C.2.2.4 Generate Lease Sale and Usage Tax Report

After the sales tax details are calculated, you can retrieve the information to view the sales tax amount recorded during calculation and actual tax collected after funding, by generating Sales usage tax (Lease) report. This report can be generated for all applications with Sales Tax Mode and Tax Method UPFRONT/ PURCHASE_PRICE.

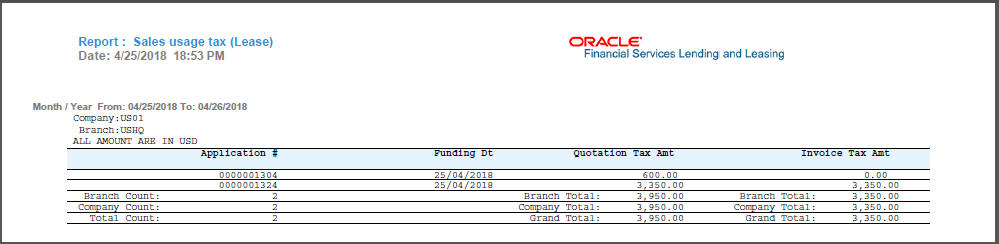

In the report, the tax recorded before funding is referred as Quotation Tax Amt and actual tax recorded for the application is referred as Invoice Tax Amt. Since this is a system generated report, any difference in these amount are to be manually updated into the account.

- From the LHS menu, click Origination > Reports link.

- In the Reports section, filter report with description SALES USAGE TAX - LEASE.

- In the Report Parameters section, select/specify the required parameters and click Run Report.

The report is generated in the selected format with the details as indicated below. For detailed information on report generation process, refer to Reports chapter in User Guide.

Figure C-3 Reports - Origination - Sales Tax

Parent topic: Sales Tax Calculation at Origination