- Letter of Credit User Guide

- Define Product Attributes

- Create LC Product

3.1 Create LC Product

This topic provides the systematic procedure to create an LC product.

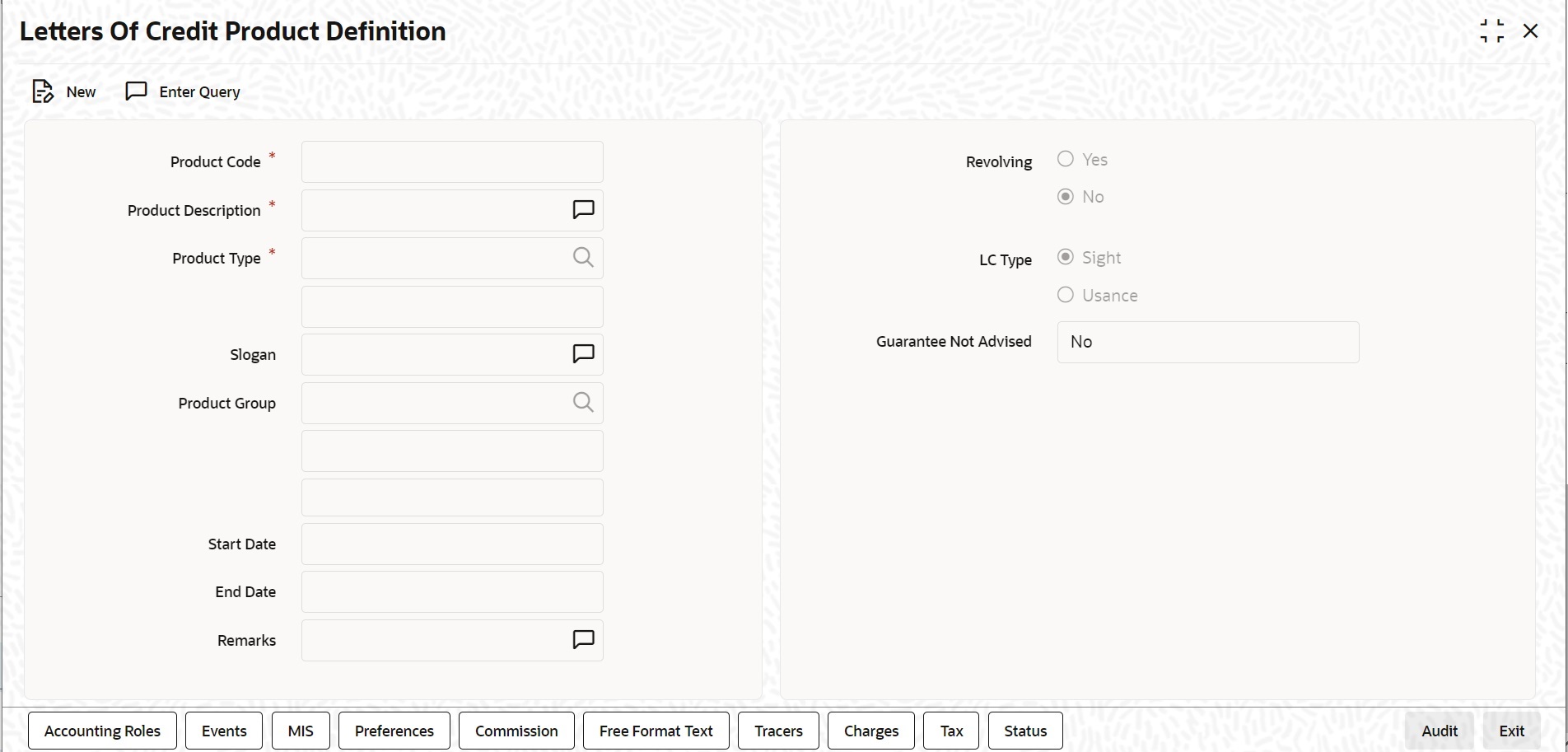

- On the Homepage, type LCDPRMNT in the text box, and click the next arrow.The Letters of Credit Product Definition screen is displayed.

Figure 3-1 Letters of Credit Product Definition

- On the Letters of Credit Product Definition screen, click New.The Letters of Credit Product Definition screen is displayed with no values in the fields.

For more information on fields, refer the Field Description table given below:

You can define the attributes specific to a letters of credit product in Letters of Credit Product Definition screen. You can view horizontal array of buttons in this screen:Table 3-1 Letters of Credit Product Definition - Field Description

Field Description Product Code Specify the Product Code. The code you assign to a product will identify the product throughout the module. The code must contain four characters. You can follow your own convention for devising the code, However, at least one of the characters must be a letter of the English alphabet. Since the code that you define is used to identify the product, it must be unique across the modules of Oracle Banking Trade Finance. For instance, if you have assigned the code ‘LC01’ to a particular product in this module, you cannot use it as a code in any other module.

This field is mandatory.

Product Description Enter a brief description of the product. This description is used to associate with the product and is also used to retrieve information. This field is mandatory.

Product Type The product type identifies the basic nature of a product. An LC product that you create in Oracle Banking Trade Finance can be of the following types: - Import LC - This is the basic LC product opened at the request of the importer (applicant) by the issuing bank in favour of an exporter beneficiary.

- Export LC - When an import LC has to be conveyed to the beneficiary through an advising bank, for the advising bank this is an export LC.

- Guarantee – This is an undertaking by the guarantor (bank) to make payment to the beneficiary of the guarantee in the event of a default by the applicant of the guarantee. Usually, the only document required for payment is a simple invocation letter. Guarantees are normally used in performance contracts

- Shipping Guarantee - This again operates on the lines of a guarantee but is used in the scenario where the shipping company releases the goods to an importer in lieu of a bill of lading (transport document) subject to a guarantee being issued in its favour

- Clean LC - A LC not backed by documents. Usually the only document in a clean LC would be the draft or bill of exchange. This type of LC is used where the goods have already been received and only the payment has to be settled through banking channels.

- Advice of Guarantee - When a guarantee has been received by a bank and is to be advised further to the beneficiary’s bank the product to be created would be an advice of guarantee.

- Reimbursement

- Transfer Type - This operates in line with Export type product. This type of product will be used for Child LC Creation in case of Transfer when use transfer product flag is checked at Trade Finance Bank Preference Maintenance

The entries that are passed, the messages that are generated and the processing of contracts involving the product, is determined by your input to this field.

The field is mandatory.

Slogan Specify a marketing punch-line to be associated with the product. This slogan will be printed on all the advices that are sent to the customer, for an LC involving this product. This field is optional.

Product Group Each product is classified under a specific group. The different groups are defined in the Product Group Definition table. This field is optional.

Start/End Date A product can be set up for use over a specific period, by defining a start and an end date. The Issue Date of an LC involving a product should be: - The same as or later than the Start Date

- The same as or earlier than the End Date.

This field is optional.

Remarks Enter information about the product, intended for the internal reference of your bank. The remarks are displayed when the details of the LC are displayed or printed. However, this information is printed on any correspondence with the customer. To maintain the allowed and disallowed customer and customer categories, click the button and process the Customer and Customer Restrictions screen. This field is optional.

Revolving LC products can be revolving or non-revolving. If you indicate that the product is revolving, you can associate the product with only revolving LCs. While actually processing revolving you can indicate whether the LC must revolve in time or in value. Note that if the product type is Reimbursement, the system will automatically select the option No. You will not be able to change it. If you indicate that the product is non-revolving, you can associate the product to only non-revolving LCs.Note:

All LCs will be of irrevocable nature. This field is optional.LC Type LC products can be sight or usance. The system displays an override message if the credit mode is not applicable for LI product. The system generates notification on authorization of any modification, addition or deletion of LC product details.

This field is optional.

Guarantee Not Advised This field denotes whether a product is of type Guarantee Not Advised or Not. Options are:- Yes - Guarantee Not Advised Product

- No - Not of type Guarantee Not Advised.

For Guarantee Not Advised products, followings are not allowed.Table 3-2 Buttons in Letters of Credit Product Definition

Field Description Accounting Roles Click this button to define the accounting role to accounting head mapping. Events Click this button to select the events for the product and then maintain event-wise accounting entries and advices. MIS Click this button to capture MIS related parameters. Preferences Click this button to define preferences like tenor, Prepayment option etc. Commission Click this button to define the Commission details. Free Format Text Click this button to attach the Documents and Free format text required for the Product. If you specify details in this screen for a Reimbursement type of product, the system will display an error message while saving the product. Tracers Click this button to enter details of the tracers that must be generated for all LCs under this product. Charges Click this button to define charge components, rules, events and other associated details. Tax Click this button to associate tax rules and select tax currencies. Status Click this button to define the criteria for LC status change. - Charge for BADV Event

- Accounting entries for BADV

- Event Advices for BADV Event

- Commission

- Tracer other than Guarantee Claim Tracer.

- Events other than BADV GCLM GCAM GCLR GCLP

For any product you create in Oracle Banking Trade Finance, you can define generic attributes, such as branch, currency, and customer restrictions, interest details, tax details, etc., by clicking on the appropriate icon in the horizontal array of icons in this screen.

You can define product restrictions for branch, currency, customer category and customer in Product Restrictions (CSDTFPDR) screen.

For details on product restrictions refer Product Restriction Maintenance chapter in Core Service User Manual.

You can define User Defined Fields in Product UDF Mapping screen (CSDTFUDF).

For details on User Defined Fields screen refer Other Maintenance’s in Core Service User Manual.

For a letters of credit product, in addition to these generic attributes, you can specifically define other attributes.

These attributes are discussed in detail in this topic.

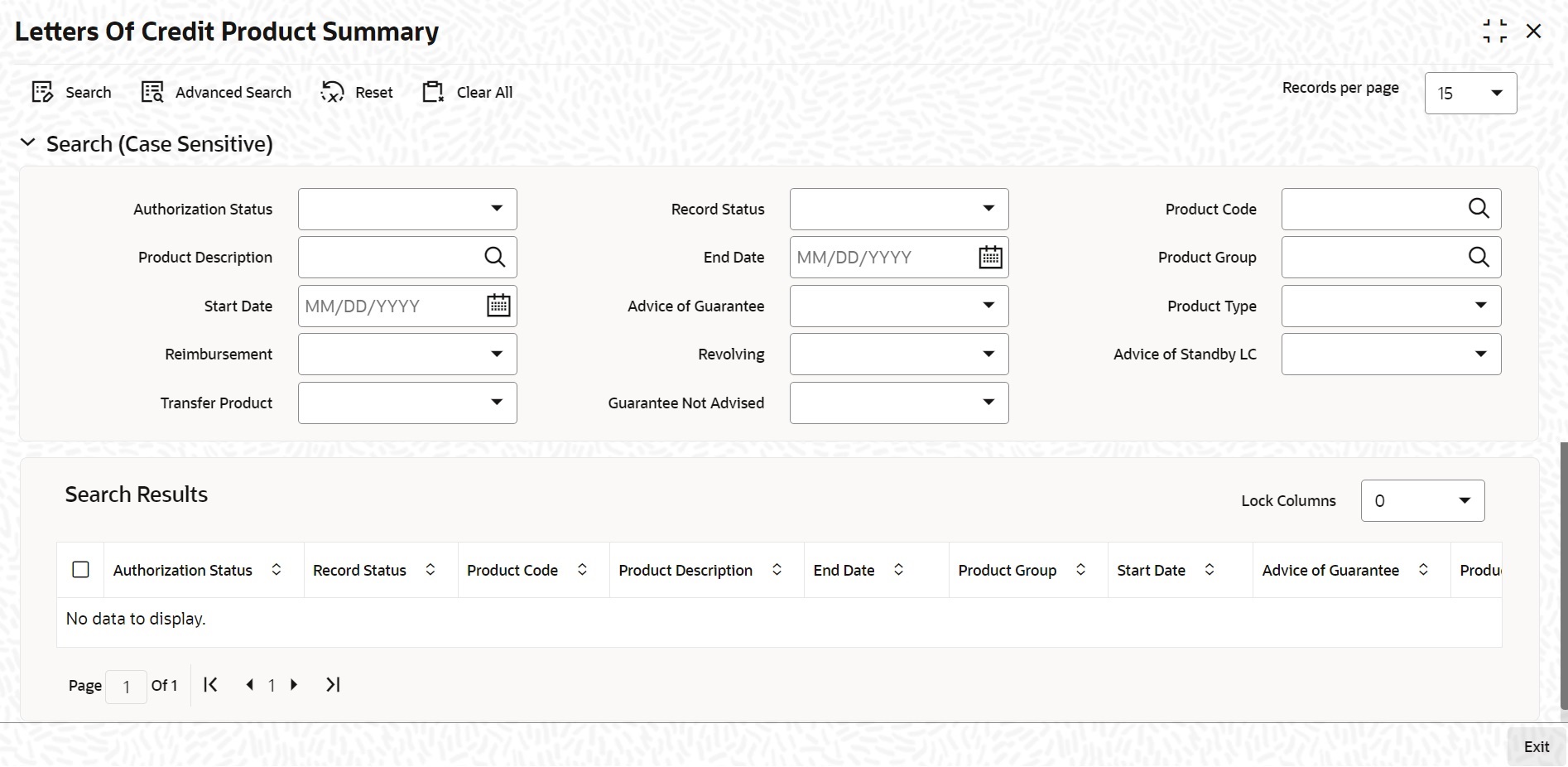

- On the Letters of Credit Product Summary screen, open an existing record.

The details of the products that you have created is displayed in a tabular format.

Figure 3-2 Letters of Credit Product Summary

- On the existing Letters of Credit Product Definition screen, you can perform the following operations:

- Create a new record

- Copy the details of letter of credit on to a new record.

- Unlock a record

- Close a record

- Reopen a record

- Unlock a record

- Print the details of a record

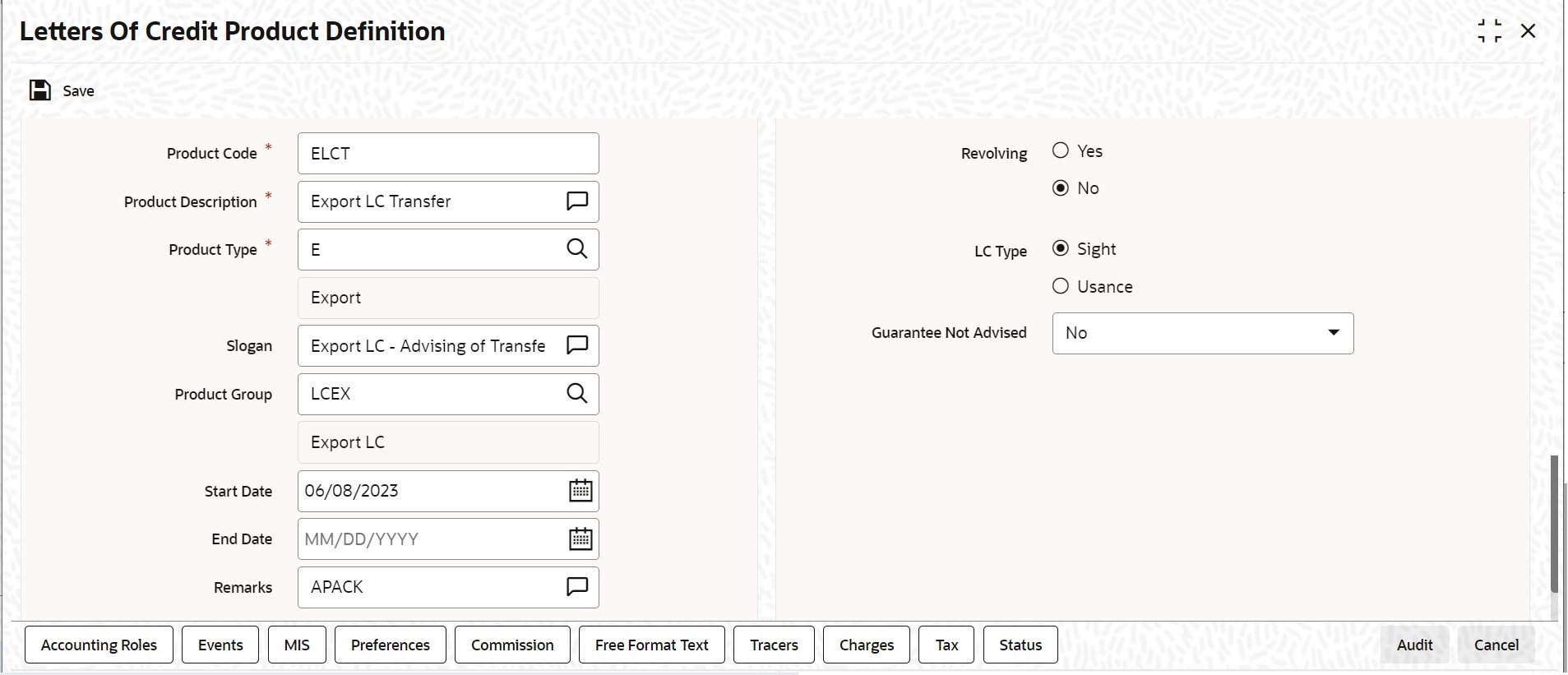

You can create/copy/unlock/close/print the details of a record.Figure 3-3 Letters of Credit Product Definition

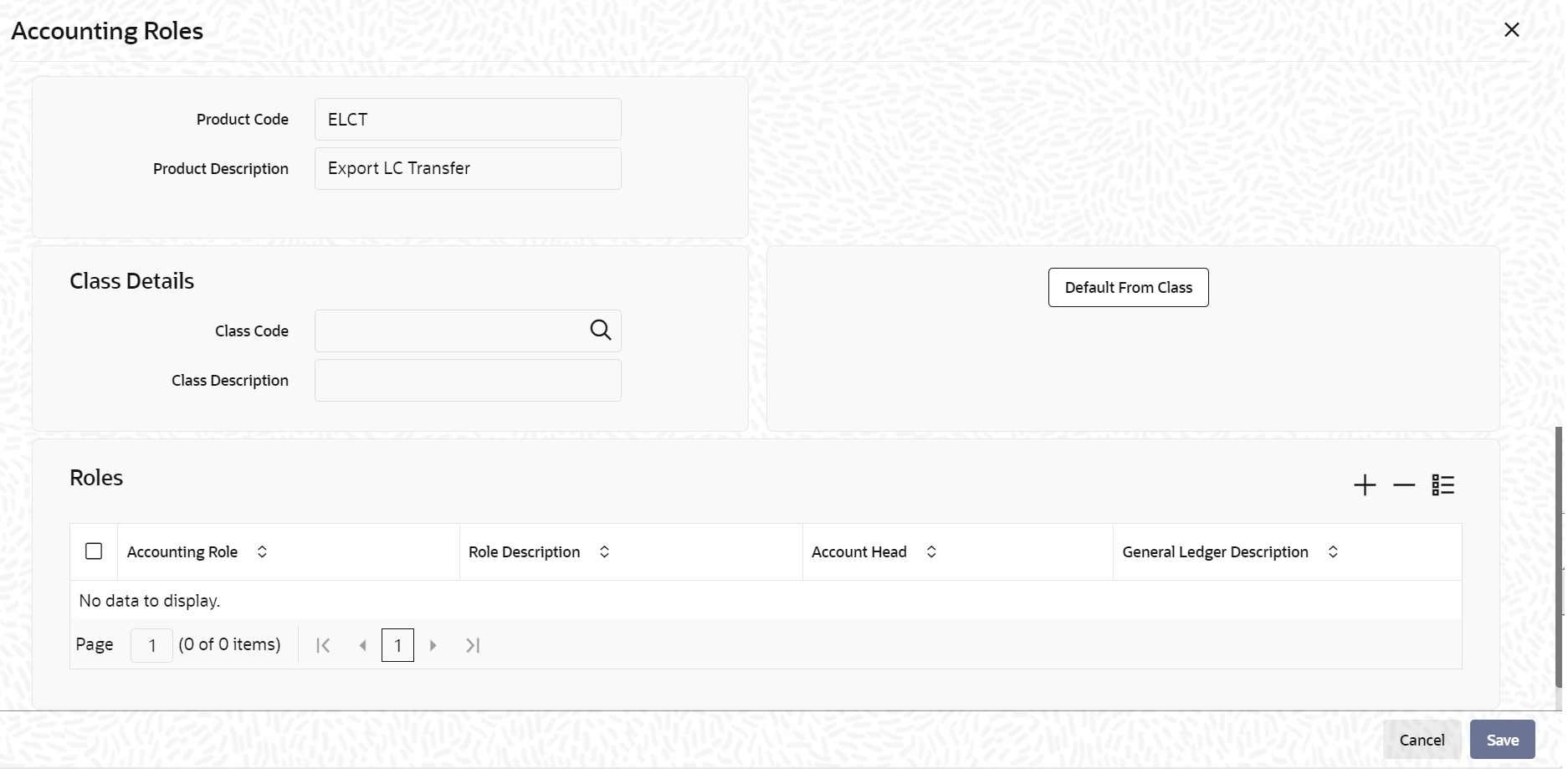

- On the Letters of Credit Product Definition screen, click the Accounting Roles button.The Accounting Roles screen is displayed.

Note:

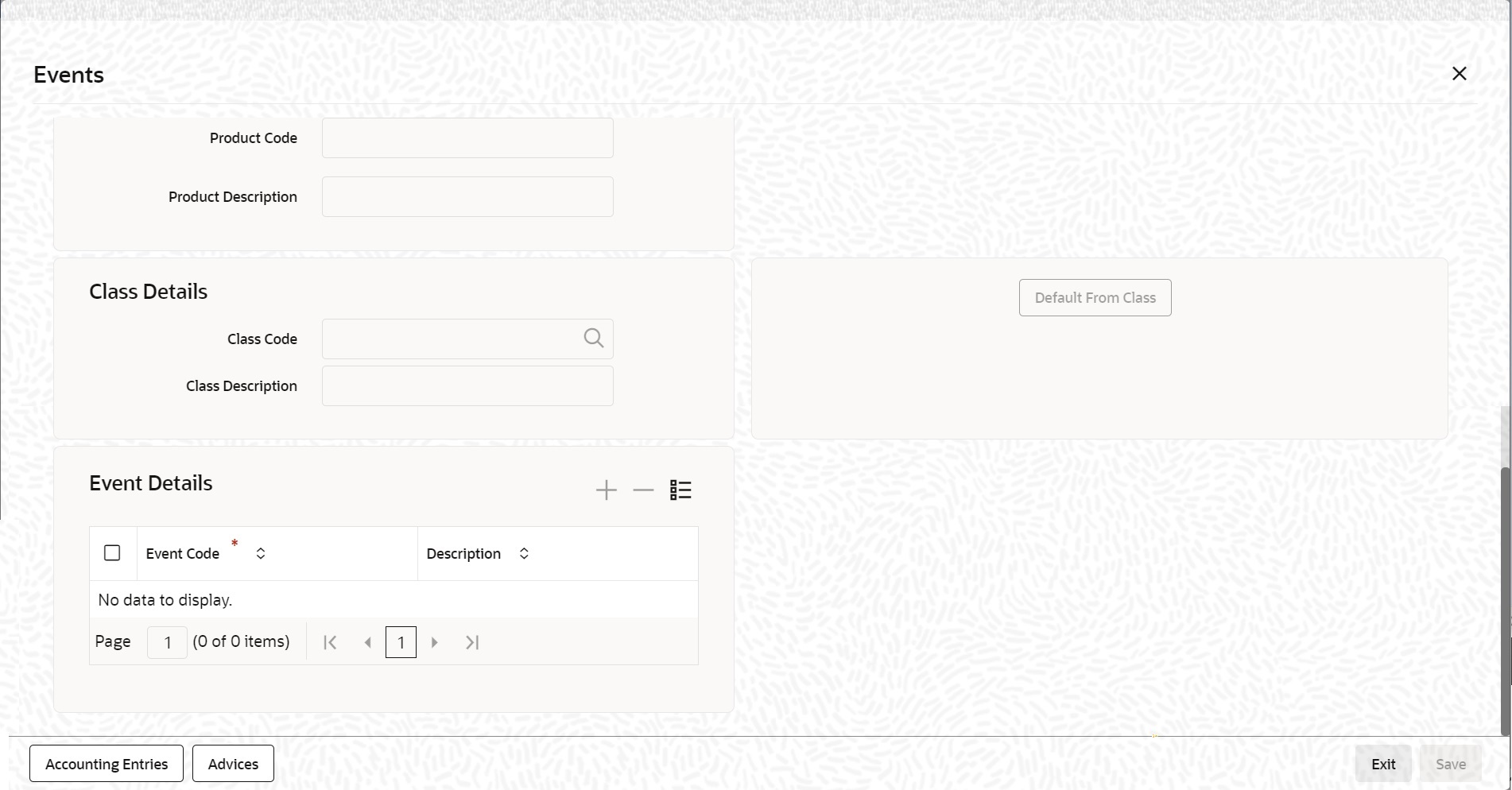

For further details on maintaining Accounting Roles refer to the Product Definition User Manual under Modularity. - On the Letters of Credit Product Definition screen, click the Events button.The Events screen is displayed.

Note:

For further details on maintaining Events refer to the Product Definition User Manual under Modularity.Table 3-3 Events

Topic Description Specify Event for Reissue of Guarantee You must associate the event REIS for an LC product for processing of reissue of guarantee. The system will display the REIS event during Events definition in the Product Maintenance. Note:

Refer Products user manual for detailed explanation of ‘The Product Event Accounting Entries and Advices Maintenance screen’.Generate Advices for the Insurance Company For generation of advice to insurance company for the LC product, you need to associate the message type ‘LC_INSURANCEADV’ for the events BISS and AMND respectively. During authorization of these two events, the system will process the messages for all import LCs. Note:

Refer Product Definition User Manual for the procedure to define advices that are generated for each event.All the messages are sent to the insurance company via mail. For this reason, you need to specify the insurance code (Receiver) and the mailing address of the Insurance Company in the LC Drafts screen.

Note:

Refer the Annexure chapter to view an advice sample generated for the insurance company.Generate Advices for Faxing LC Confirmation to Counterparty For generation of advice to the counterparty at the time of confirming an LC, you need to associate the message type ‘LC_INSTR_COPY’ and ‘LC_AM_INST_COPY’ for the events BISS and AMND respectively. During authorization of these two events, the system will process the messages for confirmed LCs. Note:

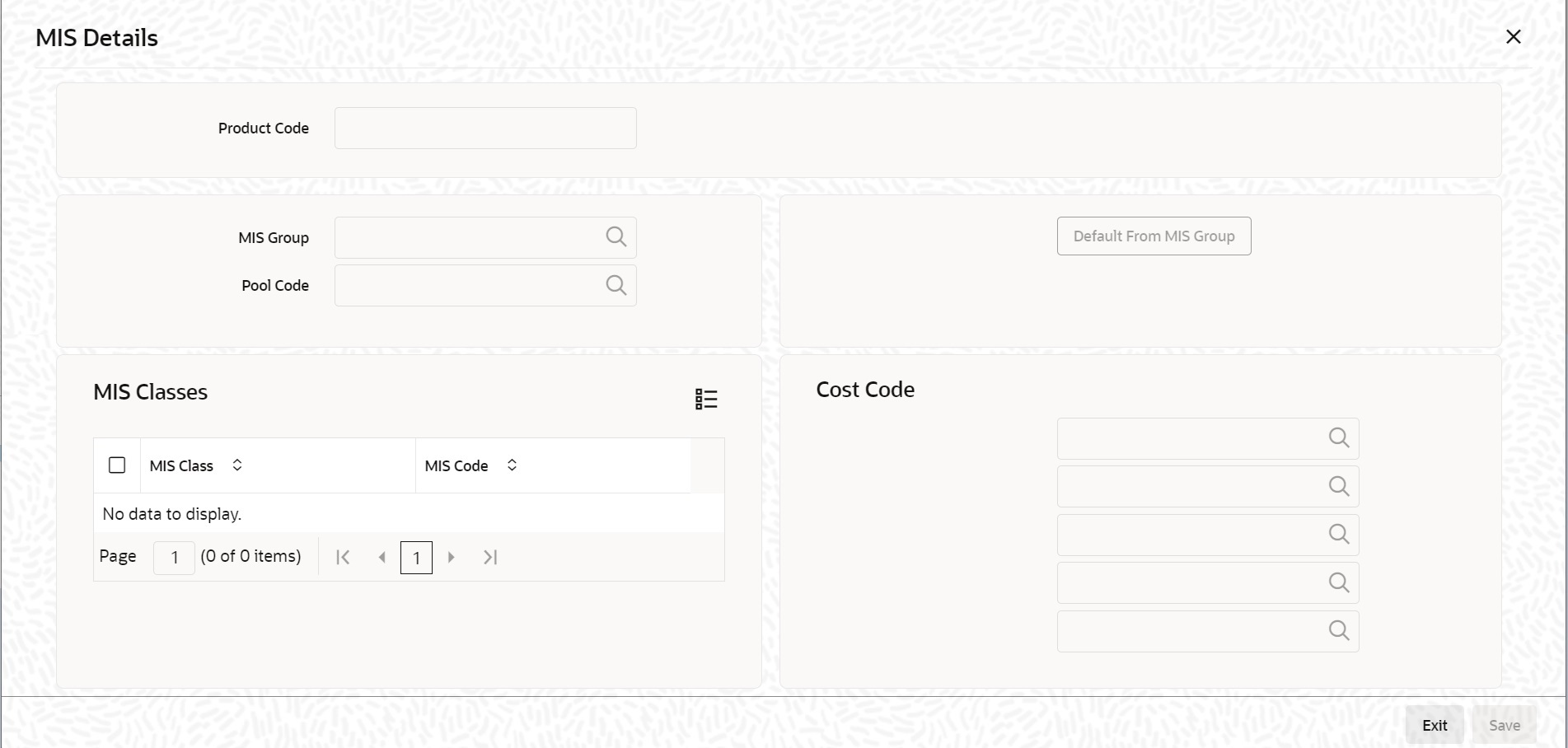

Refer the Annexure chapter to view an advice sample generated for the insurance company. - On the Letters of Credit Product Definition screen, click the MIS button.

The MIS Details screen is displayed.

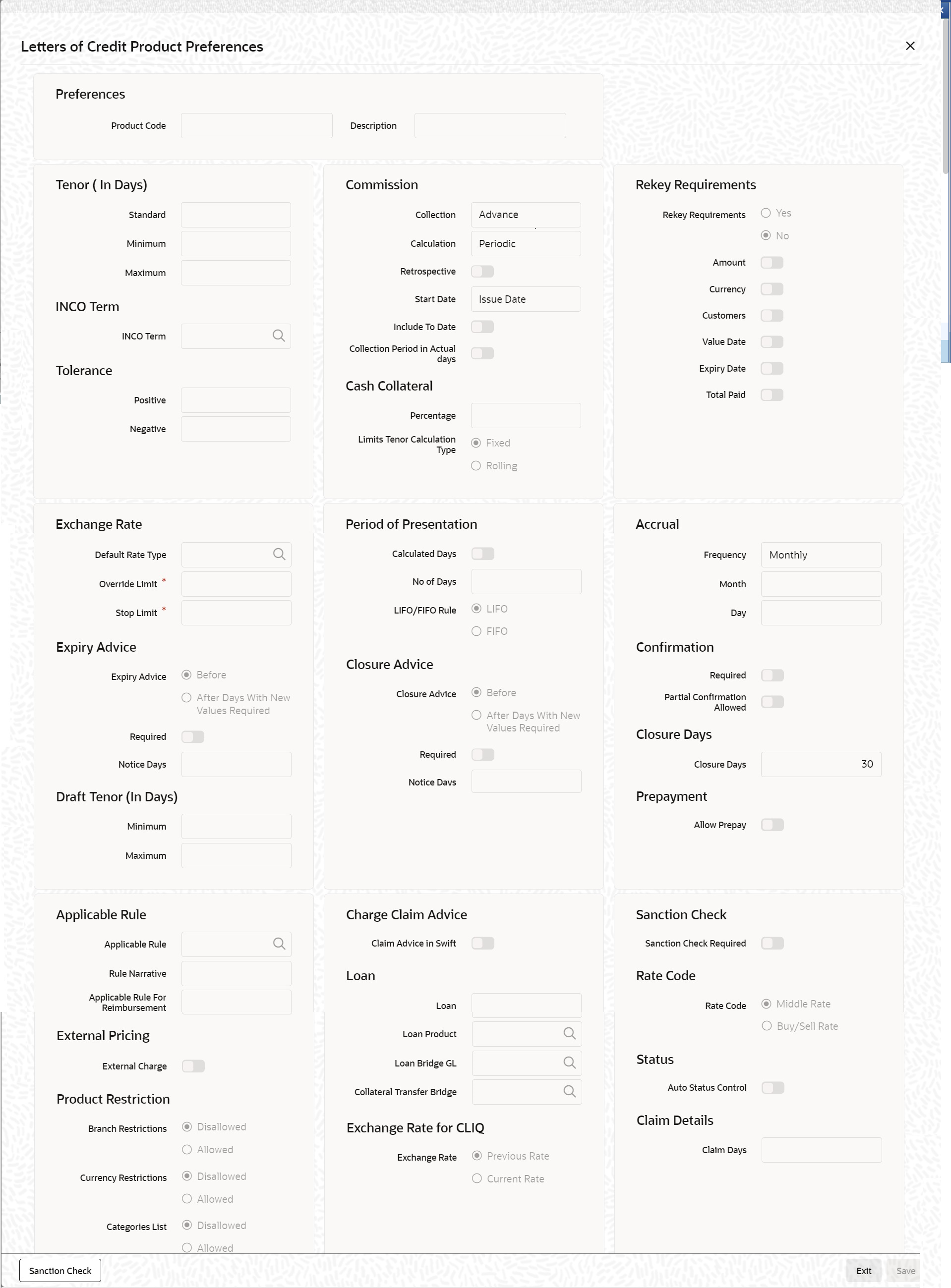

For further details on maintaining MIS Details refer to the Product Definition User Manual under Modularity. - On the Letters of Credit Product Definition screen, click the Preferences button.The Letters of Credit Product Preferences screen is displayed.

Note:

The Preferences that you define for a product will be applied to all the LC contracts involving the product.For more information on the fields, refer the Field Description table given below:Figure 3-7 Letters of Credit Product Preferences

Table 3-4 Letters of Credit Product Preferences - Field Description

Field Description Product Code and Description By default, the Product Code and the description is displayed from the main product screen. This field is optional.

Note:

If the product you are creating is of the type Reimbursement, you will be able to specify only the following details:- Limit Tenor Calculation Type

- Rekey Requirements

- Tolerance

- Exchange Rate

Tenor You can set the Standard, Minimum and the Maximum limits for tenor based LCs. The tenor details that you specify for an LC product is always expressed in days. This field is optional.

Standard The standard tenor is the tenor that is normally associated with an LC involving a product. The standard tenor of an LC is expressed in days and will apply to all LCs involving the product. If you do not specify any specific tenor while processing an LC, the standard tenor will by default apply to it. The default standard tenor applied on an LC can be changed during LC processing. An expiry date will be calculated based on the tenor, as follows:

Expiry Date = Effective Date + TenorThis field is optional.

This field is not applicable for Transfer Type Product.

Maximum You can fix the maximum tenor of a product. The tenor of the LCs that involves the product should be less than or equal to the Maximum tenor specified. If not, an override will be required before the LC is stored. This field is optional.

This field is not applicable for Transfer Type Product.Minimum The minimum tenor of a product can be fixed. The tenor of the LCs that involves the product should be greater than or equal to the minimum tenor that you specify. If not, an override will be required before the LC is stored. For example you have defined an LC product, to cater to tenor based import LCs. The minimum tenor specified for this product is 100 days and the maximum tenor is 1000 days. You have also specified a standard tenor of 500 days.

Under this product, you can process LCs with a tenor between 100 and 1000 days. As you have specified the standard tenor as 500 days, by default, an LC involving this product will have a 500 day tenor. At the time of processing the LC you can however, change this tenor to anything between the Minimum and Maximum tenor limits. This is done by changing the Expiry Date of the LC. If the new tenor falls outside the range defined as the maximum and minimum tenors, an appropriate override will be sought.

This field is optional.

This field is not applicable for Transfer Type Product.

Cash Collateral Percentage For a product, you can fix the percentage of the LC amount that must be taken as cash collateral. This percentage is applied by default and can be changed when the LC is processed. In addition, the currency in which the collateral is to be collected is specified in the LC Contract Collateral screen, while processing an LC. For example for a guarantee product, you have specified that customers should offer cash collateral to the tune of 50% of the LC amount. If you enter a guarantee, using this product, valued at USD $100,000, a sum of USD $50,000 which is 50% of the guarantee amount will be collected as cash collateral when the guarantee is issued.

If you enter a guarantee using this product, valued at GBP 500,000, then a sum of GBP 250,000 which is 50% of the guarantee amount will be collected as cash collateral when the guarantee is issued. You can collect the cash collateral in a currency different from the guarantee currency.

This field is optional.

This field is not applicable for Transfer Type Product.

LC Authorization Re-key All operations on an LC (input, modification, reversal, etc.) have to be authorized by a user other than the one who carried out the operation. Authorization is a method of cross checking the inputs made by a user. All operations on an LC, except placing it on hold, should be authorized before beginning the End of Day operations. You have the option to specify whether certain important details of an LC need to be reeked, at the time of authorization. Specify the fields that will have to be re-keyed at the time of contract authorization. You can specify any or all of the following as re-key fields:- Amount

- Currency

- Customers

- Value date

- Expiry date

- Total paid

This field is optional.Note:

When you process an LC for authorization - as a cross-checking mechanism to ensure that you are calling the right LC - you can specify that the values of certain fields must be entered before the other details are displayed. The complete details of the LC is displayed only after the values to these fields are entered. This is called the ‘re-key’ option. The fields for which the values have to be given are called the ‘re-key’ fields. The fields for which the values have to be given are called the re-key fields. If no re-key fields have been defined, the details of the LC will be displayed immediately once the authorizer calls the LC for authorization. The re-key option also serves as a means of ensuring the accuracy of inputs.INCO Term Specify the INCO term that must be linked to all contracts under this product. The option list displays all INCO terms available in the system. You can select the appropriate one. This field is optional.

This field is not applicable for Transfer Type Product.

Commission Specify the following details: Collection Indicate when the commission components of an LC should be collected. Commission on an LC can be collected in the following ways: - Advance - Select Advance to indicate that the commission components of the LC should be collected at the time the LC is initiated.

- Arrears - Select Arrears to indicate that the commission components of the LC should be collected on the maturity date of the LC.

This field is optional.

This field is not applicable for Transfer Type Product.

Calculation You can have the commission amount that is due to an LC collected in one of the following ways: Periodic - Indicate periodic if commission is to be collected in portions over a period in time. Periodic commission is calculated on the basis of a set of parameters that you define. The values of these parameters as of the beginning of the period are used as they may change when a periodic amount is calculated. For instance, the current outstanding LC amount may be lower at the time of commission collection than at the beginning of the period, because an availment has been processed. When commission is collected on a periodic basis, it is collected automatically, based on the rate period that you specify. Periodic commission is collected either in advance or in arrears, depending on your specification. This setting is made in the Product Preferences screen. The amount collected is for the current period.

Non-periodic - Indicate non-periodic if the commission amount due to an LC is to be collected as a single sum. In this case, a single commission amount is calculated at the time you enter an LC using a set of parameters that you have defined for the LC. For advance collections the commission is collected at the time you enter the LC. If it is collected in arrears, then the commission is collected on the expiry date.This field is optional.

This field is not applicable for Transfer Type Product.

Retrospective Select this check box to indicate that commission is collected retrospectively. This field is optional.

Start Date Specify the start date for commission calculation.

Value for field Start Date can be given as

- Issue Date

- Effective Date

- Lesser of two

This field is optional.

This field is not applicable for Transfer Type Product.

Include to Date Select this check box to indicate the end date for commission calculation is included in the calculation tenure. This field is optional.Note:

Refer the Commissions User Manual under Modularity for further commission related preferences.Collection Period in Actual days Select this check box to indicate that the Collection Period is based on Actual Number of days, else the collection period is based on number of days as 30. Tolerance Tolerance denotes the variance that has to be built around the LC amount, to arrive at the Maximum LC amount. Positive A positive tolerance is the percentage that should be added to the LC amount to arrive at the Maximum LC amount. When an LC is issued or advised, the Maximum LC amount will be the outstanding LC amount. This will be the maximum amount available for the availment. This field is optional.

This field is not applicable for Transfer Type Product.

Negative The negative tolerance is the percentage that should be subtracted from the LC amount. The minimum tolerance is captured for information purposes only. The tolerance percentage can be changed when an LC is processed under a product. Note:

The positive and negative tolerance amounts will be a part of the LC instrument and the subsequent amendment instruments. You must use the positive tolerance to indicate the amount that is uncovered, in the LC amount. The instances could be of the freight or insurance not being paid.This field is optional.

This field is not applicable for Transfer Type Product.

Closure Days You can also maintain the number of days after which all LCs processed under the product being defined, will be closed. The number of days specified here is calculated from the expiry date of the LC to arrive at the closure date, as follows: LC Closure Date = LC Expiry Date + Closure Days

By default, the system will display 30 days as the closure days. You are allowed to change this value. At the time of capturing the details of an LC contract, the system will calculate the closure date, based on the closure days that you have maintained for the product involved in the contract. However, you can change the date to any other date after the expiry date. For example for the import LC product, LCIR, your bank has specified the closure days as 20 days.Let us assume that the expiry date of the LC Contract involving LCIR is 29th February 2000. The system will calculate the closure date as 20th March 2000. This is arrived at, by adding the number of closure days to the expiry date of the LC (i.e. 29th Feb + 20 days = 20th March).

This field is optional.

This field is not applicable for Transfer Type Product.

Exchange Rate You can specify the exchange rates to be picked up and used, when an LC in a foreign currency, is processed. This field is optional.

Default Rate Type You can specify the exchange rates to be picked up and used, when an LC in a foreign currency, is processed. Rate Override Limit If the variance between the rate defaulted and the rate input is a percentage that lies between the Rate Override Limit and the Rate Stop Limit, the LC can be saved by giving an override. This field is mandatory.

Rate Stop Limit If the variance between the rate defaulted and the rate input is a percentage value greater than or equal to the Rate Stop Limit, the LC cannot be saved. For example for a product, you have specified the override range as between 7% and 30%. In such a case the entries in these fields would read as follows:- Rate Override Limit - 7%

- Rate Stop Limit - 30%

Below the override limit - Let us assume that for the LC you have specified the exchange rate to be 1.2. In this case the exchange rate exceeds the standard rate by 4%. The LC will be processed without any override.

Within the override limit - If you have specified the exchange rate to be 2.0. In this case you exceeded the standard rate by 20%. You will be prompted to confirm the override. If you confirm the override the LC will be processed using these rates.Above the override limit - Let us visualize a situation in which you have specified the exchange rates to be 2.5. In this case you have exceeded the standard rate by 100%. In such a case an error message will be displayed and you will not be allowed to continue until the exchange rate you specify is within the permissible limit of 7-30%.

This field is mandatory.

Period of Presentation As part of the preferences you define for a product, you can specify the manner in which the Period of Presentation should be calculated for the documents that accompany LCs processed under the product. The period of presentation can be arrived at in two ways. This field is optional.

Number of Days Firstly, you can specify it directly, in terms of days, in the Number of Days field. Typically, this would be 21 days. (However, you can change this to suit your need.) If you choose this option, the number of days specified will default to all LCs processed under the product. The value will default to the ‘Period For Presentation’ field in the LC Contract – Others screen. This field is optional.

This field is not applicable for Transfer Type Product.

Calculated Days You can opt to calculate the period of presentation as follows: Expiry Date of the LC – Latest Shipment Date (You would choose this option if the period of presentation varies for each LC processed under a product.) To specify this manner of calculating the period of presentation, choose the ‘Calculated Days’ option.

The system uses the Expiry Date and the Last Shipment Date specified for the LC you are processing, and arrives at the period of presentation. The period of presentation defined for the product - or calculated for the LC, as the case may be - will be displayed in the ‘Period For Presentation’ field in the LC Contract - Others screen. You can change the default to suit the LC you are processing.

This field is optional.LC Expiry Advices While creating an LC product, indicate whether an expiry advice need to be generated for LCs involving the product. This field is optional.

Required Check Required option to indicate that an expiry advice need to be generated for LCs involving the product. This field is optional.

This field is not applicable for Transfer Type Product.

Expiry Advice These advices are generated based on the preferences that you specify for them. Select the appropriate option on the screen to indicate your preference. If you indicated that an expiry advice should be generated, you need to indicate: - Before – Select this option if the advice is to be generated before expiry.

- After Days with New Values Required - Select this option if the advice is to be generated after expiry.

This field is optional.

This field is not applicable for Transfer Type Product.

Required Check this option to indicate that a expiry advice should be generated for LCs involving the product. Notice Days Specify the number of days before/after expiry when the advice should be generated. This field is optional.

This field is not applicable for Transfer Type Product.

LC Closure Advices While creating an LC product, you can indicate whether a closure advice should be generated for LCs involving the product. Required Check this option to indicate that a closure advice should be generated for LCs involving the product. This field is optional.

This field is not applicable for Transfer Type Product.

Closure Advice These advices are generated based on the preferences that you specify for them. Select the appropriate option on the screen to indicate your preference. If you indicated that a closure advice should be generated, you need to indicate: Before – Select this option if the advice is to be generated before closure.

After Days with New Value Required - Select this option if the advice is to be generated after closure.

This field is optional.Notice Days Specify the number of days before/after closure when the advice should be generated. This field is optional.

This field is not applicable for Transfer Type Product.

Rate Code When defining the settlement details for a product, you can specify the rate type (under the Rate Code option) that should be used in case of cross-currency settlements. Your specification for the product will default to all contracts involving the product. However, you can change the rate type defined for the product to suit a contract entered under the product. The ‘rate type’ indicates the type of exchange rate that will be used. It can be: - Mid rate maintained for the currency pair

- Buy or Sell rate depending upon the nature of the transaction (debit or credit)

Note:

In case of charges, the system will apply mid rate maintained for the currency pair as per default rate type maintained in preferences at LC Product Level.This field is optional.

Draft Tenor in Days Specify the draft tenor in days. Minimum Specify the minimum draft tenor for an LC product. The value that you enter must be non-decimal numeric value > = 0 and < Maximum Draft Tenor.

This field is not applicable for Transfer Type Product.

Maximum Specify the maximum draft tenor for an LC product. The value that you enter must be non-decimal numeric value > 0 and > = Minimum Draft Tenor: If the LC Type of an LC product is selected as Sight:

If the LC Type of an LC product is selected as Usance:Note:

- On save of LC product definition, system will validate that the value defined for minimum and maximum Draft Tenor fields in preferences sub-system is either 0 or null. If the validation fails, system will display a configurable override message.

- During LC contract creation, on save, system will validate that the value entered for Draft Tenor field in Drafts sub-system is either 0 or null. If the validation fails, system will display a configurable override message. The said validation is also performed on save of LC amendment using LC contract online function.

- On save of LC product definition, system will validate that value defined for minimum Draft Tenor is either null or 0 or any positive non-decimal numeric value > 0 but < = maximum draft tenor and the value defined for maximum Draft Tenor is a positive non-decimal numeric value > 0 and >= minimum draft tenor. If the validation fails, system will display an error message.

In instances where multiple drafts are captured for an LC contract, system validates that the Draft Tenor entered for each individual draft is within the minimum and maximum range defined for the product.

If minimum and maximum Draft tenor value is not defined for a LC product then on save of a LC contract, system will not perform the validation stated in point (ii) as no range is defined at the product level.- When only one of the values i.e. either 'Minimum Draft Tenor' or 'Maximum Draft Tenor' is defined for the LC product, then on save of both LC contract creation and amendment, the value defined that is, the 'Draft Tenor' of LC contract will be validated against the 'Minimum Draft Tenor' if 'Minimum Draft Tenor' is defined or will be validated against 'Maximum Draft Tenor' if 'Maximum Draft Tenor' is defined. If the validation fails, system will display a configurable override message.

This field is optional.

This field is not applicable for Transfer Type Product.

Charge Claim Advice Specify the charge claim Advice details. Claim Advice in Swift Check this check box to determine whether the charge claim advice should be generated in SWIFT. This field is optional.

Applicable Rules You need to indicate the rules applicable for the guarantee. Applicable Rule Indicate the rule applicable by selecting the appropriate value from the list of values. The available values are as follows: - ISPR - The guarantee is subject to International Standby Practices

- URDG -The guarantee is subjected to the ICC Uniform rules of Demand Guarantees.

- OTHR - The guarantee is subjected to another set of rules

- NONE: The guarantee is not subjected to any rules

Note:

The above values are applicable only for Guarantee type of products. The default value of Applicable Rule is set to NONE. This is applicable only for Guarantee type of products. For Import and Export type of products, the following values are applicable:- UCP LATEST VERSION

- EUCP LATEST VERSION

- UCPURR LATEST VERSION

- EUCPURR LATEST VERSION

- ISP LATEST VERSION

- OTHR: The guarantee is subjected to another set of rules

Note:

It includes the following: If the guarantee is subjected to rules other than that provided in the list of values, the applicable rule must be indicated as ‘OTHR’.The default value of Applicable Rule is set to UCP LATEST VERSION. This is applicable only for Import/Export type of products. Based on the product type, the list of values will display rules applicable for the product. ‘Applicable Rule’ and ‘Rule Narrative’ will be enabled only for import, export and guarantee product types

This field is optional.

This field is not applicable for Transfer Type Product.

Rule Narrative This is enabled only if ‘Applicable Rule’ is set to ‘OTHR’. It is mandatory to specify the rule narrative if the applicable rule is ‘OTHR’. You need to describe the Applicable rule here. Oracle Banking Trade Finance will validate the rule narrative for slashes. The Applicable Rule and Rule Narrative cannot be amended after authorizationNote:

It contains the following:- Rule Narrative’ should not start or end with ‘/’ or should not have two consecutive slashes.

- The above fields is enabled only for a guarantee.

Select applicable rule for which you need a reimbursement from the drop-down list. This list displays the following: The list displays the following:

- URR Latest Version–Select if the applicable type is latest version of URR

- NOTURR–Select if the applicable type is NOTURR

- This field is optional.

This field is not applicable for Transfer Type Product.

LIFO/FIFO Rule Specify the order in which the availment under this contract should be processed. You can choose one of the following options: If multiple amendments are made to the LC contract amount, then the system applies the FIFO/LIFO rule when utilization is made against the LC contract. - LIFO – LC amount will be utilized in ‘First In First Out’ order when availment is triggered against the multiple amended LC contract.

- FIFO – LC amount will be utilized in Last In First Out order when availment is triggered against the multiple amended LC contract

The system applies FIFO / LIFO rule when it finds that multiple amendment has been made to an LC contract against which utilization has been completed.

This field is optional.Confirmation Required Select Confirmation Required check box to indicate that confirmation message is required for all LCs under this product. This field is optional.

Partial Confirmation Allowed Select Partial Confirmation Allowed check box to confirm the partial amount. The remaining amount can be confirmed after you receive the approval from the external agent. This field is optional.Note:

Partial confirmation is allowed only for export LC.Allow Prepayment Check this option to indicate that prepayment should be allowed for commissions that are marked as Arrears. This field is optional.

Loan - Collateral Funding by Loan

- Claim Settlement By Loan

Note:

This is allowed only for Shipping Guarantee product.This field is optional.

This field is not applicable for Transfer Type Product.

Loan Bridge GL Specify the bridge GL used for accounting between loan product and shipping/bank guarantee. The adjoining option list displays a list of all GLs. Choose the appropriate one. This field is optional.

This field is not applicable for Transfer Type Product.

Loan Amount Specify the loan product used for the creation of loan account. The option list displays a list of loan products. Choose the appropriate one. This field is optional.

Collateral Transfer Bridge Specify the bridge GL used for collateral transfer from LC to shipping guarantee and shipping guarantee to Bill. The adjoining option list displays a list of all GLs. Choose the appropriate one. This field is optional.

This field is not applicable for Transfer Type Product.

Status Specify the following status details: Auto Status Control Check this box to set automatic status control for the LC product. If you do not check this box, the system will not consider the LC contracts associated with this product for automatic status change. The status of this check box is defaulted to the field Auto Status Change of every LC contract associated with this product. However, you can modify this at the contract level.

This field is optional.

Claim Details Specify the Claim Details: Claim Days Specify the claim days for the bank guarantee and advice of bank guarantee products. Claim days is used for calculating the claim expiry date. This field is optional.

This field is not applicable for Transfer Type Product.

Accrual Specify the following accrual details. Frequency Specify the frequency of accrual for commission, charge or fees. The frequency can be one of the following: - Daily

- Monthly

- Quarterly

- Half-yearly

- Yearly

In case of monthly, quarterly, half yearly or yearly accruals, you should specify the date on which the accruals have to be done during the month. For example, if you specify the date as ‘30’, accruals will be carried out on the 30th of the month, depending on the frequency.

If you fix the accrual date for the last working day of the month, you should specify the date as ‘31’ and indicate the frequency. If you indicate the frequency as monthly, the accruals will be done at the end of every month -- that is, on 31st for months with 31 days, on 30th for months with 30 days and on 28th or 29th, as the case may be, for February.

If you specify the frequency as quarterly and fix the accrual date as the last day of the month, then the accruals will be done on the last day of the month at the end of every quarter. It works in a similar fashion for half-yearly accrual frequency.

If you set the accrual frequency as quarterly, half yearly or yearly, you have to specify the month in which the first accrual has to begin, besides the date.

This field is not applicable for Transfer Type Product.

Month If you choose one of the following options for accrual frequency, specify the month in which the first accrual has to begin: - Quarterly

- Half-yearly

- Yearly

This field is not applicable for Transfer Type Product.

Day If you choose one of the following options for accrual frequency, specify the date on which the accruals have to be done during the month: - Monthly

- Quarterly

- Half-yearly

- Yearly

This field is not applicable for Transfer Type Product.

External Pricing Specify the details. External Charge Check this box to indicate that external charges can be fetched from external pricing and billing engine for contracts created under this product. External Charge is enabled only when the system integrates with external pricing and billing engine (PRICING_INTEGRATION = Y at CSTB_PARAM level).

This field is not applicable for Transfer Type Product.

Sanction Check Specify the Sanction check details. Sanction Check Required Select this check box to indicate that sanction check is required. This indicates whether any transaction booked using the product is subject to Sanction Check or not. If ‘Sanction Check Required’ flag is checked, then the event ‘SNCK’ should be maintained. Product Restriction Specify the product restriction details. Branch List Indicate whether you want to create a list of allowed branches or disallowed branches by selecting one of the following options: - Allowed

- Disallowed

This field is not applicable for Transfer Type Product.

This fields value has to be maintained same as the Parent contract's product for Transfer Type Product.

Currency Restrictions Indicate whether you want to create a list of allowed currencies or disallowed currencies by selecting one of the following options: - Allowed

- Disallowed

This field is not applicable for Transfer Type

Product.This fields value has to be maintained same as the Parent contract's product for Transfer Type Product.

Categories List Indicate whether you want to create a list of allowed customers or disallowed customers by choosing one of the following options: - Allowed

- Disallowed

This field is not applicable for Transfer Type Product.

This fields value has to be maintained same as the Parent contract's product for Transfer Type Product.

- On the Letters of Credit Product Preferences screen, click the Sanction Check button.The Sanction Check is displayed. For more information on the fields, refer the Field Description table given below:

Table 3-5 Sanction Check - Field Description

Field Description Product Code The system displays the product code. This field is optional.

Description The system displays the product description. This field is optional.

Event Code Select the event code from the option list. You can maintain the events for which the sanction check is applicable using this screen. The list displays all valid options. Select the event code from the option list. - AATC - Amendment from Advice to Confirm

- AMND - Amendment

- AMNV - Initiation of Amendment Confirmation

- AOCF - Amend from open to Open & Confirm

- APAC - Amend - Pre-advice to Adv & confirm

- APAD - Amendment from Pre-advice to advice

- BADV - Booking Export LC-operation Advice

- BANC - Booking of LC with Advice & Confirm

- BCFM - Booking export LC with Confirm

- BISS - Booking LC or Guarantee Issue

- BPRE - Booking of LC with Pre-Advice

- REIS - Reissue of Guarantee

- ROPN - Reopening of an LC

- TRNF - Transfer of LC

Description The system displays the event description automatically once you select the event code. This field is optional. - On the Sanction Check screen, specify the fields and click Ok.

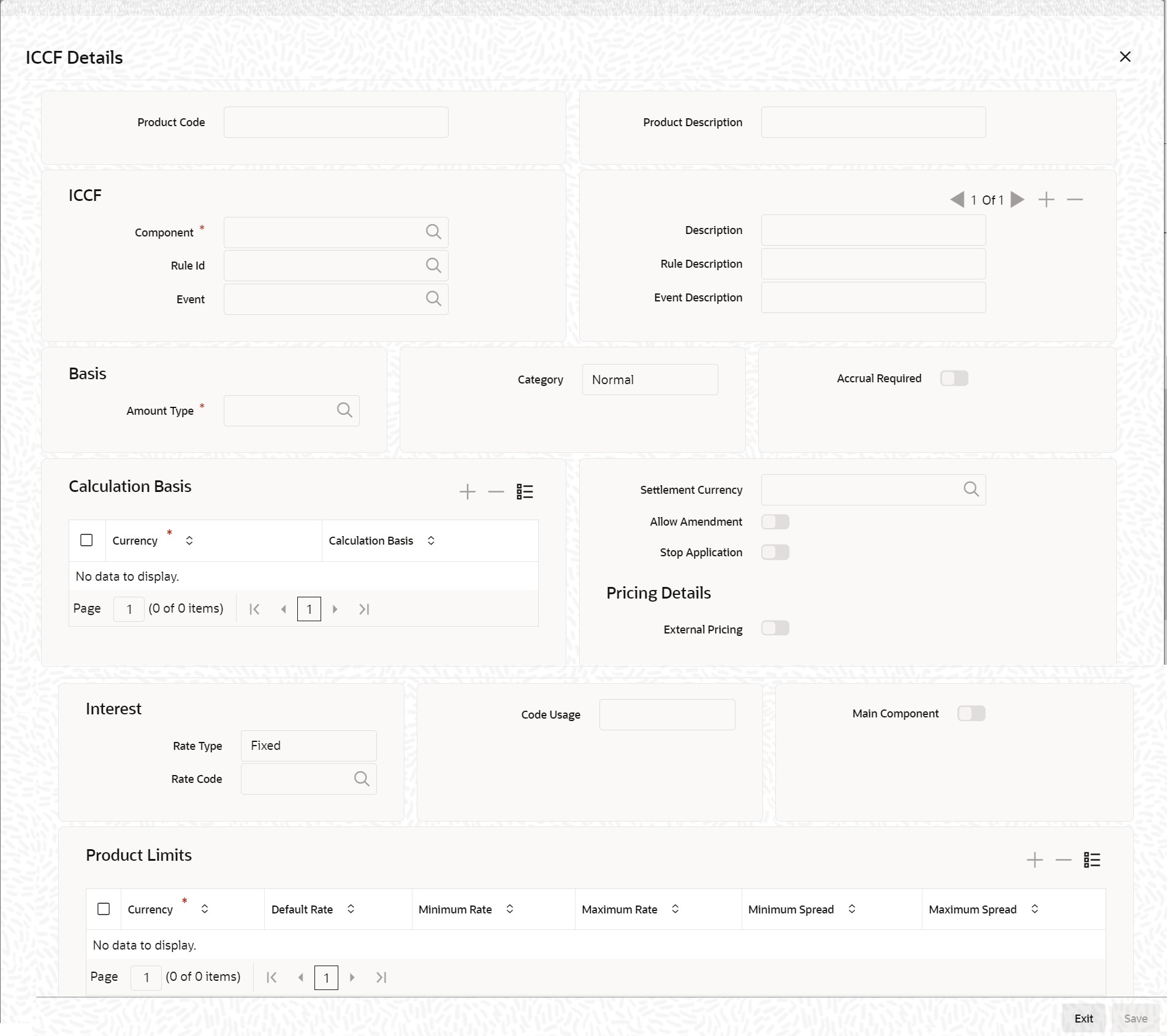

- On the Letters of Credit Product Definition screen, click the Commission button.The ICCF Details screen is displayed.

Note:

For more details on ICCF Details sub screen refer Commission user manual.

Commission is not supported for Transfer Type Product.

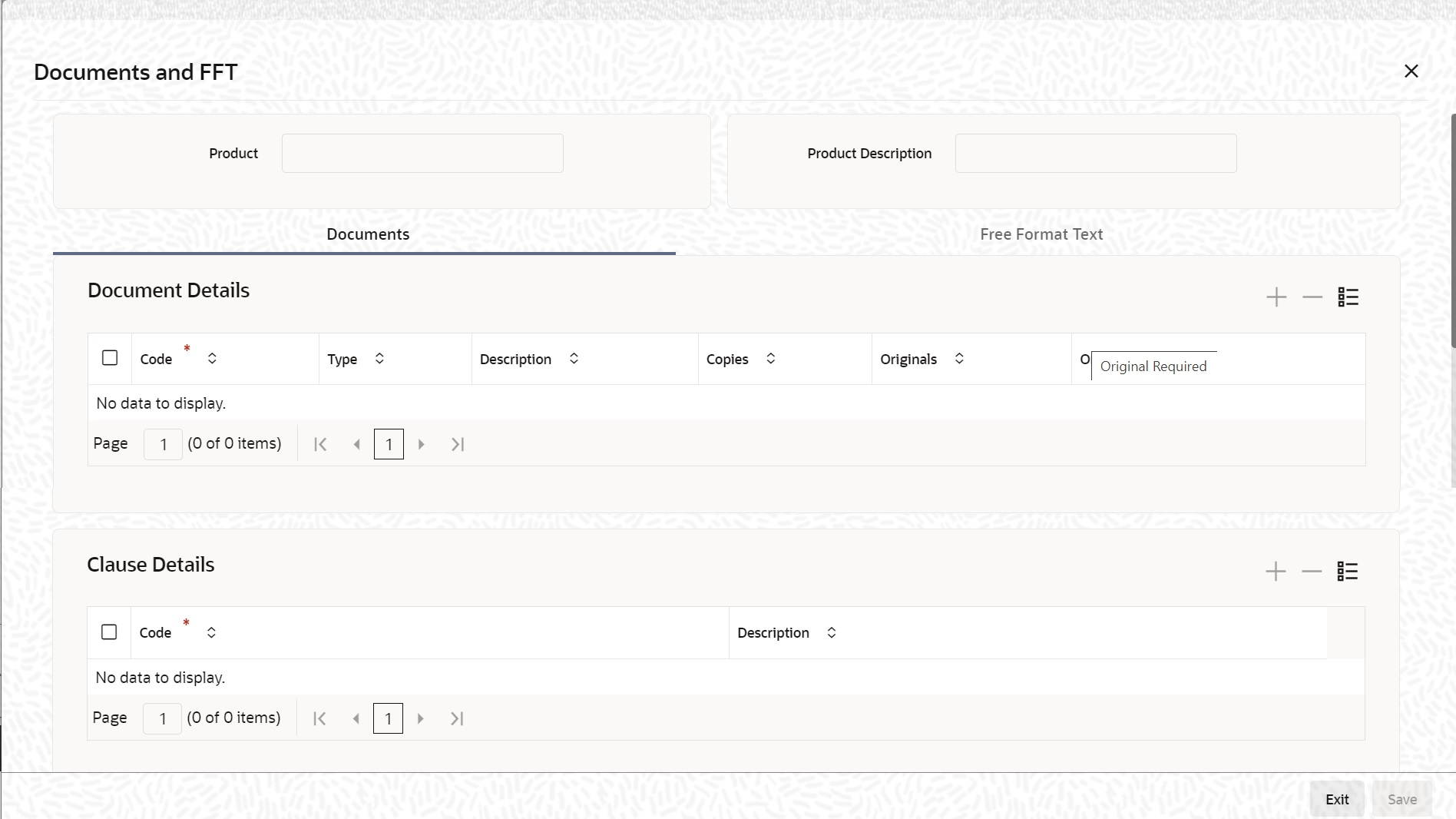

- On the Letters of Credit Product Definition screen, click the Free Format Text button.The Documents and FFT screen is displayed.

Note:

For further details on maintaining Documents and FFT refer to the Product Definition User Manual under Modularity.

Documents and clauses is not supported for Transfer Type Product.

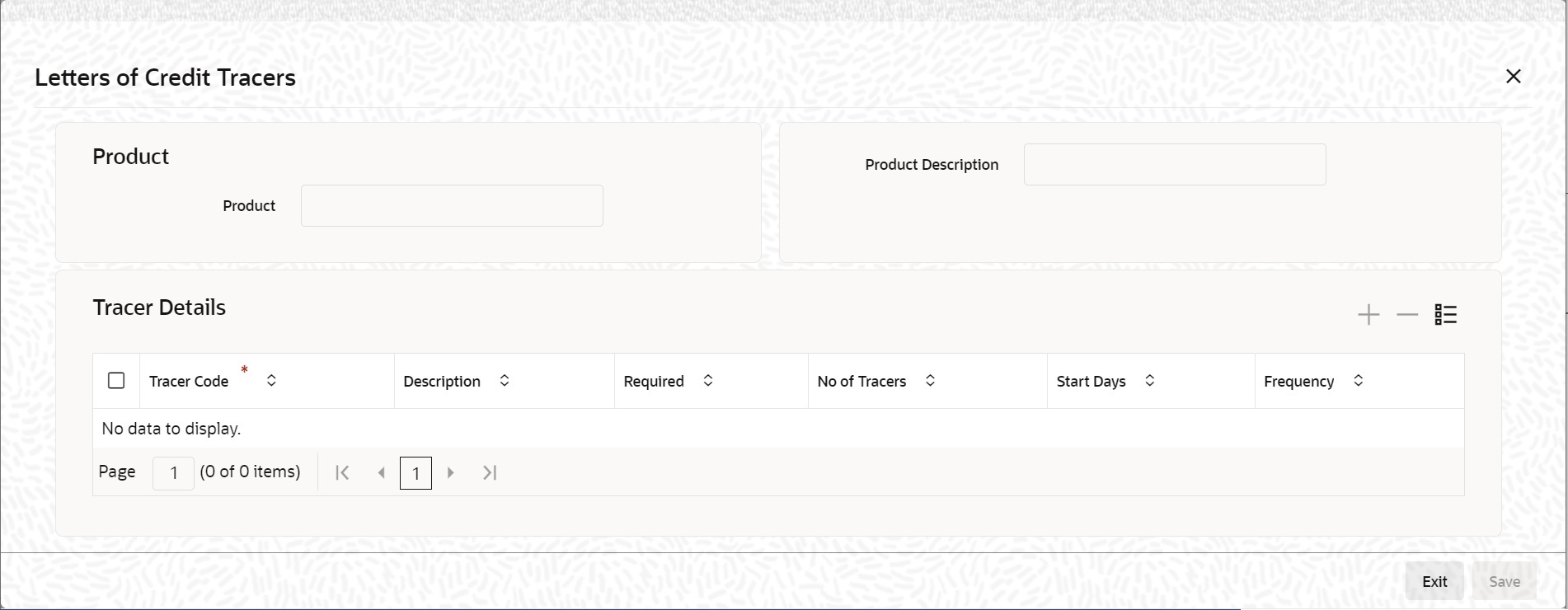

- On the Letters of Credit Product Definition screen, click the Free Format Text button.The Letters of Credit Tracers screen is displayed.

Note:

For further details on maintaining Letters of Credit Tracers refer to the Product Definition User Manual under Modularity.If the user wants to generate the Guarantee claim tracer then GUA_CLM_TRACER needs to be added in the Tracer Section and GUA_CLM_TRACER Advice needs to be linked against TRGN event.- GUA_CLM_TRACER can be mapped to Guarantee, Advice of Guarantee, SBLC and Advice of SBLC product types only else appropriate error message will be thrown.

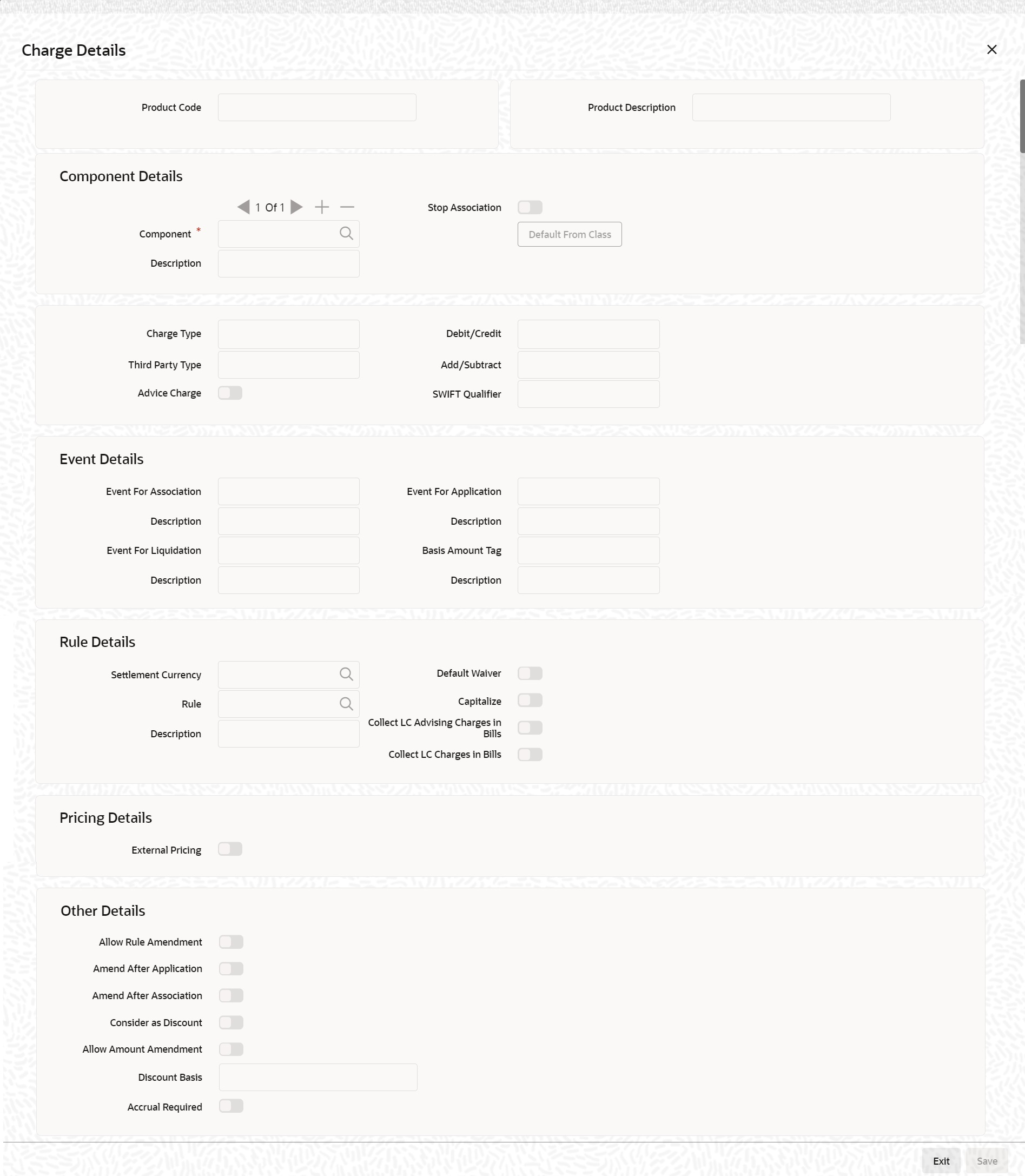

- On the Letters of Credit Product Definition screen, click the Charges button.The Charge Details screen is displayed.

Note:

For more details on Charge Details sub screen, refer Charges and Fees user manual.Note:

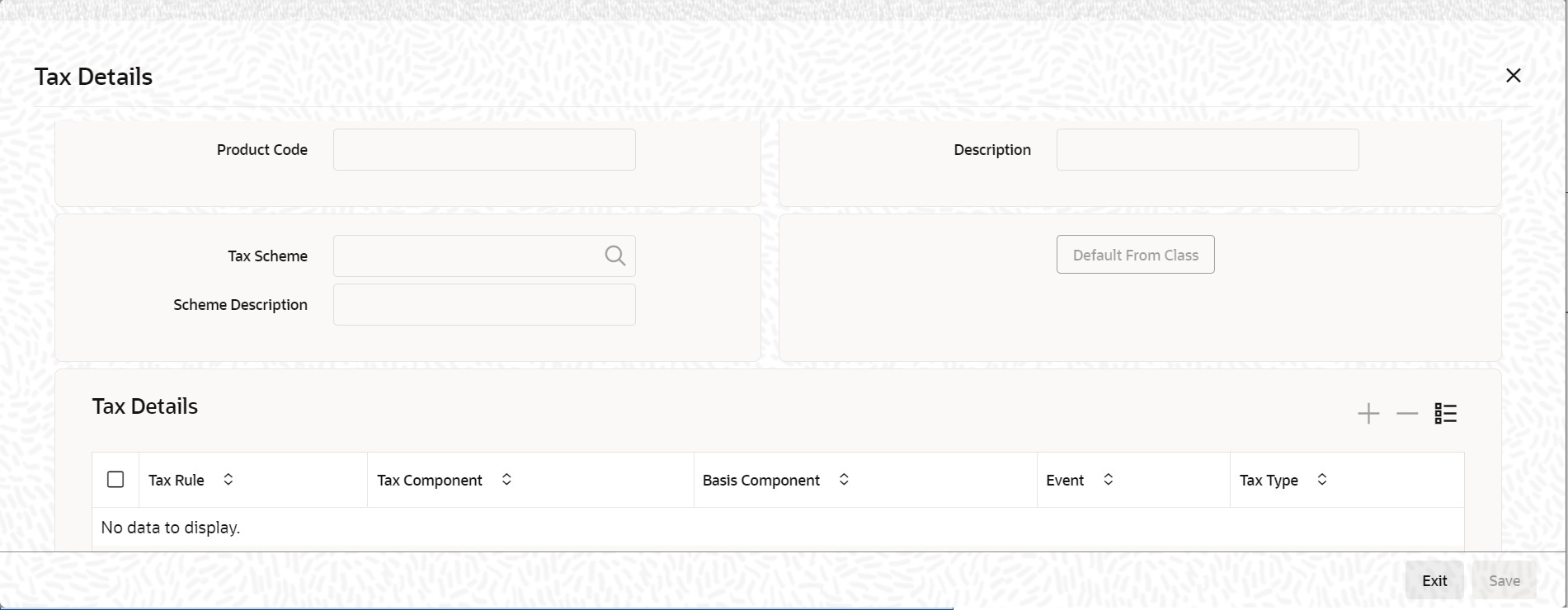

For more details on Charge Details sub screen, refer Charges and Fees user manual. - On the Letters of Credit Product Definition screen, click the Tax button.The Tax Details screen is displayed.

Note:

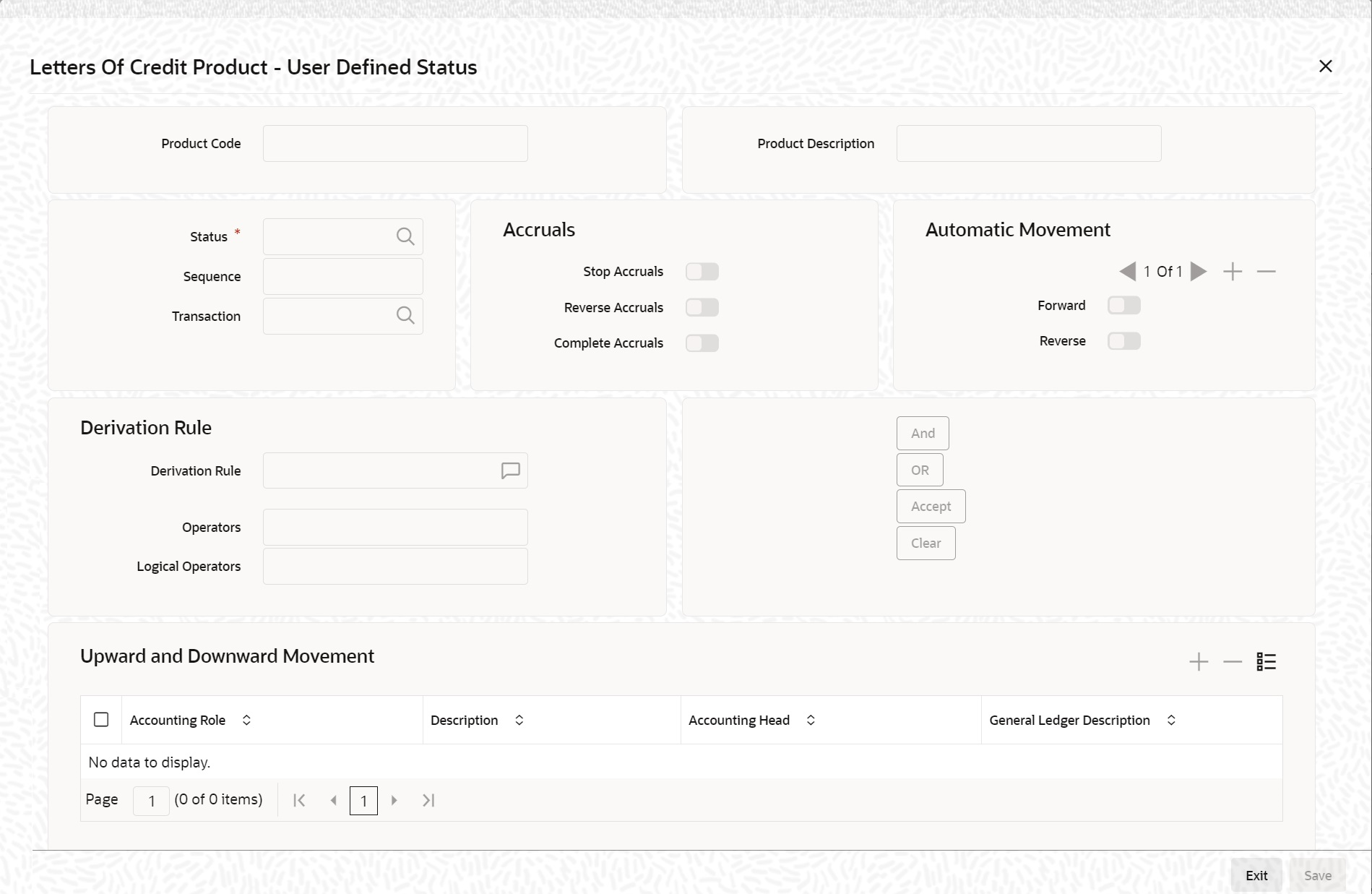

For further details on maintaining Tax Details refer to the Product Definition User Manual under Modularity. - On the Letters of Credit Product Definition screen, click the Status button.The Letters of Credit Product - User Defined Status screen is displayed.For more information on fields, refer the Field Description table reference given below:

Figure 3-14 Letters of Credit Product User Defined Status

Table 3-6 Letters of Credit Product User Defined Status - Field Description

Field Description Product Code The system displays the code that identifies the product being maintained. Product Description The system displays a brief description of the product. Status Specify the status. The LC contract will be moved to the status that you define here. If more than one status are defined for a product, you need to indicate the sequence in which a contract moves from one status to another. Sequence The system displays the sequence number if you have defined more than one status for the product. Transaction Specify the transaction code to be used for the GL transfer entries involved in the status change. The option list displays all valid transactions that are applicable. Choose the appropriate one. A transaction code is associated with every accounting entry in Oracle Banking Trade Finance. In case of status change, a component is transferred from one GL to another resulting in a new accounting entry. The system uses this transaction code to pass such entries. Accruals You can set certain preferences for accruals in the event of status change. These preferences are applicable to non periodic commission components that are collected in arrears. These are not applicable to components that are collected in advance. Stop Accruals Check Stop Accruals check box to stop further accrual on components when the LC is moved to the status defined above. If you do not check this, the system will continue to accrue the components even after LC status change. Reverse Accruals Select Reverse Accruals check box to reverse the accrued outstanding amount when the LC is moved to the status defined above. If you do not check this box, the system will not reverse the accrued amount after LC status change. Complete Accruals Check Complete Accruals check box to complete the accruals when the LC is moved to the status defined above. Further to completion of the accrual, the system proceeds with the status change. If you do not check this option, the system will not complete the accruals. Automatic Movement Indicate whether the status change has to be carried out automatically. Forward Check Forward check box to automatically move forward the status of the LC. If you do not check this option, the system will not facilitate automatic forward movement of the LC status. This is applicable only if LC automatic status processing is enabled. Reverse Check this option to automatically move the status in reverse. If you do not check this option, the system will not facilitate automatic reverse movement of LC status. This is applicable only if LC automatic status processing is enabled. Derivation Rule Indicate whether the status change has to be carried out automatically. Derivation Rule If you have opted for automatic status change, specify the criteria (rules) based on which the system will perform the status change. An LC is said to be in a specific status if any one of the five conditions associated with the status holds true. If all the conditions are false, the LC will automatically move to the next available status for which the condition is true. You can define five conditions for each status. The conjunctions ‘AND’ and ‘OR’ can be used to create multiple conditions. Use those buttons appropriately between each condition.

Operators Select the operator for building a condition for automatic status change. You can use multiple elements, in conjunction with the functions and arithmetic operators. Choose the appropriate operators from the drop-down list: - + (add)

- - (subtract)

- * (multiply)

- / (divide)

Logical Operators Select the logical operator for building a condition for automatic status change. The system uses the logical operators in combination with the elements for creating derivation rules. The drop-down list displays the following logical operators: - > (greater than)

- >= (greater than or equal to)

- < (less than)

- <= (less than or equal to)

- = (equal to)

- < > (not equal to)

Upward and Downward Movement Specify the following details: Accounting Role Specify the role to be used for provisioning accounting entries for the LC contracts in the selected status. The option list displays all accounting roles pertaining to commission components. Choose the appropriate one. Description The system displays a brief description of the selected accounting role. Accounting Head Specify the account head (GL) to which the provisioning accounting entries should be passed, for the LC contracts in the selected status. The option list displays real as well as contingent general ledgers. Choose the appropriate one. Description The system displays a brief description of the selected accounting head. Note:

In case of prepayment of commission for arrears, if the status of the contingent set of GLs changes, the system does not move the prepaid commission. Accrual continues to take place from the real GLs until the prepaid commission is exhausted. Contingent accrual takes place once the prepaid commission is exhausted.Note:

You can successfully set specific criteria for status change of an LC product.

Parent topic: Define Product Attributes