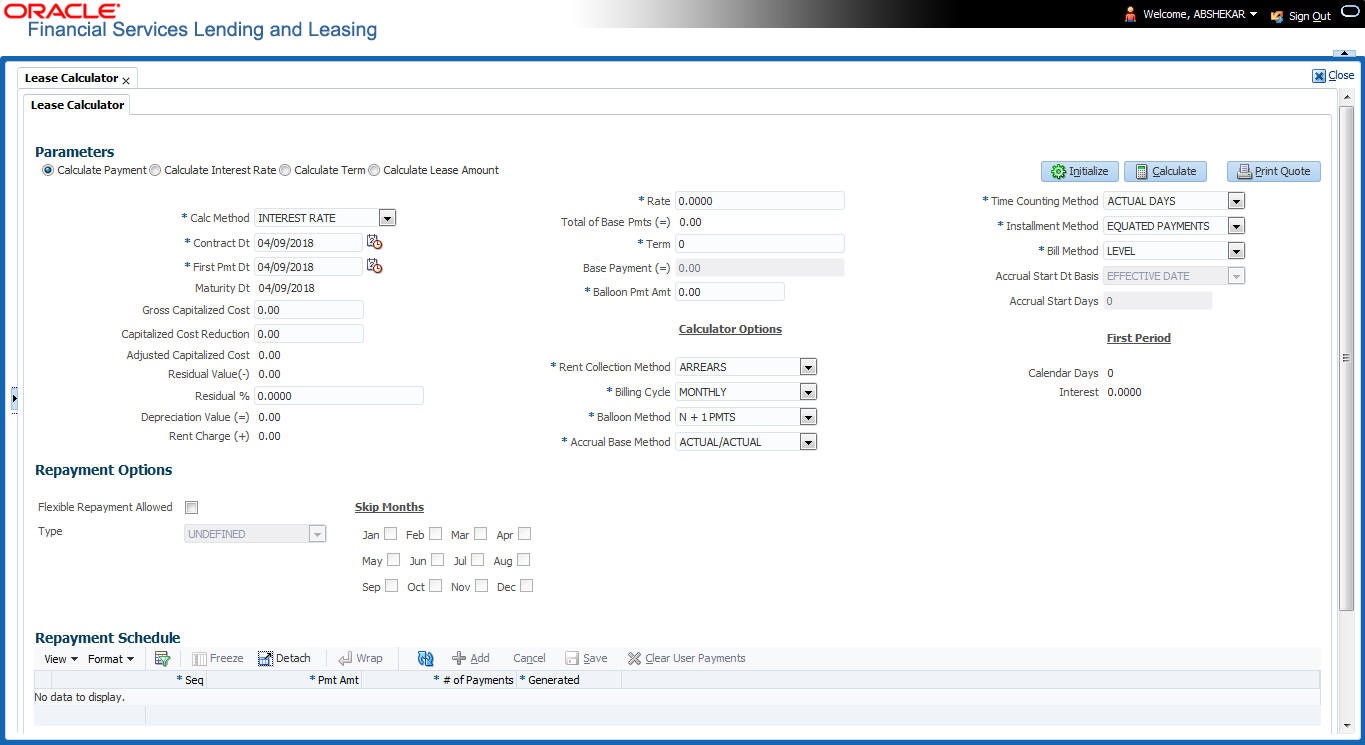

11.1 Lease Calculator

The Lease Calculator screen facilitates you to calculate various lease parameters such as Payment, Interest Rate, Residual Percent, Gross Capitalized Cost, Term and Lease Amount. You can define flexible repayment options, repayment/rate schedule and generate amortization schedules.

This screen is similar to the Lease Calculator screen opened from Underwriting or Funding screens; however, calculators opened from Tools master tab are standalone and do not link calculations or lease information to any specific application.

Based on the type of lease calculation method, the following calculation parameters are available in Lease Calculator screen:

Table 11-1 Lease Calculator

| Lease Calculation Method | Calculation Parameters Available | To Calculate |

|---|---|---|

| Rent Factor | Calculate Payment | Base Payment |

| Calculate Rate | Rate | |

| Calculate Residual Percent | Residual % | |

| Calculate Gross Capitalized Cost | Gross Capitalized Cost | |

| Interest Rate and Amortized | Calculate Payment | Base Payment |

| Calculate Interest Rate | Rate | |

| Calculate Term | Term | |

| Calculate Lease Amount | Gross Capitalized Cost |

Note:

If you want to clear (or “refresh”) the lease calculator at any time, click Initialize in the Lease Calculator section.To calculate a lease payment

- On the Oracle Lending and Leasing home screen, click Tools > Tools > Lease Calculator.

- In the Parameters section, Calculate Payment option is selected by default and the lease calculation method as Rent Factor. Select the required calculation method and the calculation parameter to display the applicable fields in Lease Calculator screen.

- In the Lease Details section, complete the following fields:

Table 11-2 Lease Details

Field Do this Calc Method Select the type of lease calculation method as one of the following:

- RENT FACTOR (selected by default)

- INTEREST RATE

- AMORTIZED

Note: Based on the above selection, some of the fields in Lease Calculator screen are either enabled or disabled, and if enabled some may be displayed in view only mode with default supported option. The same is detailed in respective fields.

Contract Dt Enter the contract date. First Pmt Dt Enter the first payment date. Ensure that the payment date is later than the contract date.

Note: This field is disabled for Rent Factor type of lease calculation method and the value is defaulted from Contract Date. However, for Interest Rate type of lease calculation, this field is either editable or displayed in view mode based Rent Collection Method.

Maturity Dt View the maturity date. Gross Capitalized Cost Enter the gross capitalized cost. Capitalized Cost Reduction Enter the capitalized cost reduction. Adjusted Capitalized Cost View the adjusted cap cost. Residual Value (-) View the residual value. Residual% Enter the residual percentage. Depreciation Value (=) View the asset depreciation value. Rent Charge (+) View the rent. Rate Enter the rate. Rent Factor View the rent factor.

Note: This field is displayed only if the lease calculation method is Rent Factor.

Total of Base Pmts (=) View the total of payments. Term Enter the term. Base Payment View the base payment amount. Balloon Pmt Amt Specify the balloon payment amount.

Note: This field is displayed only if the lease calculation method is Interest Rate.

Calculator Options section Note: Except for Rent Collection Method (as Advance or Arrears), the other fields in this section are available only for Interest Rate type of lease calculation method and the default values are populated from Setup > Contract screen. Also the Rent Collection Method field is view only for Rent Factor calculation method.

Rent Collection Method Select the applicable rent collection method from the drop-down list.

If the lease calculation method is selected as Rent Factor, the rent collection method is set to ADVANCE by default. For Interest Rate calculation method, you can either select ADVANCE or ARREARS.

In case of ADVANCE, the first payment date is displayed in view only mode and value is automatically populated from contract date. The first bill would be generated on contract date.

In case of ARREARS, you can specify the first payment date as future date (but not the contract date) and bill would be generated from first payment date.

Billing Cycle Select the billing cycle frequency from the drop-down list. System displays the applicable billing cycle by default based on the product and the calculation method defined at Setup > Products screen. The editable nature of billing cycle is controlled by the system parameter UIX_BILL_CYCLE_ALLOWED_IND.

System supports Biennial (once every 2 years) and Triennial (once every 3 years) type of billing cycles. Based on BILL_CYCLE_CD lookup, the billing cycle frequency can be defined.

During Term calculation, the Rate field is always considered as per Year only. System displays an error to refine the input data if the calculation for Biennial term goes beyond 15 years and Triennial term goes beyond 10 years. For additional considerations of Biennial and Triennial term calculations (if any), refer to product release notes available at OTN library.

Balloon Method If the lease calculation method is selected as Interest Rate, then the balloon payment method for accounts funded using this instrument is N + 1 PMTS by default. Amortization happens based on N+1 payments. Accrual Base Method Select the accrual method used to calculate interest accrual for this instrument from the drop-down list. Time Counting Method Select the time counting method used to calculate interest accrual for this instrument from the drop-down list. Installment Method For Interest Rate type of lease calculation method, the installment method by default is EQUATED PAYMENTS where-in, the installment amount is same for all billing cycle. Bill Method Select the billing method for accounts funded using this instrument from the drop-down list. Accrual Start Dt Basis Select to define the start date from when the interest accrual is to be calculated for this instrument from the drop-down list.

Note:

If you select the Effective Date, then the interest is calculated from the Contract date + Start Days (indicated below).

If you select the Payment Date, then the interest is calculated based on (first payment date + Start Days (indicated below) minus one billing cycle).

Accrual Start Days Specify the number of grace days after which the interest accrual is to be calculated. Ensure that the number of grace days is less than first payment date. First Period section Calendar Days View the number of calendar days between contract date and the first payment date. The calendar days will differ based on the calendar method selected. Interest View the profit accrued for the calendar days. - In the Lease Calculator section, click Calculate to view the results. You can further proceed with below sections to define flexible repayment options, repayment/rate schedule and generate amortization schedules.