4.5 Products

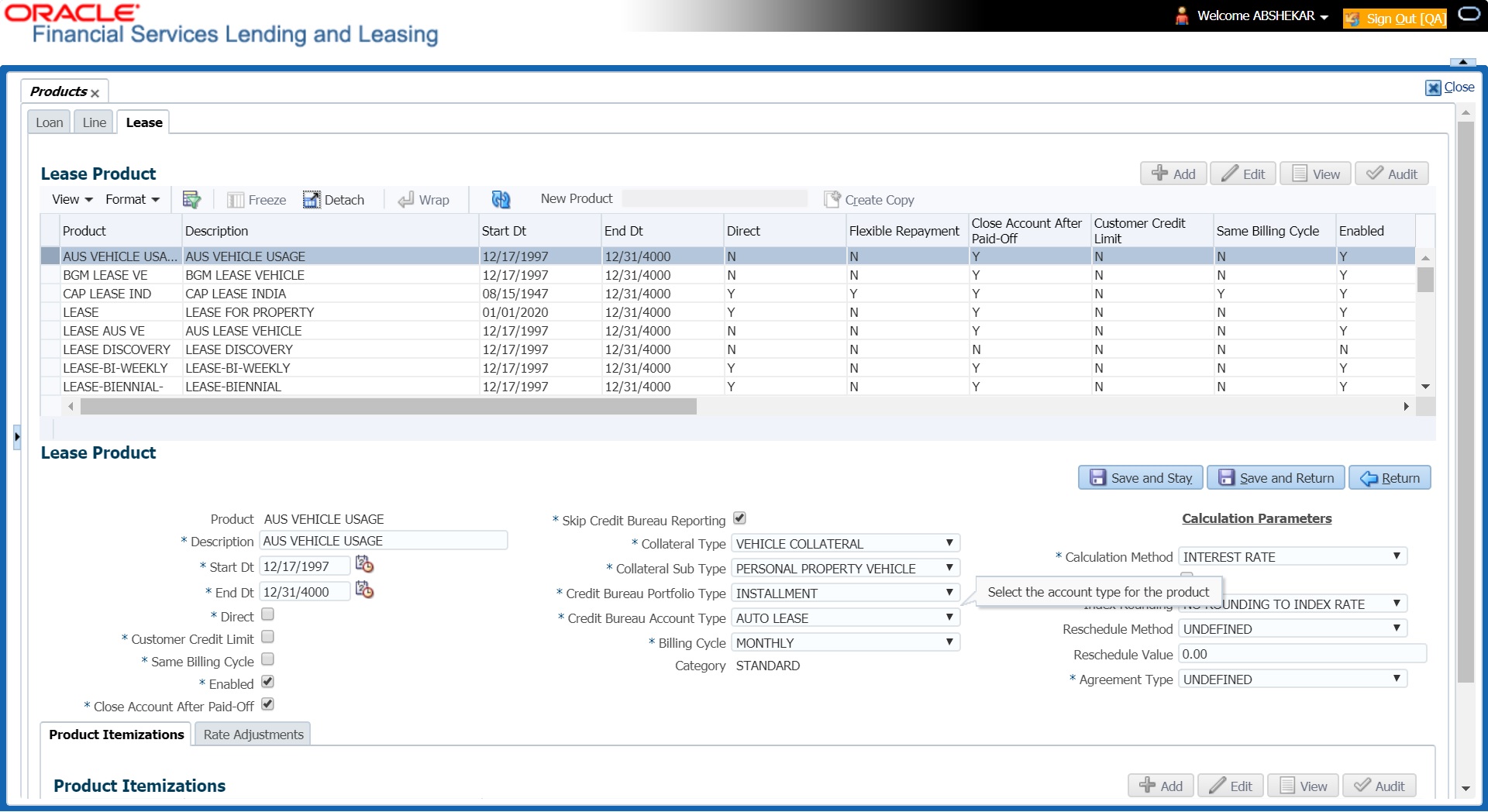

The Product screen defines the closed ended products your organization offers. This screen is enhanced to support Islamic along with the conventional.

- The collateral type and sub type

- The billing cycle

- Whether the amount is paid directly or indirectly to the customer

The Product Definition section records details about the product such as the description, start and end dates, collateral type and sub type, credit bureau reporting attributes, billing cycle, index and rate calculation attributes.

- BILL_CYCLE_CD

- LEASE_BILL_CYCLE_CD - For lease accounts, the Biennial and Triennial billing cycles are applicable only for Interest Rate type of Calculation Method and for both Advance and Arrears type of Rent Collection Methods. However, these billing cycles are allowed for Balloon Method - N+1 and not allowed for Flexible repayment > Skip Months and for Agreement type, Usage, Rental, Rental Usage types.

For a lease product definition, the calculation is based on either Rent Factor or Interest Rate and Contract and Pricing definition will be driven depending on one of the above option selected.

The Product Itemization section is used to define itemized entries for a product. This information is used on the Itemization sub screens of the Application Entry and Application screens.

The Rate Adjustments section is used to define the frequency of rate change allowed during interest rate calculations.

To set up the Product

- On the Oracle Financial Services Lending and Leasing home screen, Setup > Setup > Administration > User > Products > Products > Lease.

- In the Product Definition section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Table 4-14 Product Definition

Field Do this Product Specify the product code as defined by your organization (in other words, how you want to differentiate the products). For example, products can be differentiated according to asset. The product code, or name, is unique. Description Specify the description of the product. (This is the product description as it appears throughout the system). Start Dt Specify the start date for the product. You can even select the date from the adjoining Calendar icon. End Dt Specify the end date for the product. You can even select the date from the adjoining Calendar icon. Direct Check this box, if you need the product to be originated directly to customer. (In this case, the compliance state is the state listed in the customer’s current mailing address.) If unchecked, the product is an indirect lending product; that is, payment is made to the producer. (In this case, the compliance state is the state listed in the producer’s address.) Close Account After Paid- Off Check this box to allow the account to be closed once the account is paid off i.e. system closes the account after the number of days specified in the system parameter has elapsed. This option is selected by default.

If not selected, system ignores the system parameter and does not close the account even if the account is paid off i.e. system keeps the accounts active so that the equity can be traded with other accounts. For information on accounts trading, refer to Appendix - Trading of Accounts chapter.

Note: If the business practice of a financial institution is not to close the accounts then this Indicator need to be unchecked. Mainly in the Vacation Ownership where a Timeshare product can be traded anytime even if the account is paid-off, this feature is used.

Customer Credit Limit Check this box to enable Customer Credit Limit tab in Origination module. Using the Customer Credit Limit tab, an underwriter can define a specific credit limit for the customer while funding the first application and based on that credit limit, subsequent applications can be funded.

For more information, refer to Customer Credit Limit details in User Guide.

Same Billing Cycle Check this box to set the same billing cycle (supported only billing cycles Monthly and Weekly) for all the future applications funded for an existing customer. Enabled Check this box to activate the product.

Note: You can check this box only when Rate adjustment schedule is maintained, i.e., All the products should be variable rate products.

Skip Credit Bureau Reporting Check this box to skip credit bureau reporting of all Accounts funded with this product type - i.e. on funding an application, that particular account is enabled with this parameter and is excluded when the metro II batch job is run for credit bureau reporting.

This option can also be enabled/disabled at individual account level in Servicing by posting Skip Credit Bureau Reporting Maintenance nonmonetary transaction.

However note that existing behaviour of Stop Bureau Account condition would still be applicable.

Collateral Type Select the collateral type for the product, from the drop-down list. This field identifies what type of collateral is associated with the and assists the system in identifying the correct screen(s) to display. Collateral Sub Type Select the collateral sub type for the product, from the drop-down list. Credit Bureau Portfolio Type* Select the credit bureau portfolio type for the product, from the dropdown list. Credit Bureau Account Type* Select the account type for the product, from the drop-down list.

*Note: The Credit Bureau Portfolio Type and Credit Bureau Account Type fields determine how the portfolio is reported back to the credit bureaus.

Billing Cycle Select the billing cycle for the product, from the drop-down list.

Note: This field is not editable and the billing cycle is selected as MONTHLY by default if the lease calculation method is selected as RENT FACTOR.

Category By default the category of the product is selected as STANDARD and is not editable. Calculation Parameters: This section allows you to define the parameters for lease calculation starting from choosing the calculation method. Calculation Method Select the type of lease calculation method as one of the following:- RENT FACTOR (selected by default)

- INTEREST RATE

If the lease calculation method is selected as Interest Rate, the following fields are enabled in the screen and also the Rate Adjustments sub tab is available to specify the details:- Flexible Repayment

- Index Rounding

- Reschedule Method

- Reschedule Value

Flexible Repayment Check this box to allow flexible repayment for the Product. When you check this check box, the Flexible Repayment Allowed box of Repayment Options section available under Funding tab > Contract sub tab > Replacement sub tab of Funding screen.

Note: On the Repayment sub screen of Contract link on Funding screen, you may only enter the desired repayment schedule type in the Repayment section’s Type field if the Flexible Repayment Allowed is selected.

Index Rounding Select the index rate rounding factor for the product, from the drop-down list.

Note: For more information, refer Appendix C: Rounding Amounts and Rate Attributes.

Reschedule Method Select the rate change reschedule method for the variable rate product, from the drop-down list. Select CHANGE PAYMENT, if you want to automatically recalculate the repayment amounts on the interest rate change. Select UNDEFINED (the default value), if you do not want to take any action on interest rate change. Reschedule Value Specify the value in percent (%) to decide the repayment change. For example, if you enter 10, then the periodic repayment amount will change only if the newly computed repayment amount is higher by 10% of the previous repayment amount. Specify 0 if you want to change repayment amounts with every index rate change. Agreement Type If you have selected the Collateral Type as either VEHICLE COLLATERAL or HOUSEHOLD GOODS AND OTHER COLLATERAL, you can select one of the following types of lease agreement from the drop-down list for further calculation:- USAGE

- RENTAL

- USAGE RENTAL

Note: For each Usage or Rental details defined in Asset Type screen, you can define only one record for each asset type (i.e. one for Usage and one for Rental).

Based on the selected option, OFSLL handles the lease calculation and billing. For more information on Usage based leasing, refer to Appendix : Usage Based Leasing chapter and for Rental based leasing, refer to Rental Agreement section in Lease Origination User Guide.

- Perform any of the Basic Actions mentioned in Navigation chapter.

Note:

The 'Reschedule Method' and 'Reschedule Value' fields allows you to define and control the changes in lease amount for Variable and Fixed rate lease during originating, funding, and servicing. For more information, refer Appendix : Variable and Fixed Interest Rate.

This section consists of the following topics:

Parent topic: Product