C.2.2.1 Calculate Tax in Decision/Contract tab

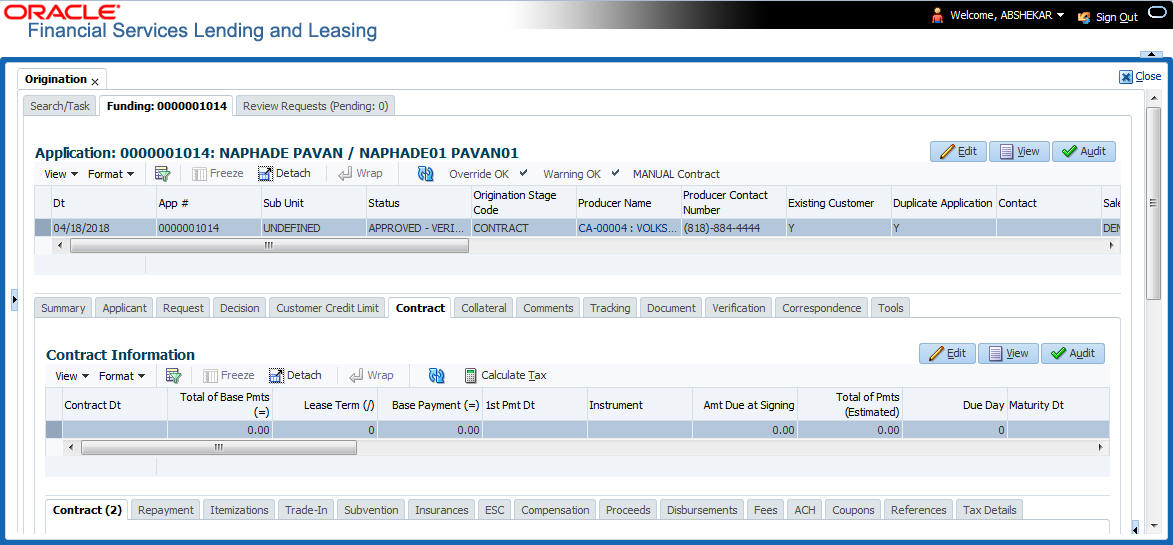

- Navigate to Origination > Underwriting / Funding > Decision/Contract screen.

Figure C-2 Calculate Tax in Decision/Contract tab

- Click Calculate Tax button. Based on the setup details, system calculates the sales tax for Upfront and Stream category in the following way:

- If Sales Tax Mode and Tax Method is UPFRONT/ PURCHASE_PRICE, the Sales and Usage Tax is calculated and updated into the itemization Cash Sale tax (ITM_CSH_SALES_TAX). On Funding, the tax amount calculated during origination will be part of Lease Receivable based on itemization adjustments.

- If Sales Tax Mode and Tax Method is CYCLE/ PAYMENT_STREAM, the Sales and Usage Tax is calculated and updated into the Contract fields - Estimated Sales Tax and Sales Tax to record the estimated tax amount and percentage. However, this data is not propagated to Account.

Parent topic: Sales Tax Calculation at Origination