D.2.3.1 Calculate Tax in Customer Service

- For the calculation method defined in setup as either Flat Transaction Amount or Percentage of Transaction Amount, the scheduled batch job posts the following type of transactions:

Table D-12 Type of transactions

Transaction Code Batch Job Transaction Bill/Due Date TXNDDT_BJ_100_01 BILLING/DUE DATES PROCESSING DDT

BILL/DUE DATE

Late Charge TXNLTC_BJ_100_01 LATE CHARGE PROCESSING FLC

LATE CHARGE

- Along with the above transaction, system automatically posts SALES / USE TAX linking transaction to determine and update the tax component separately.

- For accounts with tax exemption, sales tax will not be calculated and link transaction is not posted.

- In case of reversal, if the parent transaction is reversed then corresponding child SALES / USE TAX tax transaction will also be reversed.

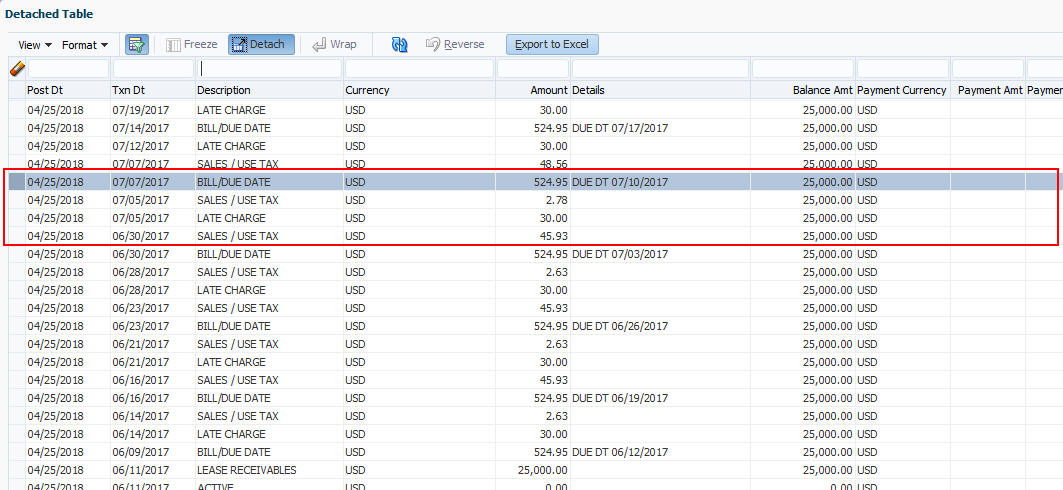

- On successfully posting the transaction, the details are updated on to the customer account in Customer Service > Transaction History > Transactions tab.

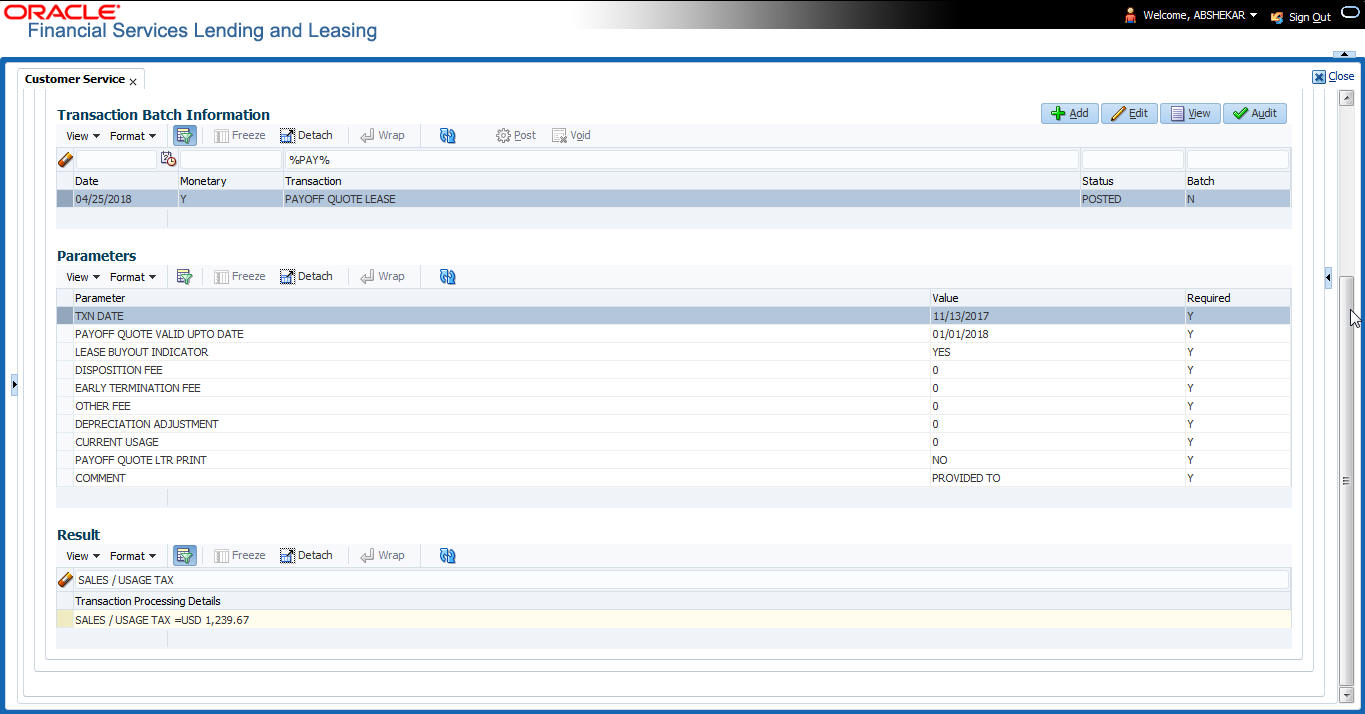

- For the calculation method defined in setup as Payoff Quote Lease, on posting this transaction system calculates the tax on unpaid Lease Receivables and displays the Sales / Usage Tax due bucket with the total of current outstanding and future dues.

Parent topic: Sales Tax Calculation at Customer Service