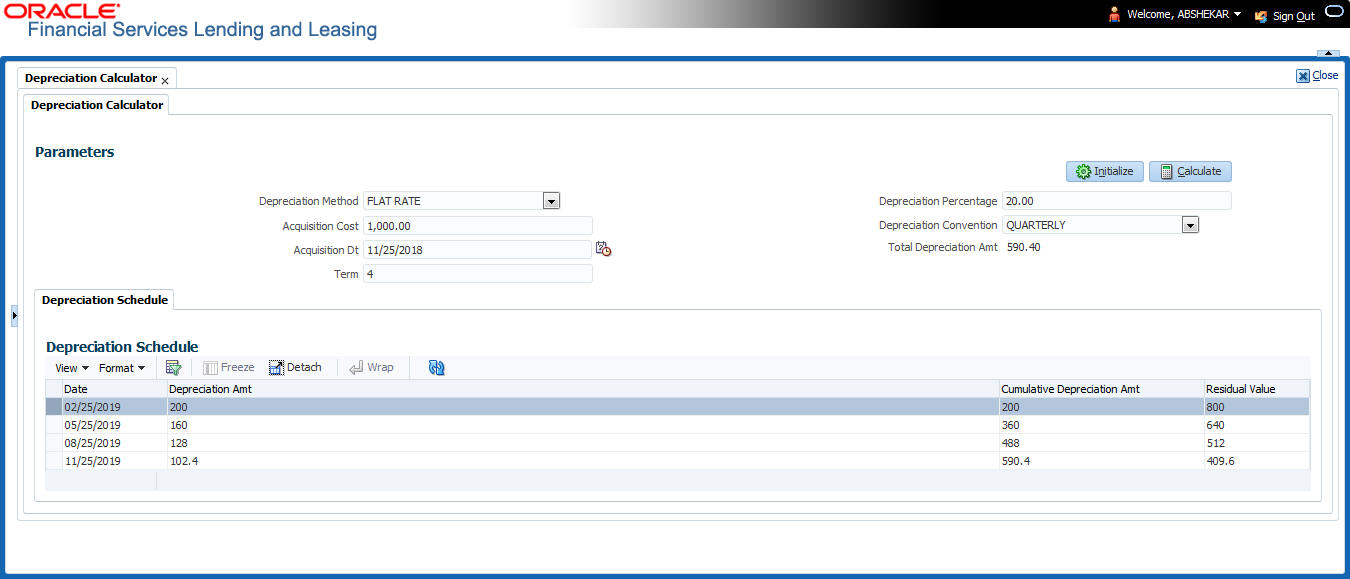

11.3 Depreciation Calculator

The Depreciation Calculator screen facilitates you to simulate depreciation calculation of an asset based on asset acquisition cost and using specific depreciation method, frequency and term. Further, you can view the depreciation amortization schedule based on calculation.

Depreciation Calculator is a standalone tab and information calculated here can only be viewed. They cannot be copied to the application / contract.

If you want to clear (or “refresh”) the Depreciation Calculator at any time, click Initialize in the Parameters section.

To calculate an asset depreciation

Parent topic: Tools