- Guarantee/SBLC Advised Claim Update User Guide

- Guarantee SBLC Advised Claim Update

- Data Enrichment

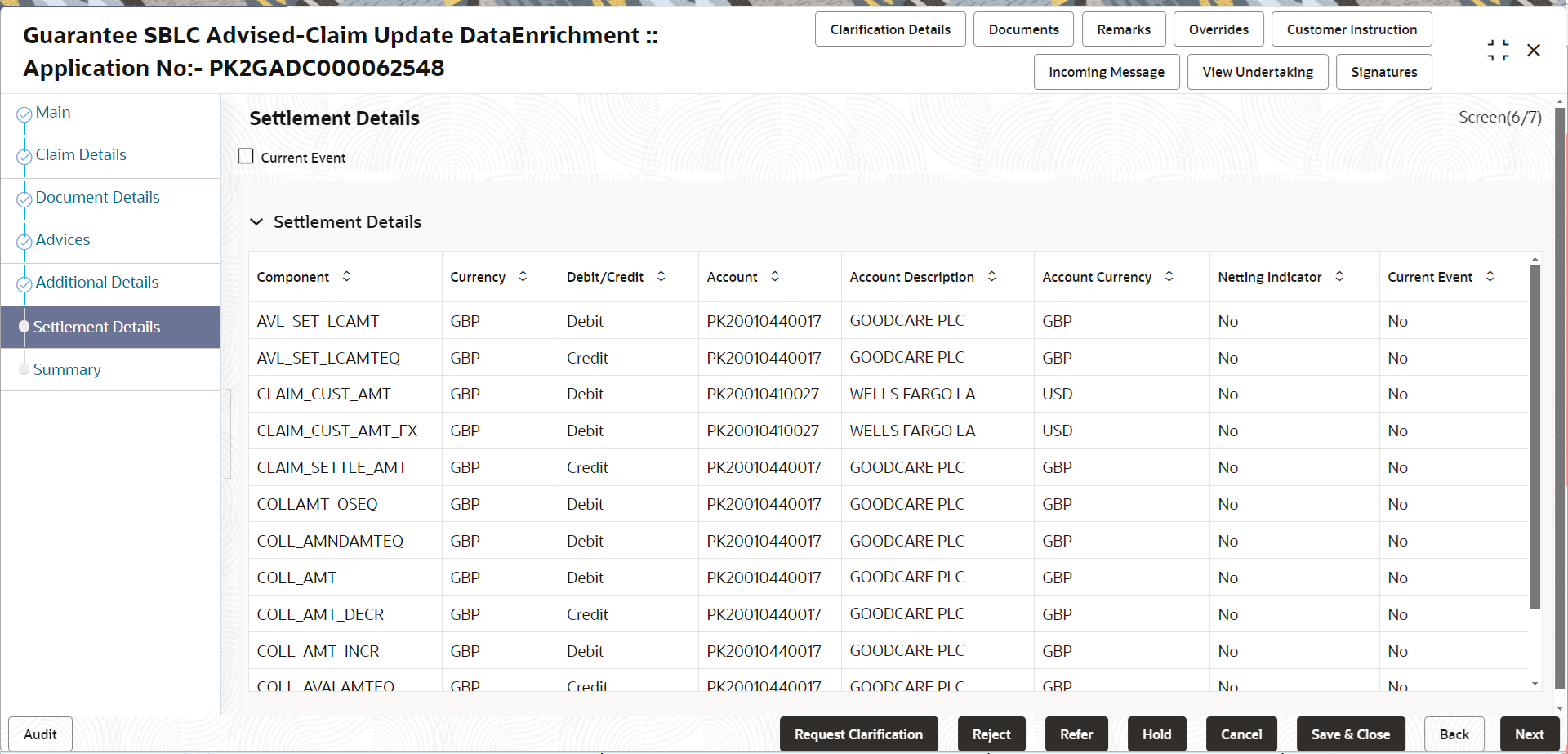

- Settlement Details

2.3.6 Settlement Details

This topic provides the systematic instructions to capture the settlement details of Guarantee SBLC Advised Claim Update request.

- On Settlement Details screen, specify the fields.

Figure 2-14 Settlement Details

Description of the illustration desettlementdetails.png

For more information on fields, refer to the field description table below.

Table 2-22 Settlement Details – Field Description

Field Description Current Event Select the check box to populate the settlement details of the current event associated with the task. On De-selecting the check box, the system list all the accounts under the settlement details irrespective of the current event Component This field displays the components based on the product selected. Currency This field displays the default currency for the component. Debit/Credit This field displays the debit/credit indicators for the components. Account This field displays the account details for the components. Account Description This field displays the the description of the selected account. Account Currency This field displays the currency for all the items based on the account number. Netting Indicator This field displays the applicable netting indicator. Current Event This field displays the current event. - Click any component in the grid.Party Details

Field Description Transfer Type Select the transfer type from the drop-down list. The options are:- Customer Transfer

- Bank Transfer for own account

- Direct Debit Advice

- Managers Check

- Customer Transfer with Cover

- Bank Transfer

Charge Details Select the charge details for the transaction. The options are:- Beneficiary All Charges

- Remitter Our Charges

- Remitter All Charges

Netting Indicator Select the netting indicator for the component. The options are:- Yes

- No

Ordering Customer Click search icon to search and select the ordering customer from the look up. Ordering Institution Click search icon to search and select the ordering institution from the look up. Senders Correspondent Click search icon to search and select the senders correspondent from the look up. Receivers Correspondent Click search icon to search and select the receivers correspondent from the look up. Intermediary Institution Click search icon to search and select the intermediary institution from the look up. Account with Institution Click search icon to search and select the account with institution from the look up. Beneficiary Institution Click search icon to search and select the beneficiary institution from the look up. Ultimate Beneficiary Click search icon to search and select the ultimate beneficiary from the look up. Intermediary Reimbursement Institution Click search icon to search and select the intermediary reimbursement institution from the look up. Payment Details

Table 2-23 Payment Details - Field Description

Field Description Sender to Receiver 1 Specify the sender to receiver message. Sender to Receiver 2 Specify the sender to receiver message. Sender to Receiver 3 Specify the sender to receiver message. Sender to Receiver 4 Specify the sender to receiver message. Sender to Receiver 5 Specify the sender to receiver message. Sender to Receiver 6 Specify the sender to receiver message. Remittance Information

Field Description Payment Detail 1 Specify the payment details. Payment Detail 2 Specify the payment details. Payment Detail 3 Specify the payment details. Payment Detail 4 Specify the payment details. - Click Next.The task will move to next data segment. For more information refer unresolvable-reference.html#GUID-A013E72E-BB24-44D3-A8FA-64616A3F6917.

Table 2-24 Settlement Details - Action Buttons - Field Description

Field Description Clarification Details Clicking the button opens a detailed screen, user can see the clarification details in the window and the status will be ‘Clarification Requested’. Documents Click to View/Upload the required document. Application displays the mandatory and optional documents.

The user can view and input/view application details simultaneously.

When a user clicks on the uploaded document, Document window get opened and on clicking the view icon of the uploaded document, Application screen should get split into two. The one side of the document allows to view and on the other side allows to input/view the details in the applicationRemarks Specify any additional information regarding the Guarantee Advised Claim Update. This information can be viewed by other users processing the request. Content from Remarks field should be handed off to Remarks field in Backend application.

Overrides Click to view the overrides accepted by the user. Customer Instruction Click to view/ input the following - Standard Instructions – In this section, the system will populate the details of Standard Instructions maintained for the customer. User will not be able to edit this.

- Transaction Level Instructions – In this section, OBTFPM user can input any Customer Instructions received as part of transaction processing. This section will be enabled only for customer initiated transactions.

Incoming Message Clicking this button allows the user should be able to see the message in case of STP of incoming MT 767. In case of MT798-MT726-MT759 request, user can view MT798 message(726-759) in this placeholder in Header of the task.

In case of MT798_MT788-MT799 request, user can view MT798 message (788-799) in this placeholder in Header of the process-task.

View Undertaking Clicking this button allows the user to view the undertaking details. Signatures Click the Signature button to verify the signature of the customer/ bank if required. The user can view the Customer Number and Name of the signatory, Signature image and the applicable operation instructions if any available in the back-office system.

If more than one signature is required, system should display all the signatures

Request Clarification Clicking this button allows the user to submit the request for clarification to the “Trade Finance Portal” for the transactions that are initiated offline. Reject On click of Reject, user must select a Reject Reason from a list displayed by the system. Reject Codes are:

- R1- Documents missing

- R2- Signature Missing

- R3- Input Error

- R4- Insufficient Balance/Limits

- R5 - Others

Select a Reject code and give a Reject Description.

This reject reason will be available in the remarks window throughout the process.

Refer Select a Refer Reason from the values displayed by the system. Refer Codes are:

- R1- Documents missing

- R2- Signature Missing

- R3- Input Error

- R4- Insufficient Balance/Limits

- R5 - Others

Hold The details provided will be saved and status will be on hold.User must update the remarks on the reason for holding the task. This option is used, if there are any pending information yet to be received from applicant.

Cancel Cancel the Data Enrichment stage inputs. The details updated in this stage are not saved. The task will be available in 'My Task' queue. Save & Close Save the details provided and holds the task in ‘My Task’ queue for further update. This option will not submit the request. Back Clicking on Back button, takes the user to the previous screen. Next On click of Next, system validates if all the mandatory fields have been captured. Necessary error and override messages to be displayed. On successful validation, system moves the task to the next data segment.

Parent topic: Data Enrichment