2.6.1 Maintain Rate Codes and their Values

This topic provides the systematic instructions to maintain rate codes and their values.

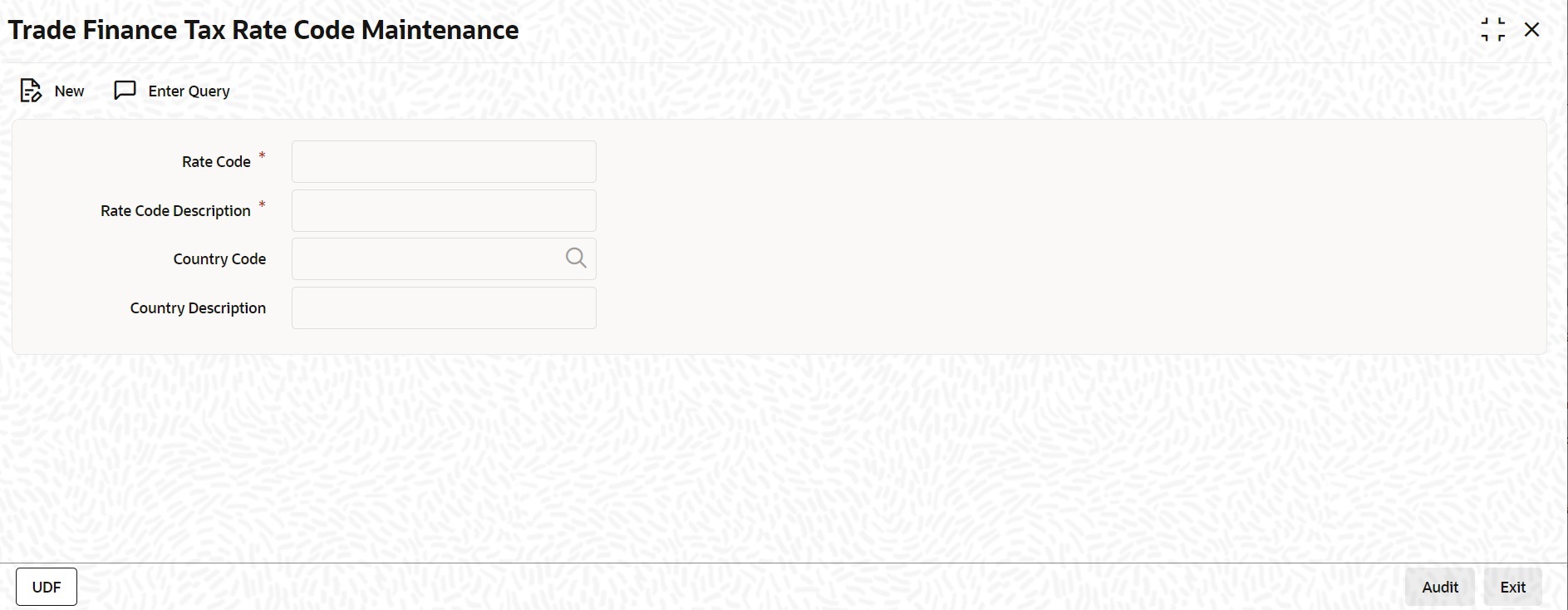

A Tax Rate Code identifies the rate that applies on an issuer tax. For instance, you can create a rate code and specify the rate values for different Effective Dates, in the ‘Trade Finance Tax Rate Code Maintenance’ screen. When building an Issuer Tax component, say Issuer_01, in the ‘Trade Finance Tax Class Maintenance’ screen, you only need to specify the Rate Code that should apply. For all securities associated with Issuer_01, the rates corresponding to the code will be picked up.

Specify the User ID and Password, and login to homepage.

Parent topic: Tax Components as Classes