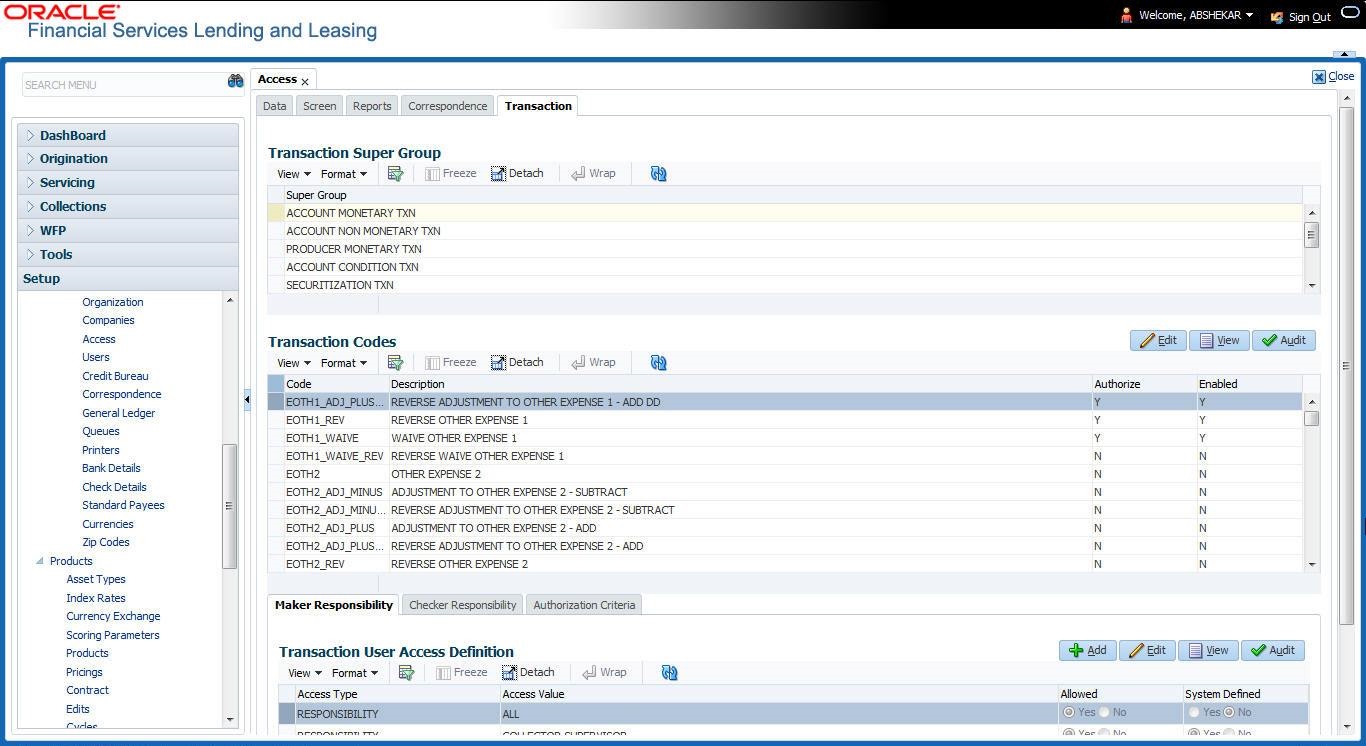

3.3.5 Transaction

- ACCOUNT MONETARY TXN

- ACCOUNT NON MONETARY TXN

- PRODUCER MONETARY TXN

- ACCOUNT CONDITION TXN

- SECURITIZATION TXN

- ESCROW MONETARY TRANSACTIONS

- ESCROW NON MONETARY TRANSACTIONS

- FEE ASSESSMENTS

- ESCROW ANALYSIS AND DISBURSEMENTS

Along with restricting access, you can also define authorization permissions for monetary transactions. While defining authorization permissions, you can allow transactions to Authorize through assigned Maker/Check responsibilities with/without having specific authorization criteria defined. However, authorization criteria can be defined only for monetary transactions which needs authorization.

- Click Setup > Setup > Administration > User > Access > Transaction.

- In the Transaction Super Group section, select the super group you want to work with.

- In the Transaction Codes section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Table 3-18 Transaction Codes

Field Do this Code The system displays the transaction code you want to work with. Description Specify/Edit the description for the transaction. Authorize Check this box to enable authorization by another user. Such transactions can be authorized on the Authorization tab of Transaction Authorization screen in Servicing Module.

Note: For monetary transactions, system allows you to define both Maker and Checker authorization in the Maker and Checker Responsibility tabs respectively. For non-monetary transactions, you can define maker responsibility for authorization.

When the Authorization check box is not selected, any new transactions posted will not go for authorization.

For more information, please refer the Transaction Authorization (Maker-Checker) chapter in the Oracle Financial Services Lending and Leasing User Guide.

Enabled Select this box to enable the transaction. - Perform any of the Basic Actions mentioned in Navigation chapter.

You can define the authorization restrictions using the following sub tab:

- Maker Responsibility

- Checker Responsibility

- Authorization Criteria

Note:

Checker Responsibility and Authorization Criteria tabs are available only for monetary transactions (i.e. Authorize flag set to Y).

- Click Setup > Setup > Administration > User > Access > Transaction.

- In the Transaction Super Group section, select the super group you want to work with.

- In the Maker Responsibility section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Table 3-19 Maker Responsibility

Field Do this Access Type Select RESPONSIBILITY as the access type from the drop-down list. Access Value Select the user responsibility from the drop-down list. Allowed Select Yes to allow access or No to restrict access to the entry in the Transaction Codes section, based on the access type and value. System Defined Select Yes, if the transaction user access definition entry is system defined.

Select No, if the transaction user access definition entry is manually defined.

- Perform any of the Basic Actions mentioned in Navigation chapter.

To define Checker Responsibility

- Click Setup > Setup > Administration > User > Access > Transaction.

- In the Transaction Super Group section, select the super group you want to work with.

- In the Transaction Codes section, select the monetary transaction with the Authorize flag as Y.

- In the Checker Responsibility section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Table 3-20 Checker Responsibility

Field Do this Access Type Select CHECKER RESPONSIBILITY as the access type from the drop-down list. Access Value Select the user responsibility from the drop-down list. Allowed Select Yes to allow access or No to restrict access to the entry in the Transaction Codes section, based on the access type and value. System Defined Select Yes, if the transaction user access definition entry is system defined.

Select No, if the transaction user access definition entry is manually defined.

- Perform any of the Basic Actions mentioned in Navigation chapter.

To define Authorization Criteria

- Click Setup > Setup > Administration > User > Access > Transaction.

- In the Transaction Super Group section, select the super group you want to work with.

- In the Transaction Codes section, select the monetary transaction with the Authorize flag as Y.

- In the Authorization Criteria section, you can add/edit the following details in the Criteria Name and Criteria Details section.

- In the Criteria Name section perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Table 3-21 Criteria Name

Field Do this Name Specify a name for the criteria. Description Specify a description for the criteria. Authorization Level Specify the level of authorization responsibility in numeric value.

Note: You will need to specify the same value as defined for each user within Checker Responsibility Lookup Type (CHECKER_ RESPONSIBILITY_CD) in Setup > Administration > System > Lookups screen.

Enabled Select this box to enable the criteria. - Perform any of the Basic Actions mentioned in Navigation chapter.

- In the Criteria Details section perform any of the Basic Operations mentioned in Navigation chapter.

Note:

Although system allows to define customized selection criteria, the execution of additional selection criteria requires additional processing at server level and can have significant performance impact delaying the EOD processing/web services. Hence it is recommended to have careful consideration while defining the additional selection criteria (like using user-defined tables and columns) and/or get approval from your database administrator before using any selection criteria.A brief description of the fields is given below:Table 3-22 Criteria Details

Field Do this Seq Specify a sequence number. ( Specify the open/entry criteria. Parameter Select the transaction parameter from the drop-down list.

The list displays transaction parameters for the selected transaction and the parameters in user defined table INP_BMP_ACC.

Comparison Operator Select the comparison operator from the drop-down list. Criteria Value Specify the required criteria value for validation. ) Specify the close/exit criteria. Logical Expression Select the logical operator from drop-down list. Enabled Select this box to enable the criteria. - Perform any of the Basic Actions mentioned in Navigation chapter.

- Click Check Criteria to validate the correctness of the statement and to resolve errors, if any.

You can add multiple checker responsibility and define multiple selection criteria for each checker responsibility.

Parent topic: Access