D.1 Variable Interest Rate Lease

Variable interest rate lease is one in which the interest component of payable lease can fluctuate over time. Fluctuation can be either due to periodic changes in index rate or varying interest rates in market. Accordingly, lease amount may increase or decrease depending on variable interest rate.

For Variable rate lease, the interest rate basically consists of two components:

- Index rate - The index rate component is based on the financial market and may fluctuate accordingly.

- Margin rate - The margin rate component is the fixed rate, which normally does not change during life of the lease.

Note:

Interest rate = Index rate + Margin rate.

During lease origination and up to the funding process, the interest rate is computed based on the prevailing index rate at the time of approval. However, once the lease is funded, the interest rate on the lease may change when the index rate changes. This interest rate change may causes changes in the lease repayment amount, if specified in the terms of the contract.

Oracle Financial Services Lending and Leasing supports the variable rate functionality for closed-end lease during the originating, funding, and servicing of new products and lease with interest rates based on various industry-standard interest rate indices.

Variable rate calculation for Lease is supported for Interest Rate calculation method only. During product setup, on selecting the lease calculation method as Interest Rate, the following fields are enabled and also the Rate Adjustments sub tab is available to specify the details:

- Flexible Repayment

- Index Rounding

- Reschedule Method

- Reschedule Value

Note the following for lease variable rate calculation:

- The index rate changes are bound by Rate Cap & Adjustments and Payment Caps which are defined at Setup > Contract level.

- If the change payment is greater than Max Pmt Inc/ Life, system does not post Rate Change and Term Change transactions and displays an error indicating ‘Rate Change not allowed, as new payment amount exceeds max increase life’ to avoid impact on residual value usage.

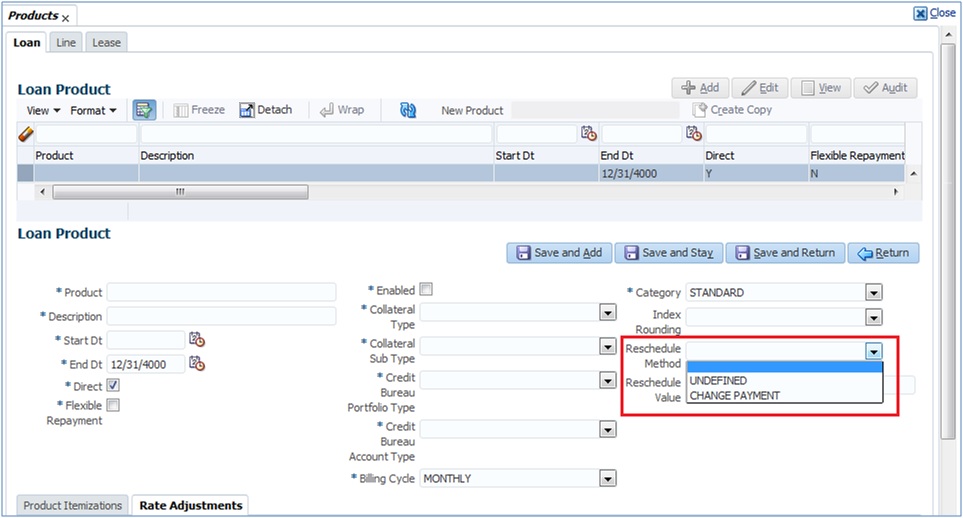

During the Product setup, you can define and control the changes in lease amount using Reschedule Method and Reschedule Value fields.

Figure D-1 Variable and Fixed Interest Rate

- When Reschedule Method is selected as UNDEFINED, no payment changes are allowed.

- When Reschedule Method is selected as CHANGE PAYMENT, and Reschedule Value is specified as 0, lease amount changes every time depending on the variable rate.

- When Reschedule Method is selected as CHANGE PAYMENT, and Reschedule Value is specified in percentage (i.e. 5%, 10%) lease amount changes only when the variable rate increases upto the defined percentage. (For example, if change percentage is specified as 10%, lease amount changes only if the variable rate increases by 10%. Else, no change is allowed.)

Hence the impact of variable rates on lease amount can be controlled to stop negative amortization.

This section consists of the following topic: