promotion. However, the interest accrued during the promotion period is not charged or collected on the account until the end of the promotion period.

Any repayment made by the customer during the promotion period is applied towards the line receivables amount. The system then calculates the interest accrual using the reduced line receivables amount, if applicable.

If the product remains unpaid after the end of the promotion period and the line receivables balance is above any stated tolerance amount, then the system starts collecting interest earned and accrued during the promotion period.

Reduced Rate Introductory Promotions

Oracle Financial Services Lending and Leasing’s promotion method PROMOTIONAL RATE allows you to create and specify promotions where customers can be charged lower interest rates during a specific promotional period of time. You may define the length of the promotion in either terms or days. Also, you will be able to set the specific interest rate you want to attach to the promotion. During the promotional period, interest on an account is accrued at the promotional rate. When the promotional period expires, the system changes the interest rate of the product to the contractual interest rate to accrue interest. The promotion expires on the promotion end date defined by the length of the promotion. However, the system allows you to set a grace period for extending the automatic cancellation of the promotion due to delinquency, similar to the grace period associated with a payment date.

- On the Oracle Financial Services Lending and Leasing home screen, click Setup > Setup > Administration > User > Products > Promotions > Line Introductory.

- In the Promotion Definitions section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Table 4-54 Promotion Definitions

Field Do this Code Specify the code identifying the promotion. Description Specify a description of the promotion being offered. Type Select the promotion type from the drop-down list. Oracle Financial Services Lending and Leasing supports the following promotion types for lines of credit:

NO PAYMENT DUE ANY INTEREST DUE (No payments are required and no interest is accrued on the outstanding accrual balances for x terms).

Term Select the promotion term from the drop-down list. Index Select the promotion index from the drop-down list. Margin Specify the promotion margin rate. Cancel Delq Days Specify the promotion cancellation delinquency days. Cancel Overlimit% Specify the promotion cancellation over limit percentage. Enabled Check this box to enable the promotion. - Perform any of the Basic Actions mentioned in Navigation chapter.

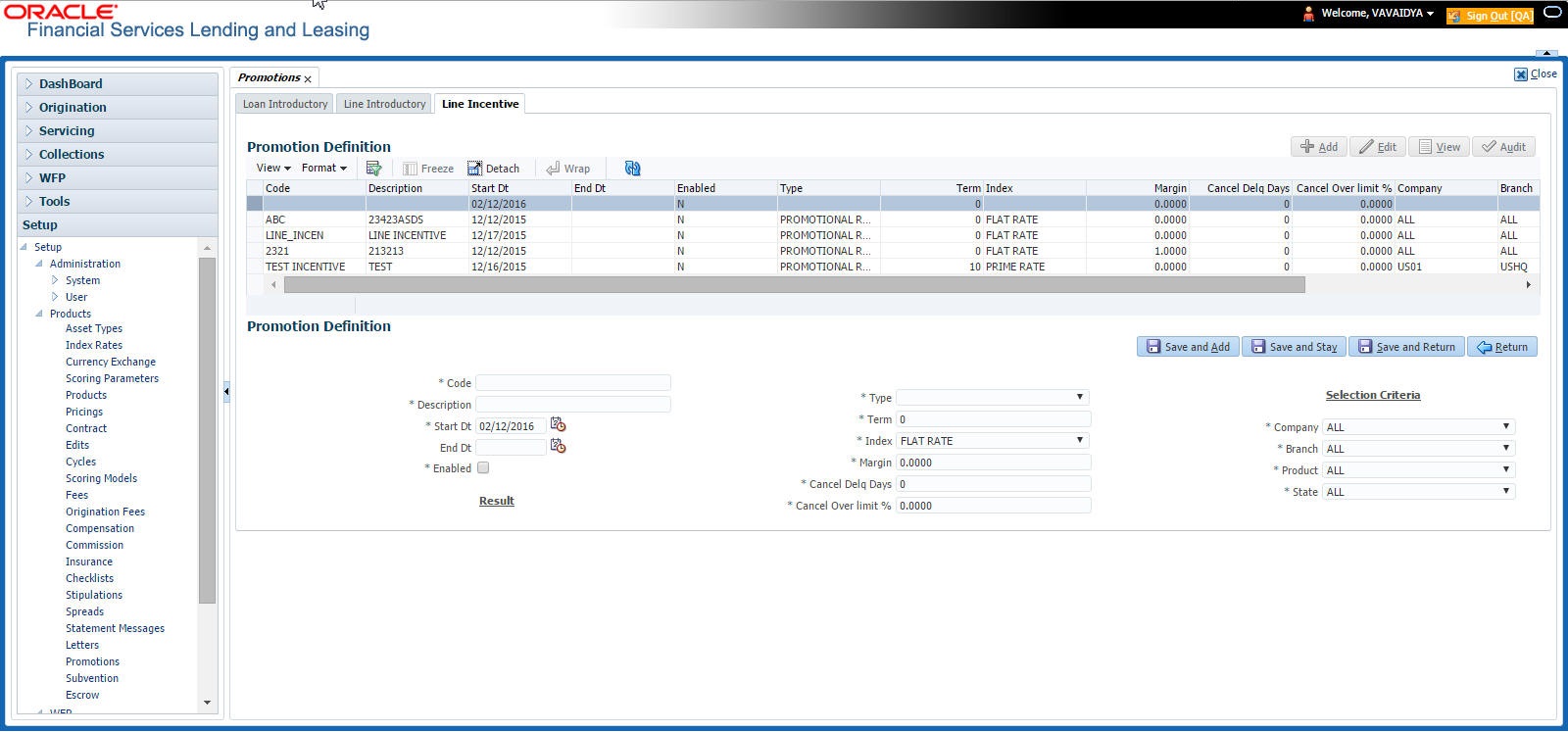

- On the Oracle Financial Services Lending and Leasing home screen, click Setup > Setup > Administration > User > Products > Promotions > Line Incentive.

- In the Promotion Definitions section, perform any of the Basic Operations mentioned in Navigation chapter.

- A brief description of the fields is given below.

Table 4-55 Promotion Definitions

Field Do this Code Specify the code identifying the promotion. Description Specify a description of the promotion being offered. Start Date Select the start date from the drop-down list. End Date Select the end date from the drop-down list. Enabled Check this box to enable the promotion. Result section Type Select the promotion type from the drop-down list. Term Specify the promotion term. Index Select the promotion index from the drop-down list. Margin Specify the promotion margin rate. Cancel Delq Days Specify the promotion cancellation delinquency days. Cancel Overlimit% Specify the promotion cancellation over limit percentage. Selection Criteria section Company Select the portfolio company from the drop-down list. Branch Select the portfolio branch from the drop-down list. Product Select the product from the drop-down list. State Select the state from the drop-down list. - Perform any of the Basic Actions mentioned in Navigation chapter.

Parent topic: Product