4.6.1 Account Details sub tab

Oracle Financial Services Lending and Leasing enables you to view account details using Account Details sub tab. In addition, you can use this screen to derive various account level business specific calculations and populate the computed values into the custom user defined fields.

Calculate Parameters

The Calculate Parameters button is available in the Account Information header. Clicking on it calculates the Target parameters for Account and all Collaterals linked to the account and populates the computed values in the custom user defined fields.

- The custom user defined fields have to be enabled in Setup > Administration > User > Access > Field Access Definition tab.

- User access to these custom fields are to be granted in Security User Access Definition Details sub tab.

- If required, these fields can be customized in the Label Configuration tab in Setup > Administration > System > Label Configuration screen.

- Further, the custom fields are to be configured to compute specific business calculations at Account level in Setup > Administration > System > User Defined Parameters screen.

For more information, refer to specific section in Setup guides.

In the Account Information section click View.

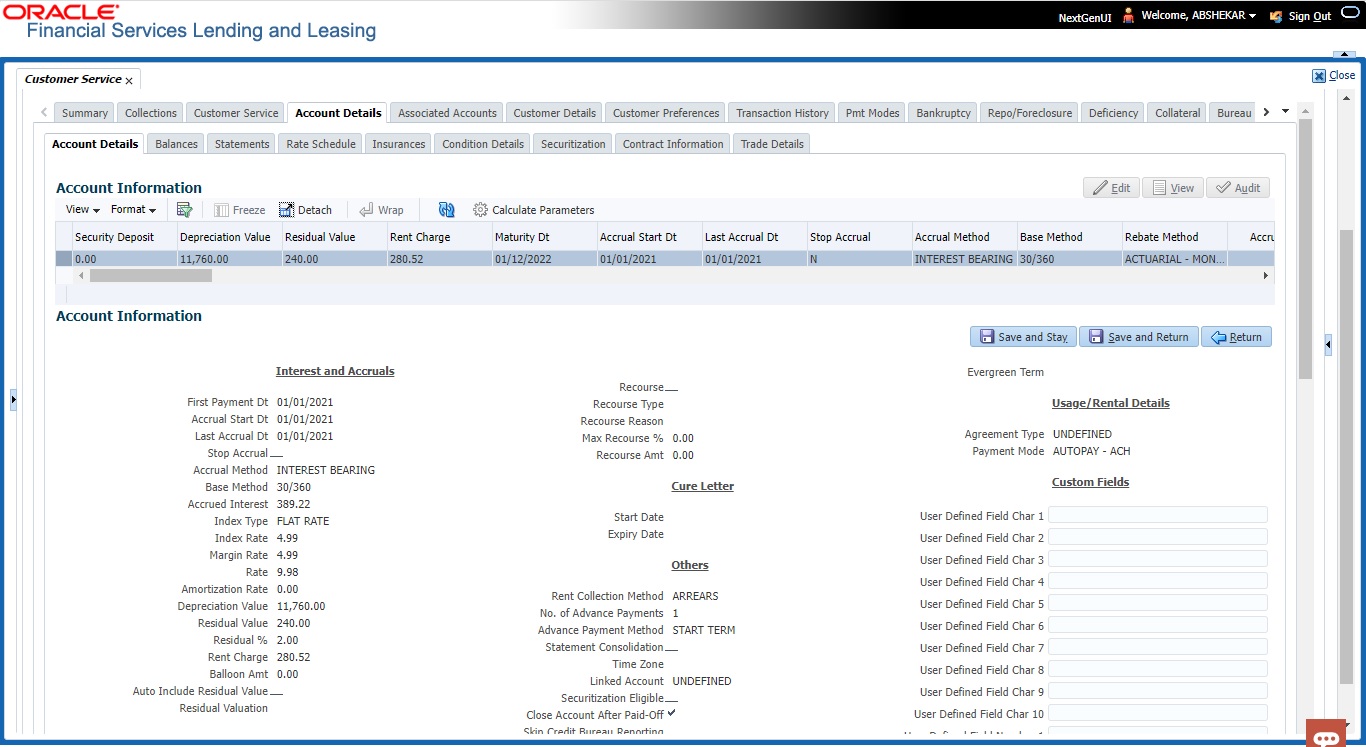

Figure 4-19 Customer Service - Account Details

View the following information for Lease servicing product.

Table 4-40 Account Details

| In this field | View this |

|---|---|

| Interest and Accruals section | |

| First Payment Dt | The first payment date. |

| Accural Start Dt | The accural start date. |

| Last Accural Dt | The last accural date. |

| Stop Accrual | If selected, indicates that the accrual has been stopped for the account. |

| Accrual Method | The accrual method. |

| Base Method | The base method. |

| Rebate Method |

The rebate calculation method. Note: This field is displayed for Rent Factor type of lease calculation. |

| Accrued Interest |

The accrued interest amount. Note: This field is displayed for Interest Rate type of lease calculation. |

| Index Type | The index type. |

| Index Rate | The current index rate. |

| Margin Rate | The current margin rate. |

| Rate | The current rate. |

| Amortization Rate |

The amortization rate that is used to calculate and generate amortized entries for GL handover. Note that this field is applicable only for SCHEDULED BASED (MONTH END ONLY) type of Amortization calculation method defined in Contract Setup > Amortization Balances sub tab. |

| Depreciation Value | The depreciation value. |

| Residual Value | The residual value. |

| Residual % | The residual percentage. |

| Rent Charge | The rent amount. |

| Balloon Amt |

The balloon amount. Note: This field is displayed for Interest Rate type of lease calculation. |

| Residual Value in Final Bill | If selected, indicates that the Residual value of the asset can be included in the final bill. |

| Residual Valuation |

The Residual Valuation as either Contract Value or Fair Market value. Note: Fair Market Value is referred from Collateral > Valuation tab. |

|

Capitalization section This section displays the capitalization parameters pre-defined at Setup > Contract screen. |

|

| Capitalize | If selected, indicates that the capitalization of balances is enabled for the account. |

| Frequency |

The capitalization frequency defined at Contract level. All the account balances are capitalized to principal in the same frequency except for Balance Frequency where different frequency may be defined for each balance type. |

| Capitalization Start Basis | View the capitalization start date as either Contract Date or First Payment Date on which capitalization next date is calculated. |

| Grace Days | View the grace days allowed in the frequency (minimum 0, maximum 31) before capitalizing the balances to account. |

| Cap Tolerance Amt | View the capitalization tolerance amount which is the minimum amount to qualify for capitalization. |

| Cap Run Date Next | View the date when capitalization batch job is next executed to capitalize account balances. |

| Rate Change Details section | |

| Rate Start of the Year | The start rate of the year. |

| Last Rate Adj Dt | The last rate adjust date. |

| # of Rate Adjs (Year) | The number of due date changes (year). |

| # of Rate Adjs (Life) | The number of due date changes (life). |

| Reschedule Method | The reschedule method. |

| Reschedule Value | The reschedule value. |

| Extn and Due Dates section | |

| # of Extensions (Life) | The number of times extensions granted (life). |

| # of Extension Term (Life) | The number of terms extensions granted (life). |

| # of Due Day Changes (Year) | The number of due day changes allowed in a year. |

| # of Due Day Changes (Life) | The number of due day changes allowed in a life of an account. |

| Last Extn Dt | The last extn date. |

| Due Day Change Dt | The due day change date. |

| Early Termination section | |

| Allowed To Terminate |

If selected, indicates that the contract is allowed to be terminated before the maturity date. Note that, system validates and allows termination only if either the Billed Term or Lease Amount Recovered % is met. |

| Billed Term | The minimum number of bills that needs to be generated before allowing for early termination. |

| Lease Amt Recovered % | The percentage of lease amount to be recovered to allow early termination. |

| Additional Details section | |

| Total Term | The total term. |

| Paid Term | The paid term. |

| Maturity Dt | The maturity date. |

| Security Deposit |

The security deposit amount paid during contract. Note: On posting SECURITY_DEP_ADJUST (Security Deposit Adjustment) transaction, the security deposit amount is deducted to adjusting the arrears on the account. |

| Payment Hierarchy | The Hierarchy Definition defined for payment allocation to corresponding due accounts. |

| Recourse Details - This section displays the recourse information captured in Origination or the information updated during servicing in the respective Contract screen. | |

| Recourse | View the recourse indicator. If selected, it indicates that there is a recourse associated with the Lease. |

| Recourse Type | The recourse type as either Partial or Full. |

| Recourse Reason | The recourse reason depending on the type of recourse selected. |

| Recourse Max % | Percentage of recourse allowed. |

| Recourse Amt | Flat recourse amount allowed. |

|

Cure Letter - This section displays the Cure Letter details if it has been issued on the account on nonconforming to certain terms that are in violation of obligations and which are to be fixed within the time provided in cure letter. System populates the Cure Letter details when the non monetary transaction CURE LETTER DATE MODIFY is posted on particular account. |

|

| Start Date | Displays the start date mentioned in Cure letter. |

| Expiry Date | Displays the date when the Cure notice expires. |

| Others | |

| Statement Consolidation |

View the statement Consolidation indicator propagated from Origination > Funding screen or updated by posting Master Account - Statement Consolidation Indicator Maintenance non monetary transaction. If checked, indicates that system generates consolidated billing statement at Master Account level along with details of all the associated accounts. If unchecked, system generates billing statement to only current account. |

| Time Zone | Customer’s time zone. |

| Linked Account |

The linked account number propagated from Origination after funding the application. Also the Linked account Xref Number or Linked account Number sent as pat of Account Boarding will be updated at Linked account. This field can also be updated by posting non-monetary transaction. For more information, refer to Linked Account Maintenance section. |

| Securitization Eligible | View the Securitization Eligible Indicator. If checked, indicates that the account is eligible for securitization. |

| Close Account After Paid-Off |

If checked, indicates that the account is allowed to be closed once the account is paid off i.e. system closes the account after the number of days specified in the system parameter has elapsed. If not checked, indicates that system does not close the account even if the account is paid off i.e. system keeps the accounts active so that the equity can be traded with other accounts. For information on accounts trading, refer to Appendix - Trading of Accounts chapter. |

| Skip Credit Bureau Reporting |

If checked, indicates that this account is skipped in Metro II batch job process and is not reported to credit bureau. This option is auto updated either on funding an application based on Product Setup or on posting Skip Credit Bureau Reporting Maintenance non-monetary transaction. |

| Allow Repossession on SCRA |

If checked, indicates that asset repossession is allowed on SCRA account who is on active military duty. This check box is not selected by default and is selected only when SCRA borrower on active military duty voluntarily offers financial institution to repossess the asset and REPOSSESSION MAINTENANCE non-monetary transaction is posted on the account. |

|

Statement section This section display the preferences for Mock Statement generation at Master Account level. The details here are propagated from Origination > Contract screen and can be updated using maintenance transaction. For more details, refer to Mock Statement Maintenance section in Appendix chapter. |

|

| Stmt preference mode | The account statement preference mode (Email or PHYSICAL) as defined in Origination > Contract screen is displayed here. |

| Mock Statement Req | If checked, indicates that account is to be included in Mock statement Generation. Based on this selection, others fields related to Mock Statement below are enabled. |

| Mock Statement Run Date Next |

The next date when Mock Statements is generated. Note: While generating Mock Statement, system considers the Mock Statement Date and Pre Bill Days to generate the next Mock Statement Run Date. In case the Mock Statement Next Run Date is less than Contract Date or GL Date which does not match the criteria, system moves the Mock Start Date to same month of next year. For more details, refer to Mock Statement Maintenance section in Appendix chapter. |

| Mock Statement Cycles | The total number of billings (between 1-12) that are to be generated post Mock Statement Start Date. |

| Mock Pre Statement Days | The number of Pre bill days for Mock Statements generation. |

| Stop Correspondence |

Stop correspondence indicator. If selected, indicates that account is excluded from sending letters or any other correspondence such as monthly statements. This option is not selected by default and can be updated by posting Stop Correspondence at Account Level non-monetary transaction. |

| Time Bar Details - System considers those accounts which are in ACTIVE or CHARGED OFF status and having dues, as time barred debts and displays the following time bar details: | |

| Start Date | View the time bar start date which is the last payment date made on the account. The time bar years is calculated starting from this date. |

| End Date | View the time bar end date. System calculates this date from the start date till the total time bar years specified in Setup > Products > Contract screen. |

| Days to Time Bar | View the total number of days remaining to reach the time bar end date. |

| Settlement Information - System displays the account settlement details when the Account Settlement Transaction is posted. | |

| Effective Dt | View the settlement agreement start date. |

| Good Through Dt | View the settlement agreement expiry date. |

| Agreed Amt | View the settlement amount agreed by customer to the lender. |

| Paid Till Dt |

View the total amount paid by the customer and allocated to account balances during the agreed period (between effective date and Good through date). System computes the total of all Good payment amounts received between effective date and good through date and displays total amount paid only after the batch (ACCOUNT SETTLEMENT PROCESSING) is executed. |

|

Ever Green Details This section displays Evergreen lease parameters propagated from Origination on funding a contract. These parameters are required for system to decide if the contract is eligible and automatically put the account on Evergreen mode on maturity. For more information, refer to Contract section in setup guide. These parameters can also be updated by posting LS_EVER_GREEN_MAINT (EVER GREEN MAINTENANCE non-monetary transaction. For more information, refer to Evergreen Lease Maintenance section. |

|

| Auto Post On Maturity | If selected, indicates that system is allowed to auto post evergreen lease transaction on maturity date + evergreen grace days. |

| Number of Unpaid Bills | The total number of unpaid bills exempted to auto renew contract to evergreen lease. |

| Unpaid Bills % |

The percentage of total unpaid bills exempted to auto renew contract to evergreen lease. System uses the greater of these two values i.e. Number of Unpaid Bills and Unpaid Bills % |

| Pmt Amount Method | The payment amount method used for billing on auto renewal of contract to evergreen lease. |

| Value | The value used to derive the asset usage billing amount based on Payment Amount Method. |

| Grace Days | The total number of grace days allowed after maturity for system to consider for auto renewal of contract to evergreen lease. |

| Evergreen Term | The new extension term which is the agreed term between customer and financial institution. |

| Usage / Rental Details | |

| Agreement Type |

View the Agreement Type if the current account belongs to any of the below category. Else, the same is displayed as UNDEFINED.

|

| Payment Mode |

View the type of repayment mode auto updated with one of the following options:

For an active Recurring ACH record, the payment mode is selected as AUTOPAY. |

| Custom Fields - This section displays the custom User Defined Fields if enabled in Setup and if configured, populates specific business computation values on clicking Calculate Parameters button. | |

| Agreement Details | |

| Agreement Number |

View the agreement number which is either propagated from Origination after funding the application or received from external system during account onboarding depending on the value of system parameter AUTO_GEN_AGREEMENT_NBR (AUTO GENERATE AGREEMENT NUMBER FOR ACCOUNT ONBOARDING). Note: Using this, you can group all those accounts with a particular agreement number. |

Parent topic: Customer Service screen’s Account Details tab