9.6.1 Post Transaction

Once the invoice details are approved, you can post a transaction for the approved invoice through the Invoice screen by clicking on Post Txns button. The button is enabled only for invoice with status APPROVED and IN PROCESS.

Before posting the transaction, verify the status of Collectible in Invoice Details section. During auto invoice validation, the Collectible field is automatically marked as Y if the same combination of a service and work order status matches with the state specific rule defined in Setup > Administration > System > Vendors > Invoice Rules tab.

If the Collectible field is Y then the transaction is posted as Expense onto the account based on the setup. Else, if the Collectible field is N accounting for the same needs to be manually handled.

On clicking Post Txns button in invoice screen, the following transactions are initiated:

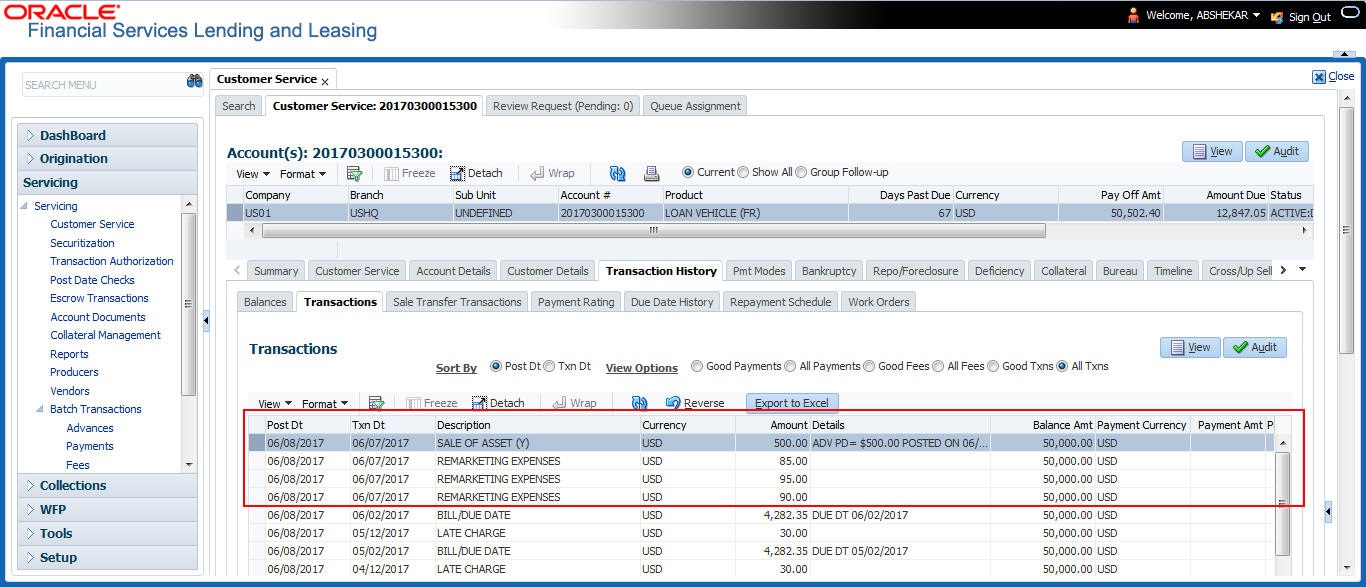

- Sale of Asset transaction - indicates the amount received after selling the asset. Also while posting this transaction, system calculates the Spread based on matching spread in Spread Matrix or from Contract Spread.

- Expense transactions. indicates the additional charges incurred by vendor to sell the asset and corresponding association of those transactions which are in-turn posted on to the account.

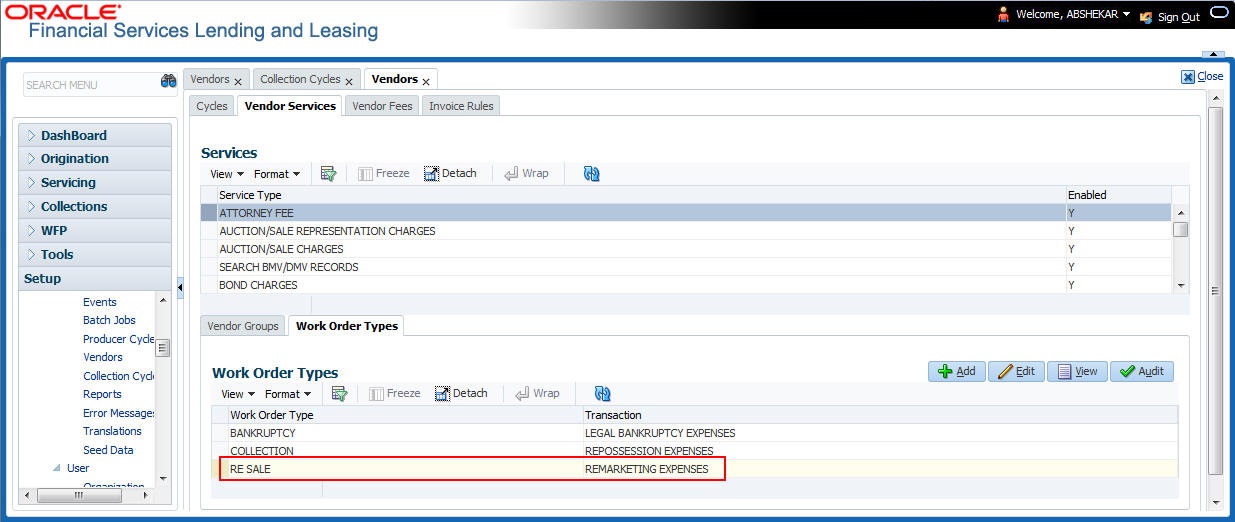

Depending on the Vendor Services setup defined in Setup > Administration > System > Vendors > Vendor Services > Work Order Types tab, specific transactions are posted. However, the same is configurable.

All the transactions posed on the account are recorded and listed in the Collections > Customer Service > Transaction History > Transactions tab.

Note:

The posted transaction can be reversed in the Transactions tab, but this does not impact/ change the status of Invoice or Remarketing.Parent topic: Invoicing